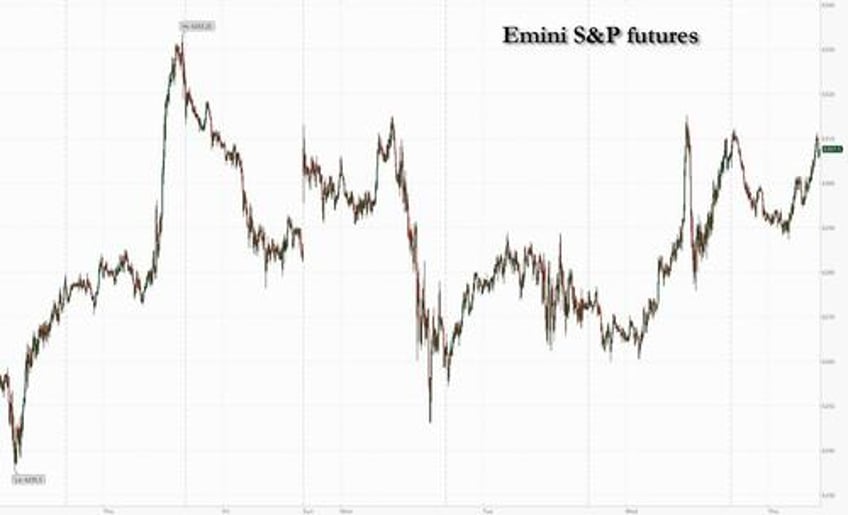

US equity futures are flat, reversing an earlier loss but lagging the Asia-Pac and EMEA sessions, following the latest batch of tariff letters with the most impactful being a 50% tariff on Brazil. As of 8:15am ET, S&P and Nasdaq futures are flat after closing just shy of an all-time high on Wednesday. Pre-market, Mag7 names are mixed with NVDA leading the Semis bid post positive TSM revenue update. Treasuries resumed their decline after Wednesday’s rebound, with the 10-year yield rising two basis points to 4.35%. The dollar was steady. Cmdtys are rebounding with bids across all 3 complexes with gold, steel, and natgas the standout performers. Today’s macro data focus is on initial jobless claims and continuing claims.

In premarket trading, Mag 7 stocks are mixed (Tesla +1%, Nvidia +0.9%, Meta little changed, Microsoft -0.1%, Alphabet -0.07%, Amazon -0.3%, Apple -0.5%).

- MP Materials (MP) soars 42% after the company struck a multi-billion dollar public-private deal with the US Department of Defense to build a new magnet plant and expand rare earth capabilities, backed by $400m in equity and a $1b loan commitment.

- Conagra Brands (CAG) falls 4% after the packaged food manufacturer posted 4Q sales that disappointed.

- Delta Air Lines Inc. (DAL) rises 12% after the carrier issued a new profit target for this year after pulling the goal three months ago.

- Embraer (ERJ) ADRs fall 6% after President Donald Trump said he will impose 50% tariffs on goods from Brazil.

- Mach Natural Resources (MNR) shares are halted for news pending.

- Mereo BioPharma Group (MREO) US-traded shares slide 34% and partner Ultragenyx Pharmaceuticals (RARE) drops 22% following a disappointing trial update for an experimental drug aimed at treating a bone disorder called osteogenesis imperfecta.

- WK Kellogg (KLG) rises 51%, with Ferrero International SA said to be nearing a deal to acquire it for about $3 billion. Shares first jumped after the WSJ reported Wednesday that the two companies are nearing a deal.

While tariff headlines have dominated the newsflow this week, there’s been little to derail a rally in US stocks. Signs of economic strength, confidence in the upcoming earnings season and optimism for artificial intelligence have given traders the conviction to keeping buying equities.

“The market’s sensitivity toward tariffs has diminished,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets. “The key driver of equity returns for us has been and remain corporate earnings, particularly in the IT sector, and here policy and trade uncertainty have not caused too much damage.”

US President Donald Trump issued a fresh batch of tariff demands on Wednesday, including a 50% rate on Brazil that sent the real tumbling. He also confirmed that the US would begin levying a 50% tariff on copper next month.

Meanwhile, sentiment got a boost from China, where a gauge of property shares jumped the most in nearly nine months, fueled by speculation a high-level meeting will be held next week to help revive the struggling sector.

