Following this morning's very modest rise in Core PCE (coming just a couple of weeks after CPI disappointed the Trump Tariff infation fear-mongers once again) and a month since the UMich survey found that "Women, Democrats, & Low-Income Americans Are Out Of Their TDS-Addled Minds", and one week after Goldman finally called out the idiocy of the UMich survey, slamming its "partisanship" and the "sample design break starting from June 2024"...

... not to mention that it has been chronically wrong, warning that "Michigan inflation expectations have already risen even more than in 2022 and this time long-term expectations have risen sharply too, all before tariffs have even meaningfully boosted consumer prices" while "technicalities have exaggerated the increase in the Michigan [inflation] survey, as other survey measures and market-implied inflation compensation have not risen much at horizons beyond the next year", moments ago the final UMich survey for the month of June saw some notable revisions to the prelim prints, to wit:

The final June sentiment index increased to 60.7 from 52.2 a month earlier, according to the University of Michigan.

The 8.5-point increase was the largest since the start of 2024. The median estimate in a Bloomberg survey of economists called for no change from the preliminary reading of 60.5.

“The improvement was broad-based across numerous facets of the economy,’’ Joanne Hsu, director of the survey, said in a statement.

“With the recent moderation in both tariff levels and trade policy volatility, consumers now appear to believe that their worst fears may not come to pass and have moderated their expectations accordingly.”

More notably, consumers expect prices to rise 5% over the next year, data released Friday showed. That is down slightly from the preliminary reading. It's also far better than the 6.6% registered in May - the biggest monthly improvement since 2001.

They saw costs rising at an annual rate of 4% over the next five to 10 years, also lower than a month earlier.

Source: Bloomberg

Under the hood, it was Democrats that eased back (very modestly) on their inflation fears (over the short term)...

Source: Bloomberg

...and over the medium term (but independents seem to have caught the 'tariff derangement syndrome)...

Source: Bloomberg

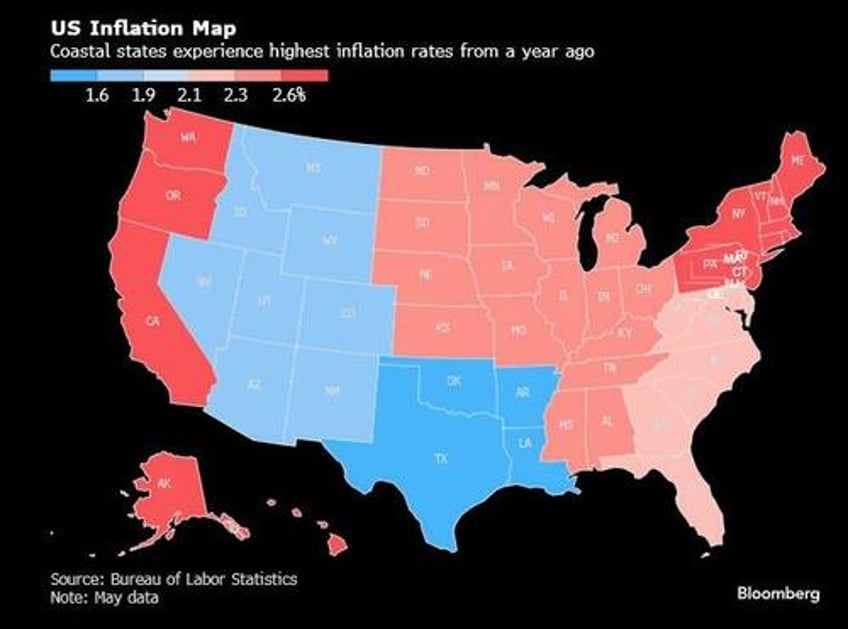

As a reminder, its the Democratic-run states that are seeing the highest level of inflation, so perhaps they're on to something...

Source: Bloomberg

One more for fun - comparing Democrats view of the inflationary outlook to the 'hard' inflationary data...

Source: Bloomberg

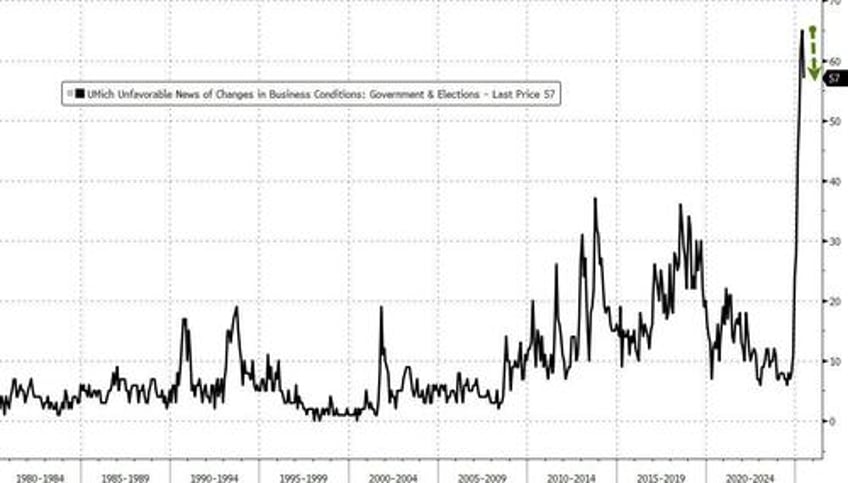

With stocks near record highs, the percentage of UMich respondents making unsolicited negative comments about news they've heard on government economic policy dropped notably from record highs...

Source: Bloomberg

The latest data suggest sluggish household demand, especially for services, extended into May after the weakest quarter for consumer spending since the onset of the pandemic.

“Consumer views are still broadly consistent with an economic slowdown and an increase in inflation to come,” Hsu said.