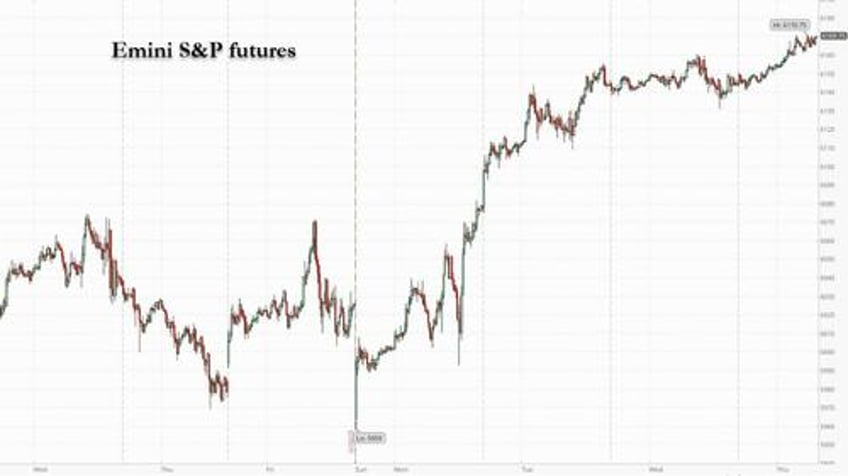

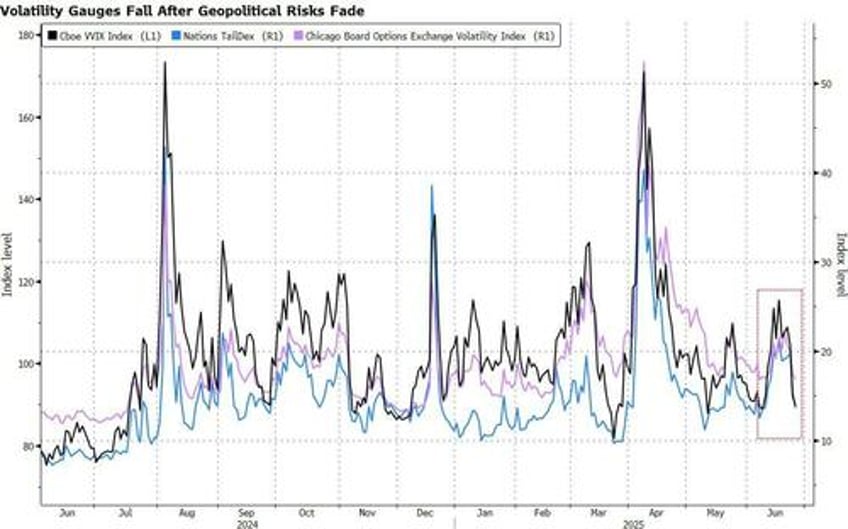

US equity futures extend their torrid short squeeze rally and are set to hit a new all time high for the S&P, with Tech outperforming while volatility is falling rapidly. As of 8:00am, S&P futures rose 0.3% to 6,170 while Nasdaq futures gained 0.5% with all Mag7 names higher again, and semis aiding the rally after solid earnings from Micron; cyclicals outperform defensives. The VIX is trading below 17 amid a relentless selloff in volatility, and heading for a four-month low, despite Trump’s looming trade deal deadline and other simmering risks. The dollar slumped to the lowest since April 2022 as traders ramped up bets for faster US interest-rate cuts, spurred by a WSJ report that Trump may fast-track his nomination for the next Federal Reserve chief. Treasury yields declined across the curve, with the 10-year rate down two basis points to 4.27%. Commodities are seeing a rebound led by Ags/Precious metals. Today’s macro data focus includes Durable/Cap Goods, Initial Claims, and regional Fed activity indicators. On Durable/Cap, Goldman expects a +15% MoM surge in Durables thanks to the sharp increase in aircraft orders after Trump's visit to the Middle East; Initial Claims are expected to print at 243k.

In premarket trading, Mag 7 stocks are higher alongside index futures (Nvidia +1.3%, Alphabet +1%, Meta +0.8%, Amazon +0.7%, Microsoft +0.4%, Tesla -0.1%, Apple -0.1%).

- Micron (MU) climbed about 1.5% after solid earnings, while Nvidia is set to extend its advance into record territory, rising 1.1%.

