There was a burst of confusion late in the day when Donald Trump said that the US and China had signed a trade deal two weeks after saying they had reached an understanding in London about how to implement a ceasefire in the countries’ dispute.

“We just signed with China yesterday,” the president said at the White House on Thursday, without providing any details.

Trump: We just signed with China yesterday pic.twitter.com/U1FreLcE46

— Acyn (@Acyn) June 26, 2025

The reality turned out to be far less exciting than what Trump represented.

Shortly after, a White House official said the US and China had "agreed to an additional understanding for a framework to implement the Geneva agreement", in a reference to the trade talks that the nations held in May, when they first negotiated a truce, which was really just an agreement to continue negotiating. And since there was still leftover confusion, Trump's Commerce Secretary Howard Lutnick, said that the US and China sign a "finalized a trade understanding" reached last month in Geneva adding that the White House has imminent plans to reach agreements with a set of 10 major trading partners.

The China deal, which Lutnick said had been signed two days ago, codified the terms laid out in trade talks between Beijing and Washington, including a commitment from China to deliver rare earths used in everything from wind turbines to jet planes.

In other words, the "deal" that was just signed was merely another reaffirmation that the two sides continue to talk about eventually sitting down to negotiate.

Lutnick told Bloomberg Television that President Donald Trump was also prepared to finalize a slate of trade deals in the coming two weeks in connection with the president’s July 9 deadline to reinstate higher tariffs he paused in April.

“We’re going to do top 10 deals, put them in the right category, and then these other countries will fit behind,” he said. Lutnick did not specify which nations would be part of that first wave of trade pacts, though earlier Thursday Trump suggested the US was nearing an agreement with India.

As a reminder, the "China accord" Lutnick described is far from a comprehensive trade deal that addresses thorny questions about fentanyl trafficking and American exporters’ access to Chinese markets.

After an initial round of negotiations in Geneva resulted in a reduction in tariffs imposed by both countries, the US and China accused each other of violating their agreement. After subsequent talks in London this month, negotiators from the US and China announced they had arrived at an understanding, pending approval from Trump and Chinese President Xi Jinping.

Lutnick said that under the agreement inked two days ago, US “countermeasures” imposed ahead of the London talks would be lifted, but only once rare earth materials start flowing from China.

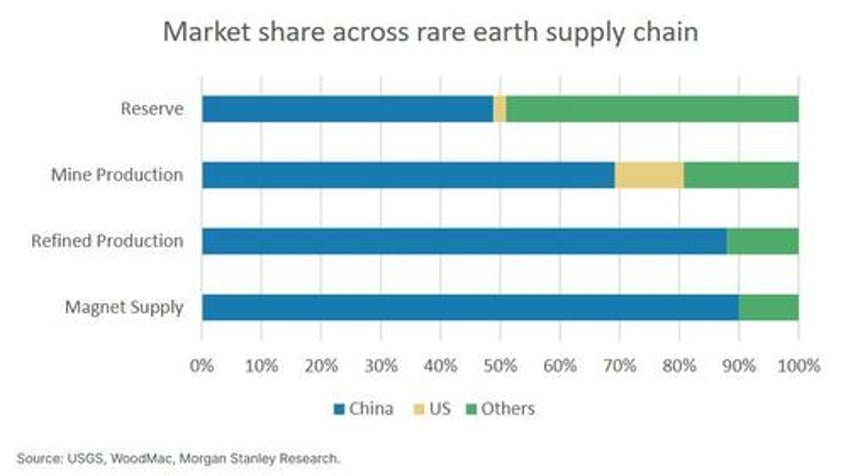

Which is a problem: as discussed previously, China's biggest point of leverage in the trade war negotiations is its control of rare earth exports to the US; it's also why the ceasefire deal announced in early June was mostly meant to restart exports of Chinese rare earths to the US.

