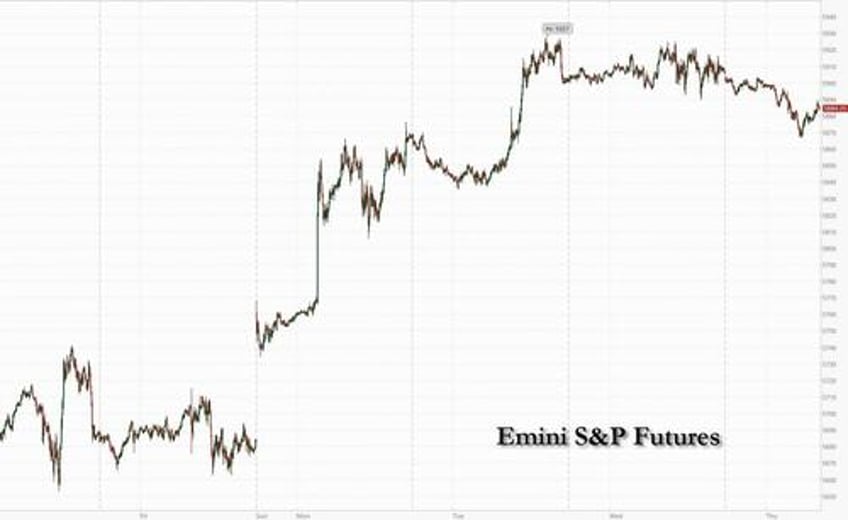

US equity futures are lower as investors take profits on Thursday and tech stocks fell as investors worried about an economic slowdown after Steve Cohen warned the chance of a recession is 45% and today’s retail sales numbers are expected to be a miss. As of 8:00am ET, S&P futures are down 0.4%, rebounding from session lows after Walmart reported solid earnings; Nasdaq futures dropped 0.5% with Nvidia, Palantir and Tesla falling about 2% in early trading. On Wednesday, the S&P failed at 5,900 for the second consecutive day. The silver lining according to JPM is that yesterday, NVDA turned positive on the year, joining META and MSFT; if the remaining members follow suit, there is another ~10% upside to the index assuming positive members are flat. YTD, AMZN is -4.2%, GOOG -12.6%, TSLA -13.9%, and AAPL -15.2%. In trade news, China removed curbs on rare earth exports to the US. Trump says India is willing to drop is tariffs on US goods. Brent sank below $64, down more than 3% after President Donald Trump said the US is getting closer to a deal on Iran’s nuclear program, fueling concern that additional oil supply may pressure the market. Bond yields and the USD are lower. Today’s macro data focus is on Retail Sales which are expected to remain unchanged in April (versus 1.5% prior); PPI, Jobless Claims, Philly Fed and Empire Manufacturing numbers are due at 8:30 am in New York, while Industrial Production prints at 9:15am. Also, traders are looking ahead to a speech by Federal Reserve Chair Jerome Powell.

In premarket trading, UnitedHealth shares sank after the WSJ reported it’s under criminal investigation for possible Medicare fraud. Walmart delivered another quarter of solid sales and earnings growth, and cautioned that tariffs and increasing economic turbulence means even the world’s largest retailer can’t hold off on price increases forever. Shares gained 2.4% premarket. Magnificent Seven stocks are lower as risk appetite falters (Tesla -1.8%, Apple -1%, Meta Platforms -1%, Amazon -0.8%, Alphabet -0.7%, Nvidia -0.6%, Microsoft -0.5%). Here are some other notable premarket movers:

- Alibaba ADRs (BABA) decline 5.6% after reporting revenue that missed estimates, dragged by a slowing international e-commerce arm and its Cainiao logistics business that’s under restructuring.

- Boot Barn (BOOT) rises 13% after the retailer of western wear gave a forecast for 1Q same-store sales growth that surpassed Wall Street estimates, despite an expected hit from tariffs.

- Cisco Systems (CSCO) rises 3.3% after the company gave a solid forecast for revenue in the current quarter, a sign the largest seller of networking gear is benefiting from demand for systems using AI technology.

- CoreWeave (CRWV) shares fall 6.6% after the cloud-computing provider’s quarterly profit forecast missed estimates due to some spending being brought forward.

- Crowdstrike Holdings (CRWD) shares are down 2.4% in premarket trading, after Mizuho Securities downgraded the software company to neutral from outperform.

- DXC Technology (DXC) shares are down 14% after the company reported forecast adjusted earnings per share for the first quarter and 2026 full-year guidance that missed the average analyst estimate.

- Dlocal (DLO) shares gain 21% after the financial technology company beat earnings expectations and unveiled plans for a special dividend.

- Foot Locker (FL) is up 84% with Dick’s Sporting Goods to buy it in a cash or stock deal implying an equity value of about $2.4 billion and an enterprise value of about $2.5 billion.

- JetBlue (JBLU) falls 1.6% after Raymond James downgraded the airline company to market perform from outperform, citing a more balanced risk-reward amid an improvement in sentiment.

- Luminar (LAZR) drops 13% after the automotive technology company’s CEO Austin Russell resigned as CEO, overshadowing better-than-expected first-quarter sales.

- NetEase ADRs (NTES) are up 6.7% after the China-based video-game company reported first-quarter results that beat expectations.

- New Fortress Energy (NFE) shares slump 38% after the energy infrastructure firm saw adj. Ebitda plunge in the first quarter, with analysts flagging that the sale of its Jamaican assets will dent cash flow.

There’s also some big company news to digest. Trump wants Apple to stop moving iPhone production to India, while Starbucks is said to be considering options to revamp its China business, including a possible stake sale.

Economic forecasters this week have said that while the Trump administration’s temporary trade deal with China has reduced the risk of a recession, the overall economy is likely to slow. “There’s definitely more clarity than a few weeks ago,” Dubravko Lakos-Bujas, chief of global markets strategy at JPMorgan Chase & Co., said in a Bloomberg Television interview. “Some of the uncertainty around trade, tariffs, policy started to get reined in.”

“The market is globally priced for perfection,” said Michael Nizard, head of multi-asset at Edmond de Rothschild Asset Management. “The retail sales figures should reveal that consumer is already depressed in terms of business confidence.”

Meanwhile, billionaire Steve Cohen, speaking at the Sohn Investment Conference on Wednesday, put the chances of a US recession at about 45%. Cohen, the founder of hedge fund Point72 Asset Management, said he doesn’t expect the Federal Reserve to cut rates right away, because “they are going to be worried about inflation from tariffs.” He said he expects US economic growth next year to slow to 1.5% or less, “which is OK but not phenomenal.”

Looking at today's macro data, Retail sales are expected to rise by a tepid 0.1% in April (versus 1.5% prior) according to Bloomberg economists, while a survey of economists is pointing to flat month-on-month sales. PPI and Empire Manufacturing numbers are due at 8:30 am in New York. Traders were looking ahead to a speech by Federal Reserve Chair Jerome Powell, as well as data on manufacturing and retail sales, for the next readout on US growth and inflation. Economists are expecting no growth in retail sales in April as consumers cut back on some purchases.

European stocks retreat for a second day. Energy stocks lead declines, driven by a fall in oil prices following a report that Iran is willing to forgo nuclear weapons in a deal with the US, while utilities and food and beverage stocks outperform. Among individual stocks, insurance firm Allianz drops after disappointing results. Stoxx 600 falls 0.2% to 542.88 with 327 members down, 263 up, and 10 little changed. Here are the biggest European movers:

- KBC shares rise as much as 2.6% after the Belgian lender reported earnings that analysts said were roughly in line with expectations, and saw a boost from increased insurance revenues.

- Engie shares gain as much as 2.2% after the utility produced what analysts said were strong results that should provide further comfort around full-year guidance and the dividend.

- Serco shares rise as much as 6.9% after the outsourcing-services company announced the award of three contracts with a combined value of more than £1b to provide maritime services for the Royal Navy.

- Watches of Switzerland shares rise as much as 6.7% after the watch seller’s update showed no deterioration in trends in either the UK or US, providing some relief to investors.

- Energy stocks are the worst-performing sector as oil falls following a report that Iran is willing to forgo nuclear weapons in a deal with the US in exchange for sanctions relief.

- Allianz shares fall as much as 3.9% after the German insurer reported earnings that analysts called disappointing.

- 3i shares drop as much as 8.1% following the private equity firm’s full-year results, with net asset value per share coming in marginally below analyst expectations.

- Deutsche Telekom shares decline as much as 1.2% after the telecom operator reported mixed trends in its home market Germany.

- Thyssenkrupp shares fall as much as 14% after the German firm reported what Morgan Stanley called a substantial miss. Analysts see challenges reaching full-year guidance.

- Orsted shares drop as much as 4.7%, to the lowest since December 2016, after Berenberg analysts cut their rating on the stock to hold from buy.

- Siemens shares fall as much as 4.4% after the German industrial group reported a solid set of second-quarter earnings, with analysts noting continued improvement for the key Digital Industries division.

- CVC Capital shares fall as much as 3.2%, with analyst saying that the buyout firm’s fee paying AUM for the first quarter disappointed as some funds reached the end of their fee-paying periods.

Earlier in the session, Asian stocks slipped, poised to snap a four-day win streak, as the rally fueled in part by reduced fear over US tariffs fizzled. The MSCI Asia Pacific Index fell as much as 0.5%, with Toyota, and Sony among the biggest drags, as a stronger yen weighed on Japanese equities. Key gauges fell more than 1% each in Thailand and the Philippines. Tencent dipped despite upbeat earnings, weighing on key Hong Kong gauges, as investors await Alibaba’s results later Thursday. The market had been looking for major Chinese tech reports to provide the next catalyst. Despite the muted response to the US-China trade truce, some market watchers are turning more positive on Chinese stocks. Strategists at Goldman Sachs have raised their Chinese stocks index targets. Morgan Stanley said MSCI China’s onshore stocks saw “meaningful improvement” in the first quarter results over the previous three months, marking the first in-line outcome after 14 quarters of misses.

In FX, the Bloomberg Dollar Spot Index declines 0.3%. The pound adds 0.2% with little reaction seen after UK GDP in the first quarter topped estimates as the period precedes a sharp rise in US tariffs.

In rates, treasuries are slightly richer across the curve with gains led by front end and belly, unwinding a portion of Wednesday’s selloff when Fed-policy pricing saw a hawkish shift. US yields are 2bp-3bp lower across maturities led by 5-year sector with 10-year near 4.51%. European government bonds also gain: bunds and gilts outperform, supporting Treasuries, following wave of European data including UK GDP and industrial production and French CPI. Slide in oil futures also supports Treasuries. US session includes April retail sales data and remarks by Fed Chair Powell on the central bank’s monetary policy framework review (text release expected at 8:40am New York time).

In commodities, WTI crude oil futures have pared a 4.2% drop to about 3.7%, extending losses for a second day after US President Trump said an agreement to curb Iran’s nuclear program is closer. Spot gold falls $11 to around $3,167/oz having pared an earlier fall.

US economic data calendar includes May Empire manufacturing, April retail sales, PPI, weekly jobless claims, May Philadelphia Fed business outlook (8:30am), April industrial production (9:15am), March business inventories, May NAHB housing market index (10am). Fed speaker slate includes Powell (8:40am) and Barr (2:05pm)

Market Snapshot

- S&P 500 mini -0.4%

- Nasdaq 100 mini -0.6%

- Russell 2000 mini -0.2%

- Stoxx Europe 600 -0.2%

- DAX -0.3%

- CAC 40 -0.2%

- 10-year Treasury yield -3 basis points at 4.5%

- VIX +0.6 points at 19.2

- Bloomberg Dollar Index -0.3% at 1229.3

- euro +0.3% at $1.1208

- WTI crude -4.1% at $60.55/barrel

Top Overnight News

- U.S. President Donald Trump said on Thursday that the United States was getting very close to securing a nuclear deal with Iran, and Tehran had "sort of" agreed to the terms. The agreement would see the country foreswear highly enriched uranium in exchange for an easing of economic sanctions. RTRS

- U.S. President Donald Trump said on Thursday that India had offered a trade deal that proposed "no tariffs" for American goods, while expressing his dissatisfaction with Apple's plans to invest in India. New Delhi is seeking to clinch a trade deal with the U.S. within the 90-day pause announced by Trump on April 9 on tariff hikes for major trading partners. RTRS

- US officials seeking to negotiate trade deals around the world are not working to include currency policy pledges in the agreements, according to a person familiar with the matter. Foreign-exchange markets are on edge over concerns President Donald Trump’s administration is seeking a weaker greenback and might use trade bargaining to achieve that goal. BBG

- Trump asked Apple’s Tim Cook to stop plans to move iPhone output to India. The president said Apple will increase production in the US as a result of their discussion. BBG

- US authorities are preparing to announce one of the biggest cuts in banks’ capital requirements for more than a decade, marking the latest sign of deregulation agenda for the Trump administration. FT

- Trump says the US will upgrade the F-35 to an F-55; will do an F-22 super, an upgrade on the F-22.

- UnitedHealth shares dropped premarket after the WSJ reported it’s under criminal investigation for possible Medicare fraud. The company said it hasn’t been notified by the DOJ. BBG

- Japan's top trade negotiator, Ryosei Akazawa, could travel to Washington as soon as next week for a third round of trade talks with the U.S., two sources with knowledge of the plans told Reuters on Thursday. RTRS

- Ignoring Ukrainian President Volodymyr Zelensky’s call to meet for direct high-level talks in Turkey, Russian leader Vladimir Putin dispatched to Istanbul a team of junior officials, making it uncertain that negotiations between the warring nations would occur at all. WSJ

- Oil demand growth to slow according to the latest IEA report – “Global oil demand growth is projected to slow from 990 kb/d in 1Q25 to 650 kb/d for the remainder of the year as economic headwinds and record EV sales curb use.” IEA

Tariffs/Trade

- EU Trade Commissioner Sefcovic says the US and EU have agreed to intensify trade talk contacts.

- WTO chief warned that US bilateral tariff deals could put trade principles at risk and said global trade was in a crisis despite the recent de-escalation of the US-China tariff war, according to FT.

- US Treasury secretary Bessent says they can accomplish "a lot" over the next 90 days; will have a series of negotiations to prevent escalation with China again.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were predominantly lower following the mixed handover from Wall St, where the major indices were somewhat choppy and small caps underperformed as yields edged higher. ASX 200 traded indecisively but eventually eked mild gains in the aftermath of the stronger-than-expected jobs data from Australia. Nikkei 225 underperformed following recent currency strength and as earnings results remained in the spotlight in Japan. Hang Seng and Shanghai Comp were lacklustre amid little in the way of fresh catalysts to spur momentum, while Tencent shares traded indecisively post-earnings and Alibaba results are scheduled for release today.

Top Asian News

- Chinese President Xi hopes the Danish Chamber of Commerce in China and member companies will continue to role as a bridge between China and Denmark and between China and Europe, according to Xinhua.

- PBoC Governor Pan said China welcomes more outstanding Latin American market players to issue Panda bonds in China and share market development opportunities, while he added that China and Latin America should promote financial cooperation in a wider range of fields and a deeper level.

Subdued sentiment across Europe after the predominantly lower APAC handover, and following the mixed handover from Wall St, where the major indices were somewhat choppy and small caps underperformed as yields edged higher. Newsflow this morning has been light but earnings picked up, whilst current focus remains on geopolitical ongoings with US President Trump in the Middle East, consolatory language from Iran, and a likely no-show from Russia President Putin in Russia-Ukraine peace talks in Turkey. Sectors are mostly a defensive bias and in line with the cautious mood across the markets.

Top European News

- Plans for a reset of UK-EU relations hit trouble due to fishing rights and youth mobility as EU member states demanded further concessions from the UK, according to the FT.

FX

- DXY subdued and contained within Wednesday's confines amid a lack of fresh catalysts overnight, n a 100.58-101.05 range at the time of writing, within yesterday's 100.27-101.14 parameter.

- EUR ekes mild gains and trades on either side of the 1.1200 level after recent fluctuations, and with ECB speakers scheduled later, although data and speakers today are not likely to shift the dial much.

- GBP is slightly firmer following better-than-expected UK GDP data; GBP/USD resides within yesterday's 1.3250-1.3360 range.

- USD/JPY retreated overnight as the underperformance in Japanese stocks spurred some haven flows into the yen.

- Antipodeans are subdued in-fitting with the broader risk tone; mild support was seen in AUD/USD following the stronger-than-expected employment data from Australia.

- PBoC set USD/CNY mid-point at 7.1963 vs exp. 7.2217 (Prev. 7.1956).

Fixed Income

- Another contained start for fixed income with USTs marginally in the green while peers across the pond resided slightly in the red in the early morning.

- USTs at a 109-26 peak with gains of a handful of ticks. While firmer, the benchmark remains markedly shy of peaks from the last three sessions at 110-09+, 110-15 and 110-19+ respectively.

- Bunds find themselves attempting to make a footing above the break-even mark at the top-end of a 129.13 to 129.47 band.

- Gilts gapped higher by 17 ticks, before then slipping to a shortlived 91.02 low given the readacross from EGBs at the time. Currently, at the mid-point of a 91.02-22 band.

- UK sells (via tender) GBP 2.0bln 0.125% 2028 Gilt: b/c 3.52x, average yield 3.768% & tail 0.7bps

Commodities

- WTI and Brent are suffering losses of USD 2/bbl, with commentary surrounding Iran applying steady pressure overnight and through the morning so far. US President Trump said the US is getting close to a deal with Iran, and they are in serious peace negotiations, adding that Iran has "sort of" agreed to the terms of a deal. This constructive commentary surrounding the nation pushed benchmarks to fresh session lows, adding to overnight losses. Losses overnight also stemmed from geopolitics, following a report that Iran is ready to sign an agreement with certain conditions in exchange for the lifting of sanctions and would commit to never making nuclear weapons and getting rid of its stockpiles of highly enriched uranium. The aforementioned lows for WTI and Brent are currently USD 60.65 and 63.63/bbl.

- Spot Gold is extending on recent losses with demand subdued as it sits below the USD 3,200/oz mark. The trend seen for most of this week remains intact, with the metal continuing to be hit by higher yields, particularly on the short end.

- Copper Futures are lower by a percent, mostly owing to a downbeat risk sentiment in APAC hours. It currently trades towards session lows of USD 9,467/t, after being modestly pressured around the time of Trump commentary.

- IEA lifts 2025 average oil demand growth forecast by 20k BPD to 740k BPD on upward revision to GDP growth forecast and lower oil prices; sees global oil demand growth dropping to 650k BPD for remainder of 2025, from 990k BPD in Q1. “Increased trade uncertainty is expected to weigh on the world economy and by extension oil demand,”. IEA sees oil inventories rising by around 720k BPD in 2025 as global supply rises expected to considerably outpace demand growth. IEA hikes 2025 global supply growth forecast to 1.6mln BPD, up by 380k BPD from previous month's report on higher Saudi production outlook. IEA raises 2026 average oil demand growth forecast to 760k BPD (prev forecast 690k BPD).

Geopolitics: Ukraine

- Russian President Putin was not on a list of negotiators the Kremlin published for talks with Ukraine in Istanbul on Thursday

- Russian Kremlin spokesperson Peskov says no chance Russian President Putin will take part in Turkey talks, according to Ria.

- US President Trump says he will go to the Russia-Ukraine talks if appropriate.

Geopolitics: Middle East

- Qatar's PM said Israeli attacks in Gaza this week send a signal that they are not interested in negotiating a ceasefire, while he added that a US humanitarian plan for Gaza is not necessary and the UN should be allowed to deliver aid, according to CNN.

- Gaza Humanitarian Foundation announced it will launch operations in the Gaza Strip before the end of the month and stated that Israel has agreed to expand the number of distribution sites to serve the entire population of Gaza.

- US President Trump said Qatar is working with the US on negotiating an Iran deal and he wants to see Iran thrive.

- Iranian President Pezeshkian said Iran will not bow to any bullying from US President Trump who he suggested thinks that he can come to the region, chant slogans, and scare them.

- Iran is ready to sign an agreement with certain conditions in exchange for the lifting of sanctions and would commit to never making nuclear weapons, as well as getting rid of its stockpiles of highly enriched uranium, according to a top advisor to the Supreme Leader cited by NBC News.- US President Trump says the US getting close to doing a deal with Iran; in serious negotiations to achieve peace; don't want to take a second step and threaten Iran. Want to end Iran in an intelligent way, not destructive

Geopolitics: Other

- China's Hainan Maritime Safety Administration warned of military training taking place in an area of the South China Sea from May 15th to 16th and prohibited entry, while it noted there were some drills near Vietnam and China's Hainan.

- Russia sent a fighter jet to "check the situation" as Estonia was attempting to detain a Russian shadow fleet tanker, according to the Estonian Foreign Minister; jet violated NATO territory for "around a minute".

US Event Calendar

- 8:30 am: May Empire Manufacturing, est. -8, prior -8.1

- 8:30 am: Apr Retail Sales Advance MoM, est. 0%, prior 1.4%, revised 1.45%

- 8:30 am: Apr Retail Sales Ex Auto and Gas, est. 0.3%, prior 0.8%, revised 0.86%

- 8:30 am: Apr Retail Sales Ex Auto MoM, est. 0.3%, prior 0.5%, revised 0.56%

- 8:30 am: Apr PPI Final Demand MoM, est. 0.2%, prior -0.4%

- 8:30 am: Apr PPI Ex Food and Energy MoM, est. 0.3%, prior -0.1%

- 8:30 am: Apr PPI Final Demand YoY, est. 2.5%, prior 2.7%

- 8:30 am: Apr PPI Ex Food and Energy YoY, est. 3.1%, prior 3.3%

- 8:30 am: May 10 Initial Jobless Claims, est. 227.5k, prior 228k

- 8:30 am: May 3 Continuing Claims, est. 1890k, prior 1879k

- 8:30 am: May Philadelphia Fed Business Outlook, est. -11, prior -26.4

- 9:15 am: Apr Industrial Production MoM, est. 0.1%, prior -0.3%

- 9:15 am: Apr Capacity Utilization, est. 77.8%, prior 77.8%

- 10:00 am: Mar Business Inventories, est. 0.2%, prior 0.2%

- 10:00 am: May NAHB Housing Market Index, est. 40, prior 40

Central bank speakers

- 5:00 am: 2nd Thomas Laubach Research Conference

- 8:40 am: Fed’s Powell Speaks on Framework Review

- 2:05 pm: Fed’s Barr Gives Opening Remarks

DB's Jim Reid concludes the overnight wrap

The strong recent equity rally showed some signs of exhaustion over the past 24 hours, even though gains for the tech mega caps helped the S&P 500 (+0.10%) extend its gains since the closing low on April 7 to +18.26%. On the other hand, Treasuries came under renewed pressure with the 10yr yield (+7.1bps) closing above 4.5% for the first time since February as investors continued to price out Fed rate cuts and increased their focus on the US fiscal outlook. The moves added to the mixed performance across US asset classes since early April, with the S&P 500 now +3.91% above the pre-Liberation Day levels but 10yr Treasuries (+40bps) and the dollar index (-2.67%) having lost considerable ground.

Trump’s Middle East tour continued to generate headlines yesterday, but their market impact was narrower in comparison to Tuesday’s rally. One notable beneficiary was Nvidia (+4.16%), which moved back into the green YTD after the oil giant Saudi Aramco signed agreements of as much as $90bn with a slew of US companies, including with Nvidia on AI infrastructure. That helped the Magnificent 7 rise +1.75% on the day, while the NASDAQ was +0.72% higher. Elsewhere, more than $243bn of deals were announced during Trump’s visit to Qatar, with the White House saying this would lay the groundwork for a bigger $1.2trn economic pledge. This included a $96bn deal to buy up to 210 Boeing aircraft. Boeing’s shares closed +0.64% on the day, having been +3% intra-day after Trump announced the deal. The president is in the UAE today, so expect more announcements.

Outside of tech the equity mood was actually pretty weak, as the equal-weighted version of the S&P 500 (-0.62%) and the small-cap Russell 2000 (-0.88%) posted visible declines. This weaker performance was also visible in Europe as the STOXX 600 (-0.24%) ended its four-day winning streak, with the DAX (-0.47%) and CAC (-0.47%) leading the decline. Among the reasons for a stalling of the equity rally was a relative absence of trade headlines, although Bloomberg reported that India’s trade minister is set to visit the US this week to discuss tariffs.

