One of the longest running traditions in modern finance is that every year, one Saturday morning in late February, the world's financial class - from professionals to mere amateurs - sit down as they have for the past 65 or so years - for an hour and read the latest Berkshire annual letter written by Warren Buffett in which the man seen by many as the world's greatest investor wrote down his reflections, observations, aphorisms and other thoughts which are closely parsed and analyzed for insight into what he may do next, what he thinks of the current economy and market climate, or simply for insights into how to become a better investor. And with Buffett's long-time investing partner, Charlie Munger, having recently passed away just shy of his 100th birthday and Buffett himself now 93, every such letter may well be the last, which is why - even though their informational content and signal-to-noise ratio has been severely diluted over the year - they are read just as obsessively as they were when Buffett was in his prime.

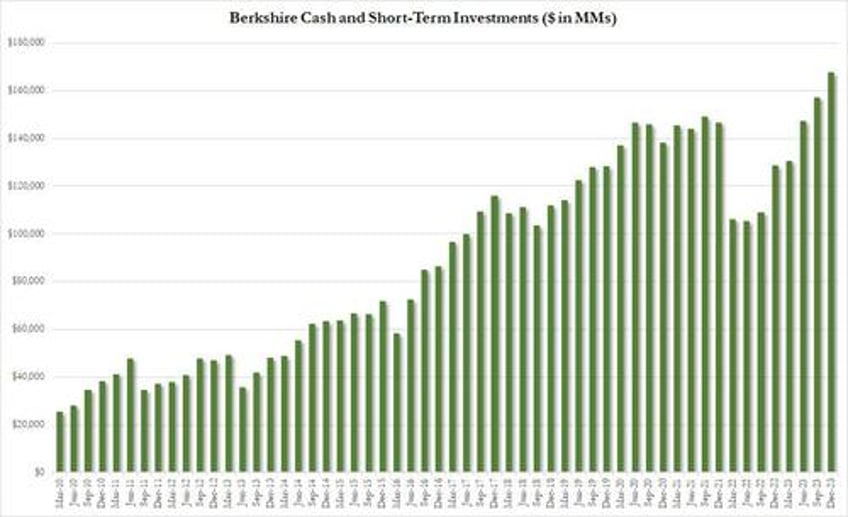

Which brings us to the latest Berkshire annual report and accompanying letter, which - at 16 pages close in at a good six pages more than last year's edition - was somewhat of a downer as the Omaha billionaire is quick to warn Berkshire's shareholders that his massive $900 billion conglomerate, whose share price just close at a new all time high, has “no possibility of eye-popping performance” in the years ahead, which is also why the company's cash pile hit a new record high of $167.6 billion, as Buffett reiterated that there were very few deals that offer the kind of transformative impact past takeovers have had, such as its purchases of insurers Geico and National Indemnity or the BNSF railroad.

"There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance", he wrote.

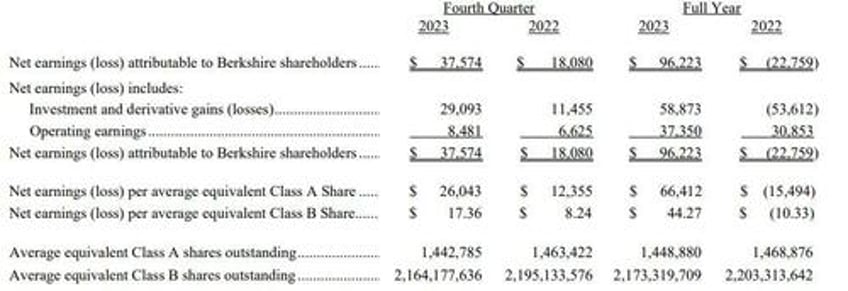

It is a problem that Buffett has been staring down for almost a decade as the growth of Berkshire’s operations and cash levels have compounded. That however did not prevent the company from reporting another stellar quarter, and in Q4 2023, Berkshire reported quarterly net income more than doubled to $37.574 billion, or $26,043 per Class A share, from $18.8 billion, or $12,355 per share, a year earlier.

