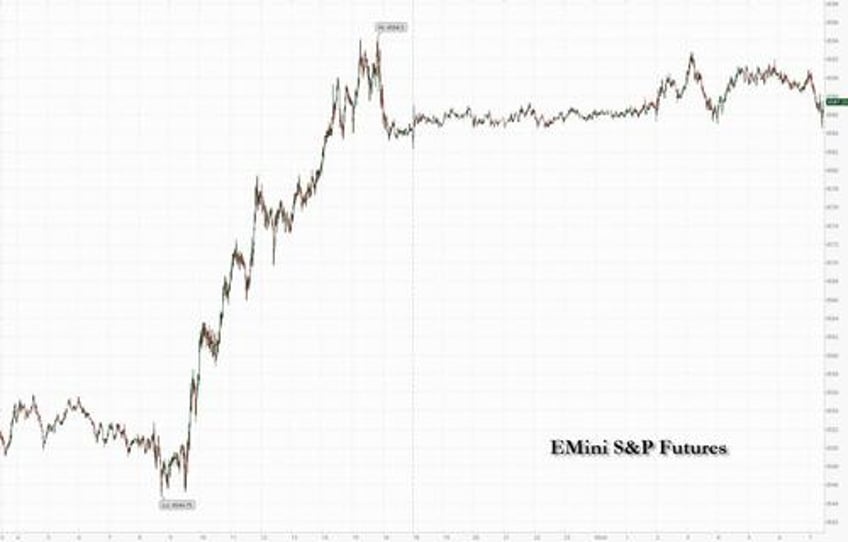

Futures were just barely higher, having erased earlier small gains following yesterday's frenzied meltup that sent spoos just shy of 4600 to a fresh 52-week high. Sentiment was boosted by sliding Treasury yields after UK inflation came in weaker than expected, sending the pound sharply lower and UK bonds led a global fixed income rally, while the USD rose as the Japanese yen resumed its slide as markets reassessed the likelihood of BOJ YCC intervention. At 7:30am ET, S&P futures were up 0.01% at 4588, following mixed results from Goldman Sachs (more details in a follow up post). Bond yields are lower and the USD is higher as pound and yen slide. Commodities are bid in both Energy and Ags; corn and wheat are up more than 3%; oil is also higher while Bitcoin trades just above $30K, erasing much of yesterday's loss.

Today’s macro data focus is on the housing sector, where thanks to the latest Housing Starts and Permits data we may see continued recovery amid a supply shortage and historically low affordability. The XHB has outperformed the SPX by 21% YTD, including by 7% over the last month. Thinking about this Goldilocks market and how far it can go, JPM writes that its Equity Derivatives Trading team tells me that vol markets are pricing in about a 35% - 40% chance of the SPX hitting 5,000 by year-end (via one-touch options).

In premarket trading, AT&T rose after the telecom company reassured investors by saying less than 10% of its nationwide copper-wire telecom network had lead-clad cables. Carvana soared after the used-car retailer reached an agreement to restructure debt and reported second-quarter revenue that beat estimates. Microsoft shares gained as much as 0.9% in US premarket trading, set for their seventh straight day of gains, as Cowen raised its price target on the stock, citing high investor demand for shares. Omnicom Group falls 6.9% in premarket trading after the advertising firm reported second-quarter revenue and organic revenue growth that missed expectations. Citi said the modest organic revenue growth miss could put downward pressure on shares. Here are some other notable premarket movers:

- Western Alliance falls 2.2% after the bank’s second-quarter net interest income and net interest margin missed consensus estimates. Truist Securities note a deterioration in credit quality, with an increase in nonperforming, classified and special-mention loans.

- Joby Aviation drops as much as 5.7% after the maker of electric vertical take-off aircraft is downgraded to underweight from neutral at JPMorgan. The broker says a surge in its shares, as well as in peer Archer Aviation, has decoupled from fundamentals.

- Lilium jumps 13% after the electric commuter aircraft manufacturer announced it had successfully arranged a capital raise of $192 million, which it said would enable it to continue the development of the Lilium Jet at full pace.

The big surprise overnight was news that Britain’s inflation rate cooled more than expected to the lowest level in more than a year, a sign that soaring interest rates may be starting to curtail the worst wage-price spiral in the Group of Seven nations. The Consumer Prices Index was 7.9% higher than a year ago in June, a sharp drop from the 8.7% reading in May, the Office for National Statistics said Wednesday. It was the first downward surprise in five months and the biggest since July 2021, below the 8.2% expected by economists.

