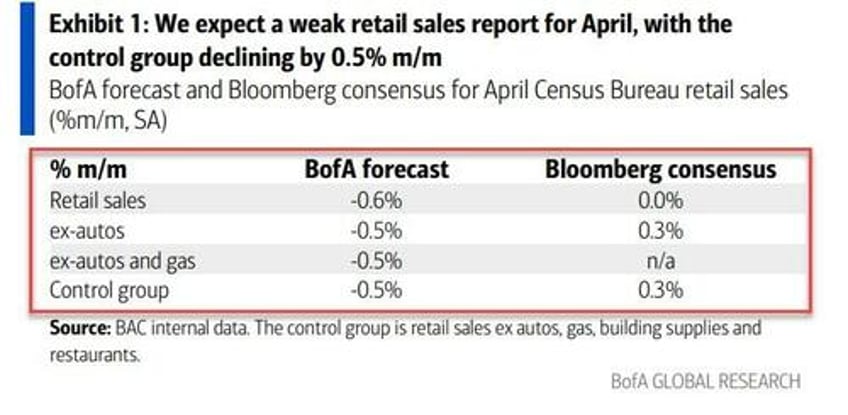

If BofA's omniscient analysts are right (and they have been serially on the correct side of this data series relative to consensus for months), then traders should brace for disappointment this morning for the retail sales data.

But...

