"Stocks stop panicking after policymakers start panicking"

- Bank of America's Michael Hartnett

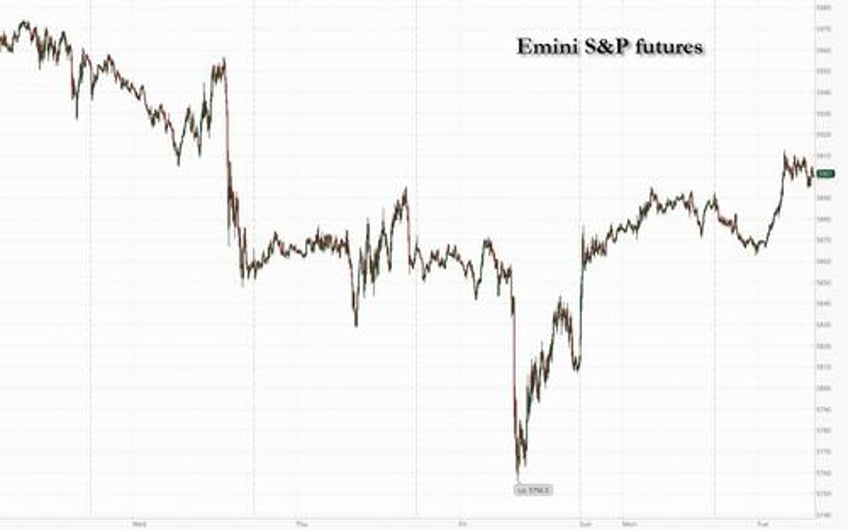

US equity futures are higher on US/EU trade optimism as well as global bond yield stabilization after the BOJ is reportedly looking to reduce domestic bond vol following last week's historic selloff which led to record losses on Japanese life insurers and other financial firms. As of 8:00am, S&P futures are up 1.5%, and Nasdaq futures gain 1.6% after Trump said he would extend the deadline for the European Union to face 50% tariffs until July 9; Stocks look like an ‘Everything Rally’ led by TMT in premarket trading with multiple Mag7 names are up more than 2% including NVDA +2.8% ahead of earnings tomorrow, buoying Semis, and Cyclicals over Defensives. The yield curve is bull flattening amid USD strengthening, perhaps setting the stage for US outperformance. 30Y yields fell six basis points to move below 5% as Japanese long-end bond yields plunged after reports that Japan’s finance ministry asked market participants for their views on the appropriate amount of debt issuance, suggesting Japan's MOF is looking to bring calm to a market where relentless selling had pushed yields to record highs and left demand for fresh supply floundering. The dollar rose 0.3%, setting the currency on track for its biggest gain in more than two weeks. Today’s macro data focus in Durable/Cap Goods, Housing Prices, and Consumer Confidence with the critical catalyst being tomorrow’s NVDA print.

In premarket trading, Magnificent Seven stock after all well in the green (Tesla +2.2%, Nvidia +2.5%, Meta +1.9%, Amazon +1.6%, Alphabet +1.5%, Apple +1.6%, Microsoft +1.1%). Gold mining stocks including Newmont (NEM) are lower, following peers in the rest of the world as gold extends a slide on weakening demand for haven assets (Barrick Mining -1.9%; Newmont -2.5%). Trump Media (DJT) surged 11% after the Financial Times reported that the company plans to raise $2 billion in equity and $1 billion via convertible bonds to buy cryptocurrencies. Nuclear stocks are set to extend a rally into a second day after President Donald Trump signed orders aimed at reviving US leadership in nuclear power Friday (Constellation Energy +2.4%, Nano Nuclear Energy +2.7%). Here are some other notable premarket movers

- Block (XYZ) gains 2.6% after BNP Paribas Exane upgraded the firm to outperform as the broker expects the digital payments company to achieve its profit growth goals.

- Informatica (INFA) rises 5% as Salesforce is said to be reviving talks to acquire the software company.

- PDD ADRs (PDD) drops 18% after the budget shopping site reported the lowest adj. operating margin in three years, citing “substantial investments” made to support merchants and consumers.

- Rocket Pharmaceuticals (RCKT) sinks 62% after a patient participating in a Phase 2 trial passed away. The FDA has placed a clinical hold on the trial to allow for further evaluation.

- United States Steel extended gains after rallying about 21% on Friday as Trump announced a partnership between the firm and Japan’s Nippon Steel Corp.

The big move overnight came from Japan's bond market where the yield on Japan’s 40-year debt fell about 25 basis points after Reuters reported that Japan’s finance ministry asked market participants for their views on the appropriate amount of debt issuance. The move suggested Japan's MOF is finally panicking and hoping to bring calm to a market where relentless selling had pushed yields to record highs and left demand for fresh supply floundering.

“That potential lower issuance is giving Treasuries a nice helping hand,” said Michael Brown, strategist at Pepperstone Group in London. “For those seeking to buy long-term debt, lower Japanese government-bond supply could force them into the Treasury complex.”

US Treasuries have come under pressure in recent weeks as President Donald Trump’s signature tax legislation and a Moody’s Ratings downgrade put the spotlight on rising debt issuance and a ballooning budget deficit. The dollar has also been hit as shifting US policies and the global trade war weighed on demand for American assets. The unpredictabililty of Trump’s tariff moves will continue to weigh on the greenback, said Kenneth Broux, a strategist at Societe Generale. The dollar has declined more than 7% this year against a basket of currencies, despite Tuesday’s gains.

“When you see these patterns of escalation, de-escalation, sleep, repeat, it’s not going to give investors a lot of confidence about what the administration is trying to do,” Broux said. “There’s still the conversations about the re-balancing from US assets. That’s a multi-week, multi-month process.”

The Stoxx 600 rises 0.6%, led by gains in travel, technology and industrial names. Germany’s DAX index also trades at a record high. Here are the top European movers:

- Elementis shares jump as much as 17%, the most in four years, after the specialty chemicals company struck a deal to offload its talc business. Analysts say this removes an overhang from the stock and improves the investment case.

- Ambea gains as much as 6.9%, the most since April 10, after Handelsbanken initiated coverage with a buy rating alongside Swedish health-care provider peers Attendo, which it rates buy, and Humana AB, which receives a hold rating.

- Burberry shares gain as much as 3% as Barclays raises its recommendation to equalweight from underweight, saying the British luxury firm’s high-end brand positioning is no longer at risk.

- FLSmidth rises as much as 5.4% to trade at the highest in more than two months, after Goldman Sachs upgraded its view to buy from neutral, arguing for a rerating for the Danish engineering group as its 12-month forward EV/Ebit multiple sits below the 10-year median.

- Zegona Communications — parent of Vodafone Spain — slumps as much as 17% in London after Spanish newspaper Expansion reported that its fiber joint venture with Masorange is now considering selling a smaller stake than previously expected.

- Qinetiq shares gain as much as 4.4% as the firm is raised to buy at Kepler Cheuvreux.

- Jupiter Fund Management shares jump as much as 12%, the most since July 2023. Peel Hunt upgrades its rating to add from hold, lauding the firm’s cost savings as a boost to profitability.

- LEM shares fall as much as 6.5% after the Swiss electrical components maker’s full-year earnings missed analyst estimates. Tariffs uncertainty could damp the cyclical recovery, according to Vontobel.

- E.On shares fall as much as 1.8% after the utility firm was downgraded by analysts at Citi following a stellar rally in the shares since the start of 2025. The stock pared its year-to-date gains to around 39%.

- Precious metals drop for a second day, its longest losing streak since April 23, as gold also extended its slide on weakening demand for haven assets.

- European auto stocks fall on after data showed a drop in new-car registrations across the region, including in major markets Germany and France.

- Premier Foods shares fall as much as 4.2%. The packaged food firm loses its clean sweep of positive analyst ratings as RBC downgrades to sector perform from outperform.

Earlier in the session, Asian equities slipped after reaching a fresh seven-month high on Monday, weighed down by losses in technology shares. The MSCI Asia Pacific Index fell as much as 0.4%, with TSMC, Samsung Electronics and ICICI Bank among the biggest drags. Benchmark gauges dropped in Taiwan, India and mainland China, while Japanese and Hong Kong shares advanced. An index of region’s tech stocks slumped as much as 1.2% to the lowest since May 14. Asian equities have been outperforming on a continued inflow of institutional funds given the weakening of the dollar and concerns over US policymaking. The MSCI regional benchmark is on pace to beat a gauge of global equities for the fourth month in a row, the longest such streak since 2017.

“We do see a slowdown coming in China,” likely in the second half, Jun Bei Liu, co-founder and lead portfolio manager at Ten Cap Investment, told Bloomberg TV. While consumer businesses should do well, “we’re just a little bit cautious” given weakness in housing and as the latest stimulus has yet to take effect.

In rates, Japanese government bonds lead a global long-end rally after Reuters reported the country’s finance ministry has asked market participants for their views on the appropriate amount of government debt issuance. Japan’s 30-year bond yield slid as much as 22 basis points, while comparable US Treasury yields drop 7 bps at 4.97%; UK and German 30-year borrowing costs fall 5 bps each. Bonds rose across Europe as well, where weaker-than-expected French inflation offered an additional boost. European equities climbed 0.5%.

In FX, the Bloomberg Dollar Spot Index rises 0.3% while the yen is the weakest of the G-10 currencies, falling 0.7% against the greenback to near 144.

Oil prices edge higher ahead of an OPEC+ meeting on supply policy. WTI climbs 0.4% to $61.80 a barrel. Spot gold falls $45 to around $3,300/oz.

Looking at today's calendar, US economic data includes April durable goods orders (8:30am), March FHFA house price index, 1Q house price purchase index, March S&P CoreLogic house prices (9am), May consumer confidence (10am) and Dallas Fed manufacturing activity (10:30am). Fed speaker slate includes Barkin (9:30am) and Williams (8pm)

Market Snapshot

- S&P 500 mini +1.5%

- Nasdaq 100 mini +1.7%

- Russell 2000 mini +1.6%

- Stoxx Europe 600 +0.6%

- DAX +0.7%

- CAC 40 +0.2%

- 10-year Treasury yield -5 basis points at 4.47%

- VIX -0.3 points at 20.25

- Bloomberg Dollar Index +0.3% at 1214.65

- euro -0.3% at $1.1351

- WTI crude +0.3% at $61.74/barrel

Top Overnight News

- Trump backed away from his threat to impose 50% tariffs on imports from the European Union next month, restoring a July 9 deadline to allow for talks between Washington and the 27-nation bloc to produce a deal. RTRS

- Treasury Secretary Scott Bessent said that US regulators this summer may ease a rule that’s served as a constraint on banks’ trading in the $29 trillion Treasuries market. “We are very close to moving” on the so-called supplementary leverage ratio, Bessent said BBG

- Japan will consider trimming issuance of super-long bonds in the wake of recent sharp rises in yields for the notes as policymakers seek to soothe market concerns about worsening government finances. RTRS

- BOJ Governor Kazuo Ueda indicated his intention to continue raising the benchmark interest rate if the economy improves as expected. BBG

- Japan’s chief trade negotiator Ryosei Akazawa indicated his aim to resolve tariff talks in time for a June meeting between US President Donald Trump and Japan’s Prime Minister Shigeru Ishiba following Trump’s surprise pivot to allow a partnership between two of the countries’ steelmakers. RTRS

- UK food inflation rose to the highest level in a year as supermarkets battle higher operating costs stemming from the government’s revenue-raising budget. BBG

- Several Eurozone countries signal they want to move quickly to strike a trade deal w/the US. FT

- Salesforce is expected to pay $25 per share for Informatica in a deal set to be announced today. WSJ

- The Fed’s Neel Kashkari doubled down on his case for caution on further rate moves. He said there’s a “healthy debate” among policymakers about whether to look through the inflation effect of tariffs as a transitory shock, or a lasting issue. BBG

Tariffs/ Trade

- EU set to focus on critical sectors in a bid to avoid US tariffs, according to Bloomberg sources, EU Trade commissioner Sefcovic will lead political negotiations on industries such as steel and aluminium, autos, pharma, semiconductors and aircraft. Talks will happen in parallel with technical discussions on tariffs and non-tariff barriers

- European Industry Association sent a survey to firms on behalf of the European Commission requesting details on US investment plans, according to Reuters sources.

- European Trade Commissioner Sefcovic said he had a good call with US Commerce Secretary Lutnick on Monday and that the European Commission remains fully committed to constructive and focused efforts at pace towards an EU-US deal, while he added that they continue to stay in constant contact.

- South Africa offered to import LNG from the US for 10 years as part of the deal proposed to Washington which would include the US investing in gas infrastructure and cooperating on technology and fracking, according to a ministerial statement.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with price action relatively rangebound amid a lack of major fresh catalysts and in the absence of a lead from Wall St owing to Memorial Day. ASX 200 edged marginally higher as strength in tech, energy and financials atoned for the underperformance in the mining and resources sectors. Nikkei 225 was subdued amid a firmer currency and after BoJ Governor Ueda reiterated the central bank's policy normalisation rhetoric, although the downside was stemmed following a lack of deviation in Services PPI data, which matched the prior reading, and as long-end JGB yields declined. Hang Seng and Shanghai Comp were lacklustre with price action in Hong Kong choppy and with the mainland constrained as focus turned to earnings releases and despite a slight acceleration in Chinese Industrial Profits, while a firm PBoC liquidity operation also failed to inspire.

Top Asian News

- Chinese Premier Li said China and Cambodia are to jointly respond to external uncertainties, according to Xinhua.

- China's Mofcom summoned industry associations and automakers such as BYD (1211 HK) and Dongfeng Motor (489 HK) to a meeting on Tuesday afternoon and intends to discuss matters including the emergence of used cars on the market that have never been driven.

- BoJ Governor Ueda said while many of his G7 colleagues looked relieved by the progress made in the fight against inflation, they also acknowledged new challenges such as heightened trade policy uncertainty and dealing with more frequent supply side shocks, while he added they are still grappling in Japan with the challenge of achieving the 2% inflation target in a sustainable manner and are now closer to the inflation target than any time during the last few decades, but are not quite there. Furthermore, he said to an extent, incoming data allows them to gain more confidence in their baseline scenario, and as economic activity and prices improve, they will adjust the degree of monetary easing as needed to ensure achievement of sustainable 2% inflation target.

- Japan Ministry of Finance will consider tweaking the composition of its bond issuance plan that could involve trimming issuance of super long debt, according to sources cited by Reuters.

European bourses (STOXX 600 +0.5%) opened incrementally firmer, but sentiment improved in tandem with a pick-up in US equity futures. Indices currently reside at session highs. European sectors hold a strong positive bias, with only a handful of industries residing in the red. Financials take the top spot, joined closely by Travel & Leisure and then Industrials. The latter buoyed by continued strength in Defence names, following Trump’s hawkish remarks on Putin following Russia’s large-scale attack on Ukraine over the weekend.

Top European News

- UK government will spend a record GBP 3bln to boost training opportunities as part of a broader strategy to train locals to fill gaps in the labour market and reduce reliance on migrant workers.

- UK Chancellor Reeves is "being forced towards" a tax raid of up to GBP 30bln by benefit giveaways and her struggle with increasing borrowing costs, according to The Telegraph, citing the NIESR.

- UK government is shifting to shorter term borrowing to lower its interest bill as a global debt sell-off adds to the pressure on its tax and spending plans, according to FT.

- ECB's Villeroy says interest rate normalisation within the EZ is probably incomplete.

- German Chamber of Commerce (DIHK) expects inflation at 2.1% in 2025 (vs 2.2% in 2024); German economy expected to contract by 0.3% in 2025 (vs prev. forecast of -0.5%); exports are expected to decline by 2.5% in 2025.

- French PM Bayrou says will unveil budget-cutting proposals in early July, according to BFM TV.

- EU Ministers approve the EUR 150bln Euro arms fund to give loans for defence projects, says Polish European Affairs Minister.

FX

- DXY is attempting to recover recent losses after printing a fresh MTD trough on Monday at 98.69. There hasn't been a clear driver for the price action with fresh macro drivers out of the US on the light side. Focus remains on the trade front with FBN's Gasparino noting yesterday that a framework between the US and India is close to being announced; this could offer some reprieve. Elsewhere, remarks from Fed 2026 voter Kashkari stated that he finds arguments against looking through tariff-induced inflation as compelling. For today's docket, the notable highlights are Durable Goods and Consumer Confidence metrics.

- EUR/USD is on the backfoot and has returned to a 1.13 handle as the USD attempts to atone for recent losses. Focus remains on the trade front after US President Trump's decision over the weekend to announce a delay to the 50% tariff deadline on EU goods to July 9th. The latest reporting via Bloomberg states that the EU is set to focus on critical sectors in a bid to avoid US tariffs; key industries include steel, aluminium, autos, pharma, semiconductors and aircraft. On the data slate, French CPI metrics came in softer-than-expected ahead of next week's EZ-wide release. EUR/USD has delved as low as 1.1338 with little in the way of support until the 1.13 mark.

- USD/JPY initially retreated amid a softer dollar and the subdued risk appetite in Japan. There were also comments from BoJ Governor Ueda who stated that, to an extent, incoming data allows them to gain more confidence in the baseline scenario and that as economic activity and prices improve, they will adjust the degree of monetary easing as needed. Nonetheless, the pair eventually clawed back losses as the dollar rebounded off lows and as long-term JGB yields declined in response to source reporting via Reuters that Japan's MoF will consider tweaking the composition of its bond issuance plan.

- GBP on the backfoot vs. the USD but to a lesser extent than most peers. Cable is currently snapping its recent strong showing which saw it hit a multi-year peak on Monday at 1.3593. Fresh macro drivers for the UK are lacking as participants return from the long weekend.

- After a strong showing in early European trade on Monday on account of the positive risk tone, both are on the backfoot as the USD picks up steam. NZD/USD hit a fresh YTD high yesterday at 0.6031 before returning to a 0.59 handle.

Fixed Income

- JGBs were initially weighed on by BoJ’s Ueda reiterating hiking plans. Action which, pushed JGBs to a 139.08 low overnight. Thereafter, the benchmark rallied on supply related sources to a 139.49 peak. Japan’s MOF is to consider tweaking its bond issuance composition, via Reuters citing sources. A tweak that could include the trimming of super long-term debt.

- The above has carried into US trade. Lifting USTs by 10 ticks at best to a 110-13 high. Yields lower across the US curve but, unsurprisingly, given the long-dated focus to the MOF reporting that area is leading the move down, sparking bull-flattening. Fed’s Kashkari stuck to the data-dependent approach that has characterised his commentary in recent days and weeks. Focus ahead now on US Durable Goods and Consumer Confidence due before a 2yr Note auction.

- Bunds were already subject to an upward bias given the JGB action, a bias which was extended on by a cooler-than-expected set of French preliminary inflation, a series that was sufficient to lift Bunds above the 131.00 mark. Further support stemmed from ECB’s Villeroy, who outlined that interest rate normalisation within the bloc is unlikely to have concluded. This added to the above bias and lifted Bunds to a 131.22 peak, where the benchmark remains. German paper was little moved by EZ Sentiment data were more-or-less in-line.

- Gilts are bolstered in sympathy with JGBs, and with two UK-specific factors also influencing. Firstly, the FT reports that the UK will be shifting to shorter-term borrowing in order to lower its interest bill amid elevated longer-dated yields which are pressuring the fiscal situation. Secondly, The Telegraph citing NIESR reports that Chancellor Reeves is “being forced towards” a tax raid of as much as GBP 30bln, due to increasing borrowing costs and benefit payments. Altogether, these factors caused Gilts to gap higher by 47 ticks (gapping from Friday’s close, owing to Monday’s Bank Holiday) and then extend another 43 to a 91.89 peak.

- Saudi Aramco mandates USD 5, 10 and 30yr benchmarks, according to IFR. IPTs (vs USTs): 5yr +115bps, 10yr +130bps, 30yr +18bps.

- Italy sells EUR 2.75bln vs exp. 2.5-2.75bln 2.55% 2027 BTP Short Term & EUR 2.0bln vs exp. EUR 1.5-2bln 1.80% 2036 & 1.25% 2032 BTPei

Commodities

- Crude price action has been uneventful and choppy within recent ranges in the run-up to the OPEC event on May 31st. WTI currently resides in a USD 61.08-62.14/bbl intraday range with its Brent counterpart in USD 64.36-64.98/bbl confines.

- Precious metals are posting losses in European hours, with early pressure seen as Shanghai commodities trade got underway, particularly for the yellow metal, amid several factors including 1) USD strength, caused in part (in more recent trade) by EUR losses after softer French Prelim CPI, 2) Unwinding of some risk premium as UK and US traders react to US delaying the EU tariffs, 3) technical factors with the yellow metal dipping under overnight support (USD 3,325/oz), yesterday's low (3,323.50/oz) and eventually, but briefly, the USD 3,300/oz.

- Base metals are subdued, and are sidelining the positive sentiment across equities, with the LME back up and running after the long weekend, whilst prices are pressured by the strengthening USD, irrespective of the constructive US-EU trade news from over the weekend. 3M LME copper remains above USD 9,500/t with a current intraday parameter between USD 9,561.95-9,640.00/t.

- The meeting of eight OPEC+ countries was brought forward to May 31st from June 1st, according to Reuters sources.

- Russian Deputy PM Novak said nothing has been discussed yet in response to a question about whether OPEC+ has discussed an oil output increase by another 411k bpd from July, and stated that OPEC+ will discuss the current market conditions and forecast, as well as make some adjustments if needed. Furthermore, Novak said the possible G7/EU tightening of Russia’s oil price cap is not acceptable and stated that price caps have not affected Russia’s oil exports, according to RIA.

- Ecuador's biggest oil refinery experienced a fire and halted operations as a precaution following the fire.

- Petrobras (PBR) CEO said if oil prices drop further, they will cut diesel, gasoline, and jet fuel prices, while he added that fuel prices are at a 'comfortable level' and that gasoline and diesel prices are below parity at the moment.

- China Steel Association said China is working to control steel capacity to resolve the mismatch between supply and demand.

- Ukraine has approved the gas transportation mechanism via the Transbalkan pipeline from Greece, awaiting approval from other corresponding nations.

Geopolitics: Middle East

- Israeli PM Netanyahu said on Monday regarding hostage deal negotiations that he hopes they will have news regarding the hostages today or tomorrow.

Geopolitics: Ukraine

- Russia's Kremlin says work on Russia-US POW swap continues; on reports of possible US sanctions, says it is aimed at wrecking Ukraine peace talks. Ukrainian attacks on Russia do not facilitate peace process.

- US President Trump is said to be eyeing sanctions against Moscow this week as he grows frustrated by Russian President Putin’s continued attacks on Ukraine and the slow pace of peace talks, according to people familiar with Trump’s thinking cited by WSJ.

- Western allies of Ukraine, including the UK and US have agreed to lift all range restrictions on weapons in Ukraine, according to The Times.

- Ukrainian President Zelensky said Russian mass attacks are Russian President Putin’s political choice and that Putin is playing with diplomacy, while he added that more pressure and sanctions must be applied on Russia.

- Authorities in Ukraine’s Sumy region said Russian forces captured several villages in the region.

Geopolitics: Other

- Guangzhou public security authorities said a technology company in China's Guangzhou was attacked by a foreign hacker organisation and the initial investigation found that the cyberattack was by a hacker organisation 'supported by' Taiwan's DPP authorities.

US Event Calendar

- 8:30 am: Apr P Durable Goods Orders, est. -7.8%, prior 9.2%, revised 7.5%

- 8:30 am: Apr P Durables Ex Transportation, est. 0%, prior 0%, revised -0.4%

- 8:30 am: Apr P Cap Goods Orders Nondef Ex Air, est. -0.05%, prior 0.1%, revised -0.2%

- 8:30 am: Apr P Cap Goods Ship Nondef Ex Air, est. -0.05%, prior 0.2%, revised 0.1%

- 9:00 am: Mar FHFA House Price Index MoM, est. 0.1%, prior 0.1%

- 9:00 am: Mar S&P CoreLogic CS 20-City YoY NSA, est. 4.5%, prior 4.5%

- 10:00 am: May Conf. Board Consumer Confidence, est. 87.1, prior 86

- 10:30 am: May Dallas Fed Manf. Activity, est. -23.05, prior -35.8

Central Bank Speakers

- 4:00 am: Fed’s Kashkari Speaks at Bank of Japan Event

- 9:30 am: Barkin Appears on Bloomberg TV

- 8:00 pm: Fed’s Williams Speaks in Moderated Discussion in Tokyo

DB's Jim Reid concludes the overnight wrap

Given that the UK and US were on holiday yesterday, today's edition will include a week ahead and a review of last week as well as discuss a quiet session in Europe yesterday and Asia overnight. This week is half-term in the UK so activity could be a bit slower which could have been a problem if we were still facing the June 1st 50% tariff deadline for the EU, but yet again we saw a deadline delay over the weekend back to the original July 9th date after a positive call between Trump and EC President von der Leyen. The Stoxx 600 (+0.99%) made up for Friday's fall (-0.93%) after the delay but even Friday's fall showed that markets are getting more accustomed to Trump's threats and now partly assume the full threat won't immediately materialise. There is certainly fear fatigue. Interestingly the dollar hasn't rallied since the news on Friday and has instead edged lower. Investors are seemingly of the view that continued aggressive tariff headlines chip away at investors desire to hold US assets. 10yr European bond markets rallied 1-3bps yesterday with 30yr yields 2-5bps lower.