The pound slid as much as 0.9% against the dollar, accounting for much of the gain in a gauge of greenback strength, as investors pared back bets on a further sharp surge in interest rates while yields on two-year UK government bonds plunged as traders pared bets on where BOE rates will peak. The yield is down around 50 basis points since last week’s softer-than-expected US inflation reading, the biggest drop among developed-nation bonds. Treasury yields retreated across the curve Wednesday.

“Today’s weaker-than-expected inflation print is arguably a relief, which should lift sentiment on the depressed domestic plays and rates plays. Investors are very bearish on the UK and under-exposed, so short covering may be powerful,” said Barclays strategist Emmanuel Cau.

“It’s clear that the latest inflation data across the globe, like this morning in England or earlier in the US or in Europe show an easing trend and that’s taking pressure off rates,” Bruno Vacossin, a Paris-based senior portfolio manager at Palatine Asset Management, said by phone. “This is providing oxygen to financial markets. So far the earnings season has provided pretty good results. All of this should help maintain markets at decent levels.”

Rate-sensitive real estate stocks led gains in Europe’s Stoxx 600 index; European real estate stocks also jump on the UK inflation figures, triggering a rally in the rate-sensitive sector as the news spurred hopes the rate-hike cycle is reaching an end. UK stocks also benefited, with the FTSE 100 rising 1.6% and outperforming regional peers. UK homebuilders surging the most since 2008 on optimism about less-aggressive hikes and as traders pared bets on further BOE rate hikes following cooler-than-expected UK inflation data. Here are the most notable European movers:

- Kering rises as much as 6.8% after the luxury group announced the departure of Gucci CEO Marco Bizzarri, a move that analysts said constitutes an opportunity to prop up the appeal of the brand

- Severn Trent shares rise as much as 3.8% after it reported an in-line financial performance, which analysts said was a good start to the year, with RBC seeing capital expenditure at guided levels

- Aston Martin Lagonda rises as much as 6.9% after Goldman Sachs upgraded the UK carmaker to buy, noting that the recent strong run in the shares is “clearly factoring in” an upcoming recovery

- Argenx rises as much as 7.4% after raising $1.1 billion in a global share offering, higher than its initially targeted $750 million. The proceeds indicate a high interest in the company, KBC says

- National Grid shares rise as much as 2.5% after the UK utility agreed to sell a further 20% interest in its UK gas transmission business to existing majority owners

- Volvo AB shares fall as much as 3.8% as consensus-beating second-quarter results at the Swedish truck and bus maker were offset by comments on demand environment

- Handelsbanken drops as much as 3.8%, among the worst performers on the Stoxx 600 Banks Index, after reporting results that Citi calls “unimpressive” versus peers as lending arrived revenue in-line

- Antofagasta falls as much as 3.4%, missing out on a broader market rally as the London-listed miner cuts its copper production guidance for the full year

- Wacker Chemie shares drop as much as 4.1%, before paring decline to 0.1%, after the German chemicals company becomes the latest company in the sector to cut its guidance

Earlier in the session, Asian stocks declined again, headed for their third-straight day of losses, amid continued worries over Chinese economic growth. The MSCI Asia Pacific Index declined as much as 0.4%, with Tencent and Alibaba the biggest drags. Key gauges in Hong Kong led declines around the region, with benchmarks in mainland China posting modest losses. A gauge of tech stocks fell as much as 2.6% in Hong Kong as China’s latest measures to boost household spending disappointed the market. Investors still expect further stimulus from Beijing to support growth, including efforts to boost the flagging real estate sector. “Until China’s property industry sees an inflection point, Chinese stock markets are expected tosee sluggish performance and rangebound trading,” said Xuehua Cui, a China equity analyst at Meritz Securities in Seoul. Markets in Malaysia and Indonesia were shut for holidays.

Stocks rose elsewhere in Southeast Asia, while South Korea’s benchmark slipped. Equities in Japan advanced after the nation’s central bank governor indicated a continuation of easy monetary policy. Australia's ASX 200 was positive with gains led by the energy sector after the recent upside in oil prices which facilitated the resilience of Woodside Energy despite its quarterly decline in output and revenue, while the mining sector was choppy amid indecision in Rio Tinto due to a mixed quarterly update.

