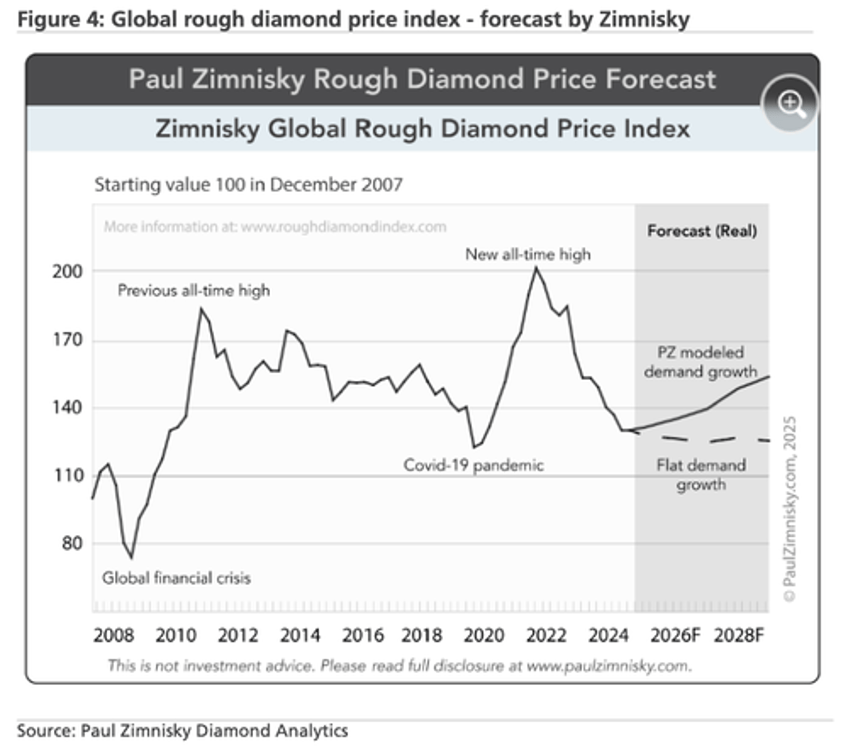

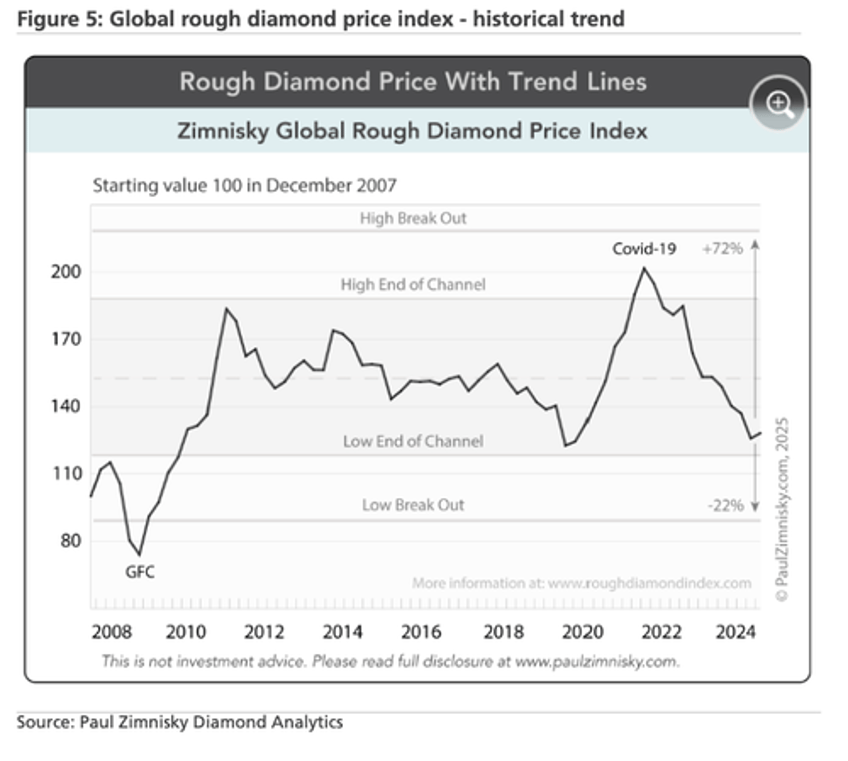

A UBS team led by Myles Allsop has called a "bottom" in the multi-year diamond bear market, citing signs of stabilization after years of falling prices driven by oversupplied conditions, the proliferation of lab-grown stones, shifting consumer preferences, and persistent macroeconomic headwinds.

Allsop hosted a call with top independent diamond expert Paul Zimnisky, in which they discussed the potential sale of De Beers by Anglo-American and the diamond market.

"Our expert sees DeBeers as a unique opportunity to effectively buy a whole luxury category and believes interest across the industry is high with a consortium the most likely buyer," the analyst said.

