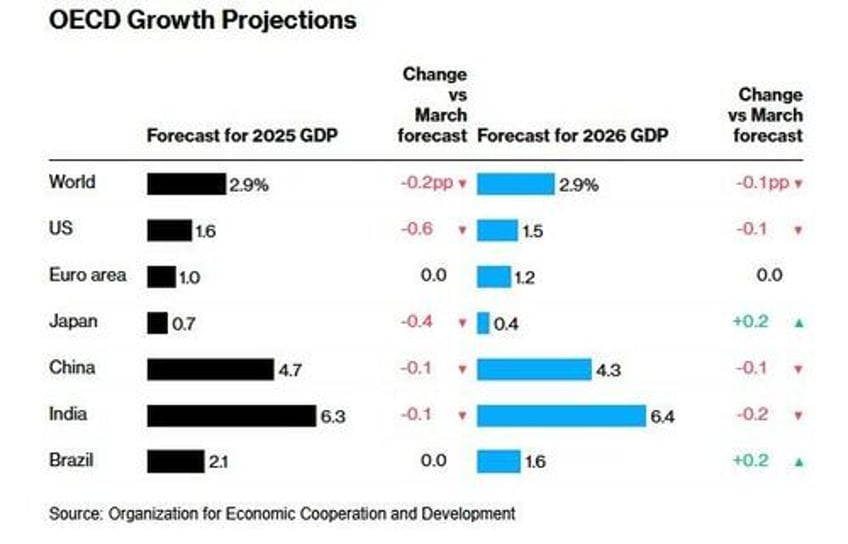

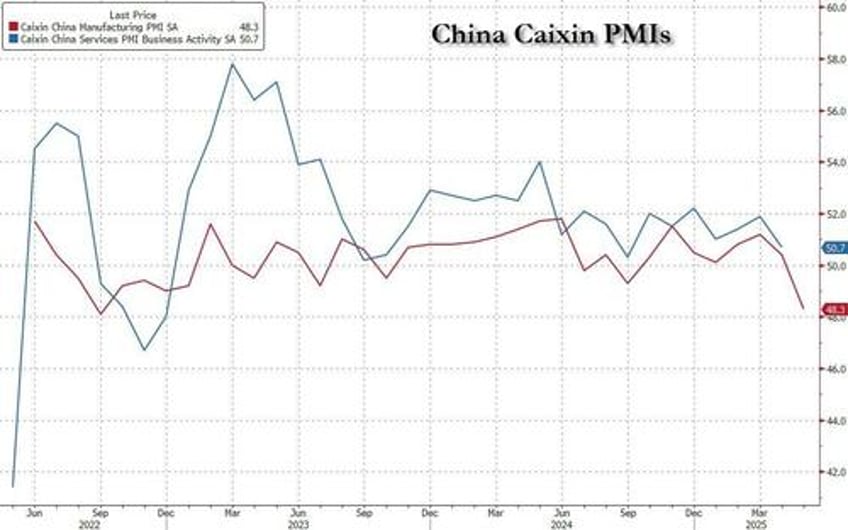

US equity futures follow European markets lower, although off session lows, amid more tariff gloom confronting traders this morning: the pressure of Trump’s tariffs pushed China’s manufacturing PMI survey to its lowest since 2022, while the OECD cut its 2025growth outlook for a second time. As of 8:00am, S&P futures are down 0.2%, erasing almost a 0.7% drop as the US benchmark is set to continue a run of daily swings between gains and losses; Nasdaq 100 futures were flat even as all Mag 7 are modestly lower premarket (AMZN/META -0.4%). Meanwhile, the OECD slashed its global economic forecast again, blaming trade anxiety for holding back investment and warning that protectionism is inflationary (which it clearly isn't judging by recent inflation prints). The OECD now expects 2025 and 2026 US GDP to print 1.6% and 1.5%, respectively; this is below the G20 average of 2.9% and 2.9% in 2025 and 2026, respectively. Bond yields are 2-3bp lower; the dollar climbed on Tuesday, posting a broad-based rebound after closing Monday at the lowest point since July 2023; all G-10 currencies declined, with the Australian dollar and Swedish krona under-performing peers. Commodities are mixed with oil moving higher and precious metals lower. Overnight headlines are mostly muted. Today's US economic data includes April factory orders and JOLTS job openings (10am).

