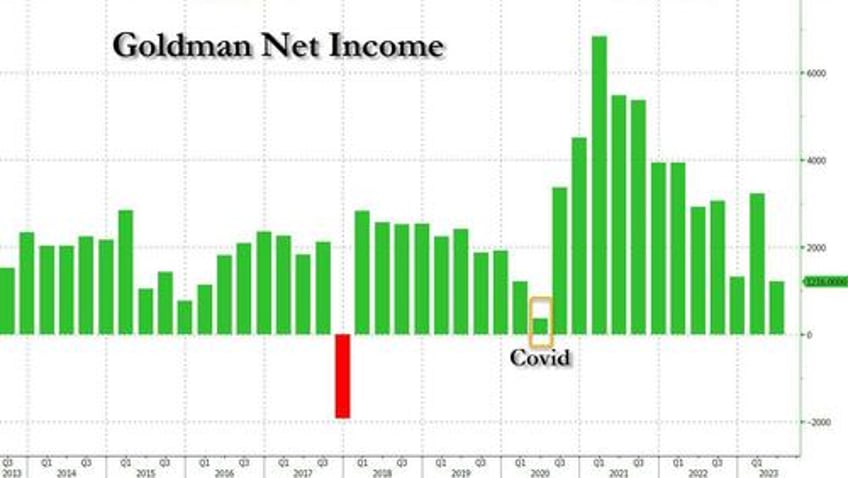

After what was a lengthy and very uncharacteristic guide-down process by a bank that has historically never preannounced earnings (and certainly not bad earnings), with Bloomberg reporting that Goldman "has embraced a new game plan to avoid a third straight quarter of disappointing investors on earnings day" and breaking "with its own long-standing convention, Goldman executives have been actively downplaying expectations for results that will be disclosed next week", this morning Goldman did not disappoint... or rather disappointed greatly when it reported its lowest quarterly profit in almost six years, weighed down by falling trading and investment banking and brutal losses tied to the Wall Street’s firm’s retreat from an ill-fated push into consumer banking.

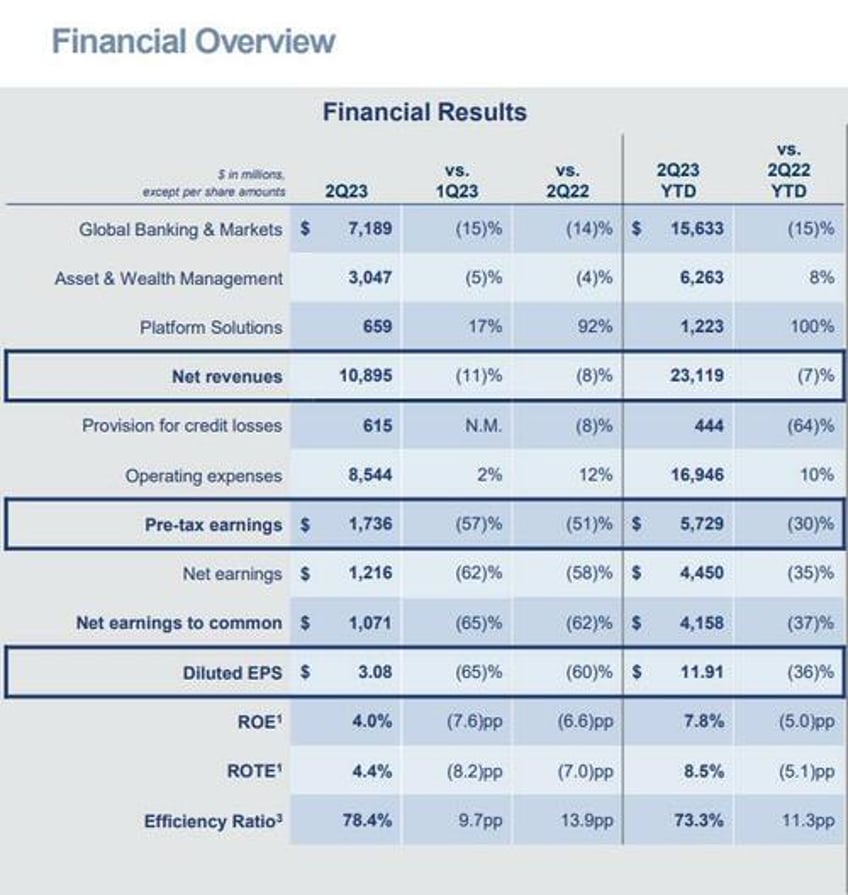

Goldman's net income plunged by 65% to $1.1 billion in the second quarter, down from $2.8 billion a year earlier, as revenues came in fractionally stronger than expected, despite some softness in the all important FICC sales and trading group. Still, the top line slumped 8% from a year ago with Global Markets revenue sliding 14%. Here are the details:

According to Mike Mayo this was Goldman's second worst quarter for CEO David Solomon, and the worst non-pandemic quarter in 5 years.