That never happened. As the WSJ reported overnight, two weeks after China promised the U.S. it would ease the exports of rare-earth magnets, Chinese authorities have been dragging out approval of Western companies’ requests for the critical components, a situation that is bound to reignite trade tensions between Washington and Beijing.

Western companies say they are receiving barely enough magnets for their factories and have little visibility of future supplies. Firms are waiting weeks as Chinese authorities scrutinize their applications, only to be rejected in some cases. And applications for raw rare earths, which are used to make magnets, are rarely granted.

As a result, Western companies are concerned that the shortages could soon affect manufacturing. Companies are so desperate for magnets that they are opting for expensive airfreight whenever licenses are granted to prevent costly production shutdowns. Some manufacturers are experimenting with workarounds that would allow them to make their products without the most powerful magnets.

“It’s hand to mouth—the normal supply-chain scrambling that you have to do,” said Lisa Drake, a vice president overseeing Ford’s industrial planning for batteries and electric vehicles, earlier this week. Although she said the situation had improved, the scarcity of the rare-earth magnets is forcing Ford to “move things around” to avoid factory shutdowns, she said.

As a result, contrary to White House assertions that the flow of the critical components would return to normal, manufacturers have taken the continuing challenges as a sign that new Chinese rare-earth export restrictions, introduced in April after President Trump raised tariffs on China, are here to stay.

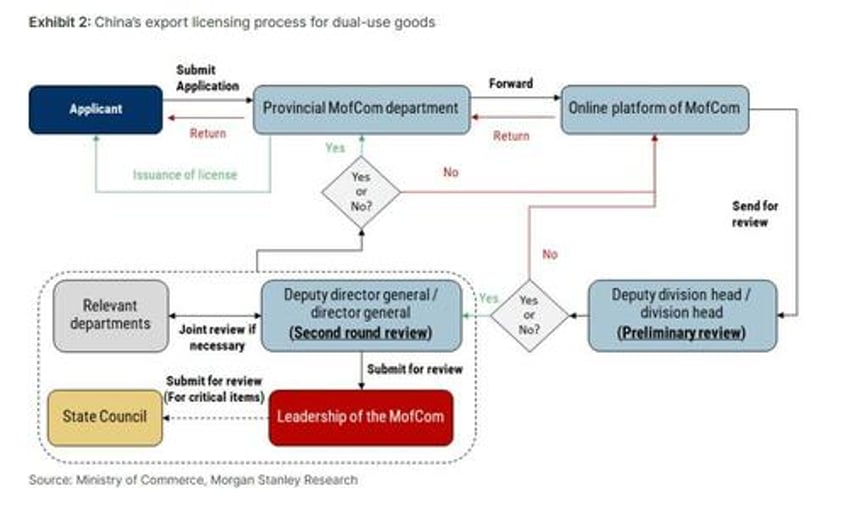

“Yes, the export restrictions have been paused on paper. However, ground reality is completely different,” said Neha Mukherjee, a rare-earths analyst at Benchmark Mineral Intelligence. The licensing process is plagued by “bureaucratic drag.”

On Thursday, China’s Ministry of Commerce issued a token statement that it has been accelerating the review of rare-earth export license applications and has approved “a certain number.”

The restrictions illustrate the power Beijing holds through its formidable supply chains and how it can use them to inflict pain on Western businesses and exact concessions from the US. China makes 90% of the world’s most powerful rare-earth magnets, a key component in everything from cars to jet fighters. In April, after Trump heaped stiff tariffs on Chinese products, Beijing established an export-control system for rare earths. While it said the license system was set up to regulate the export of materials for military use, the regime has in effect allowed China to clamp down on rare-earths supplies as it wishes.

After April, the supply of magnets to Western businesses slowed to a trickle, causing shock waves for global car, defense and electronics makers. Exports of rare-earth magnets to the U.S. declined 93% in May from a year earlier. Ford stopped production of its Explorer SUV at its Chicago plant for a week in May.