In Asia, S&P (+0.90) and NASDAQ (+0.96%) futures are notably stronger than Friday's close while 10yr and 30yr US Treasuries have rallied -3.0bps and -4.3bps after yesterday's holiday. In Japan 10 and 30 year yields are -5.6bps and -16.4bps lower with a further few basis points of this rally coming just as we go to print as a Reuters story has quoted sources at the MoF suggesting a trimming of ultra-long issuance after the recent rout. There is a 40yr auction tomorrow. This all comes after a very weak 20yr auction this time last week so things have moved fast at the Japanese long end over the last several days. The Yen (+0.29%) is strengthening, trading at 142.43 against the dollar after the BOJ Governor Kazuo Ueda signaled potential further interest rate hikes in response to rising inflation. This has also helped to lower yields at the long-end this morning.

Asian stock markets are generally trading lower in a fairly quiet session so far. As I check my screens, the KOSPI (-0.60%), the CSI (-0.56%), the Shanghai Composite (-0.33%), the Hang Seng (-0.18%) and the Nikkei (-0.18%) are all slipping. The People’s Bank of China (PBOC) yesterday directed its largest banks to increase the proportion of yuan used in international trade transactions, a move aimed at promoting the currency's use amidst ongoing trade tensions.

As we move through the rest of the week, Nvidia’s earnings tomorrow night might be the most interesting single event. Its rallied around +40% from the lows but has been range trading (in a big range) for a year now after an exponential upmove in the two prior years. In the macro world, inflation will be the key theme, with US PCE (Friday), preliminary May CPIs for Europe through the week and the Tokyo CPI (Friday). Consumer confidence indicators will also be out in the US and Germany (today), and Japan (Thursday). Elsewhere the highlights are US Durable Goods today, German unemployment, Australian CPI and the latest FOMC minutes tomorrow, the second reading of Q2 US GDP and US claims on Thursday are some of the other main highlights.

Recapping last week even if it feels a long time ago now writing this on a Tuesday morning. Markets had a rougher time as investors grew more concerned about the US debt trajectory, whilst trade fears also returned after Trump threatened a fresh round of tariffs. That was clear right from the start of the week, as markets reacted to the news of Moody’s credit rating downgrade for the United States. But even after the downgrade, the fiscal situation remained top of the agenda, as the House of Representatives narrowly voted in favour of the latest tax bill. That would extend the tax cuts from Trump’s first term and raise the debt ceiling by $4tn, so it offered markets a fresh reminder about the scale of US deficits. Indeed, on an intraday basis the US 30yr yield got as high as 5.15% on Thursday, something we haven’t seen since October 2023, and a level we haven't closed at since 2007.

Then on Friday, markets took a further hit after Trump threatened to place a 50% tariff on the EU from June 1. He said that the EU had “been very difficult to deal with”, and that the “discussions with them are going nowhere!” So that immediately led to a fresh risk-off move, with equities ending the week lower right across the world. In fact, the S&P 500’s weekly decline of -2.61% (-0.67% Friday) was the biggest since the week of Liberation Day. Meanwhile in Europe, the STOXX 600 ended a run of 5 consecutive weekly gains, falling -0.75% (-0.93% Friday). Obviously the weekend delay has helped market recoup some of last week's (and all of Friday's) losses.

Whilst equities were losing ground, it was also a tough week for sovereign bonds thanks to the fiscal concerns, particularly at the long end of the curve. For instance, the 30yr Treasury yield was up +9.3bps last week (+0.2bps Friday) to 5.04%. That was echoed elsewhere, with the German 30yr yield up +4.9bps to 3.08%, whilst Japan’s was up +6.1bps to 3.02% before this morning's big rally. Sovereign bonds at shorter maturities performed much better, with the 2yr Treasury yield down -0.8bps to 3.99%, whilst the 10yr yield was up by a smaller +3.3bps to 4.51%. And in Germany, the 10yr bund yield fell -2.3bps last week to 2.57%, ending a run of 3 consecutive weekly increases.

Several of those moves were exacerbated by the latest data releases. For instance, there were strong inflation reports in the UK, Canada and Japan last week. And in Europe, the flash PMIs for May were weaker than expected, adding to the signs that the economy had lost some momentum after Liberation Day. For instance, the Euro Area composite PMI fell to 49.5, which is the first sub-50 reading since December. So risk assets struggled across the board, with Brent crude oil prices down -0.96% (+0.53% Friday) to $64.78/bbl. And US HY credit spreads widened after a run of 6 consecutive weeks of tightening, moving up +25bps last week (+7bps Friday) to 330bps.