The daily record juggernaut in India continued as key stock gauges in India closed at another record high Wednesday, boosted by gains in index major Reliance Industries and shares of lenders. The S&P BSE Sensex rose 0.5% to 67,097.44 in Mumbai, while the NSE Nifty 50 Index advanced 0.4% to 19,833.15. The MSCI Asia Pacific Index was little changed for the day. Reliance Industries contributed the most to the Sensex’s gain, increasing 0.6%, ahead of the demerger of its financial services unit on Thursday. Meanwhile, BSE Bankex closed 0.6% higher. Out of 30 shares in the Sensex index, 20 rose and 9 fell, while 1 was unchanged

In FX, the Bloomberg Dollar Spot Index is up 0.2% extending gains into a second day versus all its G-10 rivals except the euro and Canadian dollar. USD/JPY jumped as much as 0.8% to 139.99, extending Tuesday’s 0.1% gain, after BOJ Governor Kazuo Ueda indicated it would take a shift in the bank’s assessment for stably achieving its inflation target to change its stance for persistent monetary easing. The pound fell as much as 0.9% after data showed that inflation in the UK fell more than expected to its lowest level in more than a year. A 25bps hike by the Federal Reserve next week is fully priced in, and traders are betting on roughly a one-in-three possibility of further tightening later in the year; easing US CPI data earlier this month has fueled expectations that the Fed may stop raising rates after its next meeting

In rates, treasuries were off session highs reached amid steep gains for UK government bonds sparked by bigger-than-forecast slowdown in UK inflation. Focal points of US trading day include June housing starts and 20-year bond reopening. Yields are lower by as much as 4bp-5bp at short end vs declines of more than 20bp at UK short end as traders pared bets on how much further BOE will raise rates. In the US, 10Y yields were down 2.5bp at 3.76%, and testing the 50-day moving average which they last closed below in mid-May; 30Y yield at 3.87% is through its 50-DMA, last close below was June 28. Fed swaps continue to fully price in a 25bp rate hike on July 26 and about a third of an additional quarter-point hike this year. Ahead of a $12BN 20Y bond auction (second and final reopening of issue that debuted in May), WI yield is around 4.045%, exceeding 20Y auction results since November.

In commodities, crude futures advanced with WTI rising 0.5% to trade near $76.10. Spot gold is little changed around $1,978. Bitcoin rises 0.7%.

Looking to the day ahead now, and data releases include the aforementioned UK CPI reading for June, along with US housing starts and building permits for June. From central banks, we’ll hear from the ECB’s Vujcic and BoE Deputy Governor Ramsden. Lastly, today’s earnings include Tesla, Netflix, Goldman Sachs and IBM.

Market Snapshot

- S&P 500 futures little changed at 4,589.25

- MXAP little changed at 167.90

- MXAPJ down 0.3% to 528.26

- Nikkei up 1.2% to 32,896.03

- Topix up 1.2% to 2,278.97

- Hang Seng Index down 0.3% to 18,952.31

- Shanghai Composite little changed at 3,198.84

- Sensex up 0.2% to 66,919.59

- Australia S&P/ASX 200 up 0.5% to 7,323.72

- Kospi little changed at 2,608.24

- STOXX Europe 600 up 0.3% to 462.35

- German 10Y yield little changed at 2.34%

- Euro little changed at $1.1221

- Brent Futures up 0.3% to $79.86/bbl

- Gold spot down 0.1% to $1,977.71

- U.S. Dollar Index up 0.24% to 100.18

Top Overnight News from Bloomberg

- The pound weakened and bonds rallied after inflation in Britain slowed more than expected, reviving speculation about how many more times the Bank of England will increase interest rates. Stocks in the UK and Europe advanced

- Big corporate bankruptcies are piling up at the second-fastest pace since 2008, eclipsed only by the early days of the pandemic

- Deep-pocketed sovereign funds are deploying billions of dollars to get private equity takeovers across the line, helping grease the wheels of dealmaking in a year when other funding sources are drying up

- Chinese stocks declined, a sign that traders are increasingly pricing in the lack of major stimulus from the government. Equity markets in the rest of Asia climbed, pacing US gains