Overnight, Goldman Sachs warned against loading up on stocks exposed to the economic cycle, while also recommending investors don’t be overly defensive. Trade war uncertainty is rife, with Goldman cautioning against one-sided allocation. “The equity market appears to be pricing an optimistic outlook for the US economy, but we believe there are risks in both directions and investors should not be clearly cyclical or defensive,” strategists including Ryan Hammond said. Within defensives, Goldman recommends investors own utilities and real estate, which typically benefit most from lower bond yields. In terms of cyclicals, the strategists favor basic materials versus energy on the expectation of lower oil prices.

Katharine Neiss, chief European economist at PGIM Fixed Income, warns that the average US tariff rate could ultimately exceed current expectations of “a shade above 10%.”

“There is still a huge amount of uncertainty and I don’t expect that it’s going to get resolved,” Neiss told Bloomberg TV. “These negotiations are going to drift, maybe by the time we get to the end of the year. That’s kind of bad news because the uncertainty itself is depressing decisions.”

LME copper rose 1% on Thursday, snapping a five-day losing streak. The metal gained 1.9% in New York, extending an advance to more than 11% since Monday, the day before Trump first floated the size of the tariff.

The Stoxx 600 is up 0.6% tracking their longest winning streak in a month, as miners rally on the back of higher iron ore prices. Swiss chocolatier Barry Callebaut sinks after once again cutting its guidance, while advertising group WPP ekes out gains after Wednesday’s plunge as it announced new CEO. Local bourses are led by UK FTSE 100, where mining stocks lead a 1% gain tracking gains across the metals complex. Here are the biggest movers Thursday:

- European miners are the best-performing sector in the Stoxx 600 index as iron ore headed for the highest close since May amid renewed optimism over China’s determination to eradicate industrial overcapacity

- WPP shares rise as much as 3.6% on Thursday, recouping some of Wednesday’s record drop, after the advertising agency announced that Microsoft executive Cindy Rose will be its next CEO, replacing Mark Read

- Stocks with a heavy exposure to China gain in European trading on optimism in the country’s media regarding potential fiscal stimulus, with a UBS basket of European stocks exposed to China rises as much as 1.7%

- Liontrust Asset Management rises as much as 7.7%, the most in over two months, after its trading update offered few surprises following recent annual results. Peel Hunt upgraded the stock due to recent weakness

- LISI shares rise as much as 7.7%, to the highest since January 2018, after private investment firm SK Capital submitted a firm offer for its medical division, according to a statement released after market close Wednesday

- Tecan shares gain as much as 6.5% after the Swiss laboratory equipment maker said Monica Manotas — who previously worked at Thermo Fisher Scientific — will replace Achim von Leoprechting as CEO

- Europris shares gain as much as 7.2%, the most since 2022 and taking the stock to a record high, after the Norwegian retail group reported its latest second-quarter results. DNB Carnegie sees a “strong” report

- Barry Callebaut falls as much as 10% in early trading, the most in three months, after the chocolate bulk maker cut its guidance for the second time in three months following a miss in volumes led by North America

- Grafton shares fall as much as 8%, their steepest decline in three years, after the building supply retailer and manufacturer failed to confirm its guidance for the year in a trading update that analysts called cautious

- Kemira falls as much as 6.1% after the Finnish pulp and energy equipment group released preliminary 2Q results and cut its guidance for 2025. Analysts said the report is bound to trigger smaller estimate revisions

- Johnson Service Group shares drop as much 18%, the most since May 2020, after the British textile rental and cleaning provider published a trading update that RBC described as weaker than expected

- Icade falls as much as 5.7% to the lowest in almost three months after Goldman Sachs downgraded the French commercial property investor to sell from neutral, citing sluggish growth in France and a weakening office market

- Macfarlane Group plummets as much as 15%, the most in over five years, after the company reduced its outlook and warned it expects annual adjusted operating profits to be about 10% lower than last year

Earlier in the session, Asian equities edged higher, with South Korean shares climbing following the central bank’s decision to leave its policy rate unchanged. Japanese stocks underperformed as the yen rose, while concerns remained about US tariffs. Key gauges advanced in Indonesia, Australia, Vietnam and Taiwan. The MSCI Asia Pacific Index traded in a narrow range, with TSMC and SK Hynix the biggest boosts, and Sony and Nintendo among the major drags. Stocks advanced across much of the region, amid broad optimism over trade talks with the US. South Korea led gains as investors welcomed news that the Bank of Korea is keeping its monetary policy accommodative. The benchmark Kospi rose 1.6%, advancing for a fourth-consecutive session. Chinese shares staged a late afternoon rally, fueled by speculation a high-level meeting will be held next week to help revive the struggling property sector. The jump followed unverified social media reports of a potential meeting, which analysts said sparked speculation of a possible resumption in the development of shanty-town areas.

In FX, the Bloomberg Dollar Spot Index slips 0.1%, with the Swiss franc leading G-10 losses as it edges lower against the greenback. The Norwegian krone outperforms, climbing 0.5% after core inflation rose for the first time in four months. The Aussie dollar also gains, buoyed by the rally in iron ore.

In rates, treasuries are lower, paring some of Wednesday’s advance ahead of a sale of 30-year bonds. US 10-year yields rise 2 bps to 4.35%. Bunds edge lower. Gilts curve flattens, with longer-dated maturities rising while the front end drops. The last of this week’s three coupon sales follows good results for 3- and 10-year note auctions. For the 30-year TSY reopening at 1pm New York time, WI yield near 4.875% is ~3bp cheaper than last month’s auction, which stopped through by 1.5bp

In commodities, spot gold climbs $15 to around $3,328/oz. WTI falls 0.4% to near $68.10 a barrel. Iron ore futures are up over 3% in Singapore and heading for the highest close since May amid renewed optimism over China’s determination to eradicate industrial overcapacity. LME copper climbs 0.5%. Bitcoin rises 0.4% and above $111,000.

Looking at today's calendar, US economic data slate includes weekly jobless claims at 8:30am. Fed speaker slate includes Musalem (9am) and Daly (2:30pm)

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.1%

- Russell 2000 mini -0.1%

- Stoxx Europe 600 +0.6%

- DAX +0.2%, CAC 40 +0.7%

- 10-year Treasury yield +2 basis points at 4.35%

- VIX +0.1 points at 16.06

- Bloomberg Dollar Index little changed at 1195.51

- euro little changed at $1.1731

- WTI crude -0.3% at $68.16/barrel

Top Overnight News

- Trump announced a 50% tariff for Brazil and to initiate a Section 301 investigation on Brazil due to its "continued attacks on the Digital Trade activities of American Companies".

- Trump announced a 50% tariff on copper effective August 1st after receiving a robust national security assessment, while he noted that copper is necessary for semiconductors, aircraft, ships, ammunition, data centres, lithium-ion batteries, radar systems, missile defence systems, and hypersonic weapons.

- South Korea Trade Minister says more time is needed for US trade talks; US expresses interest around cooperation in chips and shipbuilding.

Trade/Tariffs

- EU is discussing car import quotas and export credits with the US in trade talks, according to sources cited by Reuters.

- Indonesia's Economy Minister said tariff discussions with US Commerce Secretary Lutnick and US Trade Representative Greer went positively. It was later reported that Indonesia and the US agreed to intensify tariff negotiations within three weeks to achieve optimal outcomes for both parties, while negotiations cover tariffs, non-tariff barriers, digital economy and commercial partnerships, according to the Economy Ministry.

- Philippine Economic Affairs Minister said they are concerned the US decided to impose 20% tariffs on Philippine exports and officials are to fly next week for talks with US counterparts,

- Indian Trade Official says Indian trade delegation to visit US soon for further trade talks.

- Vietnam said to be preparing new rules and penalties to crack down on trade fraud and illegal transhipments; focused inspections on Chinese products which face high tariffs in the US.

- South Korea Trade Minister says more time is needed for US trade talks; US expresses interest around cooperation in chips and shipbuilding.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a mostly positive bias following the gains on Wall St although some of the upside was limited as participants digested the latest batch of tariff letters and with underperformance in Japan due to recent currency strength. ASX 200 gained with the index led by strength in mining names due to recent upside in metal prices. Nikkei 225 bucked the trend amid headwinds from a firmer currency and following somewhat ambiguous Japanese PPI data. KOSPI outperformed despite the BoK's widely expected rate pause, while the central bank's language remained dovish as it maintained the rate cut stance and a majority of members were open to a cut in the three months ahead. Hang Seng and Shanghai Comp were marginally positive in quiet trade with little fresh macro drivers, although China's State Council recently issued a notice on stepping up support for employment and will support enterprises in stabilising jobs. TSMC (2330 TT) Q2 (TWD): Revenue 933.8bln (exp. 927.8bln), via a Reuters calculation; YTD sales +40% Y/Y, June sales +26.9% Y/Y.

Top Asian News

- BoK kept the base rate unchanged at 2.50%, as expected, with the rate decision unanimous, while it stated that it will maintain the rate cut stance to mitigate downside risks to economic growth and will adjust the timing and pace of any further base rate cuts. BoK said consumption is expected to gradually recover due to an improvement in economic sentiment and the supplementary budget but noted significant uncertainties concerning the pace of recovery in domestic demand and that future economic growth faces significant uncertainties concerning developments in trade negotiations with the US. BoK said it is to closely monitor changes in domestic and external policy environments and will examine the impact on inflation and financial stability. Furthermore, BoK Governor Rhee revealed that four board members were open to a rate cut in the next three months and two members saw the policy rate unchanged in the next 3 months, while he added that uncertainty is too high to say when to lower the interest rate and by how much.

- Gauge of Chinese property shares posting largest gain in nine months amid speculation a high-level meeting will be held next week to help revive the property sector, according to Bloomberg.

- BoJ Osaka Branch Manager says there is no big impact from US tariffs seen on Kansai Western Japan's economy for now; wage hike momentum likely to be sustained.

- BoJ's Nagoya Branch Manager says some firms are putting off capex plans. Auto exports to N. America are solid given robust demand, tariff impact is extremely high.

- Shanghai Securities Times, on Chinese CPI, reports "experts interviewed believe that CPI is expected to improve and show a trend of mild recovery from a low level".

European bourses began with modest gains, upside that has gradually and incrementally increased across the morning, Euro Stoxx 50 +0.3%. Region deriving strength from the boost seen in China-related stocks on recent reports around housing support. A narrative that has led to outperformance in the FTSE 100 +1.1%, given the large number of mining names in the region and associated benefit from touted China housing construction support. Sectors opened entirely firmer, though a few have drifted slightly into the red. Basic Resources lead, given the mentioned China stimulus. Tech benefits with ASML bolstered alongside gains in NVDIA on Wednesday and after TSMC revenue beat consensus. Those in the red are the more defensive ones, with Utilities currently lagging marginally.

Top European News

- NBP's Wnorowski says another 25bps move is possible in September. Possible that there will only be one more rate adjustment in 2025.

- EU's von der Leyen survives no-confidence vote in EU parliament (as expected).

FX

- DXY contained but with a mild upward bias in a 97.271-97.469 range, vs Tuesday's 97.176-97.837 band. Specifics light thus far. On the Fed, ING wrote "Things can change a lot in the next three weeks, and our baseline call remains that the dollar will show significantly reduced interest in tariff noise. Data remains a bigger driver, and the potential FX impact of next week’s CPI figures still looks much bigger than trade news."

- EUR similarly uneventful in a thin 1.1715 to 1.1749 band, within Tuesday's 1.1682-1.1765. Commentary this morning includes European Commission President von der Leyen saying they are working non-stop to find a US agreement, to keep tariffs as low as possible.

- Havens flat. JPY and CHF contained in thin ranges. USD/JPY holding just above 146.00 but has been on either side of the figure at points. No move to Japanese PPI or remarks from various BoJ branch managers.

- Sterling a touch firmer despite a lack of newsflow, Cable in a 1.3587-1.3619 range at the time of writing, matching Wednesday's high before pulling back a touch. Ahead, BoE's Breeden scheduled on financial stability.

- Antipodeans firmer, AUD bolstered by ongoing gains in iron and copper prices with support emanating from speculation that a high-level meeting will be held next week to help revive the Chinese property sector, according to Bloomberg.

- Finally, the BRL lagged after Trump announced 50% tariffs and a Section 301 investigation.

- PBoC set USD/CNY mid-point at 7.1510 vs exp. 7.1757 (Prev. 7.1541)

Fixed Income

- A contained start to the day, awaiting fresh trade updates. USTs in a narrow 11-06+ to 111-13+ band, the upper point is a marginal WTD high. Resistance ahead at 111-28, 111-20+ and 112-12+ from last week.

- Ahead, aside from Fed speak and a few data points, 30yr supply rounds off the week’s outings. A tap that follows relatively average 3yr and 10yr issuance this week, with no sustained move spurred by US supply thus far.

- EGBs opened near-enough at highs and have been drifting since with specifics light aside from digestion of overnight trade updates. For Bunds, the peak is 130.08 and the benchmark is now down toward the 129.73 low, essentially flat on the day. No move to Final German CPI, unrevised.

- Gilts outperform, though are off best. Gapped higher and then lifted to a 92.19 peak early doors, seemingly a function of Gilts catching up to the strength seen in peers late-Wednesday. Since, with newsflow light from a few updates out of the ongoing US-France state visit (press conference expected later today), the benchmark has begun to conform to the gradual drift seen in above peers.

