A day after homeBUILDER sentiment finally cracked (though still dramatically more 'confident' than homeBUYERS)...

Source: Bloomberg

...and mortgage rates are rebounding higher, Housing Starts and Building Permits expectations were mixed ahead of this morning's print.

The actual data was indeed mixed but both were disappointly below expectations as Starts rebounded just 1.6% MoM (below the +4.0% exp) from the 10.1% MoM collapse last month (small revision higher) while Permits (more forward looking) plunged 4.7% MoM (vs -1.2% MoM)...

Source: Bloomberg

That is the biggest MoM drop in Permits since March 2024, dragging the SAAR down tits lowest since July 2024...

Source: Bloomberg

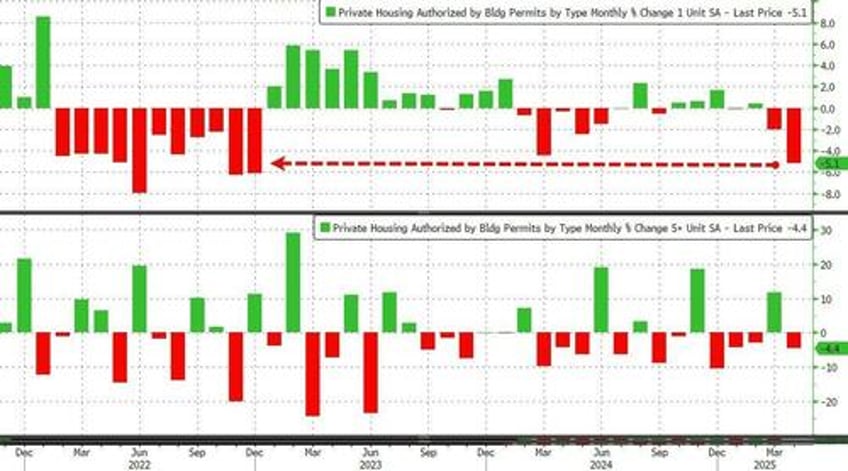

The drop in Permits was largely driven by a huge 5.1% MoM drop in Single-Family apps (multi-family fell 4.4% MoM) - the biggest drop since Dec 2022...

Source: Bloomberg

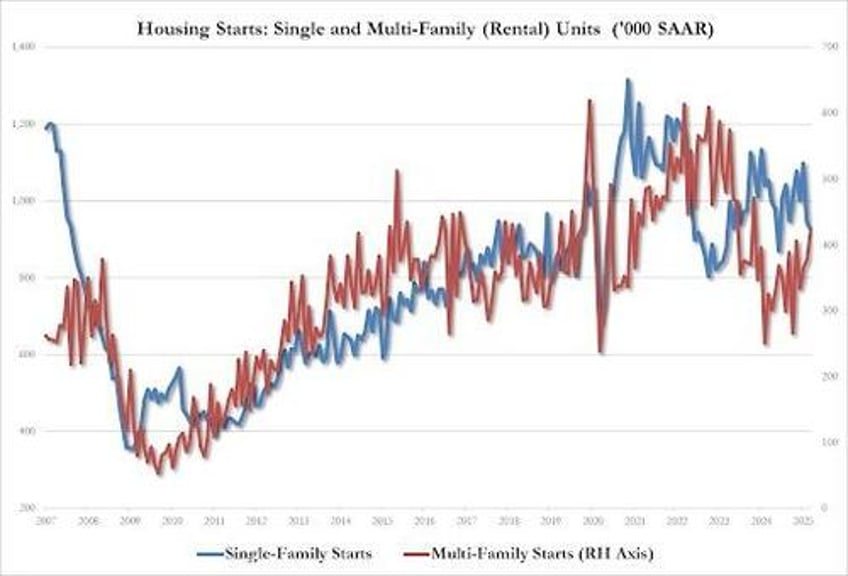

Housing starts were dominated by multi-family unit increases (for the third month in a row) as Renter Nation returns...

Single-Family down 2.1% to 927K, lowest since July 2024

Multi-family up 11.1% to 420K, highest since Dec 2023

Interstingly Starts picked up modestly despite the plunge in Homebuilder future sales expectations.,..

Source: Bloomberg

Perhaps the most shocking chart - that explains why builders are not building single-family homes is that inventories of unsold NEW homes is surging...

Source: Bloomberg

Rate-cut expectations are not helping...

Source: Bloomberg

So, don't bank on The Fed to save the day.