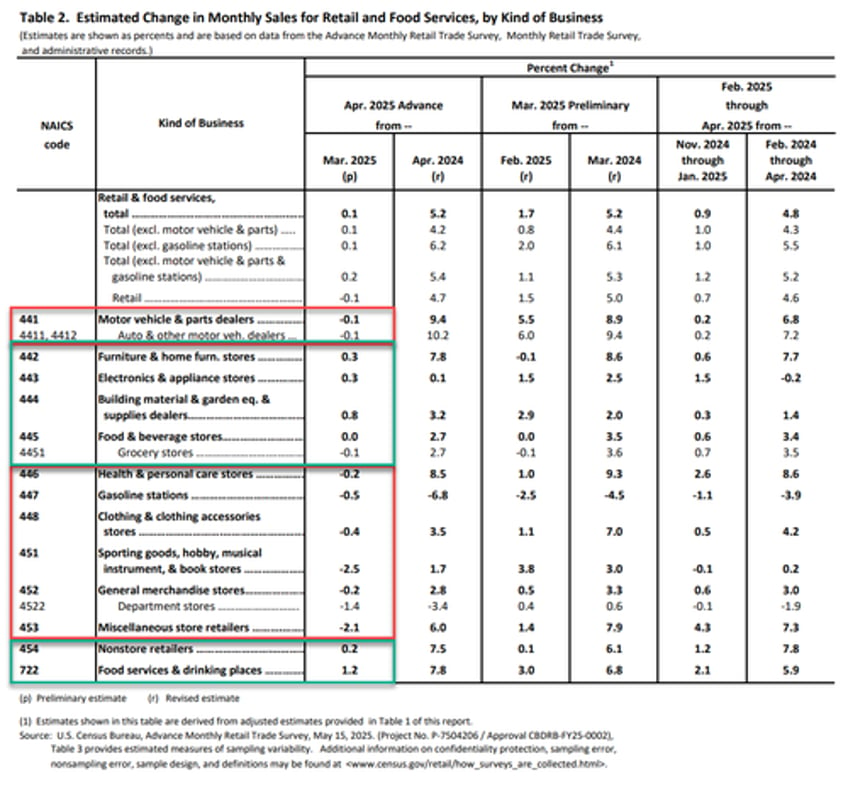

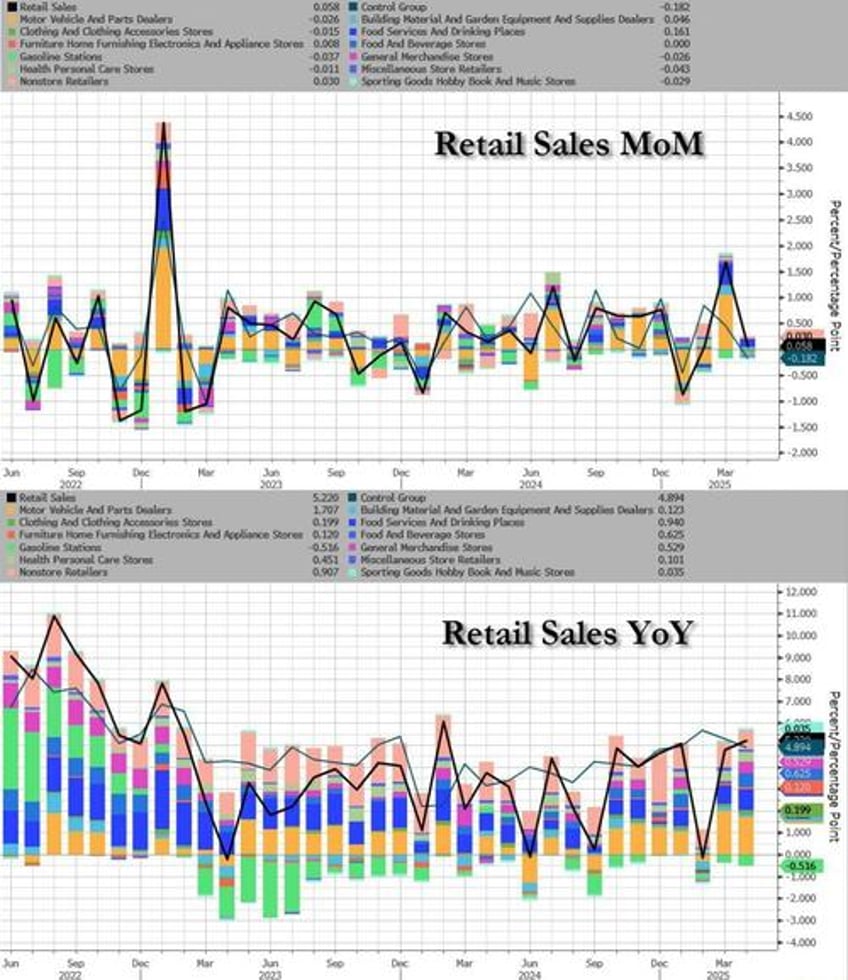

For once, the BofA analysts were incorrect as headline retail sales rose 0.1% MoM (better than the 0.0% MoM exp, but this follows a sizable upward revision in March to +1.7% MoM (from +1.4%). With the revision that left retail sales up 5.2% YoY - near its highest since Dec 2023

Source: Bloomberg

Under the hood, Sporting Goods sales declined the most while Building Materials rose the most...

The (tariff front running) surge in Motor Vehicle Sales last month has gone...

Source: Bloomberg

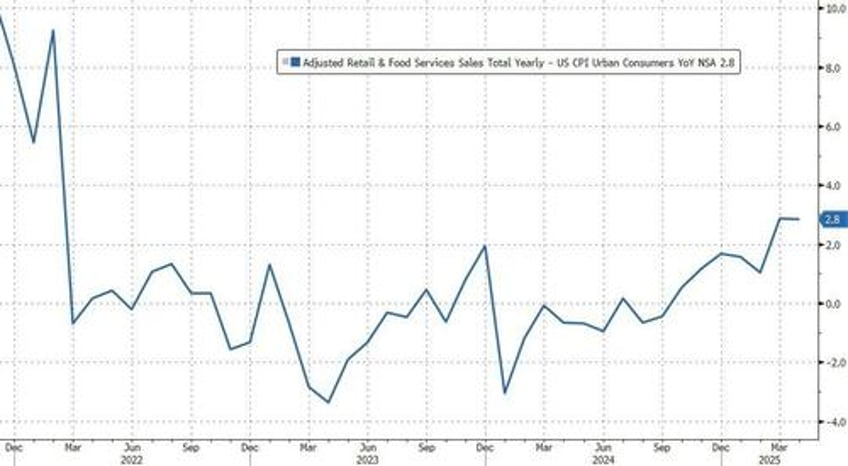

As a reminder, this data is nominal, so adjusting ()very roughly) for inflation, retail sales rose 2.8% YoY, equalling its highest since Feb 2022...

Source: Bloomberg

More problematically, the Control Group - which feeds directly into GDP - was a big miss, dropping 0.2% MoM (vs expectations of a 0.3% MoM rise)...

Source: Bloomberg

So, the good news is bottom-up Americans are spending... but top-down GDP may be negatively affected.