Return on equity, a key measure of profitability, slid to 4% in the quarter — the worst among the top US banks.

- Net revenue $10.90 billion, -8.2% y/y, beating the estimate $10.46 billion

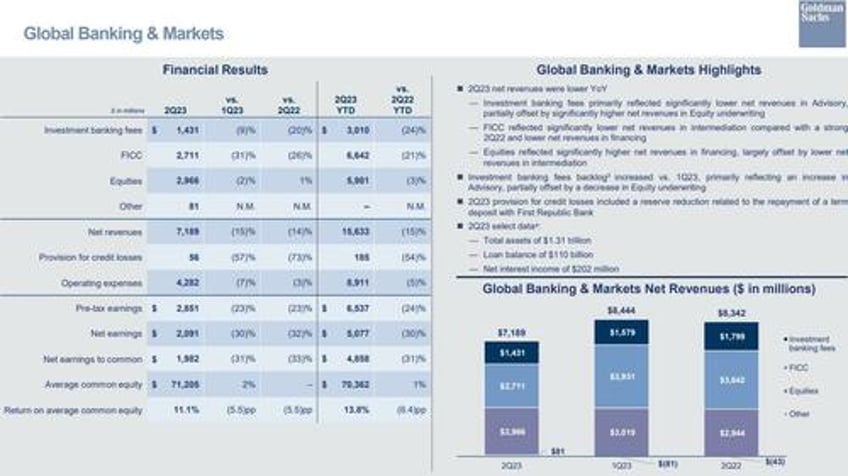

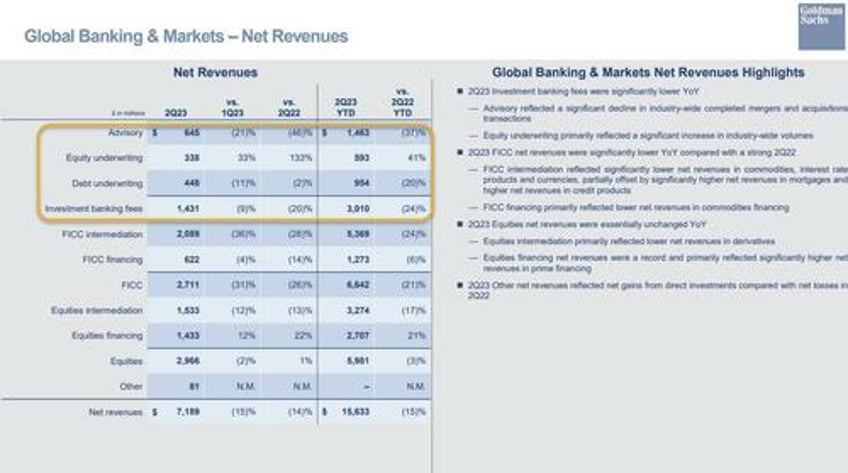

- Global Banking & Markets net revenues $7.19 billion, beating est. $6.69 billion

- FICC sales & trading revenue $2.71 billion, missing est. $2.81 billion

- Equities sales & trading revenue $2.97 billion, beating est. $2.47 billion

- Investment banking revenue $1.43 billion, missing est $1.51 billion

- Advisory revenue $645 million, missing est $774.9 million

- Equity underwriting rev. $338 million, beating est $292.4 million

- Debt underwriting rev. $448 million, beating est $445.9 million

- EPS $3.08, down 60% from $7.73 a year ago, and missing est $3.18

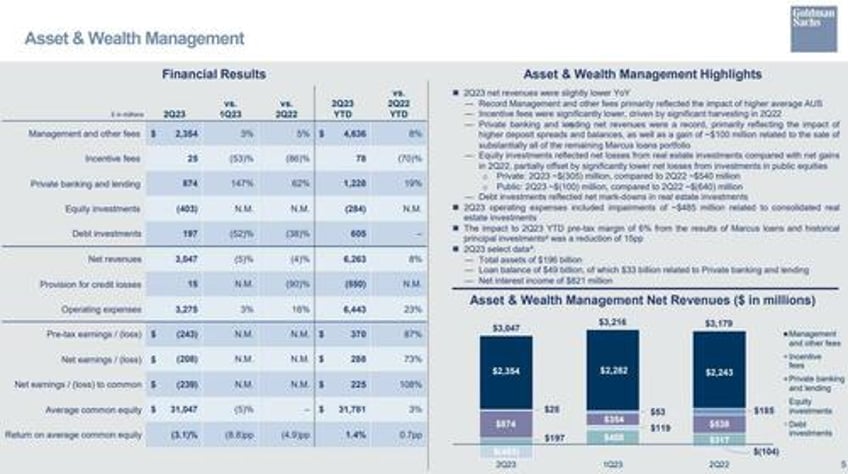

- Total assets under supervision increased to a record $2.71 trillion, up from $2.67 trillion as of March 31.

