Originally published at The Bitcoin Layer — subscribe here. Follow Joe and Nik on X.

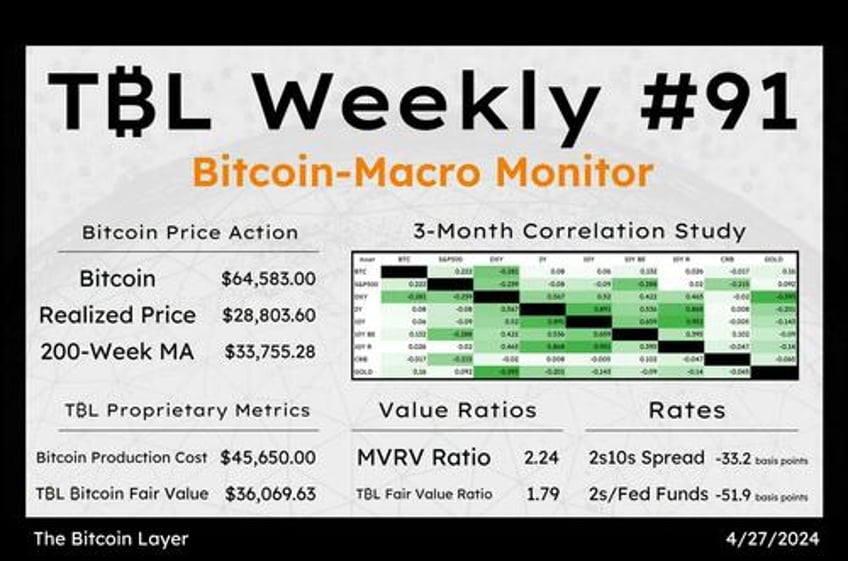

Welcome to TBL Weekly #91—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning, readers.

There are some palpable summer vibes starting to emerge in markets. Sunny afternoons on the beach mean Friday activity slows to a crawl, with the only ones stuck on their desks being the interns and analysts.

Analysts, checking in 👋

Kicking things off in the equity market, the Nasdaq 100 just had its best week since November. It looks like we’re out of the woods of multi-week correction and are resuming the bull market in earnest:

Tech earnings that met or beat expectations across the board helped springboard equities from last week’s slump, but today’s rejection of the economic stagnation narrative following as-expected PCE data helped out too.

Economic stagflation fears arose briefly yesterday following a hot quarterly core PCE report, but were dashed today. The PCE headline and core deflator only printed in-line with expectations. Headline rose slightly while core continues its descent down to the Fed’s desired target range. Striking distance at this point, we’re coming in for landing. All that’s left is for the labor market landing gear to come down properly on descent:

The milktoast PCE report helped to calm fears that the Fed would need to delay rate cuts, part of what spooked equities yesterday and caused the 5-7% correction that they are now exiting.

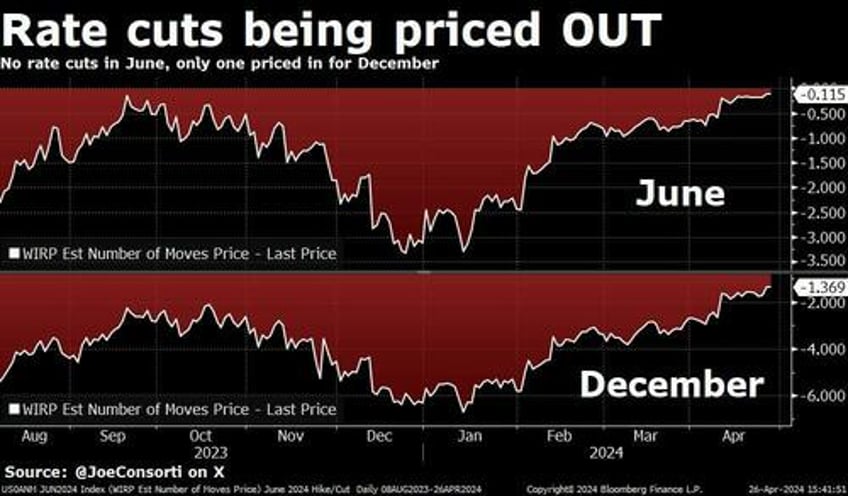

Citigroup is perhaps the most optimistic of all in its outlook for rate cuts. After today’s data, it changed its end-of-year call from 125 basis points of cuts to 100 basis points of cuts, and it thinks the Fed will start cutting in June. This is a more aggressive path for easing than the market is pricing—we wonder what makes Citi stick with such a call. The market sees a sub-50% chance the Fed cuts once by June, and a barely-100% chance it cuts once by 25 basis points by December:

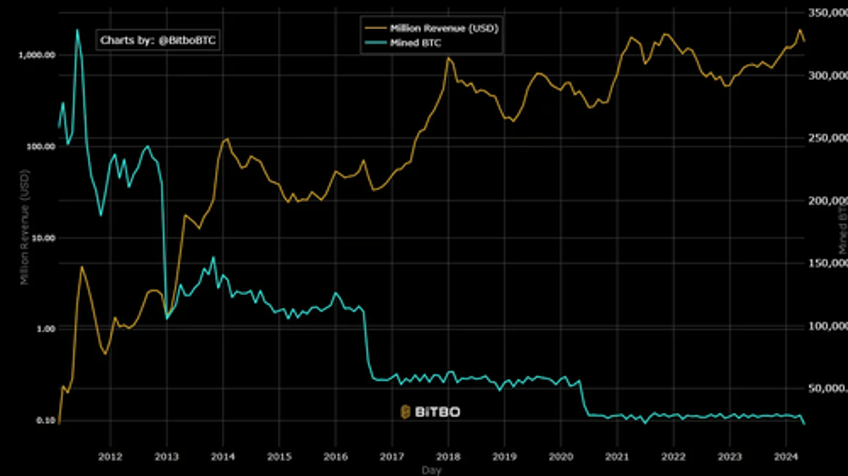

It is officially one week post-halving and bitcoin miner revenue is doing well. After an all-time high for daily revenue was hit earlier this week thanks to the Runes protocol, a spin on ordinals and inscriptions that uses bitcoin’s OP_RETURN command to store arbitrary data, revenue has normalized. Blockchain clogging fears are also abated, with fees now down close to ~50 sat/vB, where they were pre-halving.

The temporary spike in blockspace demand and massive surge in cost to move bitcoin on the base layer has brought the need for L2 scaling solutions back into the news. Personally, we’re bullish on the Lightning Network—layers inspired the name for Nik’s book and the name of this publication, after all. If you’d like some reading material, check out Layered Money and our other research on LN.

Zoom out, and miner revenue is nothing but up and to the right in USD terms:

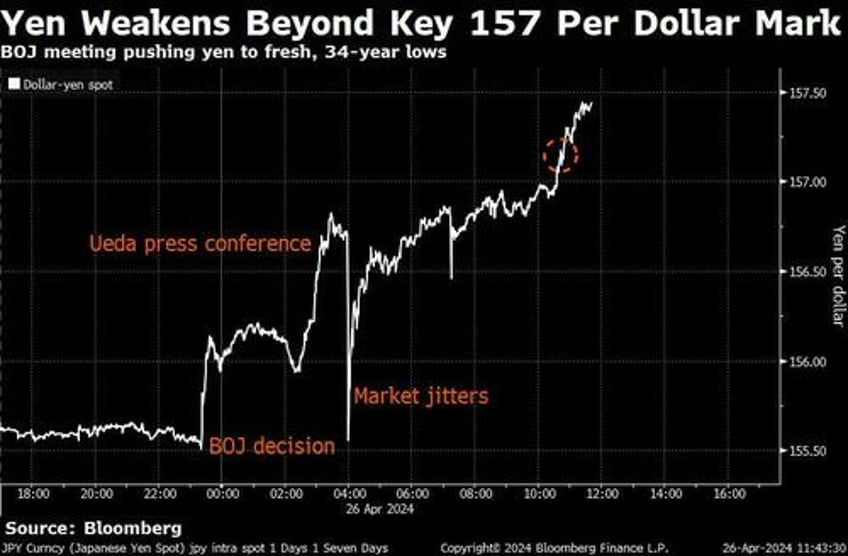

The Japanese yen is getting absolutely slaughtered. The Bank of Japan indicated that it intends to keep monetary policy easy despite the steep decline against the US dollar, extending losses to a fresh 34-year low. Odds are, despite the exit a few months ago, the BoJ will eventually have to intervene as the rout persists:

A final note from me: privacy is under attack here in the United States. Not only was Samourai Wallet shut down and its owners arrested by the FBI, but warrantless FISA surveillance was unanimously extended for two more years by Congress and Senate and passed into law. This encroachment of civil liberties is now at bitcoin’s doorstep. Today they’re attacking non-KYC custodians, then it will be LN nodes, and then it will be self-custody itself. We’ll continue keeping you updated.