In premarket trading, Mag 7 stocks were mixed (Nvidia +0.4%, Tesla +0.3%, Meta +0.1%, Apple -0.2%, Microsoft -0.2%, Amazon -0.2%, Alphabet -0.3%). Nuclear stocks (CEG) gained in US premarket trading after Constellation Energy agreed to sell power from an operating nuclear plant in Illinois to Meta Platforms, an agreement that could lead to the construction of a new reactor at the site. Here are some of the biggest US movers today:

- Block shares (XYZ) rise 3% in premarket trading after the digital payments provider was upgraded to outperform from inline at Evercore ISI, with analysts citing positives such as resilient consumer spending trends and a boost from new products.

- Bumble shares (BMBL) fall 5.4% in premarket trading on Tuesday after JPMorgan downgrades to underweight from neutral.

- Credo Technology shares (CRDO) advance 13% in premarket trading after the company reported revenue for the fourth quarter that beat the average analyst estimate.

- Dollar General shares (DG) rise 8.1% ahead of the bell after the retailer reported first-quarter profit and sales that topped expectations, and management boosted its comparable sales forecast for the full year, as well as the low end of its EPS target.

- MoonLake Immunotherapeutics shares (MLTX) jump 22% in premarket trading after the Financial Times reported that Merck held talks to buy the Swiss biotech firm, citing three unidentified people familiar with the matter.

- Pinterest (PINS) gains 3.8% in premarket trading after JPMorgan raises rating to overweight from neutral. A diversification of its advertising platform to provide full-funnel capabilities is supporting further revenue upside at the social media firm, says analyst Doug Anmuth.

- Signet Jewelers shares (SIG) climb 13% in premarket trading after the owner of Kay Jewelers boosted its adjusted earnings per share forecast for the full year, following first-quarter results that was ahead of expectations.

- Woodward shares (WWD) are up 1% after it was upgraded back to buy at Deutsche Bank, after 11 months with a hold rating on the aircraft and industrial engine component maker, with the broker conceding last year’s cut was a mistake.

Earlier today, the Paris-based OECD slashed its global growth forecasts for the second time this year, saying that a combination of trade barriers and uncertainty are hitting confidence. The alert comes two months into President Donald Trump’s push to reshape global trade and agree new deals, with few signs of a breakthrough in talks with major partners.

“We’re clearly seeing a lot of volatility and investors want more visibility,” Massimiliano Bondurri, founder and chief executive officer of SGMC Capital in Singapore, said on Bloomberg TV. “It’s normal that markets are actually going to be flip-flopping.”

The US economy has also increasingly shown signs of a moderate yet broad-based softening. A report due later Tuesday on April vacancies is forecast to show a decline in job openings to the fewest since 2020 as companies are growing more conscious about consumers’ cost-saving efforts. Payrolls data scheduled for Friday will probably show a slowing in the pace of hiring.

“Markets are trading higher than on April 2, but earnings have been revised down, global growth too,” said Gilles Guibout, head of European equities at AXA Investment Managers in Paris. “Are we really in a better position? The answer is ‘no’.”

Meanwhile, Bloomberg reported that Trump was working the phones Monday and took to social media to try to sway Republican holdouts on his multi-trillion dollar tax bill. Investors and traders have raised concern that the legislation could worsen a ballooning budget deficit and US debt pile.

Conference season kicks off in earnest this week, with CEOs gathering for gabfests from San Francisco to New York at a time when their confidence in the economy has barely recovered from the shocks of “Liberation Day.”

In Europe, the Stoxx 600 pared losses of as much as 0.5%, while the euro fell 0.4% against the dollar after inflation in the euro-area eased more than expected, dipping below the European Central Bank’s 2% target and supporting the case for interest rates to be lowered further. Here are the most notable European movers:

- UBS shares jump as much as 4.1%. Jefferies upgrades the stock to buy from hold, saying that the bank may be reaching a potential turning point on capital, with some clarity expected this week.

- Chemring Group shares rise as much as 3.6%, hitting new 2011-highs. Analysts at Shore say strong demand for defense is driving the stock higher, with shares up for a fifteenth consecutive session.

- Dalata shares gain as much as 4.3%, to 2019 highs, after a consortium including Pandox and Eiendomsspar submitted a non-binding bid for the the Dublin-based hospitality operator, valuing it at €1.3 billion.

- European miners underpeform as base metals fall on concern about China’s economic outlook, as a gauge of the country’s manufacturing activity fell to its lowest level in more than two years.

- ASML shares slip as much as 1.6% after a cut to equal-weight from overweight by Barclays, which says the firm may struggle to see any growth in unit numbers for its most cutting-edge extreme ultraviolet lithography tools next year.

- HSBC shares decline as much as 1.6% after BofA Global Research cut its recommendation to neutral from buy, citing the challenges facing large banks “in a more unstable world.”

- GSK shares fall as much as 1.7%. Berenberg downgrades the stock to hold from buy to “pause for breath” after a strong year-to-date performance from the drugmaker.

- Rio Tinto shares fall as much as 2.3% in London after Jefferies downgraded to hold from buy, with the bank citing geopolitical factors, capital allocation and expenditure risks and valuation.

- Julius Baer shares retreat as much as 2.3% after its strategy update on Tuesday failed to impress analysts, with KBW describing it as “underwhelming.”

- Poste Italiane shares fall as much as 2.1% as Morgan Stanley downgrades the stock to equal-weight from overweight expecting limited extraordinary capital deployment until 2027.

- NKT shares slide as much as 5.6% after the electrical component maker was downgraded by analysts at DNB Carnegie.

- MJ Gleeson shares slump as much as 28%, the most on record, after the UK homebuilder issued a profit warning.

Earlier in the session, Asian stocks edged higher as investors looked ahead to a potential conversation between US President Donald Trump and China’s Xi Jinping to dial down the recent flare-up in trade tensions. The MSCI Asia Pacific Index rose as much as 0.5%, before paring much of the gain. Concerns over persistent weakness in China’s economy also kept a lid on sentiment, after the latest Caixin PMI factory data showed the worst slump in over two years amid higher US tariffs.

Key benchmarks in Hong Kong jumped more than 1%, with notable advances also in Taiwan and mainland China. South Korean markets were closed for a presidential election Tuesday after months of political chaos. The White House said Trump and Xi are “likely” to speak this week, fueling optimism that trade negotiations between the two nations can get back on track. China hasn’t confirmed any decision on such talks, however, and investors remain wary after Washington and Beijing recently accused each other of violating an agreement reached in May.

In FX, the dollar rose against all of its Group-of-10 peers, erasing part of Monday’s drop, while US Treasuries gained. Focus is on job openings data, which will give an insight into the health of the labor market ahead of non-farm payrolls on Friday. Bloomberg Dollar Spot Index inched up 0.2% on Tuesday, having dropped on Monday due to a flare-up in global trade tensions. The gauge saw its weakest level since 2023 after data showed that US factory activity contracted in May for a third month running. USD/JPY gains 0.2% to ~143. The euro fell 0.4% against the dollar to 1.1383 after inflation in the euro-area eased more than expected, dipping below the European Central Bank’s 2% target and supporting the case for interest rates to be lowered further.

In rates, US Treasuries gained, sending yields about 2bps lower across the curve, as US stock futures fell; 10-year yield -2bps to 4.42%. Gilts outperformed after the Bank of England’s Catherine Mann said late Monday there’s a tension between cuts to interest rates and efforts to unwind quantitative easing; 30-year yield falls 7bps to 5.34%

Today's US economic data includes April factory orders and JOLTS job openings (10am). Fed speaker slate includes Goolsbee (12:45pm), Cook (1pm) and Logan (3:30pm).

Market Snapshot

- S&P 500 mini -0.4%

- Nasdaq 100 mini -0.4%

- Russell 2000 mini -0.4%

- Stoxx Europe 600 -0.3%

- DAX little changed

- CAC 40 -0.4%

- 10-year Treasury yield -3 basis points at 4.41%

- VIX +0.7 points at 19.04

- Bloomberg Dollar Index +0.2% at 1210.84

- euro -0.3% at $1.1411

- WTI crude +0.4% at $62.8/barrel

Top Overnight News

- The Trump administration wants countries to provide their best offer on trade negotiations by Wednesday as officials seek to accelerate talks with multiple partners ahead of a self-imposed deadline in just five weeks. RTRS

- US Commerce Secretary Howard Lutnick said he was optimistic that the United States and India would reach a trade agreement soon, but urged New Delhi to open its markets, reduce arms purchases from Moscow, and scale back its alignment with Brics. SCMP

- US President Trump posted on "Passing THE ONE, BIG, BEAUTIFUL BILL is a Historic Opportunity to turn our Country around after four disastrous years under Joe Biden. We will take a massive step to balancing our Budget by enacting the largest mandatory Spending Cut, EVER, and Americans will get to keep more of their money with the largest Tax Cut, EVER, and no longer taxing Tips, Overtime, or Social Security for Seniors".