- Apple Inc. (AAPL) shares fall 0.1% after its price target was cut at JPMorgan to $230 from $240 on the iPhone 17’s incremental lineup launch.

- Microsoft (MSFT) edges up 0.4% after Morgan Stanley raised its price target to $530 from $482, citing upside from the company’s Azure cloud service.

- General Mills (GIS) rises 0.7% after RBC raised its recommendation to outperform from sector perform, noting that the packaged food company’s full-year earnings-per-share guidance showed it would be able to weather the sluggish backdrop.

- Jefferies (JEF) shares slip 2.5% after reporting earnings that missed estimates, hurt by a slump in deal activities between March and May due to the market turmoil.

- Trade Desk (TTD) falls 2.2% after Wells Fargo Securities cuts its rating on the stock to equal-weight from overweight, predicting the advertising technology firm would feel a greater competitive impact from Amazon in 2026.

- Truist Financial Corp. shares (TFC) rise 1.5% after Citi raised its recommendation to buy from neutral, citing its balance sheet growth and its relatively cheap stock price likely increasing buybacks.

In corporate news, Tokyo Gas is said to be in discussions with multiple US liquefied natural gas suppliers to secure a long-term purchase agreement. Mars’s $36 billion takeover of snack maker Kellanova was given the green light by the FTC on the same day EU regulators opened up a lengthy probe of the deal. Shell said it has no intention of making a takeover offer for BP.

The Bloomberg dollar index fell 0.4% to the lowest level since April 2022; Treasury yields declined across the curve, with the 10-year rate down two basis points to 4.27%, as markets are pricing 64 basis points of easing from the Fed by the end of the year, compared to 51 basis points at the end of last week, with a 20% chance of a quarter-point cut next month.

The moves followed a WSJ report that Trump may announce Powell’s successor as soon as September, which could essentially create a “shadow” central bank chair who’s more open to rate cuts, before Powell’s term is over (market now pricing in a 25% chance of a July cut/100% chance of a cut by Sept meeting). According to the WSJ, "the president has toyed with the idea of selecting and announcing Powell’s replacement by September or October, according to people familiar with the matter…Trump is considering former Fed governor Kevin Warsh and National Economic Council director Kevin Hassett. Treasury Secretary Scott Bessent is being pitched to Trump by allies of both men as a potential candidate. Other contenders include former World Bank President David Malpass and Fed governor Christopher Waller."

The “discussion around naming a Fed chair early and that Fed chair presumably being more dovish, or willing to do a little more of what Trump wants to do in terms of cutting rates, it’s all going to weigh on rates and the dollar,” said Timothy Graf, head of EMEA macro strategy at State Street Global Markets.

Sentiment was boosted by the continued gains in chip stocks and the AI theme: Micron climbed about 1.5%, while Nvidia Corp. is set to extend its advance into record territory, rising 1.1%. “The Micron earnings are likely to boost tech again and when tech thrives, everything thrives,” said Pierre Alexis Dumont, chief investment officer at Sycomore Asset Management. “In that sense, we could reach a new record today.”

Sure enough, Barclays strategists expect US stocks to see further gains and note that “fears of a foreign buyers’ strike against US assets are overdone.” Elsewhere, the Treasury Department is nearing a deal that would make the so-called “revenge tax” irrelevant, a development that could bring relief to Wall Street investors worried about punitive tax measures on foreigners.

Meanwhile, the VIX is now below 17 and heading for a four-month low, despite Trump’s looming trade deal deadline and other simmering risks. It’s a big day for macro data, with durable goods, GDP and the Fed’s preferred inflation gauge, core PCE, all on deck.

Turning to trade, Deputy Treasury Secretary Michael Faulkender said the expectation is that, following negotiations with US trading partners, tariffs won’t go back as high as the reciprocal levies Trump announced on April 2. Japan’s chief trade negotiator said the country can’t accept the US’s 25% tariffs on cars, as Japanese automakers produce far more cars in the US than they export to it. China’s $1.3 trillion sovereign wealth, CIC, is in retreat from the US, as tensions with the US throw up investment roadblocks and Beijing seeks to lower risk by reining in the massive fund.

