By Peter Tchir of Academy Securities

Plato the Greek or Rin Tin Tin

Who’s more famous to the billion millions?

It seems like it has hit a point where it is impossible to avoid discussing the Magnificent Seven. However, at least I can write it with the Clash playing in the background.

Rates (the Fed)

I continue to believe in my very simple theme. After the July meeting (where the market has already given the Fed the green light to hike 25 bps):

The Fed has a high hurdle to hike again this year.

The Fed has an extremely high hurdle to cut this year.

The Fed (unless they do something new with their balance sheet reduction program) should largely be “a non-event” for the rest of this year. Yes, occasionally markets will move as the Fed messaging (or jawboning) changes tone, but unless the data comes in decidedly bad or good for an extended period of time (2 or more months), they are going to try to be on hold.

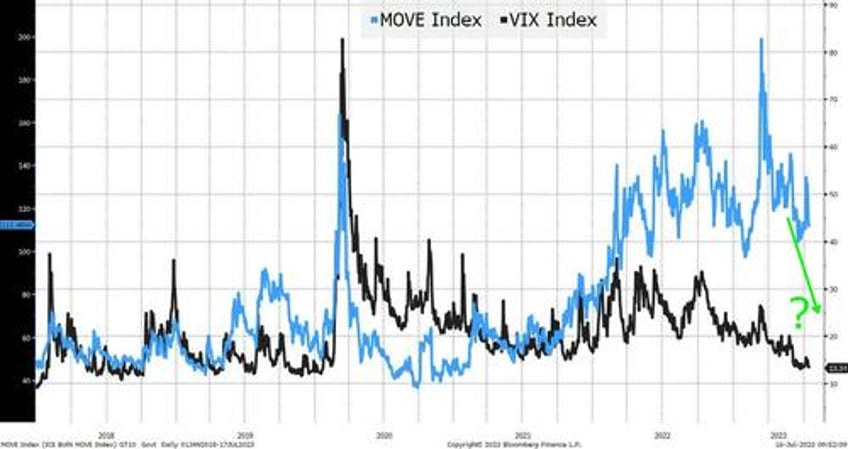

The volatility being priced into the bond market seems too high relative to equities

Traditionally, the two move in the same direction in somewhat similar orders of magnitude. Since the Fed started their hiking cycle, bond market implied volatility has been much higher than stock market volatility. While part of this is because the depth of true liquidity in the bond market is lower (relative to its size) than the liquidity in the equity market, bond market volatility should eventually decline (or “normalize”) relative to equity volatility.

I expect 2s vs 10s to become less inverted as the two-year can start pricing in a lower Fed Funds rate a year or so out. However, 10s can start to price in a higher terminal rate and a longer timeframe to get there.

Economic Data

Inflation. We should continue to see some relief in inflation (especially on the goods side of things), but many factors (particularly the re-building of more “secure” supply chains) will keep it consistently above the Fed’s 2% target.

Jobs. I expect weakness on the jobs front in the coming months, but not enough weakness to meet the extremely high hurdle required to cut rates.

The data, in general, should be impacted by the lag effect of prior rate hikes. That is why the Fed is reluctant to hike more, but since that is what the Fed wants, they won’t turn dovish either.

The Magnificent Seven

Ring! Ring! It’s 7 a.m. (ok, I couldn’t resist another line from the song).

We have seen a divergence between the major indices and their equal weighted siblings (and it has been quite extreme this year). For example, the Nasdaq 100 has a YTD return of 43% compared to an equal weighted return of 24%. The S&P 500’s YTD return is 18% vs. 8% for the equal weighted version.

Regarding the S&P, while the equal weight is “only” lagging by 10% this year, that divergence is bigger than what we have seen historically. With 500 names, it is more difficult for any one stock (or seven stocks) to drive the index returns, yet a handful of stocks have really driven this divergence. What strikes me as “curious” is that it looks like there was a clear “start date” to this trend in the S&P 500. Until March 9th, the S&P 500 and the equal weighted version marched along (more or less) in tandem. Since then, the divergence grew and has remained quite high!