The U.S. accused China of slow-walking the approval of export licenses, which China denied. The shortage drove both sides back to the bargaining table earlier this month, where China agreed to free up the flow of rare earths in exchange for the U.S. easing its own restrictions on certain U.S. exports to China.

Following the deal, Trump wrote that “full magnets, and any necessary rare earths, will be supplied up front by China.”

However, China put only a six-month limit on any new licenses, we later learned as Beijing seeks to keep DC on a tight leash. Now, in the applications for export licenses, Chinese authorities are asking Western companies for sensitive details such as contact information of those buying their magnets and even designs of how their magnets are integrated into components like motors.

Beijing also appears to be trying to prevent stockpiling by Western businesses. One Chinese magnet maker has warned clients seeking to import more magnets than usual that they may have to explain to government officials the “business drivers” behind such large orders, according to an advisory note the magnet maker shared with clients.

Fearful of shortages, many Western businesses are complying with the information requests—but are still facing long delays. The success of their application also depends on their supplier. Big state-connected magnet companies are getting export licenses faster than smaller private ones, according to many in the industry.

“The export policy for magnet[s] is still very strict,” said a representative for one Chinese magnet maker. Now, some Western businesses say they are resigned to the fact that the restrictions may remain in place indefinitely.

For a detailed analysis of the leverage China has with its supply chain of Rare Earths, please read Morgan Stanley's key report on the topic "How China Is Playing Its Rare Earth Card" (available to pro subscribers).

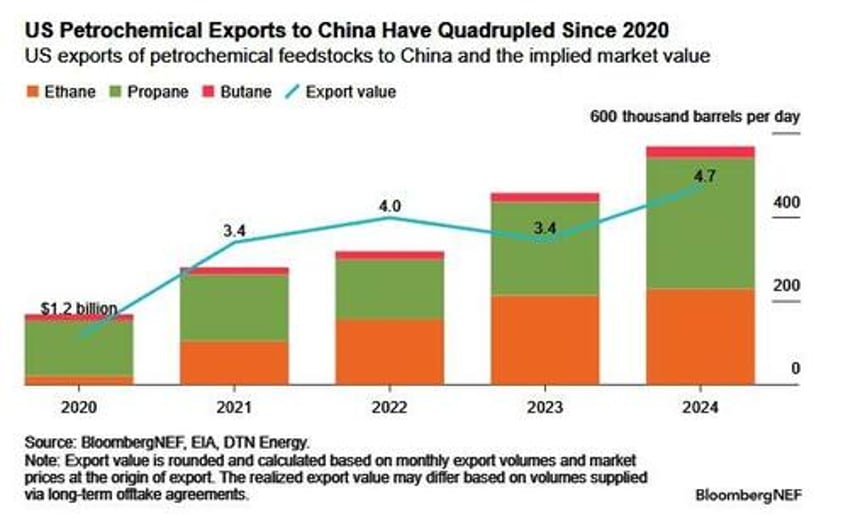

And while China is clearly dominating the rare earth supply chain (for now, as it is only a matter of time before the Trump admin subsidizes domestic producers such as MP Materials to ramp up production as an alternative to China), the US is doing the same with ethane (a relationship we described in "China's Need For US Chemicals Greater Than US Need For Rare Earths".)

China imported more than 565,000 barrels per day of petrochemical feedstocks from the US in 2024 according to the Energy Information Administration, with a value of over $4.7 billion. That dwarfed the $170 million of rare earths the US imported last year, about 70% of which came from China, according to the US Geological Survey.

The figures show the dependence the US and China have developed on each other by ever tightening trade links over the past few decades. While China has a tight grip on refining many metals crucial for industry, it also takes in niche chemicals from the US that are difficult to buy elsewhere.

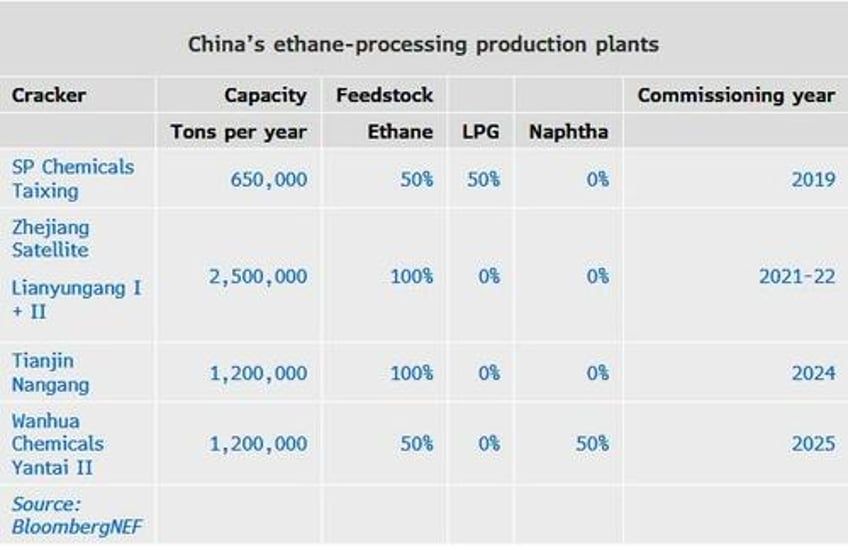

China leans on naphtha to produce most base chemicals, which are processed further to end up in everyday items like electronics and clothing. However, some plants can switch to cheaper propane when the economics make sense, which they do regularly. Propane dehydrogenation plants however can’t process alternatives like naphtha. The US accounted for over half of all China’s propane imports in 2024.

And so, with China refusing to comply with the terms of the recent ceasefire and unlock rare earth exports to the US, Washington is doing the same, and as Reuters reported yesterday, the US sent letters to Enterprise Products and Energy Transfer on Wednesday informing the companies they could load ethane on vessels destined for China but could not unload the ethane in China without authorization.

The letters from the U.S. Department of Commerce follow a licensing requirement imposed several weeks ago on the companies' exports of ethane to China, which halted shipments and led to vessels anchoring in or hovering around the US Gulf Coast

A copy of the letter seen by Reuters and later released by Enterprise Products said, "This letter authorizes Enterprise Products to load vessels with ethane, transport and anchor in foreign ports, even if... to a party located in China," the letter said. "However, Enterprise Products may not complete such export... to a party that is located in China," without further authorization.

The letters, Reuters muses, may signal the US preparing to lift restrictions imposed on exports to China in late May and early June, as the U.S.-China trade war shifted from retaliatory tariffs, to curbs on each others supply chains. With China granting rare earth export licenses to some firms and saying it would speed up the approval process, the U.S. now appears close to permitting ethane exports to China.

However, the decision to limit unloading of ethane is more likely another form of negotiation, one which signals that the cargo will not be released unless China complies with its own terms, and resumes shipments of rare earths.

About half of all US ethane exports go to China, where it is used by the petrochemical industry. China’s ethane cracking capacity is dwarfed by its capacity to process naphtha and propane, but almost all of its ethane imports come from the US. The restrictions will have a significant impact on the Lianyungang and Tianjin plants, owned by Satellite Chemical, Sinopec and INEOS. SP Chemicals, a Singapore-based producer, sources most of its feedstock from Enterprise Products Partners.

The ability to load and begin transporting ethane could relieve congestion at ports along the U.S. Gulf coast, where vessels have been stalled, although that now appears to be dependent on China complying with the terms of the London ceasefire.

Since May 23, the U.S. imposed new restrictions on exports to China of everything from ethane and chip design software to jet engines and nuclear plant parts.

As the trade war continues, it appears commodities are now leading the confrontation, with players on both sides set to feel the pain.

More in the Morgan Stanley report "How China Is Playing Its Rare Earth Card", available to pro subscribers.