- Poland is considering JPY and CHF bonds, according to the Polish debt chief

Commodities

- Base metals firmer on Chinese stimulus hopes, amid speculation that a high-level Chinese meeting will be held next week to help revive the property sector.

- 3M LME Copper trades in a USD 9,635.20-9,711.15/t range at the time of writing., firmer but just off highs and back below the USD 9.7k mark.

- Precious metals also firmer, though gains are slightly more modest. XAU at a USD 3330/oz peak, seemingly deriving some further impetus above the USD 3.3k mark, benefitting from the contained USD with specifics otherwise very light thus far.

- WTI and Brent are in the red, came under a bout of pressure in the European morning though the magnitude of it keeps the benchmark within recent ranges. No move to remarks from the OPEC SecGen or the 2050 outlook from the organisation. Pressure this morning potentially a function of some constructive geopols, after President Trump said there is a chance this week or next of a Gaza ceasefire.

- WTI resides at the lower end of a USD 67.91-68.57/bbl range, similarly Brent in a USD 69.82-70.42/bbl.

- OPEC cuts world oil demand forecast for 2026-2029, peak demand not on the horizon.

Geopolitics: Middle East

- Senior Israeli official said a Gaza ceasefire deal with Hamas may be possible within a week or two weeks but not in a day’s time, while Israel will offer a temporary ceasefire and if Hamas does not lay down its arms, Israel would proceed with military operations. Furthermore, the official said Israeli intelligence showed that before strikes on Iran, its enriched uranium was in Fordo, Natanz and Isfahan sites, while it has stayed there and has not been moved.

Geopolitics: Ukraine

- US military is delivering artillery shells and mobile rocket artillery missiles to Ukraine, according to officials cited by Reuters.

- US State Department senior official confirmed that Secretary of State Rubio will meet with Russia's Foreign Minister Lavrov on Thursday on the sidelines of ASEAN.

- Drone said to have landed in the territory of Lithuania from Belarus. "Could be a jammed and diverted drone from this night's Russian assault against Ukraine, could also be a separate provocation, few details available", via a Lithuanian journalist on X.

US Event Calendar

- 8:30 am: Jul 5 Initial Jobless Claims, est. 235k, prior 233k

- 8:30 am: Jun 28 Continuing Claims, est. 1,965k, prior 1,964k

Central Banks (All Times ET):

- 9:00 am: Fed’s Musalem Speaks on U.S. Economy and Monetary Policy

- 2:30 pm: Fed’s Daly Speaks on U.S. Economic Outlook

DB's Jim Reid concludes the overnight wrap

Optimism largely returned to markets yesterday, even as the lingering threat of further US tariffs on August 1 remained in the background. Indeed, a tech-led rebound helped the S&P 500 (+0.61%) to stabilise after its losses at the start of the week, whilst the NASDAQ (+0.94%) and the German DAX (+1.42%) hit an all-time high. In fact, there was a significant milestone, as Nvidia (+1.80%) became the first company to surpass a $4tn market cap on an intraday basis, before closing just shy of that at $3.974tn. So for everything else that’s happening right now, from tariffs to fiscal fears, AI is the great hope for US exceptionalism to return. The rally also got a further boost as lower bond yields meant that fears eased about the fiscal situation, and a strong auction helped the 10yr Treasury yield (-6.7bps) to finally decline after 5 consecutive gains. So it was a strong day all round, even if there wasn’t really a fresh catalyst to drive things higher.

However, just when you thought it was safe to emerge from the July 9th tariff deadline day, we’ve had a fresh set of announcements after the US close that signalled a more aggressive stance. First, Trump confirmed overnight that the 50% copper tariff will come into place on August 1, which is an important one given its applications across various products. And second, he announced a 50% tariff on goods from Brazil, which is significant as it broke with the trend of tariffs being broadly in line with the Liberation Day levels set on April 2. Indeed, Brazil had a 10% tariff at that time, so that’s a notable escalation, and it follows Trump’s threats to place higher levies on the BRICS over recent days. So that meant the Brazilian Real weakened by -2.29% against the US Dollar yesterday, its biggest decline since April 4 amidst the turmoil after Liberation Day. We also heard about several other countries, but the Philippines was the only other in the US’ top 50 trading partners, and they were given a 20% rate.

