It's becoming increasingly clear that cutting-edge chatbot providers and other AI and hyper-scaler businesses will require energy-intensive data centers to operate. This places a significant burden on an outdated electrical grid that desperately needs modernization.

In last week's note, "The Next AI Trade," we explained that soaring power demand is not just AI-related; there are multiple drivers, including onshoring trends, electrification of transportation and buildings, extreme weather, and, of course, data center demand. We also provided several investment ideas on how to capitalize on powering up America for the digital age.

"Every day, I'm surprised by how fast power consumption is growing," One River CIO Eric Peters wrote in a recent note, adding, "Take any application, add AI, and you need 7x-50x the compute power. AI is a black hole; it'll suck money out of everything else and into its vortex. The arms race between industry giants is a 20 on a scale of 1-10."

In addition to grid modernization efforts, we explained to readers in December 2020, "Buy Uranium: Is This The Beginning Of The Next ESG Craze." This is because nuclear power is clean and reliable compared to unreliable solar and wind. The latest sign that a nuclear renaissance is just beginning was a report last month from the federal government about the first-ever restart of a US nuclear power plant in southwestern Michigan.

Given all this, Wall Street is jumping on the bandwagon and seeing the same investment ideas as we see in the uranium industry and companies that will upgrade the power grid to handle EVs and AI data centers.

Richard Holtum, Trafigura's global head of gas, power, and renewables, is the most recent Wall Street analyst to recognize these emerging trends. On Tuesday, he told the audience at the Financial Times Commodities Global Summit in Lausanne, Switzerland, about his incredibly bullish views on power markets.

"Electrification of the vehicle fleet, AI — all these things are massively power-intensive," Holtum said.

Across the world, traders are building out power desks from the US to Japan as regulated electricity markets open up, allowing traders from overseas to buy and sell physical units, according to Bloomberg.

He said, "There's a growing realization that the one piece that binds the traditional fossil and the energy transition is the electron," adding, "As more and more grids get liberalized, the trading sphere gets even larger."

He also noted that the nuclear power industry in the US could tremendously benefit from soaring power demand.

Will there be an 80% growth in US power consumption in the next five years?

— Financial Times Live (@ftlive) April 9, 2024

Richard Holtum, global head of gas, power and renewables @trafigura, says this increase could help the nuclear industry in the US. #FTCommodities pic.twitter.com/n1sVteaKEt

Last week, Patti Poppe, the chief executive officer of Pacific Gas & Electric, told a Stanford University forum that nuclear power should continue to be part of the state's power generation mix as efforts to decarbonize the grid move forward.

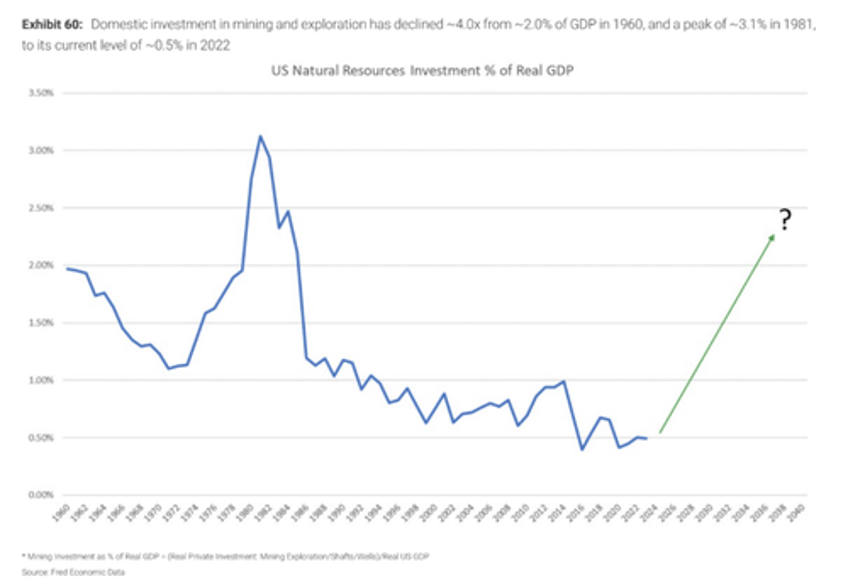

And Morgan Stanley analyst Carlos De Alba recently conveyed his optimistic outlook for the US metals and mining sector because investment levels in the industry have reached their lowest level in decades. He believes the sector is poised for massive investments as reshoring rare earth mineral supply chains goes into overdrive.

What's clear is that electrifying the economy will require an upgraded grid to handle the new electrical load - and the most reliable form of clean energy to power it all is nuclear.