Of course, as is well-known, Buffett despises GAAP earnings and instead urges investors to look at operating earnings instead which strip away the quarterly fluctuations of the conglomerate's public stock investments (i.e. unrealized gains/losses). This is what he wrote last year.

The GAAP earnings are 100% misleading when viewed quarterly or even annually. Capital gains, to be sure, have been hugely important to Berkshire over past decades, and we expect them to be meaningfully positive in future decades. But their quarter-by-quarter gyrations, regularly and mindlessly headlined by media, totally misinform investors.

Buffett did not fail to take a stab at "net earnings" this year either, and addressing those who seek the "proverbial bottom line labeled Net earnings", he writes that "The numbers read $90 billion for 2021, ($23 billion) for 2022 and $96 billion for 2023. What in the world is going on?"

You seek guidance and are told that the procedures for calculating these “earnings” are promulgated by a sober and credentialed Financial Accounting Standards Board (“FASB”), mandated by a dedicated and hard-working Securities and Exchange Commission (“SEC”) and audited by the world-class professionals at Deloitte & Touche (“D&T”). On page K-67, D&T pulls no punches: “In our opinion, the financial statements . . . . . present fairly, in all material respects (italics mine), the financial position of the Company . . . . . and the results of its operations . . . . . for each of the three years in the period ended December 31, 2023 . . . . .” So sanctified, this worse-than-useless “net income” figure quickly gets transmitted throughout the world via the internet and media. All parties believe they have done their job – and, legally, they have.

We, however, are left uncomfortable. At Berkshire, our view is that “earnings” should be a sensible concept that Bertie will find somewhat useful – but only as a starting point – in evaluating a business. Accordingly, Berkshire also reports to Bertie and you what we call “operating earnings.” Here is the story they tell: $27.6 billion for 2021; $30.9 billion for 2022 and $37.4 billion for 2023.

Yet while he did bash GAAP treatment of net income, he had a far more glowing view of the company's GAAP assessment of its balance sheet:

Berkshire now has – by far – the largest GAAP net worth recorded by any American business. Record operating income and a strong stock market led to a year-end figure of $561 billion. The total GAAP net worth for the other 499 S&P companies – a who’s who of American business – was $8.9 trillion in 2022. (The 2023 number for the S&P has not yet been tallied but is unlikely to materially exceed $9.5 trillion.)

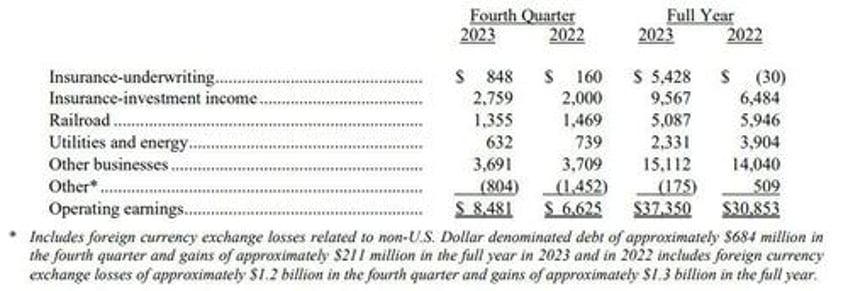

Turning to Berkshire's preferred metric for Q4, Berkshire generated operating earnings of $8.48 billion, versus $6.63 billion for the same period a year earlier, helped by an increase in insurance underwriting earnings and investment income amid higher interest rates and milder weather.

Berkshire’s earnings are always closely watched as a proxy for US economic health because of the wide-ranging nature of his businesses — from railroad BNSF, Geico and Dairy Queen. That also makes the company particularly susceptible to higher interest rates, which can crimp demand, and Buffett warned in May last year that earnings at most of its operations would fall in 2023 as an “incredible period” for the US economy draws to an end.

