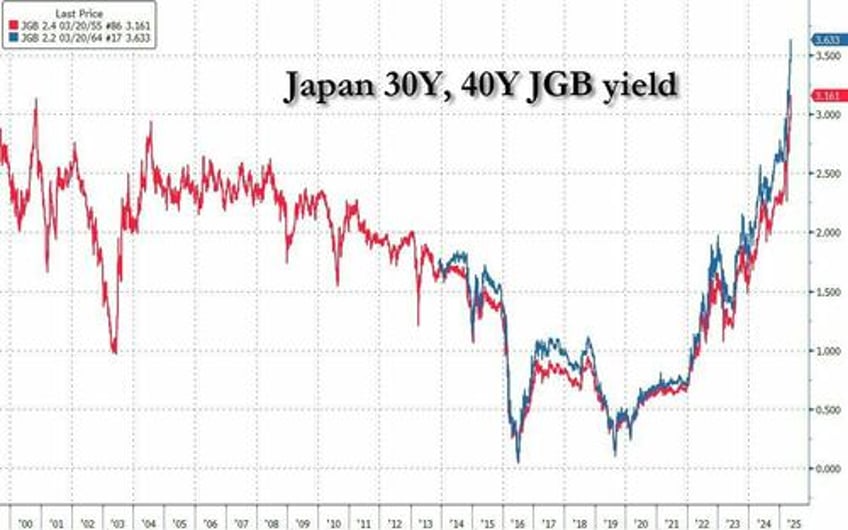

One week ago, we pointed out the startling development that at a time when all eyes were on US Treasuries, it was in fact the Japanese bond market - and especially the long-end - that was collapsing after a dismal 20Y auction priced with not only the worst bid to cover since 2012 but also the biggest tail since 1987, sending 30Y and 40Y yields - those not subject to the BOJ's Yield Curve Control - to record levels.

Shortly thereafter we provided a detailed explanation for just why the market was finally revolting. According to Goldman's Japan trading desk, the bond buyer strike revolved around three core issues: