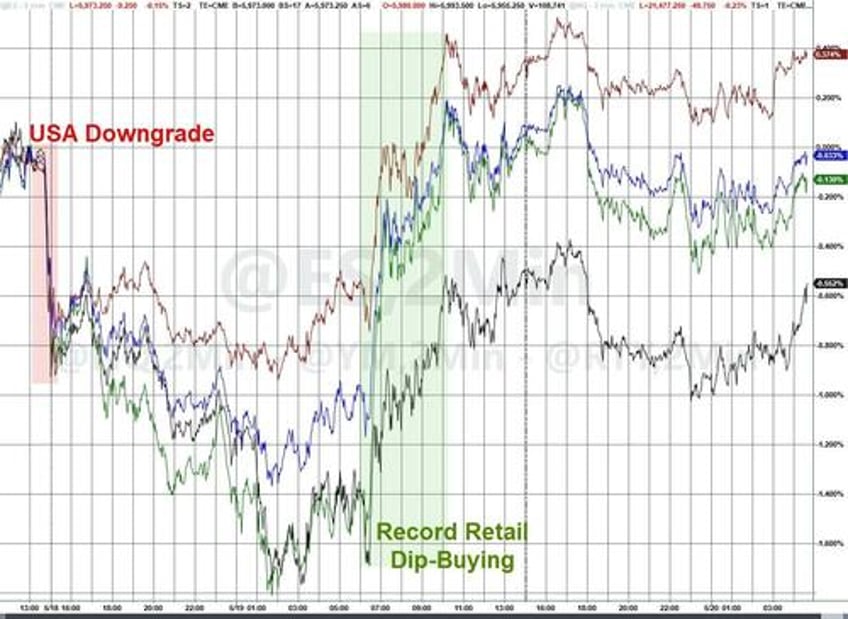

As we detailed yesterday, stocks and bonds recovered strongly after the post-Moody's downgrade selloff, despite legacy media's desperate effort to push FUD (which continues today).

Nomura's Charlie McElligott explained succinctly why the market refused to follow the FUD as the Moody’s U.S. downgrade (an utterly trivial MtM exercise at best) simply iterates what the Rates-universe has already been trading for years: