Foot Locker shares erupted in premarket trading Thursday after The Wall Street Journal reported that Dick's Sporting Goods has agreed to acquire the struggling sneaker retailer for $2.4 billion, offering $24 per share in cash or stock—a nearly 90% premium to Foot Locker's pre-announcement price. Shareholders will have the option to receive either cash or 0.1168 shares of Dick's common stock for each Foot Locker share they own.

Dick's is the nation's largest sports retailing chain and operates Golf Galaxy stores across the US. The acquisition of the sneaker chain would allow Dick's to expand globally in 26 countries.

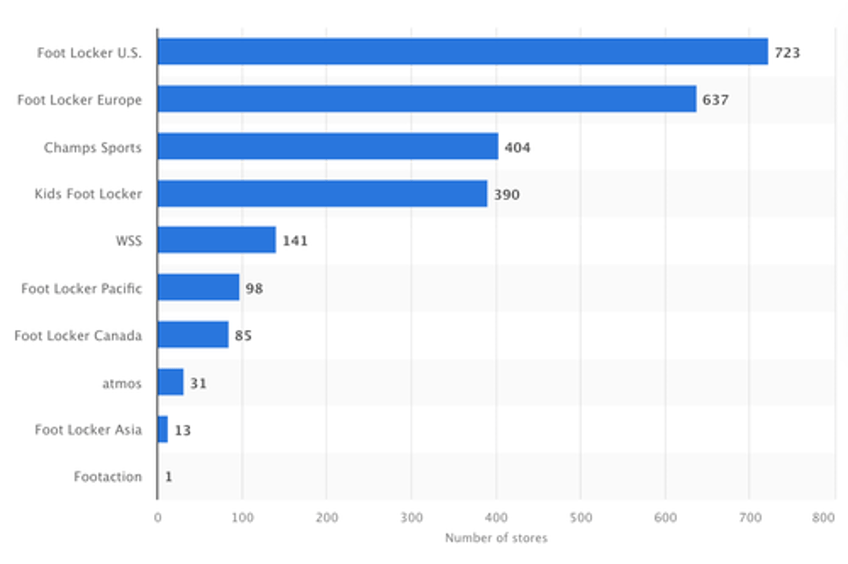

Number of Foot Locker stores worldwide as of financial year 2023, by store type (via Statista)

WSJ noted, "Dick's said it expects to operate Foot Locker as a stand-alone business unit within its portfolio and maintain the Foot Locker brands."

The move also parallels broader retail consolidation, following Skechers' recent $9.4 billion sale to 3G Capital, a private equity firm with a history in the consumer-goods sector, earlier this month.

News of the acquisition comes as both Dick's and Foot Locker have been pressured by tariff-related retail headwinds, particularly in the sneaker space.

Foot Locker shares plunged 41% this year due to weak sales forecasts and pressure from Nike's pricing changes but surged 84% in premarket trading in New York to around $23.70.

Foot Locker's float is 14.6% short - or about 13.6 million shares. Rough day ahead of the bears.

Shares of Dick's in premarket is down 9%. On the year, shares are down 8.4% (as of Wednesday's close). The deal is the largest ever for the sporting goods retailer and aligns with Lauren Hobart's strategy to grow consumer engagement.

Here's the first take from Wall Street analysts (courtesy of Bloomberg):

Bloomberg Intelligence analyst Lindsay Dutch

Foot Locker is in the midst of a challenging turnaround, and may need a buyout from Dick's Sporting Goods

"For Dick's, the potential $2 billion deal might strengthen its leading position in the $140 billion market at a discounted multiple of 0.3x price to sales, yet also increases reliance on Nike's assortment"

Morgan Stanley analyst Simeon Gutman

"Greater scale and EPS accretion are potential positives, offset by a premium for a struggling chain"

The initial reaction to the stocks may be tentative as sources of value creation not as obvious

Truist Securities analyst Joseph Civello

A potential deal can create value for Dick's over the long term

"FL's business has been under meaningful pressure over the past few years and we think a potential turnaround would likely be a long/ bumpy process"

Jefferies analyst Corey Tarlowe

A deal makes sense given Dick's and Foot Locker's category overlap and Foot Locker's "recent diversification efforts"

At $24/share it's a potentially positive offer for the Foot Locker stock

. . .