Originally published to Theya Research — subscribe for free.

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.

Today marks bitcoin's 4th halving, after which bitcoin's 5th halving epoch will begin. We'll discuss that at the end. First, let's talk about last night's geopolitical flare-up in the Middle East.

World War III is trending and we get a bitcoin halving? And here I thought that April would be a quiet month of consolidation...

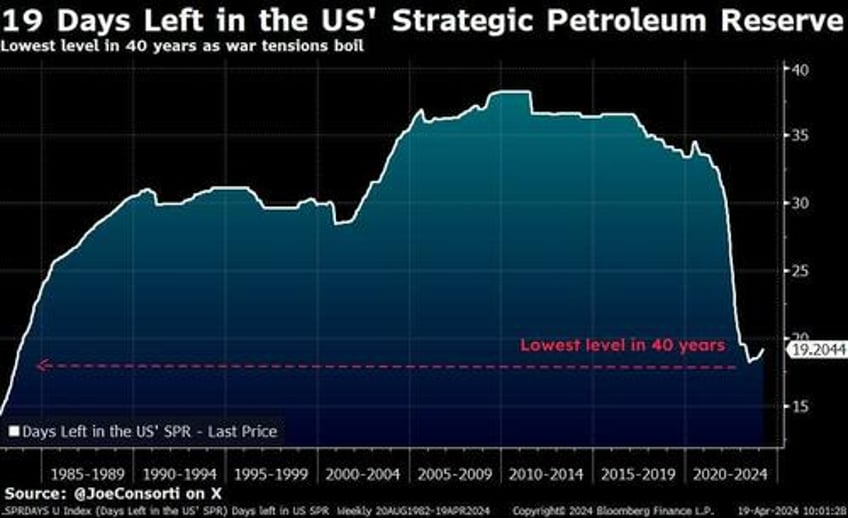

US strategic petroleum reserve at 19 days

The conflict between Israel and Iran continues to escalate. Last week, Iran attacked Israel, and a retaliatory strike from Israel on Iranian military targets occurred yesterday night that was reportedly thwarted by Iranian forces.

Oil surged on the news. The threat of sanctions and embargos on oil to Western countries, targeting of oil infrastructure during war, geopolitical risks in the Middle East, and the fact that the United States' Strategic Petroleum Reserve is at a 40-year low of just 19 days of supply have and will continue to contribute to the massive spike in crude prices. God forbid a hot global conflict arises.

You think gas prices are bad now? Just wait until the United States gets dragged into a hot war with only 19 days' worth of petroleum in the tank. A $6/gallon nationwide average sounds impossible now, but it'll seem a lot less impossible when it's on the screen at your local station:

Gold, US Treasuries bidding on geopolitical risk

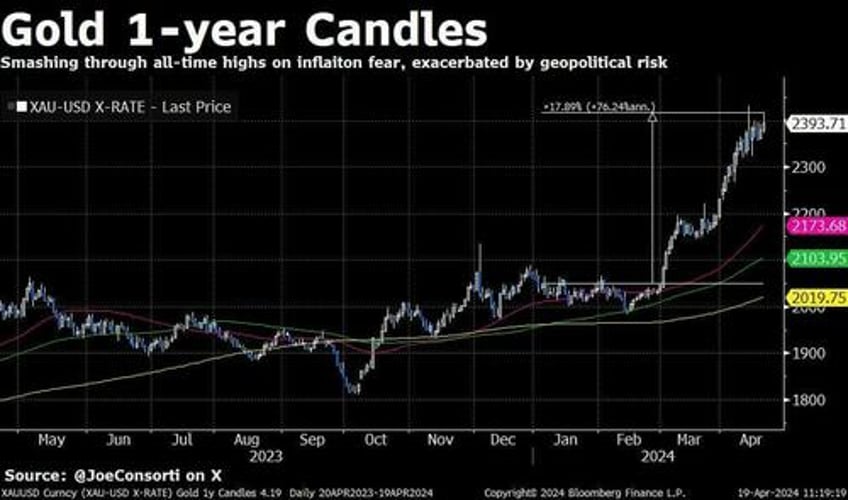

Gold once again challenged its all-time high on Thursday night just as markets opened in the east. It has corrected a little bit after news that Israel's strike was unsuccessful. Still, the transient spike in gold's price tells the story: gold is the best hedge against geopolitical risk in markets today.

Not to mention it is an accurate reflection of true price inflation. Gold is gaining on stock growth on a percentage basis year-to-date, up 17.8% compared to the 5.7% increase in the S&P 500. Stocks are starting to slide now. The Nasdaq 100 hit a fresh 10-week low today, while gold is still pressing forward. Risk-off? Not just yet.

A correction of this size is typical in the stock market. As the economy stays nominally hot and the Federal Reserve refuses to rule out further hikes, paired with geopolitical risk that would force the US Treasury to ramp up debt issuance to fund the conflict, the threat of direct Fed UST-buying and the money printing that will ensue to make it happen is looming, albeit far off, but gold smells it:

Safe haven flows also came for the US Treasury market. The world's preferred collateral and the bedrock of the global financial system is still traded like the apex risk-off asset in global financial markets. It always gets bid in crisis. Yields are still at their cycle highs, though. The 10-year yield has risen 80 basis points and the 2-year yield has risen 76 basis points, meaning that both bonds are selling off as investors still sniff out nominally hot economic activity and for the Fed to hold interest rates high for longer than anticipated to try and correct it.

