Of all the economic reports, the BEA's periodic update of US GDP is the most useless because not only is it politically motivated, but it gets constantly revised so much that by the time we get a somewhat accurate description of how strong the economy is, it is already one - if not two quarters - later. Today's second estimate of Q1 GDP - a quarter which ended almost two months ago - is just such an example.

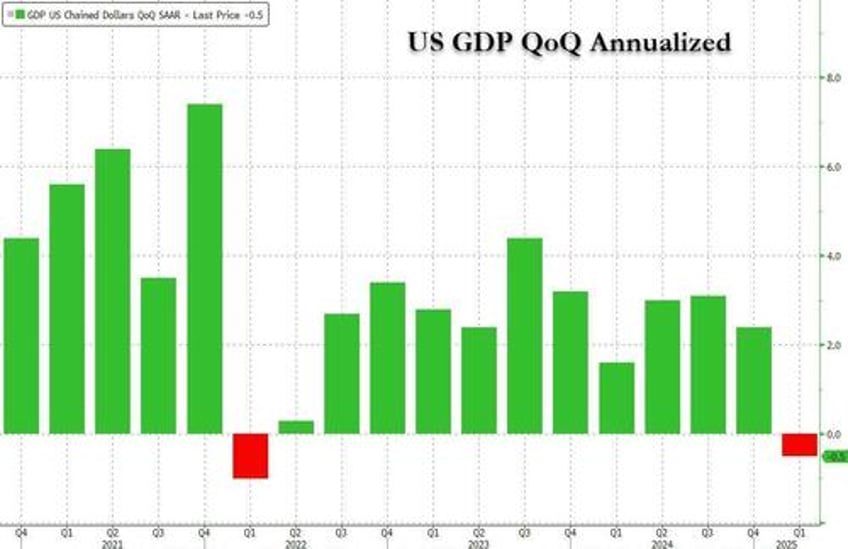

Moments ago the BEA reported that in Q1, US GDP shrank at a 0.5% annualized pace, a deterioration from the -0.2% first revision (which was also the median estimate), which in turn was an improvement from the -0.3% initial print;

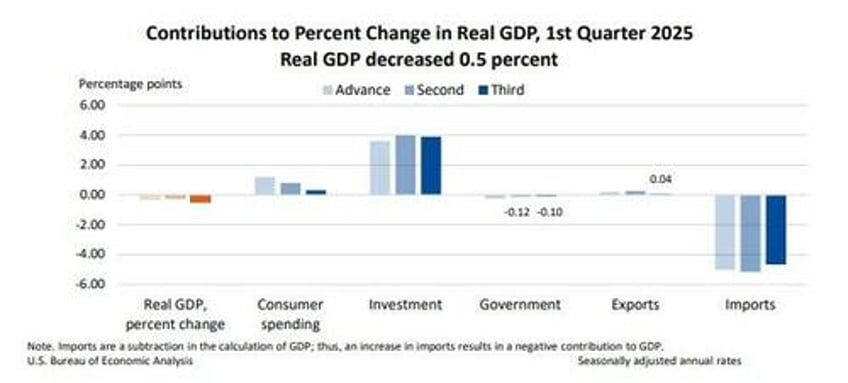

According to the BEA, GDP was revised down 0.3 percentage point from the second estimate, primarily reflecting downward revisions to consumer spending and exports that were partly offset by a downward revision to imports.

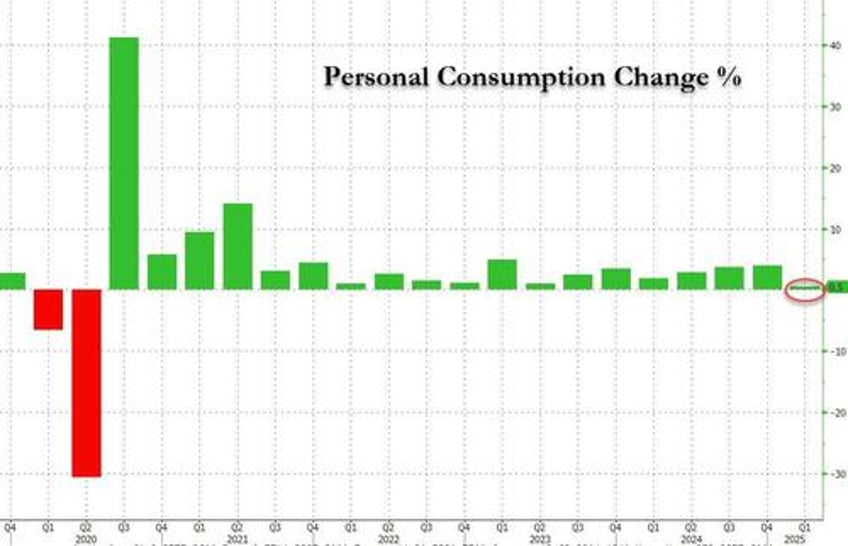

While there were few notable changes between the initial report and the first and second revision, the most notable one was in personal consumption which has continued to deteriorate, and was first cut by a third from 1.7% increase in the original print to 1.2% in the first revision, and today, to just 0.5%, making this the weakest quarter for personal spending since the covid crash.