Meanwhile on the fiscal side, there was a lot of attention on a 10yr Treasury auction yesterday given recent fears around the fiscal situation, but strong demand meant that yields continued to fall. So it helped to push back against concerns that demand for longer-dated bonds was waning. The auction saw $39bn of notes sold, and were awarded at 4.362% versus a 4.365% yield at the bidding deadline. The bid-to-cover was 2.61, above the average of the last six similar auctions (2.57). So attention will now focus on the 30yr auction later today.

That Treasury rally continued after the auction as the Fed minutes from the June meeting were released. They indicated a divide about how restrictive policy currently was, as well as the tariff impact on inflation going forward. With regards to the current policy stance, it said “A couple of participants noted that, if the data evolve in line with their expectations, they would be open to considering a reduction in the target range for the policy rate as soon as at the next meeting.” So given recent commentary these could likely be Fed Governors Waller and Bowman. However, the minutes also highlight that “some participants saw the most likely appropriate path of monetary policy as involving no reductions in the target range for the federal funds rate this year.” Regardless, it said “several participants commented that the current target range for the federal funds rate may not be far above its neutral level”, indicating that any easing cycle may not lower rates significantly in the coming months. This growing divergence in expectations matches the dot plot distribution we saw last month, where 10 of 19 officials pencilled in at least two rate cuts this year while 7 officials saw no cuts, and the other 2 policymakers saw one cut.

On inflation, the difference of opinion was mainly on the effect of tariffs, even as there were questions on how inflation ex-tariffs was progressing. It said “Some participants observed that services price inflation had moved down recently, while goods price inflation had risen. A few participants noted that there had been limited progress recently in reducing core inflation.” Potentially the key sticking point going forward is that “while a few participants noted that tariffs would lead to a one-time increase in prices and would not affect longer-term inflation expectations, most participants noted the risk that tariffs could have more persistent effects on inflation, and some highlighted the fact that such persistence could also affect inflation expectations.” Looking ahead, the next FOMC meeting (July 29-30) will be just before the August 1st extension date for the “reciprocal” tariffs, so policymakers may still be awaiting clarity on what the trade levies going forward could look like even as they try and measure the impact from the tariffs already in place. In addition, oral arguments to the Court of Appeals on whether the International Emergency Economic Powers Act authorises the president to impose tariffs will be heard on July 31.

Ahead of the minutes, there had been fresh pressure from the administration to cut rates, as Trump posted that “Our Fed Rate is AT LEAST 3 Points too high.” And markets did move to price in more rate cuts yesterday, with the amount expected by the December meeting up +3.9bps on the day to 53.1bps. In turn, that helped sovereign bonds to rally across the board, with the 2yr Treasury yield (-4.8bps) down to 3.843%, whilst the 10yr yield (-6.7bps) fell to 4.332%. And that was echoed in Europe too, where yields on 10yr bunds (-1.4bps), OATs (-0.9bps) and BTPs (-1.3bps) all saw modest declines.

For equities, it was also a decent session, as the S&P 500 closed +0.61% higher, following some intraday volatility. Those gains were led by the Magnificent 7 (+1.23%), and Nvidia (+1.80%) in particular, which briefly became the first company to surpass a $4tn market cap on an intraday basis. Indeed, Nvidia is already up +21.29% this year, which is well ahead of the +6.49% gain for the S&P 500 and the +3.76% for the Mag 7, even if it’s not as rapid as its growth in 2023 and 2024 at this point. But in Europe the picture was much stronger, with the STOXX 600 (+0.78%) up for a third consecutive session, whilst the DAX (+1.42%) hit a new record.

Overnight in Asia, the major equity indices have seen a mixed performance. In South Korea, the KOSPI is up +1.06%, which comes after the Bank of Korea kept interest rates at 2.5% as expected, and Governor Rhee said that four board members were open to a cut in the next three months. However, in Japan the Nikkei is down -0.43% this morning, and a 20yr government bond auction saw a bid-to-cover ratio of 3.15, which was beneath the 12-month average of 3.29.

Otherwise, the Shanghai Comp (+0.36%), the CSI 300 (+0.30%) and the Hang Seng (+0.09%) have all posted modest gains. But US equity futures are pointing in a more negative direction, with those on the S&P 500 down -0.23%.

To the day ahead now, and data releases include the US weekly initial jobless claims, and Italian industrial production for May. Central bank speakers include the Fed’s Musalem and Daly, the ECB’s Cipollone, Escriva and Villeroy, and BoE Deputy Governor Breeden. Finally, there’s a 30yr Treasury auction taking place.