With the recent surge driven by US-China trade discussions waning, Asian equity markets are also losing momentum this morning. Across the region, the Nikkei (-0.98%) is the biggest laggard, with the KOSPI (-0.43%) also in the red. In China, the CSI (-0.58%) and the Shanghai Composite (-0.42%) and Hang Seng (-0.25%) are moderately lower. The S&P/ASX 200 (+0.27%) is an exception in the region, trading higher. In the US, S&P 500 futures are -0.18% lower while those on the NASDAQ are near flat.

Yesterday’s more notable market milestones came for Treasuries, with 2yr (+5.1bps to 4.05%) and 10yr (+7.1bps to 4.54%) yields both closing at their highest levels since February. And the 30yr yield rose +6.7bps to 4.97%, its highest close since January and within touching distance of the 5% level it briefly breached on the evening of April 8, the night before Trump announced a 90 day delay to the reciprocal tariffs. So we are now reaching yield levels that previously seemed to trigger sensitivity from the US administration, though the recent moves are much more orderly than they were in early April.

The bond sell-off came amid an ongoing reversal in Fed rate cut expectations, with fed funds futures moving to price less than two cuts by year-end for the first time since February (-3.9bps to 49bps). That came as Fed speakers struck a measured tone, with San Francisco Fed President Daly saying that “the word of the day is patience” while Chicago Fed President Goolsbee said that a “solid hard data economy is still there” beneath the recent noise.

Meanwhile on the US fiscal side, the Republicans’ planned economic package continued to take shape, with the House Ways and Means Committee advancing the proposed tax portion that included an extension of 2017 tax cuts, eliminating taxes on tips and overtime pay and creating some new tax deductions, although some key issues such as the state and local tax deduction remain unresolved. The total of those planned tax cuts are well above the spending cuts that have been approved by other House Committees, so as things stands it looks improbable that the eventual package will deliver any meaningful reduction of the elevated US fiscal deficit.

The above rates moves come ahead of a slew of US data today, including the April PPI, where after Tuesday’s April CPI miss, we’ll be monitoring the categories that feed through into core PCE, while also watching for any evidence of tariff pass through into producer prices. Meanwhile, the April retail sales print will be watched for possible signs of pull-forward demand in response to tariffs, with April industrial production also due. Recall that while US sentiment surveys have seen a sharp weakening over the past few months, hard data have so far held up quite well.

The other notable market story yesterday were moves in the US dollar. The dollar index fell by as much as -0.72% intra-day following reporting that US and South Korea officials had discussed exchange rate policies at a meeting in early May. However, it recovered back to little changed (+0.04%) by the close following a Bloomberg report that US officials were not seeking currency pledges as part of ongoing trade negotiations. Still, there were notable gains against the dollar for the East Asian currencies, including the South Korean won (+0.88%) and Japanese yen (+0.50%). The won and yen are another +0.60% and +0.47% higher this morning. At a minimum, there is a sense that these countries may become more reticent to push back against their currencies appreciating than they have been in the past.

Turning back to Trump’s visit in the Middle East, yesterday the president said that Iran must “permanently and verifiably cease” its pursuit of nuclear weapons if it wanted to strike a deal with the US, while NBC reported that Iran is ready to sign an agreement with certain conditions. Brent crude was down -0.81% to $66.09/bbl on the back of ameliorating tensions, while gold fell -2.25% to $3,177/oz, leaving the precious metal on course for its biggest weekly decline since November.

Geopolitics will stay in focus today with Russia-Ukraine talks expected in Istanbul. The nature of any talks remains uncertain, with Ukraine’s President Zelensky calling for an in-person meeting with Russia’s Putin, but Moscow last night announcing a delegation headed by Vladimir Medinsky, a former Minister of Culture who led Russia’s talks with Ukraine back in 2022. Should the talks deliver little, a key question will be whether the US might join in announcing new sanctions against Russia which have been advocated by European leaders.

In terms of the day ahead, in the US we have the April PPI report, retail sales, industrial production, May Philadelphia Fed business outlook, Empire manufacturing index, initial jobless claims and more. We’ll also see the UK release its Q1 GDP numbers, with our UK economist expecting growth to have jumped in Q1 before reversing in Q2 (see preview here). Other data releases include March trade balances in Italy and the Eurozone. Central bank speakers include Fed’s Barkin, ECB’s Lane and BoE’s Lombardelli. The European Commission is also set to release their Spring Economic Forecasts.