In Europe, the Stoxx 600 rises 0.2%, lifted by retail shares after H&M delivered better-than-expected profit. Miners are also outperforming while auto shares lag. Here are some of the biggest movers on Thursday:

- H&M shares gain as much as 7.9%, the most since April, after the Swedish fast-fashion retailer reported better-than-expected second-quarter earnings.

- Valeo shares rise as much as 5% after Morgan Stanley double-upgrades the French car parts manufacturer, citing the stock’s attractive valuation.

- Proximus shares rise as much as 7% as Berenberg takes a more positive view on the outlook for cash returns from European telecommunications companies over 2025-2030 as the firm initiates, re-initiates and transfers coverage of 20 stocks in the sector.

- Volex shares gain as much as 19% as Jefferies says the power products manufacturer’s results came in ahead on all metrics.

- South African Precious Metal shares rise after platinum rose to the highest since 2014 on solid demand from Chinese jewelry buyers who are favoring the metal over gold.

- Carrefour shares slide as much as 6.2%. JPMorgan places stock on negative catalyst watch and downgrades estimates across the board ahead of the supermarket group’s first-half results.

- Traton falls as much as 4.9% as Bankhaus Metzler downgrades to sell and sets a joint Street-low target on the German truckmaker to reflect short-term downside risk.

- Moonpig shares plunge as much as 12%, the most since December, after the online greeting card company said CEO Nickyl Raithatha is standing down after seven years in the role.

- Next 15 shares plunge as much as 22% as the growth consultancy firm said annual profit will be materially below expectations, following a warning about potential misconduct at its Mach49 brand.

- Yara International shares tumble as much as 3.2% on news that China is loosening its ban on urea exports, a move that is likely to ease surging international prices that have been buoyed by tension in the Middle East.

Earlier in the session, Asian equities advanced, lifted by technology shares after Nvidia climbed to a record high. Stocks in South Korea and Hong Kong retreated following recent rallies. The MSCI Asia Pacific Index advanced as much as 0.9%, poised for its best three-day gain since April. The benchmark is trading at its highest level since September 2021. Tech stocks were among the biggest boosts to the gauge after Nvidia reclaimed its position as the world’s most valuable company, suggesting that the AI trade has further to run. Meanwhile, Hong Kong shares were on track for their first loss in five sessions and Korean stocks paused one of the world’s hottest rallies of the year.

In FX, the Bloomberg Dollar Spot Index is down 0.4%, the lowest since April 2022, and on course for a fourth straight day of declines after the Wall Street Journal reported US President Donald Trump is considering an early appointment for the next Federal Reserve chairman. That’s bolstering expectations that Fed interest rates will be cut sooner than previously expected. The Japanese yen is leading gains against the greenback, rising 0.9%. The Swiss franc and pound outperform most of their G-10 peers.

In rates, treasuries gain on the back of news that a shadow Fed chair may soon be revealed. Front-end yields are 2bp-3bp richer, keeping 2s10s and 5s30s spreads near Wednesday’s highs. 10-year around 4.27% is 1bp lower on the day with bunds and gilts lagging by 0.5bp and 1.5bp in the sector. Fed-dated OIS contracts price in around 62bp of easing for the year, of which about 5bp are priced for the next policy meeting in July. The week’s coupon auction cycle concludes with $44 billion 7-year note sale, following unremarkable results for 2- and 5-year notes; WI 7-year yield near 4.03% is ~16.5bp richer than last month’s, which stopped through by 2.2bp

In commodities, spot gold climbs $8 to around $3,340/oz. WTI is little changed near $65 a barrel.

Looking at today's calendar, US economic data slate includes May trade balance, May preliminary wholesale inventories, 1Q GDP revision, May Chicago Fed national activity and durable goods orders and weekly jobless claims (8:30am), May pending home sales (10am) and June Kansas City Fed manufacturing activity (11am). Fed speakers include Goolsbee (8:30am), Barkin (8:45am), Daly (8:45am), Hammack (9am), Barr (1:15pm) and Kashkari (7pm)