This note focuses less on De Beers itself and more on the broader diamond market, a space we've covered extensively over the years. The analyst stated:

The diamond market is starting to recover with prices up modestly from the floor on material supply curtailments; fundamentals look attractive medium-term assuming demand picks up with advertising.

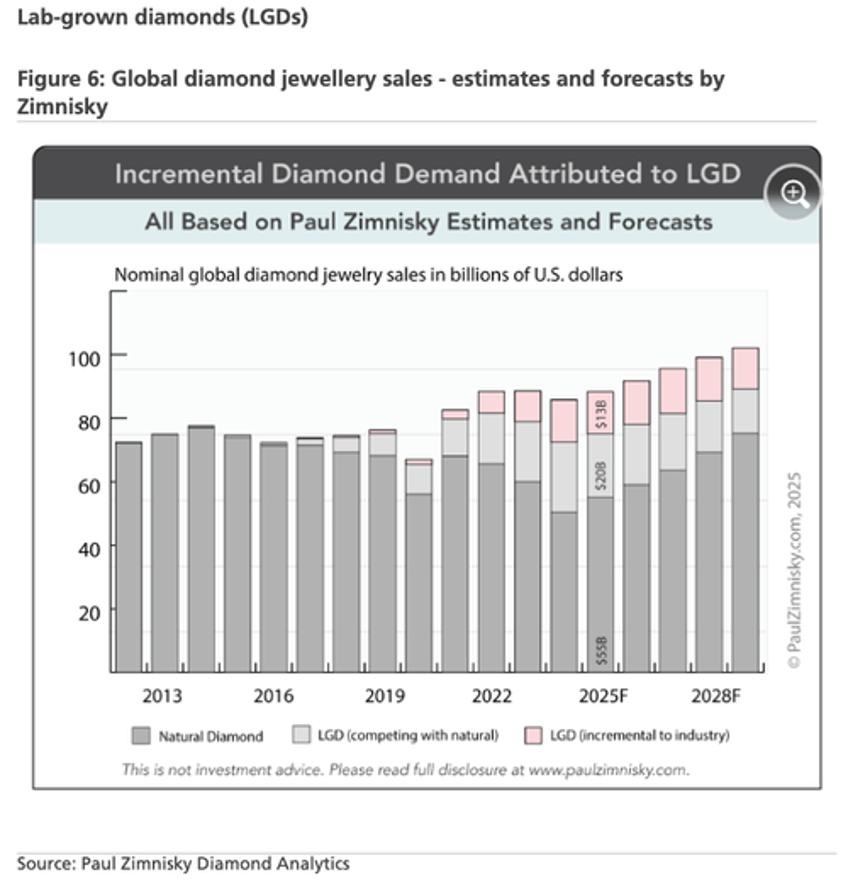

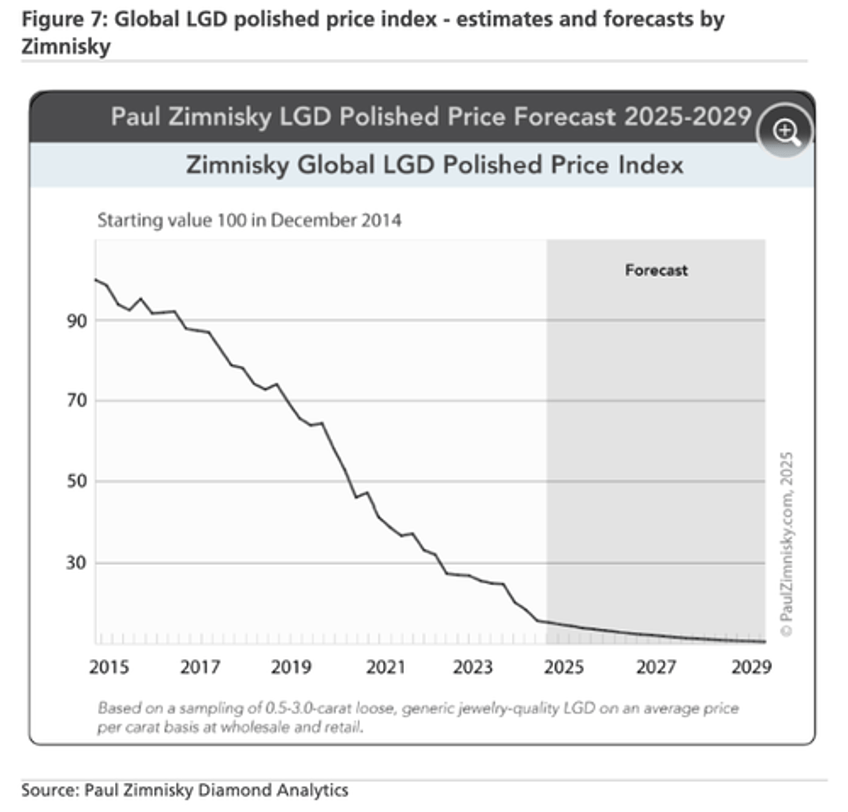

Here's a further breakdown of the diamond market outlook:

