The Big Long: What if Comex Drainage and GLD/SLV Destruction are the Same ?

Would you be willing to bet the Bullion used to create these derivatives is not double-claimed given that months ago we did not even know they existed as Gold bets at all?

Contents:( included excerpts)

- Summary:

- What are Structured Derivative Products?

- What happens when these SPs expire?

- But what if a bunch of these expire at the same time as Bob notes?

- What if the SP closes and the client(s) want(s) the gold?

- How do we know if the Banks Are Buying Metal from miners?

- What About Comex Deliveries?

- What happens if the counterparties Want the Gold?

- Brics Behavior Observed

1- Summary:

GoldFix ZH Edit

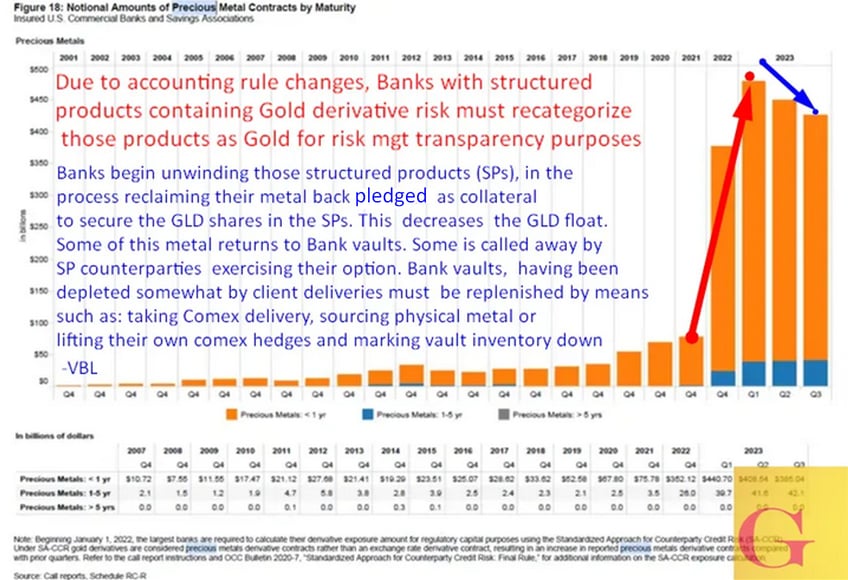

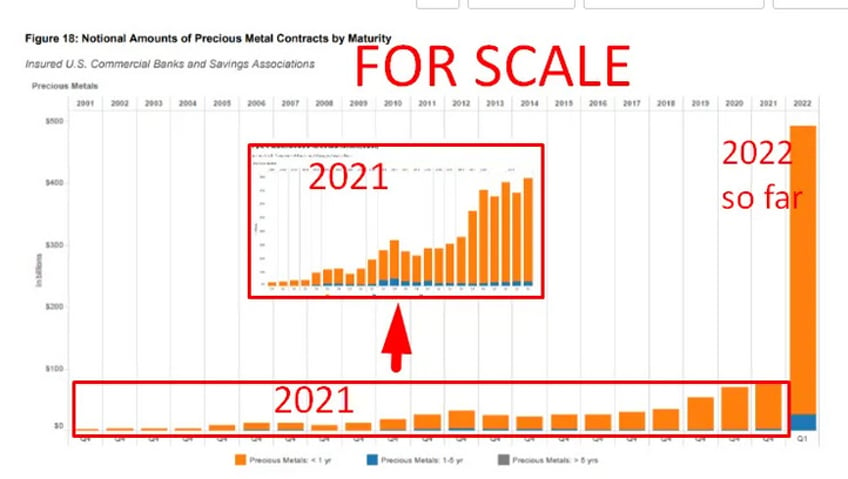

Reading Bob Coleman’s analysis in Gold and Silver ETF flows diverge with price caused this publication to take a closer look at correlations previously seemingly written off as semi-coincidences this past year in the Gold market. They never are coincidences at all it seems. Gold Derivative positions exploded in 2022 due to accounting changes. Since Q2 of 2023 they are now being drawn slowly down concurrent with: ETF bullion holdings dropping, Comex being drained, and price making new all-time highs.

Coincidence? We do not think so and seek to explore the connection. Let’s start by understanding what much of these big orange bars represent. Namely, they represent Stuctured Products, a type of exotic derivative class for institutional investors.

2- What are Structured Derivative Products?