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.4%

- Russell 2000 mini +0.2%

- Stoxx Europe 600 +0.2%

- DAX +0.8%

- CAC 40 +0.2%

- 10-year Treasury yield -1 basis point at 4.28%

- VIX -0.1 points at 16.68

- Bloomberg Dollar Index -0.4% at 1194.63

- euro +0.5% at $1.1715

- WTI crude little changed at $64.87/barrel

Top Overnight News

- The dollar sold off to a 3 year low and treasury yields fell on bets that US rate cuts may come sooner than expected as Trump increases pressure on Powell. The WSJ reported he may name a replacement for the Fed chair as early as September. Among those being considered for the job are former Fed Governor Kevin Warsh, NEC Director Kevin Hassett and Treasury Secretary Scott Bessent. BBG

- US Senate Republicans are reportedly considering delaying cuts to Medicaid in a bid to win over more moderate holdouts from the party, who threaten progress of the Reconciliation Bill: Punchbowl.

- Congress is still hashing out Trump’s tax bill, with the SALT deduction a point of tension between the chambers. US Republican Representative Lalota said, in reference to SALT, "We are far from a deal still." Senator Susan Collins also floated a tax hike on those making more than $100 million a year. BBG

- US President Trump is set to hold a “One, Big, Beautiful Event” at the White House on Thursday to urge the Senate to pass the reconciliation bill, according to a White House official: CBS News.

- US tariffs will probably fall well below the April 2 levels after negotiations with trade partners, Deputy Treasury Secretary Michael Faulkender said. Meanwhile, Japan said it can’t accept 25% tariffs on its cars, a sticking point in talks. BBG

- China has taken a series of actions in the past week on counter-narcotics, in a sign of cooperation with U.S. demands for stronger action on the synthetic opioid fentanyl, a key irritant in the bilateral relationship. RTRS

- Chinese premier Li Qiang said on Thursday reforms and a shift to a consumption-led model in the world's No. 2 economy will help it continue to be the world's biggest driver of economic growth. RTRS

- China’s oil demand may have peaked in 2023, with consumption falling 1.2% last year amid slowing growth and rising EV adoption, the Energy Institute said. The shift may accelerate the prospect of a global usage plateau. BBG

- German Chancellor Friedrich Merz is demanding that Brussels strike a trade deal with the United States within days, as concerns grow that the EU will end up with an unbalanced agreement that only benefits Donald Trump. BBG

- Investors are fleeing long-term US bond funds at the swiftest rate since the heights of COVID 5 years ago as America’s soaring debt load tarnishes the appeal of one of the world’s most important markets. Net outflows from long dated US bond funds spanning government and corp debt have hit nearly $11bn in the 2nd quarter. FT

- Blue Origin and Jeff Bezos reportedly appealed to the White House for more government contracts following Elon Musk’s departure: WSJ.

- Meta (META) has reportedly poached three OpenAI researchers – Lucas Beyer, Alexander Kolesnikov, and Xiaohua Zhai: WSJ

- BlackRock (BLK) is increasing its push into private investments; intends to offer a 401(k) target date fund with a 5-20% allocation to private investments, depending on investor age, in H1-2026: WSJ

Trade/Tariffs

- Japanese Economy Minister Akazawa said Japan will continue tariff talks with the US ahead of reciprocal tariffs due on July 9th, but cannot accept the 25% auto tariff, according to Reuters.

- India and US trade talks face roadblocks ahead of the tariff deadline, according to Reuters citing sources; India is resisting tariff cuts without US commitments; delegation is exp. to travel to US before deadline.

- Chinese authorities are dragging out approval of Western companies’ requests for rare earths, two weeks after the nation said it would ease exports, according to WSJ.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed in choppy fashion following a similar session on Wall Street, with overnight newsflow relatively light as Israel and Iran seemingly continued to observe the ceasefire. ASX 200 was weighed on by the tech sector despite outperformance in the space stateside. ASX-listed software giant Xero fell over 7% after announcing its intention to purchase payments provider Melio for around USD 3bln. Nikkei 225 outperformed and topped the 39k mark for the first time in over a month, led by strong gains in the industrial sector. This came despite a firmer JPY, with market focus turning to the upcoming US-Japan trade talks after local media flagged Japanese Economy Minister Akazawa’s planned visit to Washington as early as June 26th. Hang Seng and Shanghai Comp were mixed, while Chinese Premier Li said authorities will take forceful steps to boost consumption. Thereafter, bourses drifter higher as a Chinese state planner official said that with policy implementation and introduction, "we are confident and capable of minimizing the adverse impacts from external shock."

