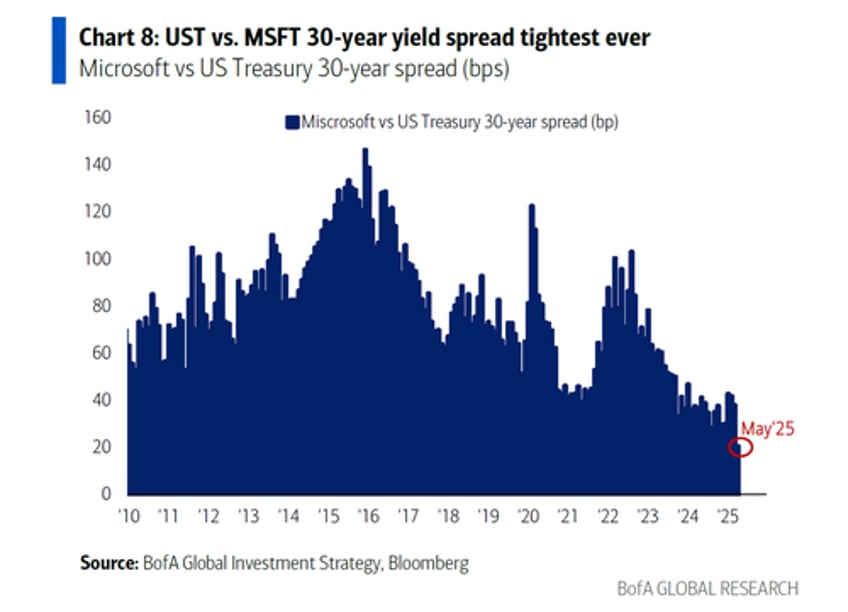

Something remarkable happened after the US lost its final AAA rating last week (thanks to the politically timed Moody's downgrade): not only are US yields now higher than Microsoft bond yields out 3 years; but the 30-year Treasury/MSFT yield spread is now just 20bps, the tightest ever. Very soon, Microsoft will be a lower credit risk than the country behind the world's reserve currency.

As to how we got here, BofA's Michael Hartnett is, as usual, descriptive: as he writes in his latest Flow Show (available to pro subs), if you spent $100 every second, it would take you 2248 years to equal the $7.1 trillion the US government spent in the past year; and as we discussed last week, now that the "Big, Beautiful Bill" is fast-tracked for passage, assuring it will also "Bust the Budget", Hartnett tactically still thinks “up-in-yields, down-in-US $” (i.e. 30-year UST >5% + US$ DXY index <100) will prove to be negative risk assets.