- Deutsche Bank AG has drawn fresh criticism from the European Central Bank over foreign-exchange sales even after the lender completed an internal probe into past practices that led to initial changes

- The European Central Bank plans to substantially tighten how it monitors liquidity after several bank runs in the US and Switzerland heightened concerns about a risk that several regulators say hasn’t received sufficient attention

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed as the ongoing China economic woes partially offset the constructive lead from Wall St where risk sentiment was underpinned after strong bank earnings results and recent dovish ECB commentary. ASX 200 was positive with gains led by the energy sector after the recent upside in oil prices which facilitated the resilience of Woodside Energy despite its quarterly decline in output and revenue, while the mining sector was choppy amid indecision in Rio Tinto due to a mixed quarterly update. Nikkei 225 outperformed after recent comments by BoJ Governor Ueda provided the latest hints regarding the unlikelihood of a policy tweak at next week’s monetary policy meeting. Hang Seng and Shanghai Comp were lower as Hong Kong suffered from tech losses and with a non-committal tone in the mainland amid ongoing economic woes and recent support efforts.

Top Asian News

- China's Industry Ministry said China's industrial sector faces difficulties and challenges such as insufficient demand and declining revenues, while it will formulate plans to stabilise the growth of 10 sectors including auto and steel, according to Reuters.

- US Climate Envoy Kerry said his talks with Chinese officials this week were constructive but complicated with the two sides still dealing with political externalities including Taiwan. Kerry added that they are just reconnecting and trying to re-establish the process they have worked on for years, according to Reuters.

- US Climate Envoy Kerry meets with China's Vice President Han Zheng in Beijing and told him that if they can come together over the next months heading into COP28, they will have an opportunity to make a profound difference on climate change, while he added that the US side pledges to work closely with China in order to help their presidents to be able to produce real results. Furthermore, Han told Kerry that both countries have had close communication and dialogue after Kerry became the special envoy for climate and said China and the US have maintained long-term good communication and exchanges on climate, as well as reached some important consensus'.

- US President Biden's administration formally halted the Wuhan Institute of Virology’s access to US funding due to COVID probe failures, according to Bloomberg.

- China's Commerce Ministry says China's foreign trade faces an extremely severe situation in H2.

European bourses are in proximity to the unchanged mark as opening gains have pared in a relatively quiet second half of the session; Euro Stoxx 50 +0.3%. With the exception of the FTSE 100 +1.4% following cooler-than-expected UK CPI and substantial gains in UK equities as a result, particularly housebuilders. As such, Real Estate is the outperforming sector while Basic Resources lag given base metals action and after Rio Tinto cut its FY refined copper/alumina guidance. Stateside, futures are a touch firmer and hanging onto the majority of Tuesday's RTY & MSFT/Tech driven upside ahead of key earnings incl. Netflix, Tesla & GS. ASML (ASML NA) Q2 (EUR): Revenue 6.9bln (exp. 6.73bln), Net Income 1.9bln (exp. 1.82bln), Interim Dividend 1.45/shr, Gross Margin 51.3%. Q3 Outlook: Revenue 6.5-7.0bln (exp. 6.42bln), Gross Margin 50%. US DoJ and FTC have proposed merger guidelines which signal a tougher stance against private equity and Tech, via FT. Reminder, the DoJ and FTC heads are both appearing on CNBC 13:30BST/08:30ET. UK CMA has provisionally cleared the Broadcom (AVGO) and VMware (VMW) deal; deal unlikely to harm innovation, would not weaken competition.

Top European News

- UK PM Sunak is set to delay a decision on whether Britain should rejoin the EU's Horizon science program until after the summer holidays, according to FT.

- ECB is to push banks for weekly liquidity data, according to Bloomberg sources; reflects need for information rather than acute concerns.

- ECB's Nagel says "‘Inflation is a greedy beast. That's why it would be a mistake to ease up on the fight too soon and cut interest rates again prematurely." adding that "practically everyone expects an increase of 25bp" re. July.

- ECB's Simkus says there is a clear need to hike in July, option for a hike should be discussed in September, via Econostream. Would not be surprised if ECB continues to hike in September. The risk of doing too little is still higher than the risk of doing too much.

FX

- Pound plunges post-UK inflation data as headline and core CPI slow more than expected, Cable probes Fib at 1.2933 after pulling up shy of 1.3050 and EUR/GBP eyes Fibs just under 0.8700 vs low close to round number below.