Top Asian News

- Chinese state planner official said with policy implementation and introduction, "we are confident and capable of minimising the adverse impacts from external shock", according to Reuters.

- The PBoC injected CNY 509.3bln via 7-day reverse repos, maintaining the rate at 1.40%.

- Citi raised its China 2025 GDP growth outlook to 5.0% (prev. 4.7%).

- Chinese Commerce Ministry (on rare earth export licenses for EU firms) says it has been accelerating development of rare earth export licenses in accordance with the law

European bourses (STOXX 600 +0.2%) are generally modestly firmer across the board, following a mixed and choppy APAC session overnight. Though it is worth noting that price action (aside from the DAX 40) has been quite choppy and within a tight range so far. European sectors hold a positive bias, in-fitting with the broadly positive mood in European indices. Basic Resources takes the top spot, lifted by strength in metals prices following positive commentary from Chinese Premier Li and the State Planner; the latter said that with policy implementation and introduction, they are confident in minimising adverse effects from external shocks. Retail is found in the second spot, buoyed by post-earning strength in H&M (+5.2%).

Top European News

- German GfK Consumer Sentiment (Jul) -20.3 vs. Exp. -19.3 (Prev. -19.9, Rev. -20.0)

- Swedish Total Industry Sentiment (Jun) 94.8 (Prev. 98.9); Sentiment (Jun) 92.8 (Prev. 94.6)Manufacturing Confidence (Jun) 99.3 (Prev. 100.1); Consumer Confidence SA (Jun) 84.6 (Prev. 83.1)

FX

- DXY is on the back foot for the fourth consecutive day, and currently trades towards the lower end of a 96.93-60 range – the index now trades at levels not seen since March 2022. Overnight reporting suggested that US President Trump may accelerate the announcement of a successor to Fed Chair Powell, possibly as early as this summer, or in September or October, according to WSJ sources. A slew of US data later, including US PCE (Q1), GDP Final (Q1), Jobless Claims and Durable Goods. Fed speak today via Daly, Barkin, Hammack, Barr and Kashkari.

- EUR/USD continues to benefit from the broader Dollar weakness and currently trades above 1.17; session peak at 1.1744. EZ-specific docket has been exceptionally light today; German GfK Consumer Sentiment printed a touch below expectations, no reaction on this.

- JPY is the G10 outperformer today, largely thanks to the pullback in US yields overnight and broader Dollar weakness. USD/JPY has fallen below both its 21 DMA (144.50) and 50 DMA (144.27) to currently trade below the 144.00 mark at around 143.83. Overnight, upside in the JPY was briefly capped on reports that Japanese Economy Minister Akazawa said Japan will continue tariff talks with the US ahead of reciprocal tariffs due on July 9th, but cannot accept the 25% auto tariff.

- GBP also benefits from the Dollar weakness and trades at multi-year highs, and marginally topped its 2022 high at 1.3749. Beyond that, there is a little bit of clear air up until the 1.3800 mark, whereby the high from Oct 29 2021, at 1.3804 may be in focus. UK-specific newsflow has been very light so far, but docket ahead includes BoE's Bailey.

- Antipodeans are modestly benefitting from the Dollar weakness, but also amid some positive commentary out of China overnight – remarks which helped to boost base metals also. Firstly, the Chinese State Planner said with policy implementation and introduction, "we are confident and capable of minimising the adverse impacts from external shock", according to Reuters. Secondly, Premier Li said authorities will take forceful steps to boost consumption. Lastly, Citi raised its China 2025 GDP growth outlook to 5.0% (prev. 4.7%).

- PBoC set USD/CNY mid-point at 7.1620 vs exp. 7.1561 (prev. 7.1668); strongest CNY fix since Nov 8 2024

- HKMA bought HKD 9.42bln as the Hong Kong dollar hit the weak end of its trading range, marking the first such intervention since 2023 to defend the currency peg.

- South African President Ramaphosa is reportedly considering a cabinet reshuffle, via News24 citing sources; this could involve Deputy Trade Minister Whitfield and Minister Nkabane. USD/ZAR lifted from 17.62 to 17.70 on speculation of, and since source reporting around, a potential cabinet reshuffle.

