Submitted by QTR's Fringe Finance

Remember just one month ago when the media was acting like tariffs were a guarantee of 100 years of famine, plague and pestilence? Well tomorrow the stock market is going to be well on its way toward all-time highs, again.

Tom Lee will look like a genius and bears will look like morons. You know the drill. Stop me if you’ve heard this one before.

My readers will remember that just about a month ago, after “Liberation Day,” I made the case that the mainstream financial media’s panic and histrionics over President Trump’s tariffs were equal parts embarrassing and pointless.

I argued the age-old point that “you can’t make an omelette without breaking some eggs” and that the discomfort making these so-called “financial professionals” squirm in their seats—and even audibly cry out for help—was actually proof that what President Trump set out to do, recalibrate the world stage and redefine how people think about global trade, was working.

In fact, I titled my article accordingly.

Your Discomfort Means It's Working

I thought the media’s behavior was ridiculous for a couple of reasons. First, as I said, how can anyone expect meaningful change without experiencing some temporary discomfort? Second, I found it downright embarrassing how the slightest downtick in the stock market—a market that has arguably been overvalued for decades—immediately sent analysts and media personalities into a full-blown panic over tariffs before they even went into effect, and certainly before we’d had any chance to negotiate deals.

My stance was simple: “Everybody calm the hell down and let’s just wait and see what happens.” I found it hilarious that people acted as though these tariffs would remain in place for eternity and that the seeds of America’s demise had already been sown for the next hundred years.

I wrote at the time:

America was a country founded by rugged individuals, but there’s nothing rugged about throwing a fit because your NASDAQ investment, up 150% over the last 5 years, is down 5% today — especially when the “problem” likely will be resolved to some degree within a matter of weeks, if not months.

I argued that patience was in order—and that, given time, deals would start falling into place.

And lo and behold, that’s exactly what’s happening. While final, fully inked deals haven’t yet crossed the finish line, we’ve already held constructive talks with Canada and have a framework in place with the United Kingdom. Negotiations continue with countries like India and Japan, who I originally expected would be among the first to reach agreements.

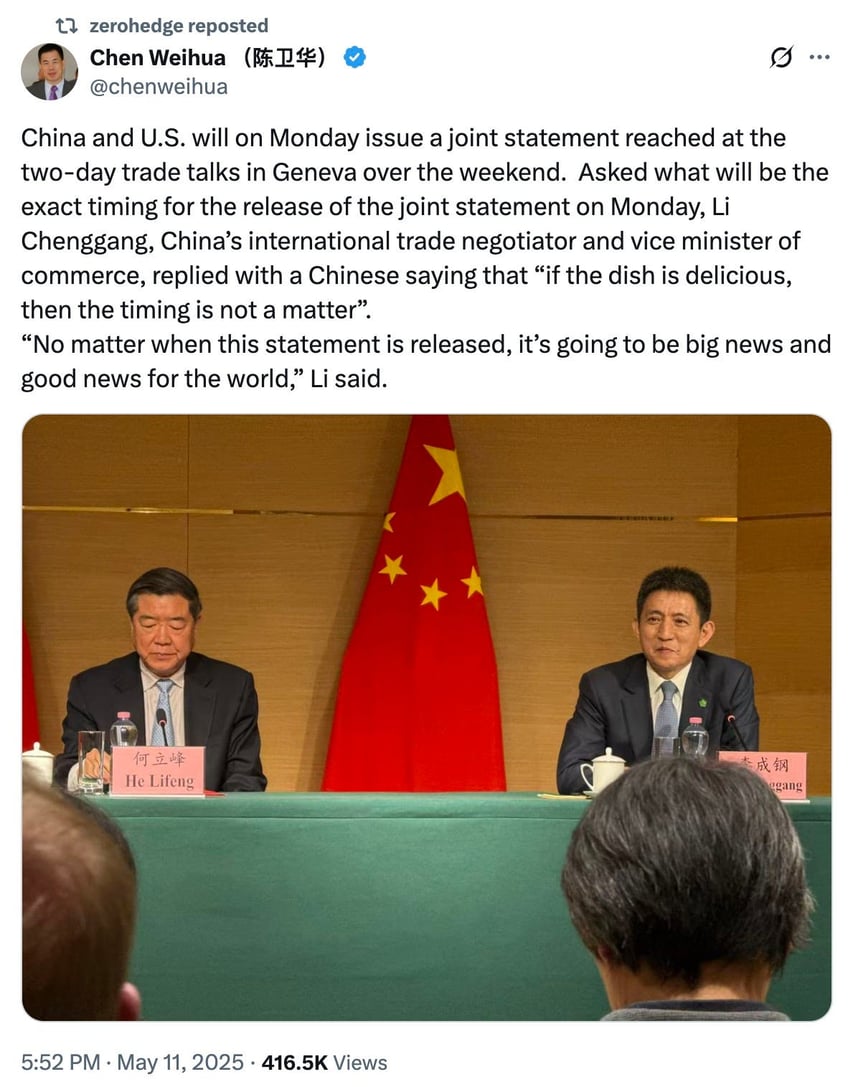

But the biggest surprise came this weekend, when, after barely two days of negotiations, the United States and China appear to have agreed on a framework for a trade deal. To quote Agent Paul Smecker: “CNBC, we’ll start the ass kissing with you.”

Like everyone else, I assumed China would be the toughest nut to crack and the last to make a deal—not only because they’re seasoned negotiators, but also because they represent a massive portion of America’s imports. And trust me, I was just as skeptical as anyone about the Trump administration’s Sunday claim that things were going well—until I saw Chinese officials echo those very same sentiments.

While a finalized deal isn’t 100% complete yet, both sides have come forward with statements that can only be described as optimistic.

At this point, it’s hard to deny that tangible progress has been made.

This, of course, is great news for the stock market, which will likely rally on Monday. One of the biggest market unknowns has been partially resolved, and nothing ignites the animal spirits of the market like a major geopolitical win.

But beyond that, it’s simply a deliciously prompt resolution to a problem the media insisted would be a long-term economic catastrophe.

All I said a month ago was “hold on and let’s see what happens.” And here we are, a mere month later—without any meaningful shortages or real discomfort in our daily lives—and the “problem” is well on its way to being solved.

Oh, and did I mention that with every new deal we strike, the United States is in a stronger position than it was just two months ago?

Sure, there will always be cynics and skeptics who want to argue the ins and outs of these deals, pointing to data that suggests only minuscule gains for the U.S. or marginal concessions from foreign nations. But the simple fact is the posture this gives the United States—and President Trump—on the global stage is one of leverage, power, and respect.

Let the cynics fill in whatever narrative suits their agenda. But for better or worse, Trump’s administration went to bat for the United States and brought home better deals than we had just a month ago. If you want to argue the minutiae of how much better these deals are, go ahead.

I’ll be too busy savoring the sweet, intoxicating catnip of the mainstream media’s buffoonery from a month ago.

As I’ve said many times before, I still believe the stock market is overvalued—and with this week’s rally, it will remain so. I made that case clearly in my market review earlier this month, which you can read here:

Trading The Sh*t Show: May 2025 Market Review

But the real lesson here is this: The next time the mainstream financial media is in full-blown financial panic mode, hold your head high, keep your cool, and remind yourself that compared to them, you’re the institutional investor in the room.

And if you do that, you might just find yourself standing calmly amidst the chaos… right in the middle of a money-making opportunity.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.