Indeed, while the company's core insurance-linked businesses once again outperformed - as earnings from insurance underwriting jumped to $848 million for the period from $160 million in the same quarter a year earlier and Geico posted full-year pretax underwriting earnings of $3.64 billion compared to a loss in 2022 after it raised premiums and received fewer claims - Berkshire noted that operating earnings from its railroad operations fell to $1.36 billion for the quarter, versus $1.47 billion for the same period a year earlier. Operating earnings from utilities and energy also fell to $632 million from $739 million.

“Our insurance business performed exceptionally well last year, setting records in sales, float and underwriting profits,” Buffett said in the shareholder letter. “We have much room to grow.”

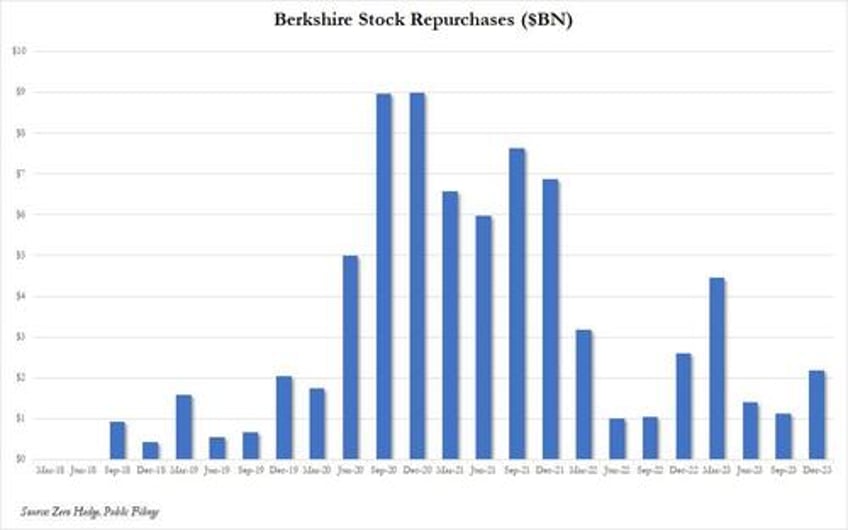

Berkshire also repurchased $2.2 billion of its own stock in Q4, and boosted full-year buybacks to $9.2 billion. Buffett noted that investors' "indirect ownership of both Coke and AMEX increased a bit last year because of share repurchases we made at Berkshire. Such repurchases work to increase your participation in every asset that Berkshire owns. To this obvious but often overlooked truth, I add my usual caveat: All stock repurchases should be price-dependent. What is sensible at a discount to business-value becomes stupid if done at a premium."

“Buffett is observing a lack of attractive opportunities — and with a rise in Berkshire’s share price, even repurchasing its own shares is less attractive,” Jim Shanahan, an analyst with Edward Jones told Bloomberg. “But that’s his pattern: Nothing will really happen and then he goes big.”

With buybacks well below levels reached during 2020-2021 when Buffett went on a stock repurchasing spree, and even though Berkshire spent billions acquiring truck-stop operator Pilot Flying J and insurance conglomerate Alleghany in recent years, adding them to a portfolio that includes ice cream purveyor Dairy Queen and utility behemoth Berkshire Hathaway Energy, those outlays put only a minimal dent in Berkshire’s cash pile, which continues to climb. It hit a record $167.6 billion at the end of 2023, up $10 billion in the quarter, and up $39 billion over the course of the year.

The cash mountain was so large that interest income alone in 2023 would be around $7.5 billion assuming the company earned a 5% interest on its $150 billion average cash hoard over the year.

“Size did us in, though increased competition for purchases was also a factor,” Buffett said. “For a while, we had an abundance of candidates to evaluate. If I missed one — and I missed plenty — another always came along. Those days are long behind us.”

That said, Buffett has a long history of stepping in to aid firms in crisis, leveraging his cult investing status and financial heft to help them restore confidence and rebound from their difficulties. In his letter, Buffett said Berkshire is ready to step in should financial disaster strike, noting such market seizures may offer it an “occasional large-scale opportunity.” That’s a tacit reminder from Buffett that problems do arise, according to Cole Smead, president of investment firm Smead Capital Management.