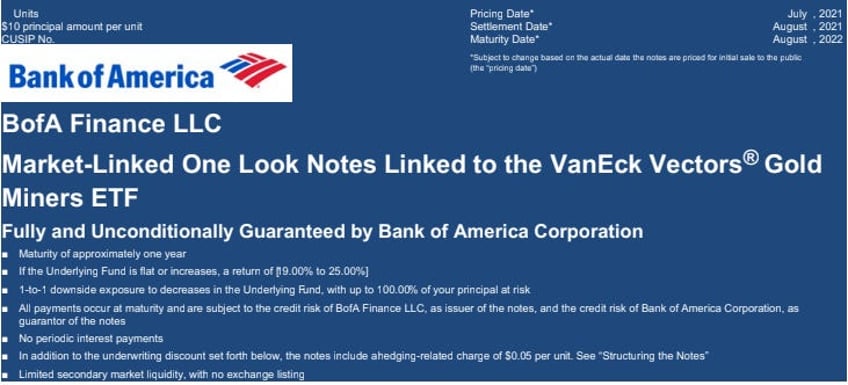

“Structured Products” are paper derivative contracts that can encumber physical assets. Structured Products are custom private instruments created by banks to accommodate risk plays clients wish to implement.

They can be similar to prop bets in a gambling house. Remember The Big Short and the Jenga tower scene? That was a structured product.

We think, but cannot prove, that their existence and unwinding is a contributing factor ( in combination with a host of other drivers) that are simultaneously:

- driving GLD ETF bullion holdings down,

- contributing to Comex depletion,

- and consequently Gold prices higher.

We further think what is happening right now connects GLD to Comex drawdowns and *at least partially* to BRICs demand.

Note this statement by Bob Coleman:

These large banks who also have separate market making and authorized participant businesses, may have deposited their underlying metal or inventory (as the industry calls it) to create ETF shares that could be then used to benchmark their tertiary derivative/structured investment vehicles bought by institutions and accredited investors

This is a mechanism very familiar and a good place to begin unraveling recent market behavior.2

Bullion Banks have been doing deals for decades where major clients want Gold/Silver price exposure backed by physical metal but do not necessarily want the metal. Nevertheless, the deals clients want still need to be backed by real deliverable metal just in case.3

This, depending on your perspective is a hedge or “Put” on some sophisticated portfolio you wish to protect…

Specifically they want:

- Price exposure (from a reliable public index) to Gold or Silver without the hassle of physical delivery and storage.

- To be backstopped by physical metal in case the price exposure to which the deal is indexed does not properly reflect the value of the metal for any reason at all4 at a price.

Another example of an exotic product…

Investments, bullion, and leverage pic.twitter.com/TDx1cVhKmy

— VBL’s Ghost (@Sorenthek) March 22, 2024

What happens if the collateral (gold or silver in our case) is called away by the client on expiration? Worse. What happens if that collateral is already tied up in something else, double claimed, or just not available immediately?

Continues here

8- What happens if SP Counterparties Want the Gold?

The price goes up to the extent the bullion bank needs to replace what they deliver. It can almost be like the banks getting spoofed by an entity or nation that decides it wants the Gold or Silver. We have no legal proof this is going on. But we think it is. Softbank did it in equities repeatedly and without retribution. Why not Gold or Silver?

Put another way, given the following massive list of concurrent events numbered 1 to 14 below:

- BRICS want more Gold for their New Monetary Unit.

- Central Bank buying has accelerated this past year

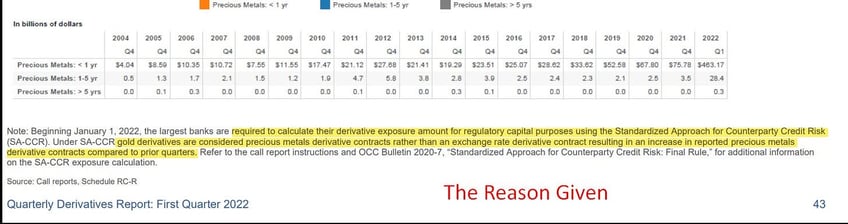

- Bullion banks were mandated to reveal their Gold derivative risk as gold

- Basel 3 causes deleveraging of bullion markets and reclamation of collateral

- A US Bullion Bank made delivery more than once to China to arbitrage the SGE/ Comex price differential

- China continues to announce monthly gold purchases, when historically they did not announce monthly

- India’s recent Silver buying is off the charts reaccelerating this past month

- LATAM countries are hedging significantly less Silver rproduction

- African countries like Ghana are demanding payment from operating mines like Newmont in gold

- Gold has been accepted as payment for Fuel for Ghana by their vendor (likely Russia)

- China is telling its citizens to accumulate gold

- Russia and China have been doing gold backed Yuan deals for Oil since 2017

- The Saudis are considering, if not outright accepting Yuan for Oil now

- EU nations are openly talking about repricing gold to maintain balance sheet solvency.

