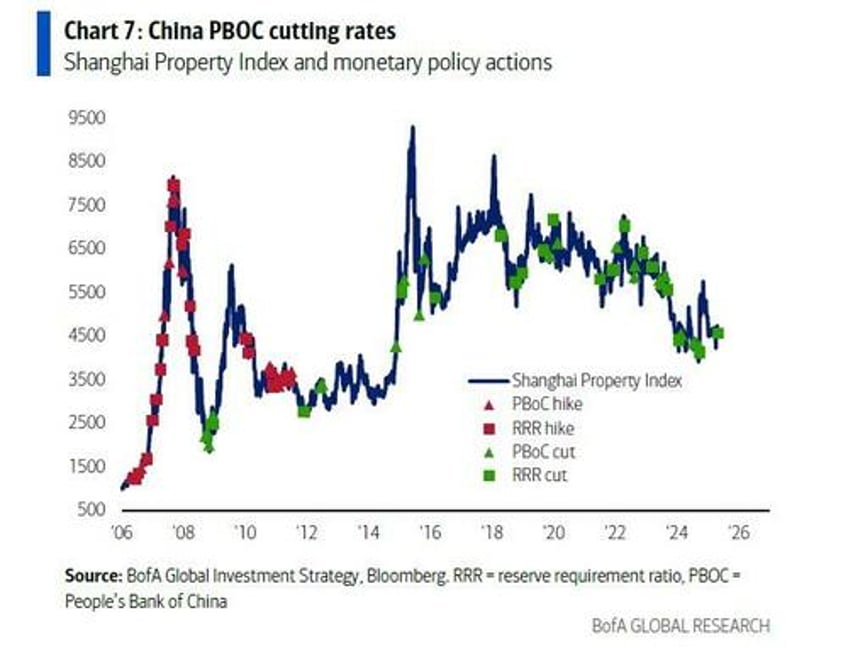

One week after Michael Hartnett took a well-deserved vacation, if only judging by the truncated length of his latest note (though he still took the time to explain why the market was "Expecting Trump Pivot To Lower Tariffs, Lower Rates, Lower Taxes"), one of Wall Street's best is back with his latest (longish) note, in which he covers the usual list of topics, but the highlight is his tactical view on how to trade the ongoing trade war, which we will focus on front and center for those strapped for time. Notably, what Hartnett says is that he expects the market to “buy the expectation, sell the fact,” and sees stocks fading after trade deals are revealed; meanwhile, he says to stay short the US dollar until Fed forced to cut; and stay long 5-year US Treasuries until GOP Reconciliation Budget formalizes future tax cuts/extensions. Furthermore, Hartnett thinks “macro” via 3Cs of China deal, rate Cuts (where China does the biggest easing as shown below...

... and strong Consumer remain most likely catalysts for further bull run; conversely, “asset prices” via deleveraging contagion the bear risk, especially in Trump/Powell “lose the long-end”... as shown below, Q1 global debt levels hit all-time high $324tn, and it's only a matter of time before we get a buyers strike.