- OECD cut its global growth forecast this morning (2025 from +3.1% to +2.9% and 2026 from +3% to +2.9%) due to rising headwinds (“Substantial increases in trade barriers, tighter financial conditions, weakened business and consumer confidence, and elevated policy uncertainty all pose significant risks to growth). OECD

- A private gauge of China’s manufacturing activity tumbled into contraction in May, touching the lowest level since September 2022 as tariffs continue to weigh despite a trade truce with the U.S. The Caixin manufacturing purchasing managers index slid to 48.3 in May from 50.4 in April. WSJ

- China’s chief trade negotiator, He Lifeng, is prepared to play “hardball” with the US as Beijing pursues a more confrontational approach to talks w/Washington vs. Trump’s first term. WSJ

- Stronger demand at Japan’s 10-year bond sale brought some temporary relief as traders position for another auction in less than 48 hours that will test appetite for longer-dated debt (30 yr). BBG

- Russia told Ukraine at peace talks on Monday that it would only agree to end the war if Kyiv gives up big new chunks of territory and accepts limits on the size of its army. RTRS

- Eurozone CPI for May comes in below expectations at +1.9% on the headline (down from +2.2% in Apr and vs. the Street +2%) and +2.3% core (down from +2.7% in Apr and vs. the Street =2.4%) BBG

- TSMC said profit will rise to a record this year and reaffirmed its plan to invest another $100 billion on manufacturing in Arizona. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher as the region took impetus from the rebound on Wall St but with gains capped following disappointing Chinese Caixin Manufacturing data and as trade uncertainty lingered. ASX 200 edged higher amid strength in mining stocks but with further upside limited as defensives lagged and after mixed data releases including a surprise contraction in net exports contribution to GDP. Nikkei 225 kept afloat but lacked firm conviction after recent currency fluctuations and after a deluge of comments from BoJ Governor Ueda who reiterated they will continue to raise interest rates if the economy and prices move in line with forecasts, but also noted there was no preset plan for rate hikes and that they will raise interest rates only if the economy and prices turn up again and outlooks are likely to be realised. Hang Seng and Shanghai Comp were underpinned after the US reportedly extended the tariff pause on some Chinese goods to August 31st, while the White House Press Secretary stated that US President Trump and Chinese President Xi will likely talk this week, although the upside was restricted in the mainland given the lack of confirmation by Beijing regarding Trump-Xi talks and as participants also digested disappointing Caixin Manufacturing PMI data which showed its first contraction in eight months and printed its weakest since September 2022.

Top Asian News

- BoJ Governor Ueda said Japan's economy is modestly recovering despite some weakness seen, corporate profits are improving and business sentiment is solid, but noted the slowdown in the overseas economy pressures corporate profits and the pace of economic growth is expected to slow down. Ueda reiterated that they will continue to raise interest rates if the economy and prices move in line with forecasts and they will conduct monetary policy appropriately depending on price, and economic developments to achieve the 2% target in a stable and sustainable manner. However, he noted it is important to make judgments without any preset ideas and that they said in the Outlook Report that the baseline scenario could change significantly, as well as stated there is no preset plan for rate hikes and they will raise interest rates only if the economy and prices turn up again and outlooks are likely to be realised. Furthermore, Ueda said they will review bond taper plans at the next policy meeting taking into account the opinions of bond market participants and he is aware of the market view that some investors' appetite for super-long JGBs has declined.

- BoJ Governor Ueda says domestic and overseas economic developments have changed shape since Liberation day, which the levels exceeded many expectations; price environment is becoming more complex. Uncertainty is high; could weigh on corporate and household spending. Must look at underlying inflation, which excludes direct cost-push factors, in judging whether Japan sustainably achieves the BoJ's 2% inflation target.

- RBA Minutes from the May meeting stated the Board considered keeping rates unchanged and cutting by 25bps or 50bps but decided the case for a 25bps cut was the stronger one and preferred policy to be cautious and predictable. RBA said inflation is still not at the mid-point of the target band and the labour market is still tight, while the Board agreed developments in the domestic economy alone warranted a rate cut and progress on inflation meant policy did not need to be as restrictive. Furthermore, it was stated that a larger move might offer more insurance against adverse global scenarios although the Board was not persuaded that 50bps was needed and US tariffs had not yet affected the Australian economy, while it would be challenging for businesses and households if aggressive easing had to be reversed and the Board judged it was not yet time to move monetary policy to an expansionary setting.

