Oil prices are dumping this morning, after overnight gains following API's reported big crude draw as soft US economic data and concerns about rising supplies eroded the risk-on sentiment from a court ruling that blocked a swath of the Trump admin’s tariffs.

Crude had earlier rallied as much as 2% after a trade court blocked a vast range of President Donald Trump’s trade levies.

“The path to sustainably higher prices remains extremely narrow,” with the market likely to struggle to absorb additional barrels from OPEC+ over the coming months, said Daniel Ghali, a commodity strategist at TD Securities.

In the near term, algorithmic selling activity will weigh on prices into the weekend meeting, he added.

Will the official data confirm API's bid draw and rejuvenate the rebound?

API

Crude -4.24mm

Cushing -342k

Gasoline -528k

Distillates +1.3mm

DOE

Crude -2.795mm

Cushing +75k

Gasoline -2.44mm

Distillates -2.795mm

The official data showed across the board drawdowns in inventories for crude and products. The Cushing hub saw a teeny tiny build in stocks...

Source: Bloomberg

Even including the 820k barrels added to the SPR, total crude stocks fell 1.975mm barrels - the biggest draw in two months

Source: Bloomberg

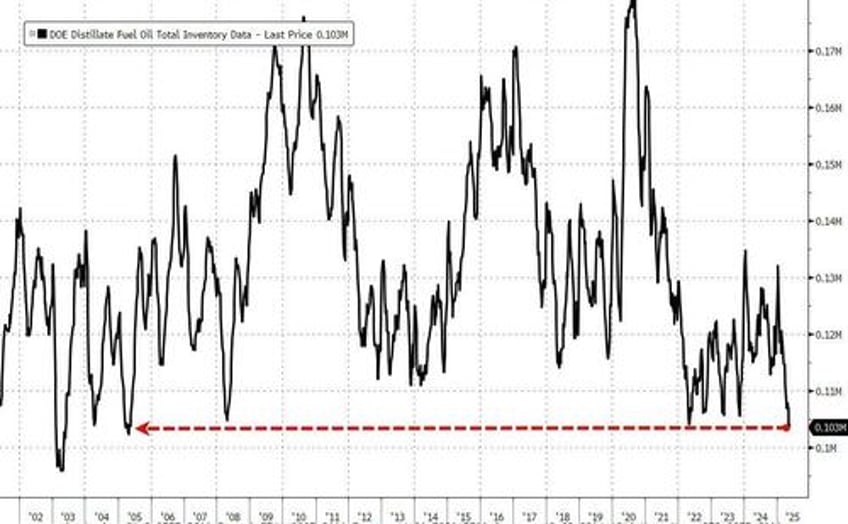

Distillate stocks plunged to their lowest since May 2005...

Source: Bloomberg

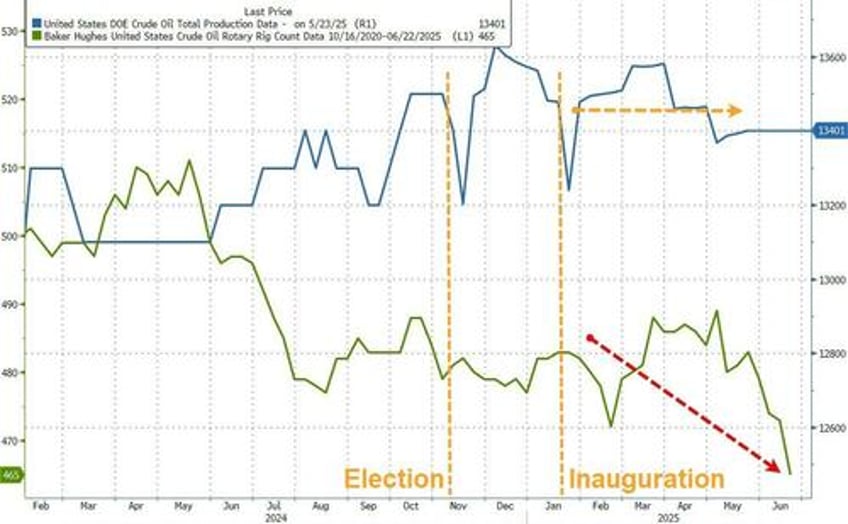

While the US rig count continues to slump (drill,m baby, drill?) US crude production hovers near record highs...

Source: Bloomberg

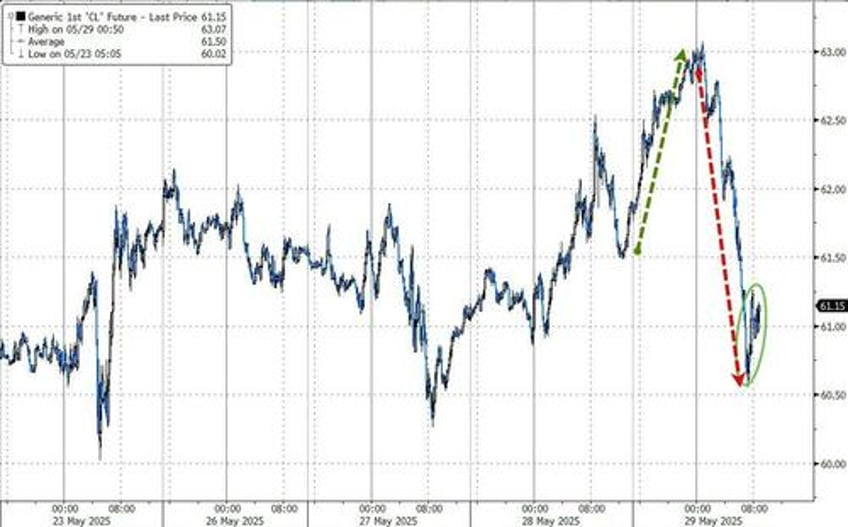

Crude prices are 'off the lows' of the day on the official inventory data, but still down on the day...

Source: Bloomberg

Oil has trended lower since mid-January on concerns about the fallout from Trump’s tariff war, with the revival of idled production by OPEC+ adding to headwinds.

The trade measures have rattled global markets, raising concerns over economic growth and demand for commodities.

Elsewhere, Libya’s eastern government said it may shut down oil production and exports in protest after a militia stormed the state oil company’s headquarters. The move highlights the persistent threat to output in the OPEC+ producer.

Wildfires near major Alberta oil sand sites also threaten more than 200,000 barrels a day of Canadian production.