“Buffett is whispering when he used a megaphone in the past,” Smead said. “He’s whispering: Be very careful — problems do arise. He’s saying we’ll be ready, but that Berkshire will only be a buyer when no one else is a buyer.”

But while the odds of a transformative deal may be gone (until the next crisis at least), Buffett believes that “Berkshire should do a bit better than the average American corporation and, more important, should also operate with materially less risk of permanent loss of capital. Anything beyond “slightly better,” though, is wishful thinking."

Whether "slightly better" is enough for Buffett shareholders remains to be seen: to be sure, the all time high in the stock is easing any concerns, but the recent passing of Berkshire’s acerbic sidekick has turned investors’ attention towards the company’s prospects without Buffett at its helm. Greg Abel, Buffett’s anointed successor, and Todd Combs and Ted Weschler, his investment deputies, are lined up to steer the giant. They have a very tough act to follow. Since 1964, Berkshire shares have returned 4,384,748%, a CAGR of 19.8%, far outstripping the 31,233% gain - and double the 10.2% CAGR - by the benchmark S&P 500.

One final point: this was the first time Berkshire reported earnings since Charlie Munger, Berkshire’s vice chairman and Buffett’s long-time sidekick and investing partner, died at 99 last November. Buffett devoted much of the letter to praising Munger’s role in creating the sprawling firm, calling him the “architect” of the company and referring to himself as the person “in charge of the construction crew.” Together the pair would hold court at Berkshire’s annual meetings in a crowded Omaha sports arena, opining on topics ranging from stock markets to cryptocurrency and even life and success.

“Come to Berkshire’s annual gathering on May 4, 2024,” Buffett said in the letter. “On stage you will see the three managers who now bear the prime responsibilities for steering your company,” he said, referring to himself, Ajit Jain and Greg Abel. Jain runs Berkshire’s insurance businesses and Abel — Buffett’s anointed successor-in-waiting — oversees the non-insurance operations.

Financials aside, here are some of the notable highlights from Buffett's annual letter to investors.

On what Berkshire does (well):

Our goal at Berkshire is simple: We want to own either all or a portion of businesses that enjoy good economics that are fundamental and enduring. Within capitalism, some businesses will flourish for a very long time while others will prove to be sinkholes. It’s harder than you would think to predict which will be the winners and losers. And those who tell you they know the answer are usually either self-delusional or snake-oil salesmen.

At Berkshire, we particularly favor the rare enterprise that can deploy additional capital at high returns in the future. Owning only one of these companies – and simply sitting tight – can deliver wealth almost beyond measure. Even heirs to such a holding can – ugh! – sometimes live a lifetime of leisure

On finding attractive investments:

This combination of the two necessities I’ve described for acquiring businesses has for long been our goal in purchases and, for a while, we had an abundance of candidates to evaluate. If I missed one – and I missed plenty – another always came along. Those days are long behind us; size did us in, though increased competition for purchases was also a factor.

On managing expectations:

There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance.

* * *

Berkshire benefits from an unusual constancy and clarity of purpose. While we emphasize treating our employees, communities and suppliers well – who wouldn’t wish to do so? – our allegiance will always be to our country and our shareholders. We never forget that, though your money is comingled with ours, it does not belong to us.

With that focus, and with our present mix of businesses, Berkshire should do a bit better than the average American corporation and, more important, should also operate with materially less risk of permanent loss of capital. Anything beyond “slightly better,” though, is wishful thinking. This modest aspiration wasn’t the case when Bertie went all-in on Berkshire – but it is now.

On Berkshire's Not-So-Secret Weapon

Occasionally, markets and/or the economy will cause stocks and bonds of some large and fundamentally good businesses to be strikingly mispriced. Indeed, markets can – and will – unpredictably seize up or even vanish as they did for four months in 1914 and for a few days in 2001. If you believe that American investors are now more stable than in the past, think back to September 2008. Speed of communication and the wonders of technology facilitate instant worldwide paralysis, and we have come a long way since smoke signals. Such instant panics won’t happen often – but they will happen.

