ONE LESS RIG

Dolphin Drilling creditors to sell Bolette Dolphin drillship, form new mid-water drilling firm

Majority lenders in Oslo-listed offshore drilling contractor Dolphin Drilling’s $2 billion loan are moving forward with reorganization and recapitalization of the company’s drilling business. The proposed deal includes the sale of the Bolette Dolphin drillship and establishment of a new mid-water drilling company.

For contrarian/deep-value investors like ourselves, this is poetry in motion.

The available supply of offshore drilling rigs keeps shrinking. As our head trader, Brad McFadden, mentioned in a recent Insider monthly Q&A call, we have roughly 30-40% less available drilling rigs today as compared to a decade ago. So Dolphin throwing in the towel is not an anomaly — it’s simply a continuation of the trend that has been in motion for years.

Meanwhile, demand for offshore rigs (and day rates) has been steadily creeping higher from COVID levels.

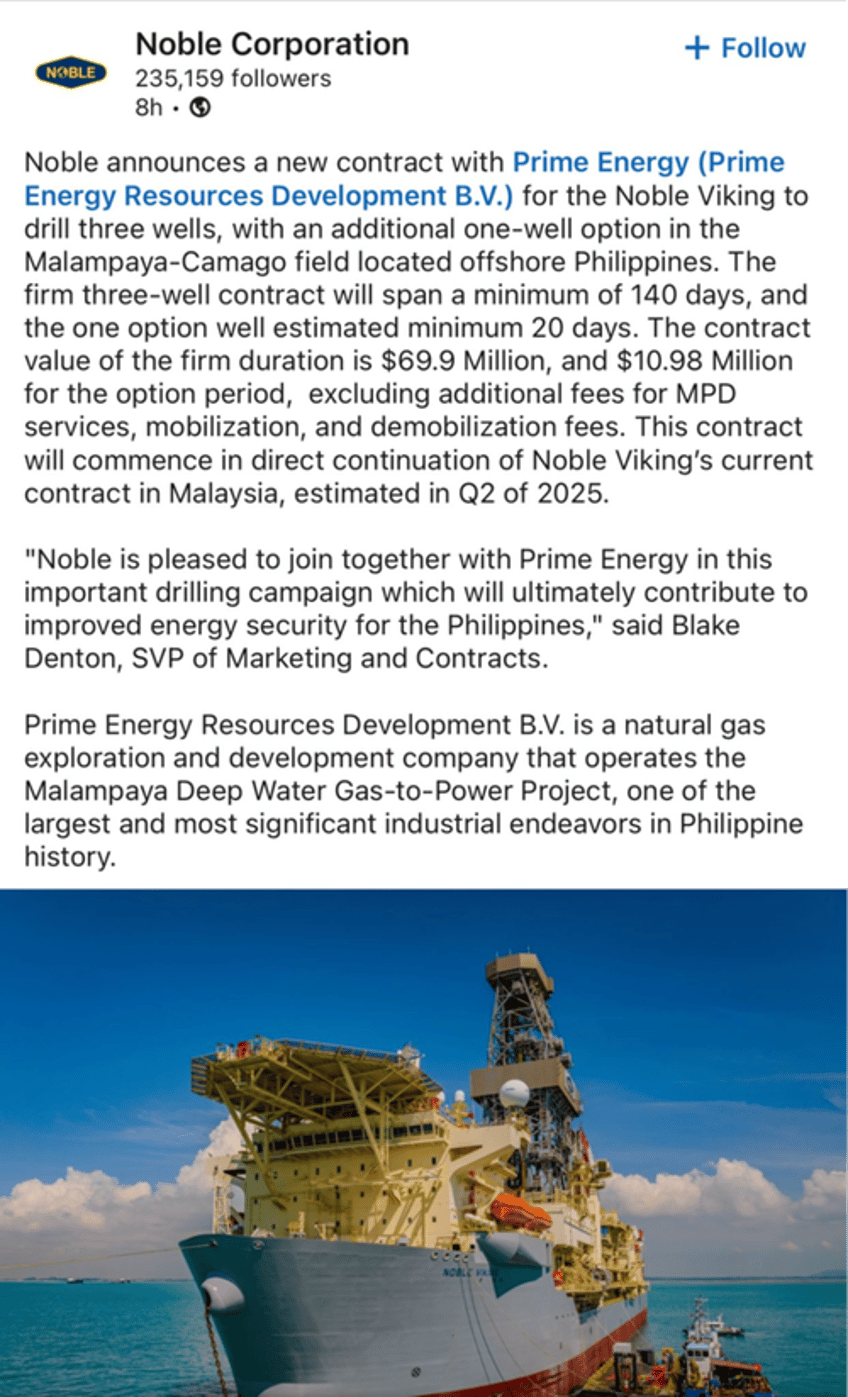

Just the other day, Noble landed a $69.9 million offshore deal that works out to a $499,000 day rate ($499,000 and a change, to be precise).

If you’ve got two minutes, listen to what SLB (Schlumberger) CEO has to say on the state of the offshore market here. In essence, the growth in demand for offshore drillers has legs and could last longer than many expect.

It gets better. We are not likely to see any increase in capacity in the offshore service sector. Recent commentary from Tidewater illustrates this point:

From the article:

Despite buoyant OSV market fundamentals and his company’s strong financial and operational performance in 2023, Tidewater chief executive, Quintin Kneen, said now is not the right time to pull the trigger on newbuildings.

“We are still not back to a place where the underlying economics on vessels justify newbuildings,” Mr Kneen told investors during Tidewater’s Q4 2023 earnings call on 1 March.

Tidewater management estimates costs to build a new OSV would be US$65M, requiring a three-year construction timeline. Taking into account opex, dry docking, and weighted average cost of capital, an OSV would have to earn US$44,000 per day and have a utilisation rate of 90% over 20 years for an owner to breakeven.

A tightening global supply of OSVs, limited newbuildings and increasing offshore oil and gas demand generated strong returns for the Houston-based company in 2023. During its earnings call, the Big board-listed OSV owner reported leading edge vessel day rates improved 40% year-on-year, ending at US$29,511. As a result, Tidewater generated US$1Bn in revenues and US$111M in free cash flow during 2023.

In a nod to shareholders, Tidewater used US$35M to conduct a share buyback programme in Q4 2023, and its board has authorised further buybacks of up to an additional US$48.6M of the company’s common stock.

Perhaps you get an appreciation of stockholders’ willingness to take on risk. They would rather have stock buybacks with spare cash rather than capital expenditures. It also suggests that the existing OSV fleet is way undervalued (otherwise Tidewater wouldn’t be looking for acquisitions).

Here is an example of how cheap OSVs (still) are. Atlantic Navigation — an owner of 21 OSVs with a market cap of $100m, which works out to about US$4.75m a vessel.

Something tells me that these vessels are way under valued, probably not far off scrap value.

Unlock the secrets of successful investing with the Insider Newsletter - Capitalist Exploits Insider.

Gain access to unique and carefully researched investment ideas delivered directly to your inbox. Managed by experienced investors responsible for managing significant funds, this professional investment service offers regular stock ideas, an extensive idea database, rational analysis of global market issues, educational resources, and guidance on international investing.

No constant marketing, sharing of data, or infotainment. Just valuable content that helps you make informed investment decisions.

Start your 30-day trial today with a minimal fee and the flexibility to cancel anytime. Don't miss out on this opportunity to enhance your investing journey. Get started now!