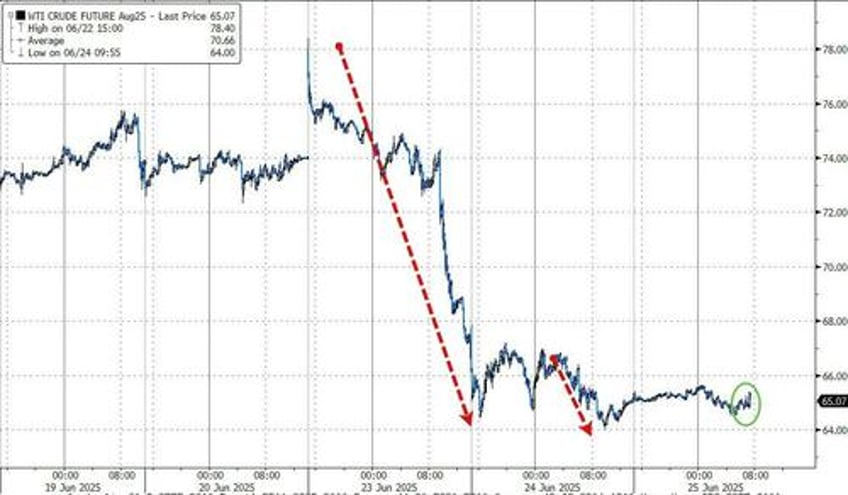

Oil prices edged higher this morning after posting the biggest two-day decline since 2022, as traders assessed the Iran-Israel ceasefire and the API report overnight that pointed to another drop in US crude stockpiles.

“There is no longer any real fear of the conflict spreading,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management.

“With Trump’s comments on Iranian oil exports, downward pressure on oil prices is likely to continue.”

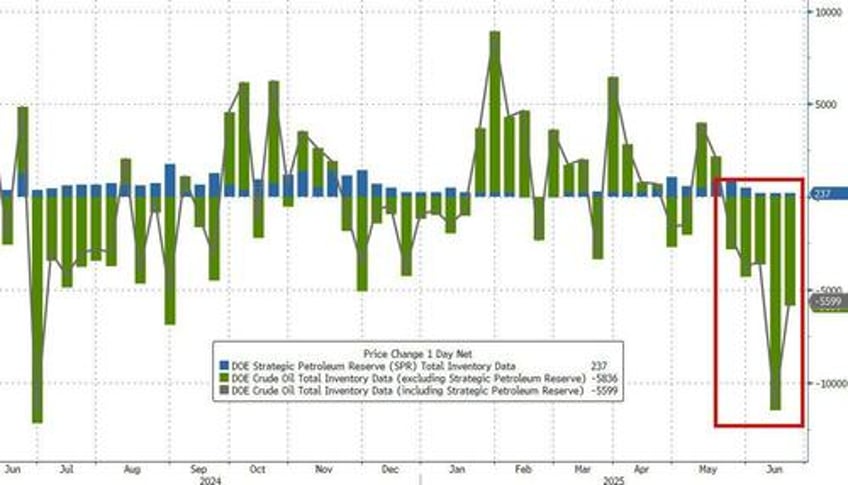

API

Crude -4.28mm

Cushing -75k

Gasoline +764k

Distillates -1.03mm

DOE

Crude -5.84mm

Cushing -464k

Gasoline -2.08mm

Distillates -4.07mm

The official data confirmed API's reported big crude draw and products also saw major inventory drawdowns last week...

Source: Bloomberg

Total US crude stockpiles dropped to their lowest since January...

Source: Bloomberg

Despite a small 237k addition to the SPR, Crude stocks fell for the 5th straight week...

Source: Bloomberg

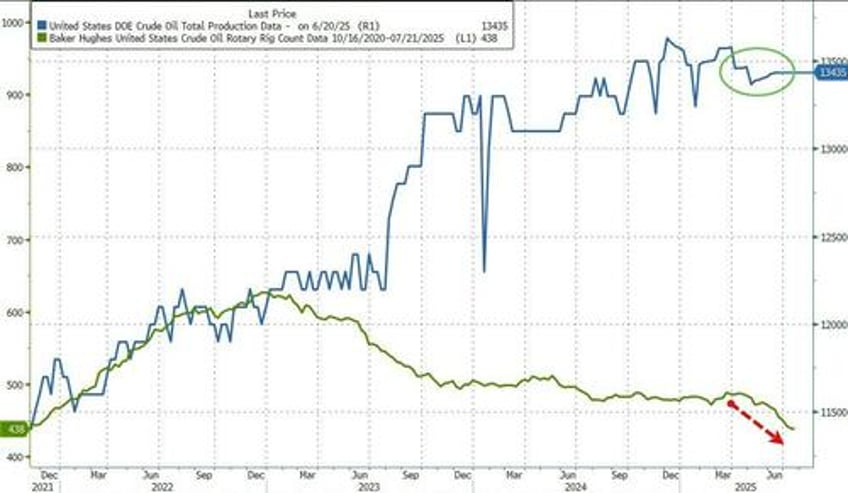

US crude production pushed modestly higher last week as the rig count continues to slide...

Source: Bloomberg

WTI Crude prices inched higher after the report following two days of carnage...

Source: Bloomberg

The OPEC+ alliance is due to hold discussions on July 6 to consider a further supply boost in August.