- Dollar gathers momentum at the expense of Sterling and other rivals as DXY rebounds further from recent lows to 100.300, Yen extends reversal vs Greenback from 138.77 to 139.79 after BoJ Governor Ueda underscored dovish guidance.

- Aussie labours ahead of employment report and amidst renewed Yuan weakness on Chinese economic jitters, AUD/USD towards base of 0.6820-0.6764 range.

- Euro underpinned by EUR/GBP and EUR/JPY tailwinds, but EUR/USD capped by decent option expiry interest at 1.1250.

- Kiwi loses momentum following brief pop on the back of firmer than forecast NZ Q2 CPI, NZD/USD at lower end of 0.6315-0.6226 bounds.

- PBoC set USD/CNY mid-point at 7.1486 vs exp. 7.1798 (prev. 7.1453)

Fixed Income

- Gilts gains slowing, but still growing in wake of softer than forecast UK inflation data.

- 10 year bond extends to 97.84 from a 96.64 Liffe low and 95.85 close.

- Bunds fade after less well covered long-dated German supply within a 134.88-01 range and T-note midway between 113-06+/112-22 bounds before US housing metrics and USD 12bln 20 year issuance.

Commodities

- Crude benchmarks are firmer this morning, detaching themselves somewhat from the tepid equity tone (ex-UK) as market focus continues to centre around upcoming US earnings, with a particularly key after-market docket.

- Elsewhere, nat gas continues to pullback following the resumption of the Nyhamma plant.

- Finally, metals are contained and caught between the tentative tone and the USD’s Sterling-driven resurgence.

- US Energy Inventory Data (bbls): Crude -0.8mln (exp. -2.3mln), Gasoline -2.8mln (exp. -2.1mln), Distillate -0.1mln (exp. -0.1mln), Cushing -3.0mln.

Geopolitics

- US assessed that North Korea's launches do not pose an immediate threat but show the destabilising impact of North Korea's illicit weapons program, according to the US military.

- South Africa claimed it cannot arrest Russian President Putin at a planned BRICS summit in Johannesburg next month as Russia has threatened to “declare war” if the International Criminal Court warrant against its leader is enforced, according to FT.

- US official said Secretary of State Blinken signed a new 120-day waiver to allow Iraq to pay Iran for electricity and that the waiver was expanded to allow Iraq to deposit payments for Iranian electricity into non-Iraqi banks, while it is hoped that the waiver will ease Iran's pressure on Iraq for access to funds which previously only went to restricted accounts in Iraq.

US Event Calendar

- 07:00: July MBA Mortgage Applications 1.1%, prior 0.9%

- 08:30: June Building Permits, est. 1.5m, prior 1.49m, revised 1.5m

- 08:30: June Building Permits MoM, est. 0.2%, prior 5.2%, revised 5.6%

- 08:30: June Housing Starts, est. 1.48m, prior 1.63m

- 08:30: June Housing Starts MoM, est. -9.3%, prior 21.7%

DB's Jim Reid concludes the overnight wrap

There are two quite important prints today that might give markets some direction one way or another. The first is UK CPI just after we go to print with the second US housing starts which after a surprise spike up last month is expected to normalise back to low levels. But there will be fun and games if it doesn't. In terms of earnings, stand by for Tesla, Netflix and IBM after the bell and Goldman Sachs before.

With regards to the UK, it has the highest inflation rate in the G7 at 8.7%, and we’ve had upside surprises in all of the last 4 CPI prints, so it’s generated more and more focus. In turn, that’s driven a big reappraisal as to how far the Bank of England will need to hike rates, whilst gilts have significantly underperformed their counterparts elsewhere this year. In terms of what to expect today, our UK economist sees the year-on-year measure coming down half a point to 8.2%. However, he thinks that core CPI will inch up to 7.2%, which would be the highest in 31 years. Last month saw the BoE surprise with a 50bp hike, and today’s reading will be an important factor in whether they go for 50bps in August again or dial back to a 25bps pace. As it stands, markets are pricing in a decent 75% chance of a 50bps move.