European bourses (STOXX 600 -0.3%) opened modestly firmer across the board, but sentiment soon slipped surrounding reports that Dutch Far Right Leader Wilders, confirmed to quit government coalition. European sectors opened with a strong positive bias, but sentiment soon dwindled to display a negative picture in Europe. Telecoms took the top spot, then joined by Utilities; Financial Services was the morning’s outperformer, lifted by upside in UBS (+2.7%) after it received a broker upgrade at Jefferies. Basic Resources have been pressured today given the downside in metals prices following weaker-than-expected Chinese Caixin Manufacturing PMI. US equity futures are broadly in negative territory, in-fitting with the risk tone and scaling back from some of the upside seen in the prior session.

Top European News

- Dutch Far Right Leader Wilders, confirms to quit government coalition (as expected), according to NOS. Dutch Far Right leader Wilders tells PM Schoof that all of his ministers will quit government.

- Dutch Cabinet scheduled to meet at 13:30 CET (12:30 BST) to "discuss next steps".

- OECD GDP Forecasts: Forecasts generally downgraded, with the exception of the EZ (maintained) and Japan 2026 (upgraded).

- Polish Parliament Speaker has proposed a government confidence vote to take place next week.

BoE TSC

- BoE Governor Bailey says the key factors for the May rate decision were domestic and not tariffs; have not seen particular inflation surprises. Labour market has loosened somewhat, pay growth is above levels consistent with the 2% inflation target but lower than expected in February. Gradual and careful remain "my guide for rates". Savings to public finances through changing reserve remuneration by tiering would be illusory.

- BoE's Breeden says sees merit in maintaining a gradual and careful approach to adjusting the policy stance. As the BoE approaches a neutral policy stance, evidence of restrictiveness will become less clear, and the decision to further loosen policy will require a greater degree of certainty that inflation is on track. Has gained greater confidence that the disinflationary process is progressing at a steady pace. The economy appears to be moving gradually into excess supply. Sees downside risks from greater trade diversion, but also sees upside risks from the introduction of supply chain frictions globally. Thinks this latter channel is likely under-represented in models. Tariffs expected to have a small impact on the UK economy. In March, “I expected that I would vote to cut again in May”.

- BoE's Mann said must consider interactions of QT and rate decisions, while she added that the BoE cannot exactly offset high long-term rates caused by QT by cutting the bank rate further and extra cuts to short rates to compensate for QT could run counter to the need to purge structural rigidities in the UK labour and product markets. Furthermore, she expects these issues will be part of MPC considerations before the September QT decision.

- BoE's Dhingra says risks to inflation and growth are tilted to the downside; would have preferred the bank rate to followed a different path. Overly restrictive policy risks supressing demand and disincentivising investment.

FX

- USD is attempting to atone for recent losses after being sold yesterday on account of trade woes, ongoing fiscal concerns and a miss on ISM manufacturing PMI. Focus thus far has been on the trade front after a Reuters report noting that US President Trump's administration wants countries' "best offer" by Wednesday. Elsewhere, the White House Press Secretary said US President Trump and Chinese President Xi will likely talk this week; note, we have not seen any confirmation of this from the Chinese side. Focus now turns to US JOLTS Job Openings and Fed speak.

- EUR is on the backfoot vs. the USD but just about holding above the 1.14 mark. Losses were extended in early European trade alongside a deterioration in the risk environment as news broke that Dutch Far Right Leader Wilders confirmed he is to quit the government coalition. Flash CPI metrics were cooler-than-expected with both the headline and core figures printing shy of expectations.

- JPY is softer vs. the USD but to a lesser degree than peers. USD/JPY briefly reclaimed the 143 level but failed to hold onto the level alongside a deterioration in the risk environment and a slew of comments from BoJ Governor Ueda who reiterated the Bank will continue to raise rates if the economy and prices move in line with forecasts. On the trade front, Japan's trade negotiator Akazawa said they are aiming to have cabinet discussions towards a US trade deal and are seeking to accelerate talks ahead of the mid-June G7 talks. USD/JPY is back on a 142 handle and has traded within a 142.39-143.27 range.