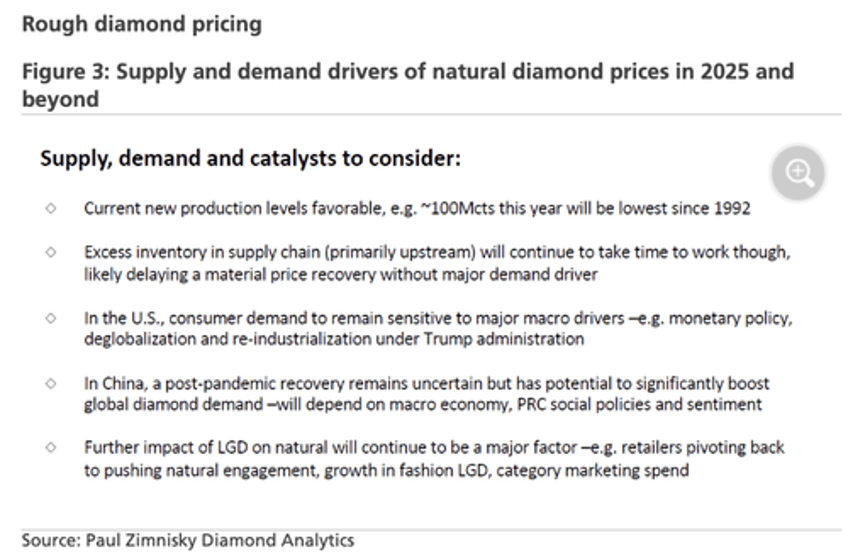

Prices are modestly rebounding due to supply curtailments from De Beers and Alrosa.

High-quality diamonds are already up 10% YTD.

Market fundamentals are improving assuming demand picks up with advertising.

On the supply side, Allsop noted, "Supply to remain low until end of the decade..."

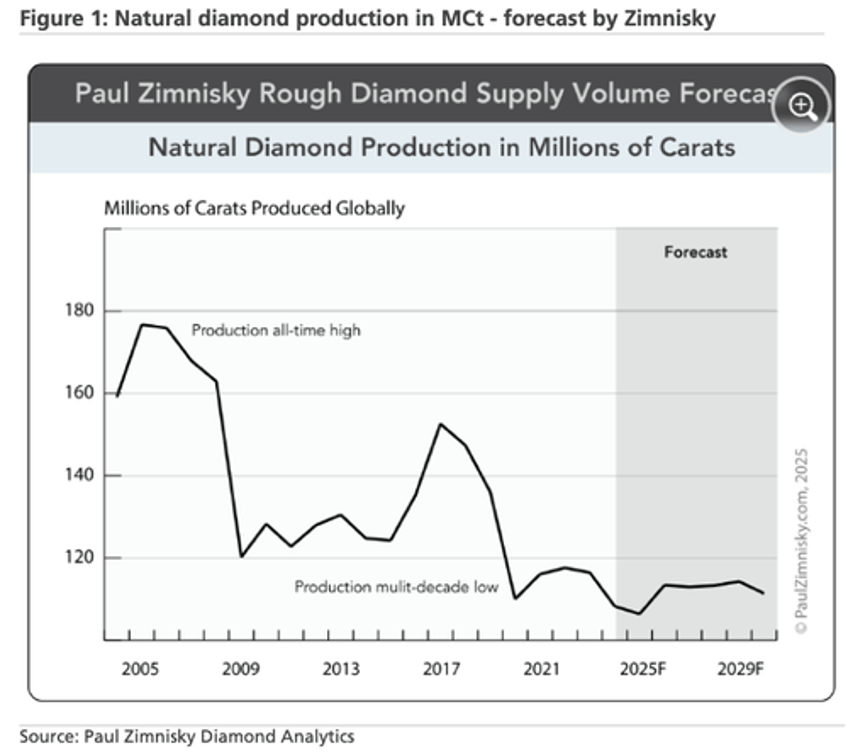

Zimnisky expects natural diamond production to remain flat at record level lows of100-125Mct through to at least 2029 (2025 ~100Mcts; Figure 1). Most natural deposits have been depleted, with Luele in Angola the only major source of new supply (Phase 1 adds 4-5Mcts this decade) still in early stages of development. Whilst the core diamond assets including DeBeer's Jwaneng, Orapa, Debmarine & Venetia still have >2-3 decades of mine life, Zimnisky expects natural production to fall to ~50% of the current level long-term.

Visualizing the diamond market in a series of charts:

Without comment.

. . .