Some more details on the quarter:

- Net interest income $1.68 billion, -2.9% y/y, estimate $1.61 billion

- Total deposits $399 billion, consisting of consumer $148 billion, private bank $91 billion, transaction banking $71 billion

- Provision for credit losses $615 million, estimate $626.9 million

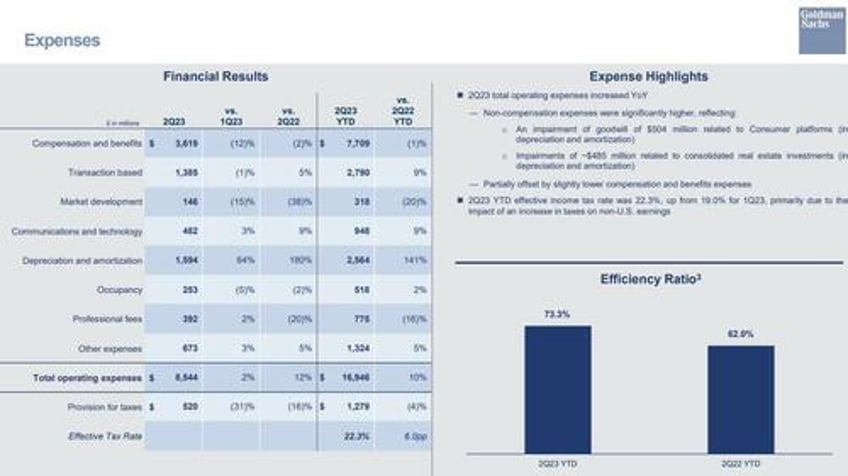

- Total operating expenses $8.54 billion, +12% y/y, estimate $7.91 billion

- Compensation expenses $3.62 billion, -2.1% y/y, but higher than estimate $3.44 billion

- Annualized ROE +4%, estimate +5.14%

- Return on tangible equity +4.4%, estimate +5.94%

- Standardized CET1 ratio 14.9%, estimate 14.7%

- Book value per share $309.33 vs. $301.88 y/y

Goldman provided the following Q2 perspective:

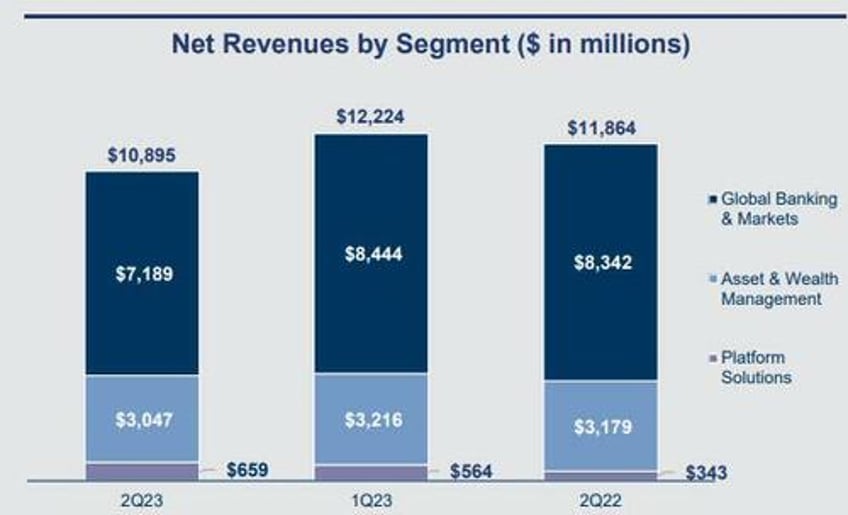

- Q2 23 net revenues were lower YoY in Global Banking & Markets and Asset & Wealth Management and higher in Platform Solutions

- Q2 23 provision for credit losses was $615 million, reflecting net provisions related to the credit card and point-of-sale loan portfolios, driven by net charge-offs and growth, and individual impairments on wholesale loans, partially offset by a reserve reduction related to the repayment of a term deposit with First Republic Bank

- Q2 23 operating expenses were higher YoY, driven by an impairment of goodwill of $504 million related to Consumer platforms and impairments of ~$485 million related to consolidated real estate investment

In an attempt to be more optically palatable, the bank charted its revenue... if only it wasn't from right to left.