Fixed Income

- USTs are firmer, benefitting from the WSJ reports that President Trump could announce the next Fed Chair much earlier than is traditionally the case. Trump himself has intimated he has the list down to a handful of individuals; unsurprisingly, all those on the WSJ list are or are expected to err on the dovish side of things. USTs to a 111-28 peak thus far, notching another best for the month and now to within a point of the 112-23 peak from May, but of course still a significant distance from the mark. Ahead, 7yr supply rounds off the week’s taps, which have gone well thus far. US data and Fed speak is also due.

- Bunds are also bid, in-fitting with the above. A bout of upside was seen at 07:00BST, from 130.62 to 130.74 in the space of two-three minutes. Upside that occurred alongside a soft German GfK survey, a release that shows that while the government’s fiscal support is aiding business expectations this is yet to filter through to the individual consumer level. Since, Bunds have continued to climb and peaked at 130.80 before experiencing a modest pullback as the morning continued and the risk tone continues to improve. Action that has caused Bunds to pullback from the above high by around 15 ticks, but remain in the green by a similar magnitude. Ahead, the docket features ECB speak from heavyweights Lagarde, de Guindos and Schnabel.

- Gilts gapped higher by 14 ticks and then continued to climb, above Wednesday’s 93.38 open to a 93.45 high for today; just shy of Tuesday’s 93.51 peak and 92.57 from Wednesday thereafter. Ahead, the docket is sparse and as such Gilts will likely follow the narrative of US events, particularly anything further on the Fed Chair, and speeches from the ECB and Fed.

- UK sells GBP 1.0bln 4.25% 2046 Gilt, via tender: b/c 1.99x, average yield 5.162%.

Commodities

- WTI and Brent began the European morning on the front foot, taking impetus from the softer USD and improving risk tone. Drivers that were sufficient to lift WTI and Brent to peaks of USD 65.57/bbl and USD 67/08/bbl, respectively. However, as the morning progressed and despite or perhaps in-part because of the lack of newsflow the benchmarks have lost ground with WTI now below USD 65.00/bbl and threatening a move into the red.

- Spot gold is firmer given the softer USD and lower yield environment on the back of the WSJ-Fed report around an early Fed Chair nominee announcement. A move that has been interpreted as one to undermine the authority of Chair Powell, with a dovish move occurring on the back of it given the list of potential nominees all fall on that side of the hawk-dove discussion. XAU itself gleaning some further impetus on the narrative that the undermining of Chair Powell draws into question the Fed's credibility and/or independence. XAU up to a USD 3350/oz peak, firmer but yet to approach USD 3369/oz or USD 3398/oz from Tuesday and Monday.

- 3M LME copper is firmer, benefiting from the increasingly constructive risk tone and the discussed USD pressure. Sentiment boosted by China-related headlines overnight; Firstly, the Chinese State Planner said with policy implementation and introduction, "we are confident and capable of minimising the adverse impacts from external shock", according to Reuters. Secondly, Premier Li said authorities will take forceful steps to boost consumption. Lastly, Citi raised its China 2025 GDP growth outlook to 5.0% (prev. 4.7%).

- Citi reaffirms its Brent forecast of USD 66/bbl and USD 63/bbl for Q3- and Q4-2025, respectively

- Goldman Sachs upgraded its H2 2025 LME copper price forecast to an average of USD 9,890/t (prev. USD 9,140/t), citing a tariff-driven reduction in ex-US stocks and resilient activity in China. The bank expects copper to peak at USD 10,050/t in 2025, before easing to USD 9,700/t by December. For 2026, it forecasts an average copper price of USD 10,000/t (prev. USD 10,170/t), reaching USD 10,350/t.

Geopolitics

- Al-Akhbar reports that another round of talks between Israel and Hamas is expected within the next few days, according to Egyptian sources cited; Hamas is reportedly ready to release all hostages in exchange for Israeli commitments

- Iranian defences shot down an unknown drone over the border strip with Iraq, according to Al Arabiya; the incident occurred over the border area of Siba in southern Iraq, according to Al Hadath.

- CIA Director said the CIA can confirm that credible intelligence indicated Iran’s nuclear programme had been severely damaged by recent strikes. Several key Iranian nuclear facilities had been destroyed and would have to be rebuilt over the course of years, according to Reuters.