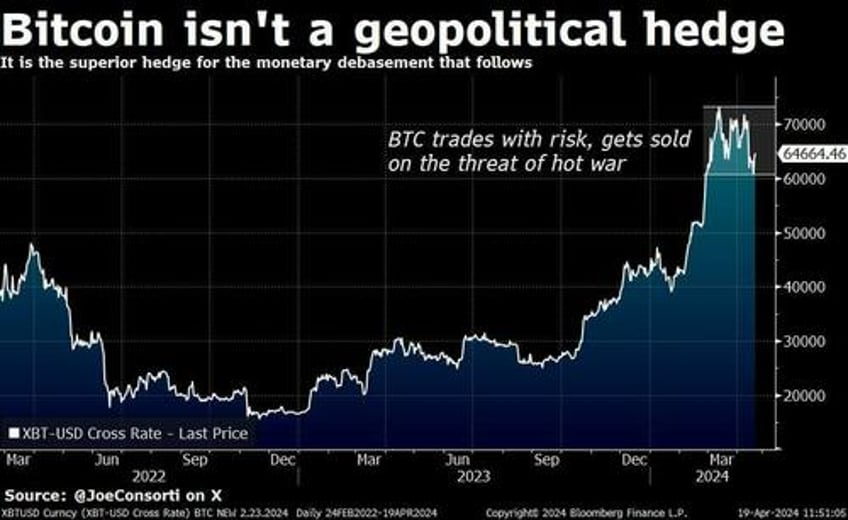

Bitcoin hedges wartime money printing

Bitcoin is not a geopolitical hedge, at least at the outset of conflict. This was made abundantly clear on Thursday with the way it was traded following the news out of the Middle East, with it tanking $4,000 from $63,600 to a local low of $59,600. It has since recovered and is now back above the $64,000 mark, but the initial trade, like with gold, tells the story: on the threat of hot war, investors sold their bitcoin. This is another factor that has added to the multi-month consolidation trend that bitcoin has experienced between $60,000 and $70,000:

As I mentioned in Monday's post: this isn't necessarily a bad thing, it is simply a reflection of market inefficiency.

The US Treasury is already running a $2-trillion deficit and is 50% over budget for 2024. In the threat of hot war, where debt issuance will ramp up further, massive flight from risk will create an initial investment glut, and the Fed steps in with rate cuts and possible direct buying to support the US Treasury market, you want to hold what they can't make more of. Let's call it debasement insurance.

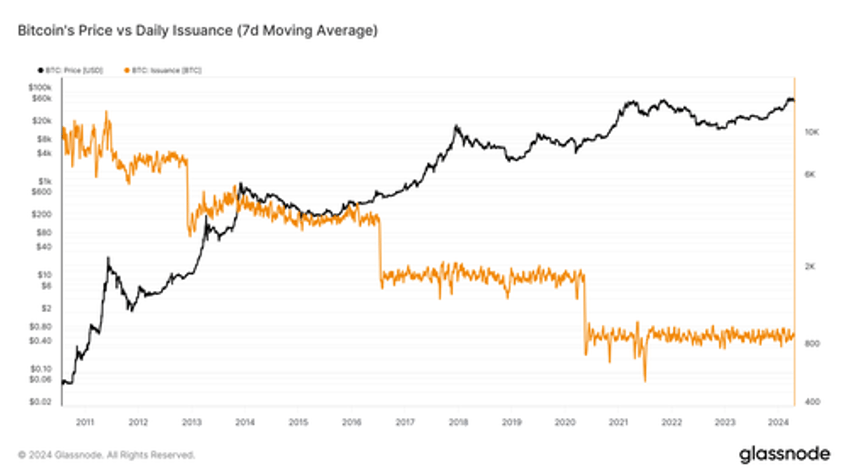

Bitcoin is the best debasement insurance. It performs gold's principle function of hedging against monetary inflation better than gold does because it has no supply response. Gold supply issuance will rise as it continues to shatter all-time highs; miners will increase capital investment to mine more gold, acting as a headwind to drive the price down with more supply coming online. Bitcoin's supply issuance will fall by 50% in a few hours, programmatically, even though it's at all-time highs. Its supply schedule, the rate at which new BTC is minted, can't be adjusted upward for miners to capture more revenue.

Only the Bitcoin network puts monetary policy above the profit incentive. Only bitcoin is perfectly supply inelastic. That's on top of BTC being more portable, divisible, and verifiable than gold. The icing on the cake is that as of ~9:00 PM EST today, April 19th, 2024, bitcoin will be scarcer than gold. After its 4th halving from 6.25 BTC per block (every ~10 minutes) to 3.125 BTC per block, bitcoin's stock-to-flow ratio will be higher than gold's mean stock-to-flow ratio of 70 over the last 100 years. Markets aren't perfectly efficient, and this is one of the most assymetric trades in history for those willing to set aside their pride, learn about bitcoin's properties and their immutability, and position themselves accordingly:

Final thought: the endgame for the US' fiscal and monetary situation is a certainty. Hold bitcoin and hold it tightly. Might I suggest a multi-sig vault?

Take it easy,

Joe Consorti

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.