US stocks closed lower into the long weekend after a record post-Moody's meltup (driven by record retail BTFDing), with the S&P down 2.6% on the week, spooked by headlines that Trump is recommending a straight 50% Tariff on the European Union as soon as June 1st if trade negotiations fail (which is just another typical Trump negotiating gambit but as usual, the algos bought it all the way). This uncertainty added to last Friday's Moody’s downgrade, a catastrophically weak Japan bond auction, higher UK CPI, and deficit concerns that the market had to digest this week.

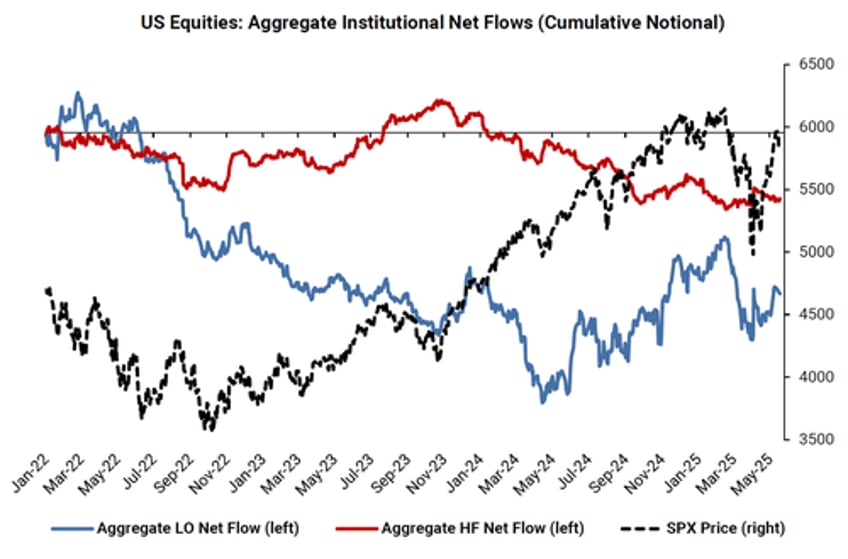

In its weekly lookback, the Goldman share sales desk writes that Long Onlies finished -$2BN net sellers for the week, while Hedge Funds were flat. Supply was concentrated in macro products as higher yields weighed on risk appetite and kept investors frozen in lack of incremental positive news.