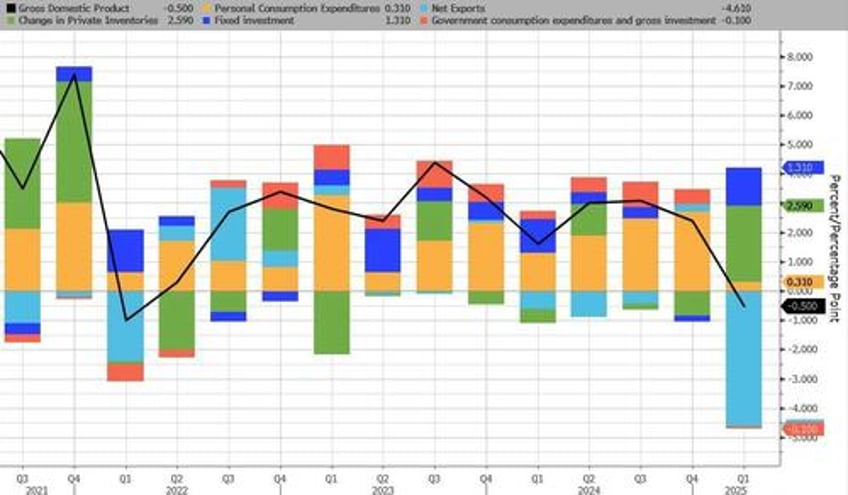

Here are some other notable changes:

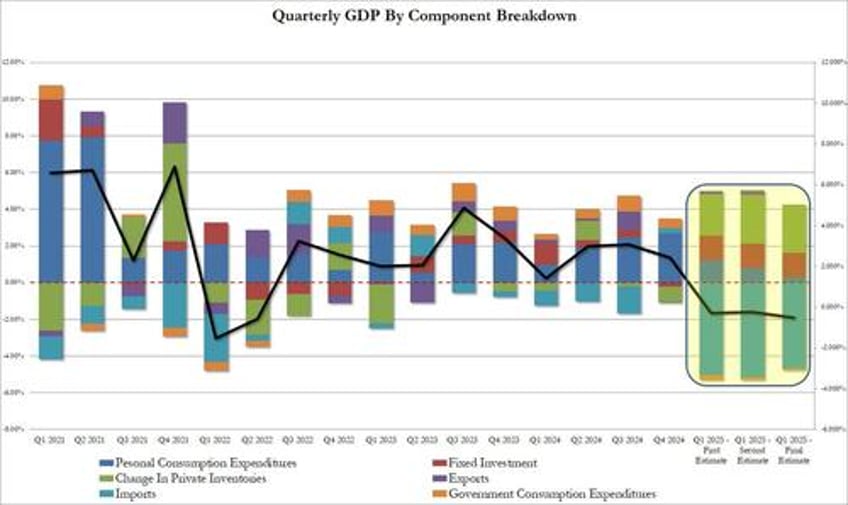

- Personal consumption contributed just 0.31% to the bottom line GDP print, down from 0.80% in the first revision and from 1.21% in the original estimate; also down sharply from 1.21% in Q4.

- Fixed Investment came at 1.31%, largely unchanged from the 1.34% in the previous revision, and driven by major data center investments

- The change in private inventories was also flat, printing at 2.59% in the third estimate, down from 2.64% in the second and from 2.25% initially.

- Trade or net exports (exports less imports), was generally in line, subtracting 4.76% from the GDP number, a modest improvement from the 4.9% previous revision, and from the 4.84% original print.

- Finally, government subtracted 0.10% from the GDP number, a slight improvement from the -0.12% decline in the previous estimate.

And visually:

The sharp revision in personal consumption meant that Real final sales to private domestic purchasers, the sum of consumer spending and gross private fixed investment, often viewed as a much more accurate indicator of actual growth, increased by 1.9% in the first quarter, revised down 0.6% from 2.5% in the first estimate, and 1.1% from the original estimate.

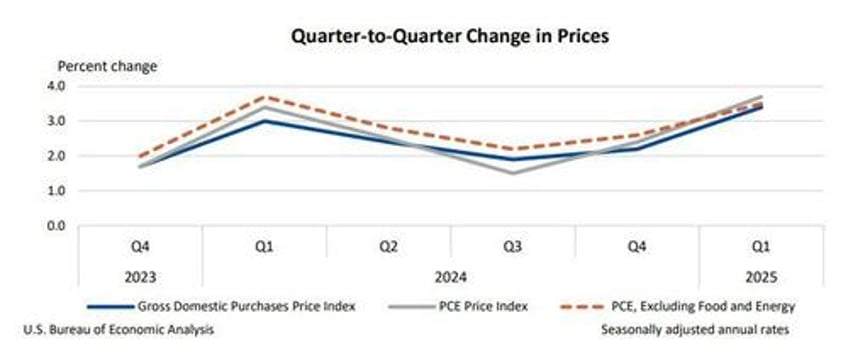

While the GDP data was stale, the inflation data was especially so, even if there were even fewer changes here:

- GDP price index rose 3.8%, up fractionally from the 3.7% increase in the previous estimate.

- Core PCE (ex food and energy) was 3.5%, also a fractional increase from the 3.4% previously reported.

Overall, the report painted an uglier picture of the US economy in Q1, although it is likely a "kitchen sink" because in Q2 we expect that the bullwhip from the reversal in imports (a boost to GDP) coupled with the deferred surge in personal consumption to propel Q2 GDP to 3% if not higher.