Given all these things listed, Would you be willing to bet that clients taking delivery of Bullion Bank gold was not a risk? Would you also be willing to bet the Bullion used to create these derivatives is not double claimed given that months ago we did not even know they existed as Gold bets?

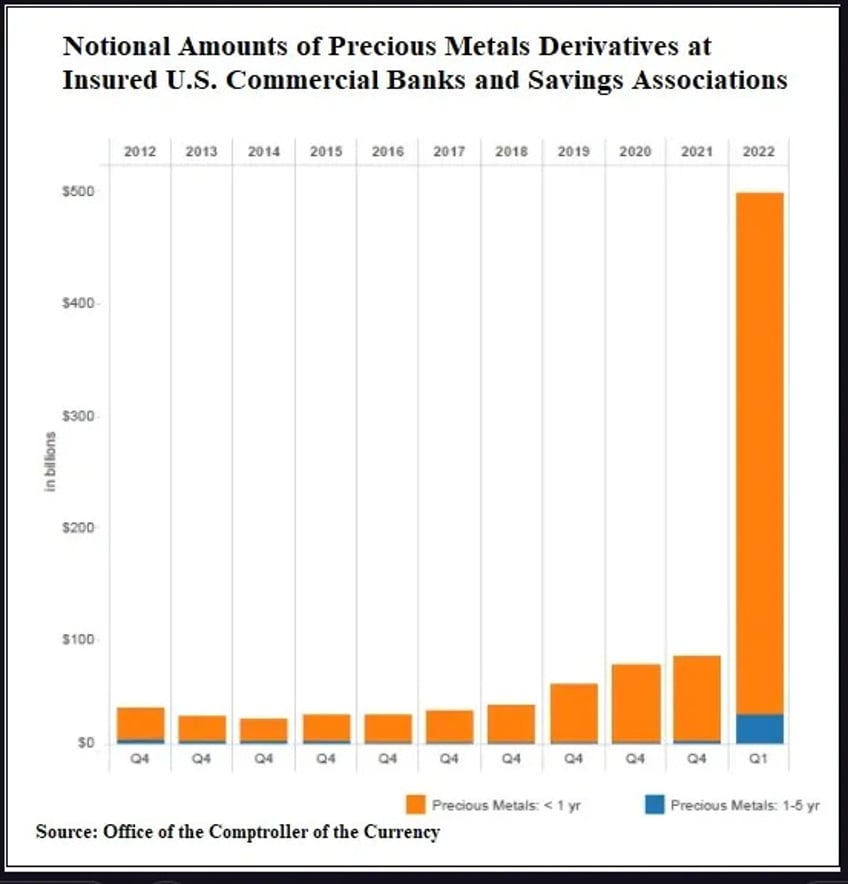

We would not take that bet. The spike in derivatives on the very first chart tells us some thing has been wrong from day one here. Here is that spike when it first happened from the post: JPMorgan And Citi are 90% of The U.S. Gold Derivative Market

Does this explanation (in yellow) satisfy you…

Here it is one more time for scale…

Something is definitely not right here.

9- Brics Behavior Observed

Here are some BRICS particulars worth considering as another part of the calculus before assessing the risk described above

Both BRICS and G7 central Banks are publicly buying Gold

BRICS nations like India are buying Silver very publicly out of season

It is believed at least one sovereign wealth fund added Gold to its portfolio between December 4th 2023 and Feb 29th 2024

The next BRICS summit is in October where an announcement is expected on their progress towards a common currency.

A currency secured by Gold and other assets for use in international BRICS (and G7) trade.

This event would supplant the US Treasury in a good chunk of Global commodity trade as a Store of Value while simultaneously creating a monetary UNIT that will use an NFT as currency with Gold (Some bonds, some fiat, and possibly Silver) collateral backing. Gold bars would compete with the UST while Gold NFT’s could effectively be the new USD in those transactions

Now. If you are a Bullion Bank and every time your phone rings it’s a client— be it Nation, Central Bank, sovereign fund, and even your own Treasury — looking for Gold delivery. What would you do?

More here

Free Posts To Your Mailbox