* * *

Berkshire’s ability to immediately respond to market seizures with both huge sums and certainty of performance may offer us an occasional large-scale opportunity. Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.

* * *

I believe Berkshire can handle financial disasters of a magnitude beyond any heretofore experienced. This ability is one we will not relinquish. When economic upsets occur, as they will, Berkshire’s goal will be to function as an asset to the country – just as it was in a very minor way in 2008-9 – and to help extinguish the financial fire rather than to be among the many companies that, inadvertently or otherwise, ignited the conflagration.

On volatility and Wall Street incentives:

One fact of financial life should never be forgotten. Wall Street – to use the term in its figurative sense – would like its customers to make money, but what truly causes its denizens’ juices to flow is feverish activity. At such times, whatever foolishness can be marketed will be vigorously marketed – not by everyone but always by someone.... Occasionally, the scene turns ugly. The politicians then become enraged; the most flagrant perpetrators of misdeeds slip away, rich and unpunished; and your friend next door becomes bewildered, poorer and sometimes vengeful. Money, he learns, has trumped morality.

On Berkshire's impact in the US economy:

Berkshire now has – by far – the largest GAAP net worth recorded by any American business. Record operating income and a strong stock market led to a yearend figure of $561 billion. The total GAAP net worth for the other 499 S&P companies – a who’s who of American business – was $8.9 trillion in 2022. (The 2023 number for the S&P has not yet been tallied but is unlikely to materially exceed $9.5 trillion.) By this measure, Berkshire now occupies nearly 6% of the universe in which it operates. Doubling our huge base is simply not possible within, say, a five-year period, particularly because we are highly averse to issuing shares (an act that immediately juices net worth).

On the difference between GAAP earnings and operating earnings:

The primary difference between the mandated figures and the ones Berkshire prefers is that we exclude unrealized capital gains or losses that at times can exceed $5 billion a day. Ironically, our preference was pretty much the rule until 2018, when the “improvement” was mandated. Galileo’s experience, several centuries ago, should have taught us not to mess with mandates from on high. But, at Berkshire, we can be stubborn.

On compounding

Make no mistake about the significance of capital gains: I expect them to be a very important component of Berkshire’s value accretion during the decades ahead. Why else would we commit huge dollar amounts of your money (and Bertie’s) to marketable equities just as I have been doing with my own funds throughout my investing lifetime? I can’t remember a period since March 11, 1942 – the date of my first stock purchase – that I have not had a majority of my net worth in equities, U.S.-based equities. And so far, so good. The Dow Jones Industrial Average fell below 100 on that fateful day in 1942 when I pulled the trigger.” I was down about $5 by the time school was out. Soon, things turned around and now that index hovers around 38,000. America has been a terrific country for investors. All they have needed to do is sit quietly, listening to no one.

* * *

One investment rule at Berkshire has not and will not change: Never risk permanent loss of capital. Thanks to the American tailwind and the power of compound interest, the arena in which we operate has been – and will be – rewarding if you make a couple of good decisions during a lifetime and avoid serious mistakes.

On cash and Treasury holdings and disaster preparedness:

Your company also holds a cash and U.S. Treasury bill position far in excess of what conventional wisdom deems necessary. During the 2008 panic, Berkshire generated cash from operations and did not rely in any manner on commercial paper, bank lines or debt markets. We did not predict the time of an economic paralysis but we were always prepared for one... Extreme fiscal conservatism is a corporate pledge we make to those who have joined us in ownership of Berkshire. In most years – indeed in most decades – our caution will likely prove to be unneeded behavior – akin to an insurance policy on a fortress-like building thought to be fireproof. But Berkshire does not want to inflict permanent financial damage – quotational shrinkage for extended periods can’t be avoided – on Bertie or any of the individuals who have trusted us with their savings.

Full letter below (pdf link).