- US President Trump called on Israeli Prime Minister Netanyahu’s domestic trial to be cancelled immediately and for him to be granted a pardon, via Truth Social.

- The Pentagon released a document outlining FY26 weapons requests, including funding for 24 F-35 warplanes and two submarines, according to Reuters.

US Event Calendar

- 8:30 am: May P Wholesale Inventories MoM, est. 0.17%, prior 0.2%

- 8:30 am: 1Q T GDP Annualized QoQ, est. -0.2%, prior -0.2%

- 8:30 am: 1Q T Personal Consumption, est. 1.2%, prior 1.2%

- 8:30 am: 1Q T GDP Price Index, est. 3.7%, prior 3.7%

- 8:30 am: 1Q T Core PCE Price Index QoQ, est. 3.4%, prior 3.4%

- 8:30 am: May Chicago Fed Nat Activity Index, est. -0.13, prior -0.25

- 8:30 am: May P Durable Goods Orders, est. 8.5%, prior -6.3%

- 8:30 am: May P Durables Ex Transportation, est. 0%, prior 0.2%

- 8:30 am: May P Cap Goods Orders Nondef Ex Air, est. 0.1%, prior -1.5%

- 8:30 am: May P Cap Goods Ship Nondef Ex Air, est. -0.12%, prior -0.1%

- 8:30 am: Jun 21 Initial Jobless Claims, est. 243.19k, prior 245k

- 8:30 am: Jun 14 Continuing Claims, est. 1950k, prior 1945k

- 10:00 am: May Pending Home Sales MoM, est. 0.13%, prior -6.3%

Central Bank Speakers

- 8:30 am: Fed’s Goolsbee Appears on CNBC

- 8:45 am: Fed’s Barkin Speaks on the Economy

- 8:45 am: Fed’s Daly Appears on Bloomberg TV

- 9:00 am: Fed’s Hammack Gives Opening Remarks

- 1:15 pm: Fed’s Barr Speaks on Community Development

- 7:00 pm: Fed’s Kashkari in Q&A at Montana Chamber Event

DB's Jim Reid concludes the overnight wrap

Markets were broadly steady yesterday, with few headlines to push things in either direction. Indeed, for a sense of that, the S&P 500 fell just -0.0003%, which was its smallest move in either direction since 2017, whilst the 10yr Treasury yield only moved -0.4bps. Admittedly, there were several political developments, but none really had a market-moving impact, and the ceasefire between Israel and Iran continued to hold. We also heard from Fed Chair Powell again at the Senate Banking Committee, but after his testimony the previous day, there was little that changed our understanding of the Fed’s near-term outlook either. So there were few big moves among the major assets, and with calm returning to markets again, the VIX index of volatility (-0.72pts) closed at a 4-month low of 16.76pts.

With markets holding steady, we’re now at a point where the focus is turning to several important catalysts over the next two to three weeks. The first is the US tax bill, which is currently working its way through the Senate, and the administration is trying to get it passed by Independence Day on July 4. To achieve that, things could move quickly from here, and Senate Majority leader Thune has previously said to Axios that they could start voting on the bill tomorrow.

Moreover, Politico also reported earlier this week that House Speaker Johnson told House Republicans to stay in town, given that the House needs to pass the same version as the Senate before President Trump can sign the bill. So it’s a fluid situation on timing, but given the upcoming July 4 deadline, it will need to move swiftly in the days ahead in order to pass by then. Remember that alongside the tax cuts, the bill also contains an increase to the debt ceiling, so if passed, it would remove that risk from the summer as well.

As well as the tax bill, the focus is set to swiftly turn back to tariffs, as the 90-day extension to the reciprocal tariffs ends in less than two weeks’ time on July 9. As it stands, it’s still unclear what will happen at that point, although several countries remain in negotiations with the US. The administration has signalled that trade deals are likely to follow the passage of the tax bill, and NEC director Kevin Hassett said earlier in the week that “We know that we’re very close to a few countries and are waiting to announce after we get the Big Beautiful Bill closed”.