- After a session of gains yesterday, GBP is softer vs. the USD but still managing to hold above the 1.35 mark. In terms of UK-specific newsflow, UK Trade Minister Reynolds will meet USTR Greer on Tuesday to discuss the implementation of a trade deal that has been complicated by the announcement of fresh US tariffs on steel, according to Reuters. Elsewhere, BoE's Mann said the BoE cannot exactly offset high long-term rates caused by QT by cutting the bank rate further. Cable's session low sits at 1.3511. Do note that the BoE's Treasury Select Hearing on the BoE May MPR is ongoing. Just to pick out the key commentary so far; Breeden reiterated the Bank's gradual and careful approach; Bailey highlighted that the May rate decision were domestic and not tariffs; Mann kept her usual hawkish tone and suggested Services is above what she viewed as consistent to get inflation back to target.

- Antipodeans are both softer vs. the USD and at the bottom of the G10 leaderboard in a reversal of yesterday's price action. Losses come as risk sentiment has deteriorated. RBA minutes noted that the Board considered keeping rates unchanged and cutting by 25bps or 50bps, but decided the case for a 25bps cut was the stronger one and preferred for policy to be cautious and predictable. Elsewhere, Australian data saw a surprise contraction in net exports contribution to GDP.

Fixed Income

- Japan’s 10yr sale was met with strong demand overnight and a very small price tail, a well-received outing that sparked immediate upside in JGBs and weighed on yields. Japanese paper was unreactive to BoJ Governor Ueda comments overnight.

- Bunds picked up at the resumption of trade, perhaps acknowledging ongoing trade uncertainty and the commentary from China in response to the EU on Monday taking action to limit China’s participation in healthcare. Thereafter, German paper picked up following the strong Japanese 10yr auction overnight, a move which has continued into the European morning. There was some choppy action on news that the Dutch government collapsed. As for EZ HICP, metrics were cooler-than-expected sparking some modest upside in Bunds but failed to test the earlier peak of 131.49.

- As above, USTs picked up on the Japanese auction and has continued to grind higher since. As high as 110-25, but so far at least has stalled ahead of a double-top at 110-30 from the two sessions prior. Ahead, the docket features JOLTS, Factory Orders, RCM/TIPP, the latest Discount Rate Minutes and remarks from Fed’s Cook (voter), Goolsbee (2025) and Logan (2026).

- Gilts began the day on the front-foot, given the outlined bullish bias. Specifically, it opened higher by 24 ticks and then climbed another 22 to take out last week’s 91.89 best and print a 92.01 peak for the day. Do note that the BoE's Treasury Select Hearing on the BoE May MPR is ongoing. Just to pick out the key commentary so far; Breeden reiterated the Bank's gradual and careful approach; Bailey highlighted that the May rate decision were domestic and not tariffs; Mann kept her usual hawkish tone and suggested Services is above what she viewed as consistent to get inflation back to target.

- UK sells GBP 1.25bln 4.0% 2063 Gilt: b/c 3.51x (prev. 2.8x), average yield 5.281% (prev. 5.076%), tail 0.3bps (prev. 0.3bps)

- Germany sells EUR 3.678bln vs exp. EUR 4.5bln 1.70% 2027 Schatz: b/c 2.9x (prev. 2.2x), average yield 1.78% (prev. 1.94%), retention 18.27% (prev. 24.42%).

Commodities

- Crude is trading in positive territory and has been trading with a modest upward bias throughout the European morning. This comes in contrast to a mostly downbeat mood across markets, with energy traders still very much focused on the current geopolitical backdrop with Iran dismissing the US proposal for a nuclear deal as "unrealistic". Brent Aug'25 currently trading towards the mid-point of a USD 64.68-65.09/bbl range. Do note that Kpler's Bakr reported that there was no OPEC+ discussion about a higher hike than the 411k bpd over the weekend - but the complex was little moved on this.

- Precious metals are broadly in the red, with some modest underperformance in spot silver. As for spot gold, the yellow-metal was subdued overnight and scaled back from the upside seen in the prior session; it has traded sideways throughout the European morning. XAU/USD currently trades in a USD 3,351.81-3,392.10/oz range.

- Base metals are entirely in negative territory, in reaction to weaker-than-expected Chinese Caixin Manufacturing PMI data and as the Dollar moves a little higher. 3M LME Copper currently trades in a USD 9,521.55-9,610.90/t range.

- "During the OPEC-plus meeting on Saturday with the 8 member states, there were no discussions at all about a higher hike than the 411kbd, according to delegates attending the meeting", via Kpler's Bakr." Russia did propose a pause which was also supported by Oman, but quick consensus was reached to go ahead with the 411kbpd addition in July".

