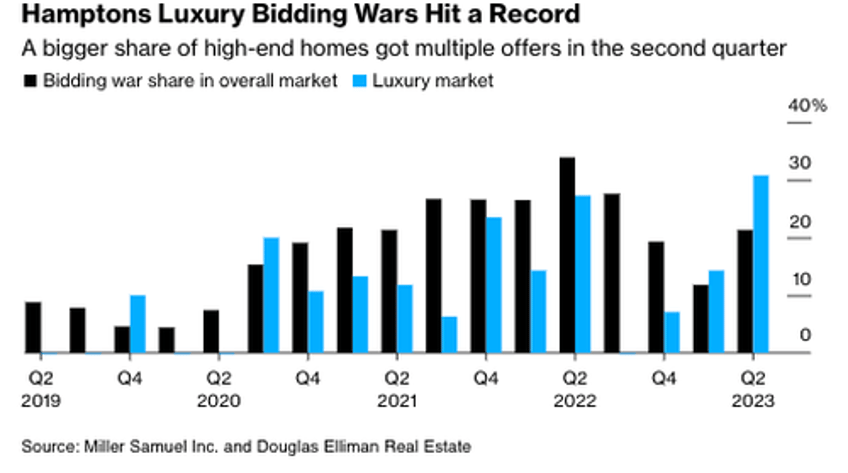

The US housing market has remained surprisingly resilient price-wise despite 7% mortgage rates. The Fed continues pushing interest rates to 22-year highs to curb the multi-year inflation storm. In the luxury market, bidding wars for mansions in the Hamptons hit a record high in the second quarter, even as prices and sales cooled.

About 31% of the mansions that closed in the quarter had several offers, topping the previous high of 27% set a year ago, according to Bloomberg, citing new data from appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. This was for homes priced at $4.4 million and above, representing about 10% of transactions.

Justin Agnello, an East Hampton-based agent at Douglas Elliman, explained the continued bidding wars for luxury homes are because of a "lack of inventory." He said if buyers "bring something to the market that's really appealing, buyers are even more hungry for it."

Across all homes in the seaside playground for Wall Street's centi-millionaires and billionaires, 21% of all homes sold in the quarter were over asking prices. One example is 37 Dune Road #C in East Quogue, a five-bedroom beach house that Douglas Elliman listed for $3.25 million. The agent on the deal told the buyer to expect a $3 million sale, but after a four-way bidding war, the house sold for $3.526 million.

Strong demand for Hamptons single-family homes and condos persists even as the overall market in the beach community cools. Miller Samuel and Douglas Elliman's data showed the median sale price of a home in the area was around $1.45 million, a 9.4% decline in the second quarter versus the same quarter last year.

The biggest issue is inventory as buyers during Covid, fleeing NYC and other major metro areas, along with record low borrowing costs, went on a buying spree, leading to an inventory shortage. The good news is the number of listings available in the quarter rose 6.6% to 955 versus 2Q22.

Even with mounting macroeconomic uncertainty and the highest borrowing costs in decades, there's still demand for Hamptons residential real estate even as the median prices in the second quarter are 71% higher versus 2Q22.

The overall theme is that the lack of available homes on the market puts upward pressure on prices. We saw that this week with the latest Case-Shiller figures for America's 20 largest cities.