After that, the June CPI report on July 15 is likely to assume outsize importance, as that’ll be crucial for whether the tariff pass-through is being felt in consumer prices. Only yesterday, Fed Chair Powell mentioned the uncertainty around this, saying that in terms of who’ll pay for the tariffs, “it’s very hard to predict that in advance”. But it’s crucial for the path of rate cuts, as those officials calling for caution have in part based that around the tariff impact showing up in the summer inflation numbers. We’ve already seen an impact in categories like major appliances, and even with the 90-day reciprocal tariff delay, there’s still the baseline 10% in place, as well as others in place like the steel/aluminium tariffs, the Canada/Mexico tariffs, and the China tariffs.

With all that to look forward to, markets remained in a holding pattern yesterday, with the S&P 500 (-0.0003%) holding steady as investors awaited to see what would happen on the above issues. The overall mood leant on the cautious side, with the equal-weighted version of the S&P down -0.75% and small cap Russell 2000 (-1.16%) seeing a sizeable underperformance. However, tech stocks advanced, with the NASDAQ 100 (+0.21%) hitting a fresh all-time high, whilst the Mag-7 were up +0.47% as Nvidia (+4.33%) posted a record high of its own. Meanwhile, banks (+0.87%) outperformed within the S&P 500 as the Fed Board unveiled plans to ease the enhanced Supplementary Leverage Ratio. By contrast, the declines were more consistent in Europe, with losses for the STOXX 600 (-0.74%), the DAX (-0.61%) and the CAC 40 (-0.76%).

On the geopolitical front, the ceasefire between Iran and Israel continued to hold over the last 24 hours, and President Trump said on Iran that “We’re going to talk to them next week”. Nevertheless, oil prices did recover a bit after falling over -12% over Monday and Tuesday, with Brent crude up +0.80% yesterday to $67.68/bbl, and overnight they’re up another +0.33%. Separately, the NATO leaders’ summit was taking place in the Netherlands, where the leaders agreed that by 2035, they’d spend 5% of GDP “on core defence requirements as well as defence-and security-related spending”. That’s going to be made up of 3.5% on the “core defence”, and 1.5% of GDP on areas like infrastructure.

Reviewing the summit outcome, my colleague Peter Sidorov writes that while several European countries may struggle to reach the 3.5% core spending target, it’s the ramp-up of spending and defence industrial capacity over the next few years that will determine the success of Europe’s new defence strategy.

In the meantime, sovereign bonds saw a fresh steepening yesterday. 2yr Treasury yields fell -4.3bps as investors continued to dial up expectations of Fed rate cuts, with the amount priced by year-end rising to 64bps, its highest since early May. Those moves came even as Fed Chair Powell again struck a patient tone at the Senate Banking Committee.

Significantly overnight, the WSJ also reported that President Trump is considering announcing the new Fed Chair earlier than usual, potentially by September or October, although the person would not replace Powell until next May when his current four-year term ends. That’s helped to push Treasury yields lower overnight, with the 10yr yield down another -2.2bps to 4.27%. And in turn, that’s weighed on the dollar index, which is trading at a 3-year low this morning, whilst the euro is currently trading at its highest level against the dollar since late-2021, at $1.1685.

Over in Europe, 10yr bunds (+2.2bps) underperformed OATs (+0.8bps) and BTPs (+1.5bps) for a fourth day running, following on from the increased German borrowing announcement the previous day.

Overnight in Asia, there’s been a pretty mixed performance across the major equity indices. The Nikkei (+1.35%) has posted a strong advance, which would leave the index at a 4-month high. But others have struggled, and South Korea’s KOSPI is down -1.27% after hitting its highest level since September 2021 the previous day. Elsewhere, the Hang Seng (-0.48%) and CSI 300 (-0.01%) have posted smaller losses, with the Shanghai Comp (+0.11%) only up a small amount. And looking forward, US equity futures are up slightly, with those on the S&P 500 up +0.07%.

Lastly, there was little data yesterday, although US new home sales fell by more than expected to an annualised rate of 623k in May (vs. 693k expected). That’s their lowest level since October, and the monthly drop of -13.7% was the biggest monthly decline since June 2022.

To the day ahead now, and data releases in the US include the weekly initial jobless claims, pending home sales for May, preliminary durable goods orders for May, and the third estimate of Q1 GDP. Central bank speakers include ECB President Lagarde, Vice President de Guindos, and the ECB’s Schnabel, BoE Governor Bailey, and the Fed’s Barkin, Daly, Hammack and Barr. Finally, an EU leaders’ summit will begin in Brussels.