Geopolitics: Middle East

- US President Trump posted on Truth Social "The AUTOPEN should have stopped Iran a long time ago from “enriching.” Under our potential Agreement — WE WILL NOT ALLOW ANY ENRICHMENT OF URANIUM!"

- An Iranian official reportedly said the US nuclear proposal is unrealistic, according to CNN.

- US State Department said Secretary of State Rubio spoke with Saudi's Foreign Minister and discussed Ukraine and Russia talks, stabilisation in Syria and the situation in Gaza.

Geopolitics: Ukraine

- Russian-controlled parts of Zaporizhzhia in Ukraine lost power as a result of Ukraine's attacks although the power cut-off had not affected the Zaporizhzhia nuclear power plant, according to Russian agencies.

- Ukraine's Energy Minister says Russian Rocket attack hit a large energy generation facility in overnight attack

US Event Calendar

- 10:00 am: Apr Factory Orders, est. -3.2%, prior 4.3%, revised 3.44%

- 10:00 am: Apr F Durable Goods Orders, est. -6.3%, prior -6.3%

- 10:00 am: Apr F Durables Ex Transportation, est. 0.19%, prior 0.2%

- 10:00 am: Apr F Cap Goods Orders Nondef Ex Air, est. -1.29%, prior -1.3%

- 10:00 am: Apr F Cap Goods Ship Nondef Ex Air, est. -0.08%, prior -0.1%

- 10:00 am: Apr JOLTS Job Openings, est. 7100k, prior 7192k

Central Banks

- 12:45 pm: Fed’s Goolsbee Participates in Moderated Q&A

- 1:00 pm: Fed’s Cook Discusses Economic Outlook

- 3:30 pm: Fed’s Logan Gives Opening Remarks at Fed Listens

DB's Jim Reid concludes the overnight wrap

This morning DB host our 29th annual European LevFin Conference, the largest in the continent with well over 1000 issuers and investors attending. I've been speaking at it for 20 years now and kick off the event at 8am this morning. In previous years the likes of Bon Jovi, Duran Duran and The Killers, amongst others, have performed. Hopefully they've taken away some sage advice on their CLO portfolios. These events have evolved over the years across the industry and there is now sadly more chance of having my band perform than rubbing shoulders with Jon Bon Jovi.

Looking on the Mr Brightside, yesterday we released our latest World Outlook from DB Research, which updates all our global macro forecasts. It is called “The Limitations of Liberation…” You can read the full report here. It’s a difficult time to forecast right now given the relentless crossfire of trade headlines. But there’s a growing sense that we’re now on a turbulent but sustained path towards de-escalation. Even if the US administration remain hawkish on trade, we have already seen there are limits to that approach, particularly in the face of market turmoil and declining approval ratings for President Trump. So although we think there’s likely to be prolonged uncertainty and a notable slowdown in US growth over H2, the de-escalation so far will support growth relative to earlier expectations.

Nevertheless, a lot of collateral damage has already been done. Our outlook argues that the structural foundations of US exceptionalism – particularly the ability to finance itself cheaply via the dollar’s reserve status – have begun to erode. So we remain structurally bearish on the dollar and expect US term premia to keep rising.

The biggest risk to our view would be if the US administration reverts to a more aggressive stance after the court ruling. But in a world where funding US deficits is now going to be structurally harder, Washington may not have the latitude it once did. For Europe, this may be a rare window to recapture the geopolitical and economic momentum. Indeed, their economy has shown surprising resilience so far, and we revised up our 2025 Euro Area forecast back to 0.8%, where it was in our last World Outlook in November. Indeed since last November the largest growth downgrade is the US and the largest up move is Germany. See the full report for much more.

When it comes to the last 24 hours, June has got off to a mixed start amidst the latest trade tensions and an underwhelming ISM manufacturing print. To be fair markets have been more resilient than sentiment with the S&P 500 managing to recover from a weak open to close +0.41% higher, even if futures have given up these gains this morning. Bonds saw a renewed sell off, with the 30yr Treasury yield (+3.4bps) moving up to 4.97% before rallying back a basis point this morning. Matters also weren’t helped by a fresh rise in oil prices, as OPEC+ only increased supply in line with expectations for July over the weekend. Brent crude was up +2.95% to $64.63/bbl, which in turn led to a renewed bout of concern about inflationary pressures. So although there wasn’t a single story driving markets, the incremental newsflow predominantly leaned in a more negative direction.