I’ll be driving down to Virginia to spend my 23rd birthday weekend with family. Spring has sprung, summer is right around the corner. Relax and enjoy.

Next Week with Nik

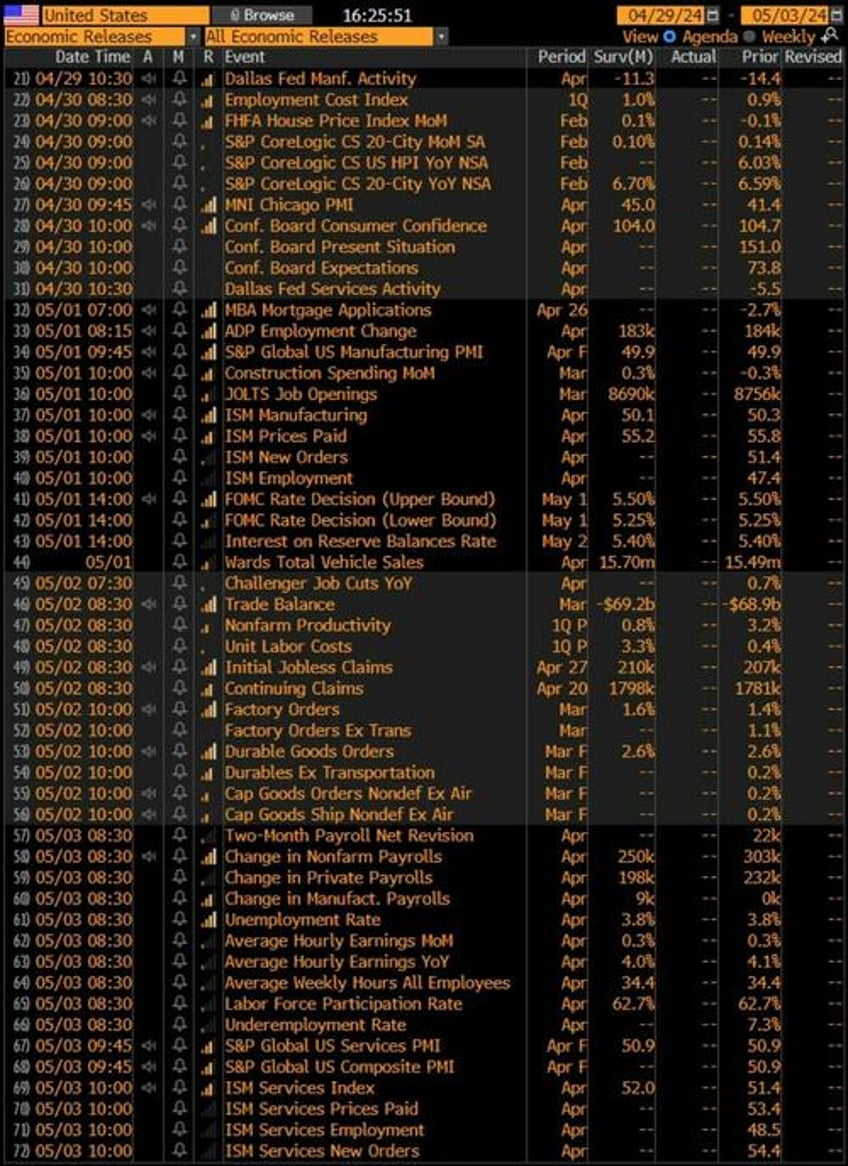

In the week ahead, we are for the second time this year faced with a single-week onslaught of tier-one information for the market—Treasury’s refunding plans, the FOMC’s policy meeting, ISM, and unemployment. Despite the synthesis of important economic data, it is fair to say that all eyes will be on Washington next week, starting on Monday with information out of the borrowing committee.