If there is any “consolation” for those mired in the Russell 2000, both the equal weighted and regular weighted indices have lagged the broader market (Russell is up less than 10% YTD). Historically, you would expect that the Russell 2000 would do well when the other major indices are doing well, because it should be about the economy or liquidity. However, the Russell 2000 is struggling to get out of its own way this year. And yes, if there were problems in the high yield bond market (or even the leveraged loan market), I’d expect that to weigh on the Russell 2000, but those markets have both been healthy this year. Yes, there are some concerns (especially about some segments of the leveraged loan market), but as a whole those markets are behaving well, which should support the Russell 2000.

Some of the blame can be attributed to the regional banks (KBW Regional Bank Index is down 20% YTD). But is that really enough? Does that explain this divergence? I don’t think so.

I haven’t mentioned ARKK (a “disruptive tech” ETF) in a long time and it is “only” up 55% YTD. Yes, 55% is a great return, but if you told me that the Nasdaq 100 would be up 43% this year, I would have bet (based on its high beta) that ARKK would be up much more than 55%.

Again, this highlights just how specific the themes/trends have been this year.

Churrascaria

On this rainy Sunday morning, I am thinking about barbecue. More specifically, I’m thinking of those Brazilian steakhouses (no offense if they aren’t really authentic) where you get a disk with green on one side (you want more meat brought to you) and red on the other (indicating, at least for a moment, that you need a breather).

It almost looks as though on March 9th, someone turned their disk to green and has been gorging ever since.

The questions are:

Can this continue? Possibly. We’ve seen valuations stretched in the past (think ARKK) so this could continue, especially as the AI theme is bigger and more interesting/compelling than other themes that have driven the market (I never got the “metaverse” to be honest). Also, with so many (including myself) eyeing the laggards and not fully benefiting from the amazing performance by the market leaders, that could easily become the “pain trade”. Though at some point, especially if AI can deliver on its promises of efficiencies, it should help the broader market more than it has since the benefits should accrue to each and every company that can harness it.

If it doesn’t continue, do the laggards catch up? Or do the rising stars come back to earth? If there is to be some form of convergence, will it be because we spark a rally that lifts the laggards? Or will the convergence come as valuations drop on the high flyers? Or maybe whoever is in charge of the disk at the steakhouse will flip it red.

What I want to believe:

50% chance of convergence due to a pull back.

40% chance of convergence due to laggards outperforming.

10% chance that the current trend continues.

What I’m starting to believe:

10% chance of convergence due to a pull back.

40% chance of convergence due to laggards catching up.

50% chance that the current trend continues (and won’t stop until every investor buys into the trend, which just hasn’t happened yet).

Bottom Line

Well, this basically leaves me with a good song and some steak on my mind.

Rates: Lower volatility, rangebound, with less inversion.

Credit: A slow grind to tighter spreads.

Equities. I am scared that the scenarios that I want to see play out won’t actually happen. For now, I want to bet on convergence, largely spurred by the re-balancings being done in the indices. I have a more or less neutral view on overall risk (while the laggards outperform). However, I am truly horrified that this is an extremely consensus view.

Two final thoughts (mostly related to equities):

What if there is just too much money chasing too few liquid assets, which is only going to push equity valuations higher and higher? That is an argument that has been discussed a lot in the past and would help explain a permanent shift to much higher/richer valuations. AI might be a justification, but there could just be a much greater need to invest (and those with money are earning income that needs to be invested).

What if any economic weakness won’t translate into price action reflecting a potential recession, but will instead be viewed as a positive for stocks because rates will have to come down? Could the markets jump from recession fears to “hey, the Fed has our back sooner or later” hopes? Will the market just “look through” any recession because it will eventually end with the Fed being accommodative? Basically, it doesn’t matter if you get the recession call right or not because stocks will react positively no matter what. Seems like I’m saying that good news is good for stocks and bad news is good for stocks, which seems illogical (and even impossible), yet we seem to be living in that sort of a world.

I am really looking forward to earnings because they will provide the best insights into how sustainable the current valuations are and whether we could see a pop in the laggards!