To be fair, there wasn’t much optimism going into the session, as markets were already reacting to Trump’s tariff announcement after the close on Friday, where he promised to double the steel and aluminium tariff rate to 50%. As a reminder, that’s one where Trump’s still able to take action, as the court ruling last week did not include the steel/aluminium/automobile tariffs. And from a market perspective, it reminded investors that the administration wasn’t backing down from an aggressive trade posture, despite the various court rulings.

Then as the US session got underway, the latest ISM manufacturing print for May came through. That unexpectedly fell to a 6-month low of 48.5 (vs. 49.5 expected), so that added to investor nerves about the near-term outlook. Strikingly, the import component slumped to just 39.9, which is beneath its low point during the Covid pandemic, and at a level unseen since May 2009 as the economy was emerging from the GFC. Meanwhile, the prices component remained elevated at 69.4, so there wasn’t much to get excited about, and it offered a fresh indication of how the trade war was having a tangible economic impact.

That backdrop was a pretty tough one for markets, and the various developments meant the dollar index (-0.63%) continued to slide, moving very close to its post-Liberation Day low back in late-April. In bond markets, there was another round of déjà vu as the 30yr Treasury yield bounced off the 5% mark again. That’s proved something of a resistance level in this cycle, and by the end of the session, it was up +3.5bps to 4.97% (4.96% in Asia). That move in yields was echoed across the curve, with the 10yr yield (+3.9bps) up to 4.44%, whilst the 2yr yield (+3.7bps) was up to 3.94%. Meanwhile in Europe, yields on 10yr bunds (+2.4bps), OATs (+2.8bps) and BTPs (+1.9bps) all moved higher as well. And the Italian-German 10yr spread fell to its tightest level since September 2021, at just 97.5bps.

Equities also struggled for much of the day, with the S&P 500 trading as much as -0.85% lower shortly after the ISM release. However, the equity mood improved as the session went on, with the S&P closing +0.41% higher led by gains for energy (+1.15%) and information technology (+0.89%) sectors. The Mag-7 advanced +0.59%, while the Philadelphia Semiconductor index (+1.57%) saw an outsized gain. Still, the overall equity mood was far from upbeat, with just over half of the S&P 500 stocks moving lower on the day. In Europe, markets closed before the late US rally, with the STOXX 600 (-0.14%) falling back slightly. Meanwhile, gold prices (+2.81%) were one of the few beneficiaries of the more anxious mood, posting their biggest daily jump in almost a month.

Asian equity markets are mostly higher this morning with the Hang Seng (+1.47%) recovering from yesterday's losses. The S&P ASX 200 (+0.41%) briefly reached a near four-month high following the release of the RBA’s May meeting minutes, which largely indicated a dovish outlook from the central bank. Elsewhere, mainland Chinese markets have resumed trading after a long weekend, with the CSI (+0.49%) and the Shanghai Composite (+0.48%) both higher perhaps after US Press Secretary Leavitt last night suggested that Trump and Xi could still speak as soon as this week. S&P 500 (-0.42%) and NASDAQ 100 (-0.40%) futures are both lower though.

Early morning data revealed that China’s manufacturing activity in May contracted at its most rapid rate since September 2022, as the Caixin/S&P Global manufacturing PMI printed at 48.3 (compared to the expected +50.7) and fell sharply from 50.4 in April. This decline was exacerbated by a significant drop in new export orders, underscoring the effects of stringent US tariffs.

In FX, the Japanese yen (-0.32%) weakened past 143 against the dollar, ending a three-day winning streak, despite BOJ Governor Kazuo Ueda expressing willingness to raise interest rates once the central bank is sufficiently convinced that economic and price growth will resume after a period of stagnation.

In terms of other data releases yesterday, UK mortgage approvals were weaker than expected in April, coming down to a 14-month low of 60.5k (vs. 62.8k expected). We also got the final manufacturing PMIs for May. The Euro Area PMI was unchanged from the flash print at 49.4, but the US number was revised down three-tenths from the flash reading to 52.0.

To the day ahead now, and data releases include the Euro Area flash CPI print for May, along with the unemployment rate for April. We’ll also get the US JOLTS report for April, and factory orders for April. Central bank speakers include BoJ Governor Ueda, the Fed’s Goolsbee, Cook and Logan, BoE Governor Bailey, Deputy Governor Breeden, and the BoE’s Mann and Dhingra.