Treasury will tell the market how much it plans to issue, but we specifically care about how much it plans to issue in the long end of the curve—10s, 20s, and 30s. With more paper issued long, the investment universe is placed with risk that has proven to move the market over the past several quarters. October 31st was the only exception, as coupon issuance failed to meet expectations and Treasuries rallied. Otherwise, coupons arriving in size has steepened the yield curve. If Treasury issues more notes and bonds than expected, I anticipate the risk spectrum to have a negative reaction. With that as the first order of effect, I can safely say that so many market events are happening next week that any forecast would be useless.

Those events include the Federal Reserve decision, yet another meeting during which rates will be held steady—we are now approaching a year at “terminal.” Higher for longer, they said, and they were right. With a June move now almost gone from the market, it does feel like even the Fed has their eyes on the beach and desired cocktail on ice. Will we perhaps see a tweak to the Quantitative Tightening program? It’s possible, but inflation doesn’t necessarily suggest the Fed needs to get creative. We’ll have much more on the Fed if it does indeed move its policy on balance sheet.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Subscribe to The Bitcoin Layer

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, Nik Bhatia and Ritik Goyal present an in-depth graduate seminar on money creation. With over a dozen examples of monetary operations, watch this episode to learn how money is created by banks, the relationship between banks and central banks, the interaction between reserves and deposits, and an overview of repo. For those looking for over an hour of balance sheet mechanics and T-chart examples, this episode is for you. Grab your pens and pencils!

Check out—HOW MONEY WORKS: Dollar Creation & Fed Money Printing 101

Tuesday

“A red sunrise can mean that a high-pressure system (good weather) has already passed, thus indicating that a storm system (low pressure) may be moving to the east. A morning sky that is a deep, fiery red can indicate that there is high water content in the atmosphere. So, rain could be on its way.”

I don’t want to alarm anyone, but there’s a shift in the wind recently.

Check out—Red sky at morning, sailor's warning.

In this episode, Nik is joined by Jack Farley, host of the Forward Guidance podcast. Jack and Nik discuss their favorite books on finance and global macroeconomics. From banking history to financial markets to science fiction, Jack discusses what he loved about each book and inquires about Nik's background as a money markets and Treasury repo trader. Books and authors mentioned during this recording:

Check out—Best Books On Finance & Global Macroeconomics with Jack Farley

Wednesday

With buyback trials completed, the U.S. Treasury is ready to unclog the “off the runs” from its debt distribution pipes. Dissecting the plan.

Check out—U.S. Treasury Wraps Up Buyback Trials: What's Next?

In this episode, Nik is joined by veteran investor Craig Shapiro to discuss the US Treasury debt market and what it means for the global monetary system, gold, and bitcoin. Craig explains what to look for during next week's FOMC meeting and Treasury refunding announcement, and how the balance between Treasury bills and coupons affects risk markets. He also dissects double speak out of the Fed on financial conditions and provides an epic rant on the case for bitcoin in today's global setting.

Check out—Bitcoin Is Gold For The People

Thursday

Everybody is always humming along until the correction. While prices go up, it’s “can you believe the records bitcoin ETFs are setting?”, but when they decline, panic is often at the fingertips. Today, we’ll reset on the bitcoin market to try and objectively assess where we are. That also means looking at the macro picture, which has significantly changed its tone of late.

Reaching you all on a weekly basis has made me a better researcher, but it’s more than just that. Five years ago, 12 hours away from home daily to sit on a trading desk as a fiduciary didn’t necessarily leave a ton of time for reading. As a forever student, I feel genuine momentum on my path to full-time researcher, taking down more books than ever and simultaneously comprehending how much more there is to know. Asking brilliant people questions for our channel isn’t hurting the process either. The goal then becomes to synthesize it all for you and tell you what matters. Let’s reset.

Check out—Bitcoin sends warning

Friday

In this episode, Nik brings us a global macro update to discuss recent weakness in stocks and bitcoin, and looks ahead to next week Treasury's quarterly refunding announcement. With over 30 charts from inflation to the economy to asset markets, Nik shares his analysis on the stocks/bitcoin correlation, the Fed's mistakes around rhetoric and financial conditions, and the dangers stemming from a significant devaluation of the Japanese yen.

Check out—Global Macro Update: Proceed With CAUTION

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Subscribe to The Bitcoin Layer

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.