As Bloomberg notes, Goldman has been scrambling to smooth the firm’s increasingly erratic and volatile quarterly results, which featured big gains during the post-pandemic boom followed by a run of missed profitability goals. Investors are looking to see whether the second quarter represents a trough for the New York-based company, with a steadier run of earnings gains ahead.

Like its peers, Goldman has been hammered by a prolonged slowdown in investment banking and trading, the group’s historic profit engines, due to soaring interest rates which have effectively frozen capital markets activity. But a testing quarter was also marred by several charges, including a $504mn writedown on GreenSky, an online lender the bank acquired in 2021 that it is already trying to sell. Goldman also recorded a $485 million impairment on its real estate investments.

While FICC missed and tumbled 26% YoY (reflecting "significantly lower net revenues in commodities, interest rate products and currencies, partially offset by significantly higher net revenues in mortgages and higher net revenues in credit products), equities trading was a rare bright spot, coming in ahead of its major rivals at just under $3 billion in revenue, compared with estimates for $2.47 billion. According to Goldman, "equities reflected significantly higher net revenues in financing, largely offset by lower net revenues in intermediation."

Still, total banking and markets revenue came in at $7.2 billion, down 14% Y/Y, and down 15% from Q1. Goldman also disclosed that 2Q 23 results contained a "provision for credit losses included a reserve reduction related to the repayment of a term deposit with First Republic Bank."

As also noted earlier, investment-banking revenue of $1.43 billion fell short of analysts’ average estimate of $1.51 billion. Equity underwriting climbed from a year earlier and advisory fees plunged. Bankers have cautioned that even when dealmaking rebounds, the low volume of announced mergers so far this year could keep the pressure on through the rest of the year.

Goldman’s asset-and wealth-management business posted revenue of $3.05 billion, down 4% from a year earlier, and a big miss to the consensus estimate of $3.5 billion. Some details from the former Goldman prop:

- Private banking and lending net revenues were a record, reflecting the impact of higher deposit spreads and balances, as well as a gain of ~$100 million related to the sale of substantially all of the remaining Marcus loans portfolio

- Equity investments reflected net losses from real estate investments compared with net gains in 2Q22, partially offset by significantly lower net losses from investments in public equities

- Private: 2Q23 ~$(305) million, compared to 2Q22 ~$540 million

- Public: 2Q23 ~$(100) million, compared to 2Q22 ~$(640) million

The unit was hammered by the bank’s exposure to the real estate sector, with writedowns both on its lending portfolio and its equity investments contributing to a $1.15 billion pretax earnings hit tied to its principal investments.

The bank also reported a jump in operating expenses due to how it accounts for impairments tied to some of its consolidated real estate investments as well as the goodwill writedown. The impairments totaled about $1 billion.

As the FT notes, the slump in earnings highlights the pressure on chief executive David Solomon, who is mired in the most challenging period of his tenure as profits and morale falter and according to media reports has been facing growing worker disenchantment which, absent a dramatic reversal in the company's fates, may even lead to mutiny.

Solomon last year pivoted away from consumer banking and re-emphasised the bank’s core investment banking and trading businesses, which are among the best on Wall Street but are both suffering from falling revenues.

“I remain fully confident that continued execution will enable us to deliver on our through-the-cycle return targets and create significant value for shareholders,” Solomon said on Wednesday.

Speaking on the conference call, CEO DJ-Sol did his best to boost spirits:

- GOLDMAN SACHS CFO SAYS WE SAW SOME SIGNS OF REOPENING IN THE CAPITAL MARKETS. ALTHOUGH VOLUMES CONTINUE TO REMAIN WELL BELOW MEDIUM AND LONG TERM AVERAGES

- GOLDMAN CEO SAYS INVESTMENT BANKING IS PERFORMING AT LOWEST LEVEL IN ALMOST A DECADE

- GOLDMAN CEO SAYS THERE'S DEFINITELY A PICKUP IN EQUITY CAPITAL MARKETS AND M&A DIALOG

- GOLDMAN CEO SAYS WE FEEL GOOD ABOUT WHERE WE ARE ON HEADCOUNT

After a volatile kneejerk reaction to the earnings report, the stock was last seen down 1% on the day, and down modestly on the year.

Goldman's investor presentation is below (pdf link):