In terms of US housing starts. The May reading saw a massive surge in the measure to a 13-month high, whilst it marked the biggest monthly jump in percentage terms since October 2016. So the big question is whether that can be sustained. Our US economists expect that to fall back in June, coming in at 1.425m, down from 1.631m in May. So back to relatively subdued levels. However, there is other evidence that US housing is continuing to rebound, with yesterday’s NAHB housing market index rising to 56 as expected, which marks its 7th consecutive monthly gain.

The biggest moves over the last 24 hours have been in European rates after Dutch central bank governor Knot, one of the biggest hawks on the Governing Council, partially pushed back on the idea of a second ECB hike in September. He said that “beyond July it would at most be a possibility but by no means a certainty”. The fact that was coming from a more hawkish voice added to the sense that the ECB’s widely-expected hike next week might be their last of this cycle. 10yr bunds (-9.7bps), OATs (-10.1bps) and BTPs (-14.1bps) saw significant declines. The terminal ECB rate priced in for December 2023 fell by -3.3bps, though this is still pricing in 47bp of further hikes, while June 2024 pricing saw a more pronounced -10.2bp decline.

The data was a bit mixed yesterday with US industrial production contracting for a second consecutive month in June. In fact, it’s now in negative territory on a year-on-year basis for the first time since the pandemic, so that’s another indicator pointing towards stagnating growth in a week where the more optimistic soft-landing narrative rules the waves.

In terms of the details of that release, the main headline was a -0.5% contraction in June (vs. unch expected), as well as a downward revision to May. On top of that, the capacity utilisation number came in at a 20-month low of 78.9% (vs. 79.5% expected). And if that wasn’t enough, US retail sales were also fairly mixed, with the headline measure up just +0.2% in June (vs. +0.5% expected), albeit with modest upward revisions to May. However, retail control (which feeds directly into GDP) was strong at +0.6% versus +0.2% expected.

Nonetheless, market optimism dominated during the US session. Confidence in the view that the Fed will hike next week inched up a fraction, with a 96% chance of a move priced in, while June 2024 Fed pricing rose +3.6bps yesterday to 4.68%. This front-end move saw the 2yr Treasury yield rise slightly (+2.4bps), closing +11bps above its intra-day lows. The 10yr yield partially reversed its earlier rally during European hours to finish -1.9bp on the day but has dipped back another -1.7bps this morning.

US equities put in another strong performance, with the S&P 500 (+0.71%) advancing to a fresh 15-month high. Energy stocks outperformed as oil and gas prices saw a decent rebound, with Brent Crude up +1.44% to $79.63/bbl. Bank stocks also outperformed (+1.90%) as results from Bank of America (+4.42%) and Morgan Stanley (+6.45%) beat expectations with investors seeing optimism in the outlooks. Tech stocks performed strongly as well, with the NASDAQ (+0.76%) and the FANG+ (+1.36%) gaining ahead of earnings from Tesla and Netflix after the close today. Back in Europe equities saw a solid rise after Monday’s declines, with the STOXX 600 recovering by +0.62%.

Asian equity markets are mostly lower this morning erasing their earlier gains as China’s growth concerns continue to weigh on risk sentiment. As I type, the Hang Seng (-1.43%) is extending its losses and is the worst performer across the region with the CSI (-0.32%), the Shanghai Composite (-0.25%) and the KOSPI (-0.15%) also trading in negative territory. Elsewhere, the Nikkei (+0.97%) is bucking the trend. S&P 500 (-0.05%) and NASDAQ 100 (-0.09%) futures are marginally lower ahead of a busy earnings day.

In FX, the Japanese yen (-0.28%) has weakened for a second consecutive day against the dollar, trading at 139.22, after the Bank of Japan (BOJ) Governor Kazuo Ueda indicated that the central bank would maintain its ultra-easy monetary policy as there is still some distance to sustainably achieve its inflation target.

There wasn’t much other data to speak of yesterday, but we got a mixed picture from the latest Canadian inflation release. That showed headline CPI was down to 2.8% in June (vs. 3.0% expected), but the core measures were more resilient than expected. For instance, the core CPI median measure remained at 3.9% (vs. 3.7% expected), and the core CPI trim measure only fell to 3.7% (vs. 3.6% expected).

To the day ahead now, and data releases include the UK CPI reading for June, along with US housing starts and building permits for June. From central banks, we’ll hear from the ECB’s Vujcic and BoE Deputy Governor Ramsden. Lastly, today’s earnings include Tesla, Netflix, Goldman Sachs and IBM.