Originally published to The Bitcoin Layer — subscribe here. Follow Joe on X.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

“A red sunrise can mean that a high-pressure system (good weather) has already passed, thus indicating that a storm system (low pressure) may be moving to the east. A morning sky that is a deep, fiery red can indicate that there is high water content in the atmosphere. So, rain could be on its way.”

I don’t want to alarm anyone, but there’s a shift in the wind recently.

You can see it most evidently in stock prices, which have been on a month-long correction from their nonstop tear during late 2022 and all throughout 2023. Nik and I discussed this in our Tuesday and Saturday posts last week, and the trend remained intact until Monday’s trading when the S&P 500 managed to claw back less than 1 percentage point of gains. Nik flagged a double top in the index at the start of April. The index is down 5% from its high set four weeks ago, and analysts at JPMorgan expect losses to extend 16% lower by the end of the year:

JPMorgan analyst Marko Kolanovic cites forthcoming macro factors like rising US Treasury yields, a strong dollar, and rising oil prices as reasons for the selloff worsening. An undoubtedly bearish outlook, but one that has picked up some steam over the last four weeks of trading.

This week’s earnings reports for Q1 could offer upside—180 names from the index including MSFT, AAPL, FB, and TSLA are slated to report. The names that have reported so far have beat EPS estimates by 6% in aggregate, and big tech names are expected to do the same.

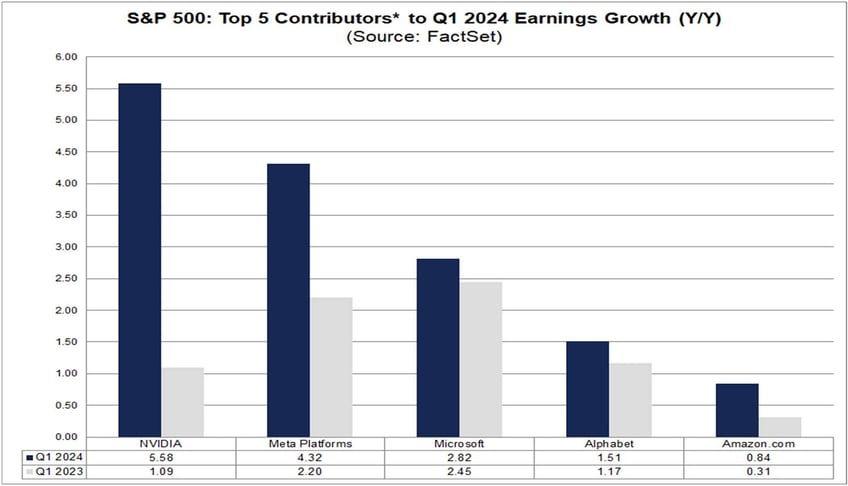

One major caveat here: the contribution from megacap tech to Q1 2024 EPS growth is much higher than it was for Q1 last year. The big tech names are carrying the index on their back, a signal that corporates are losing momentum and a potential top in earnings growth is being formed. At more than 40% of the total market cap of the S&P 500 index, any slip up could be the final impetus to solidify a shift to lower lows:

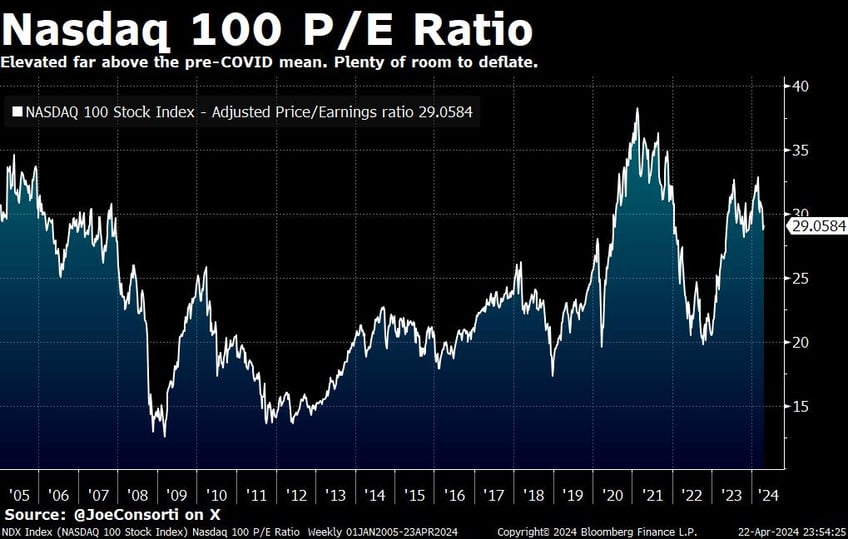

The earnings multiplier, or how over/undervalued stocks are compared to their underlying earnings, is still very high for the tech-heavy Nasdaq 100 index. The mean adjusted P/E ratio before the COVID stimulus supercharged asset prices was 22.5, and the Nasdaq’s current adjusted P/E is 29. Plenty of room to deflate:

Bitcoin & global macro research.

Lo and behold, the Nasdaq 100 fell 5% last week to a 10-week low, solidifying its longest streak of weekly losses since December 2022, when it was in a bear market:

Taking it all in, investors have begun shifting their pieces defensively. Although not super visible in US Treasury yields due to a) enormous issuance and b) upside stickiness for inflation keeping the path for yields higher, gold has demonstrated a risk-off bid. Price inflation and geopolitical risk have seen the king of safe haven commodities soar, still challenging its all-time high levels despite a two-day stumble from Friday to Monday:

A rising dollar on geopolitical deterioration has also applied pressure on risk. Bloomberg’s broad dollar index BBDXY is on the move and gunning for its 2023 highs:

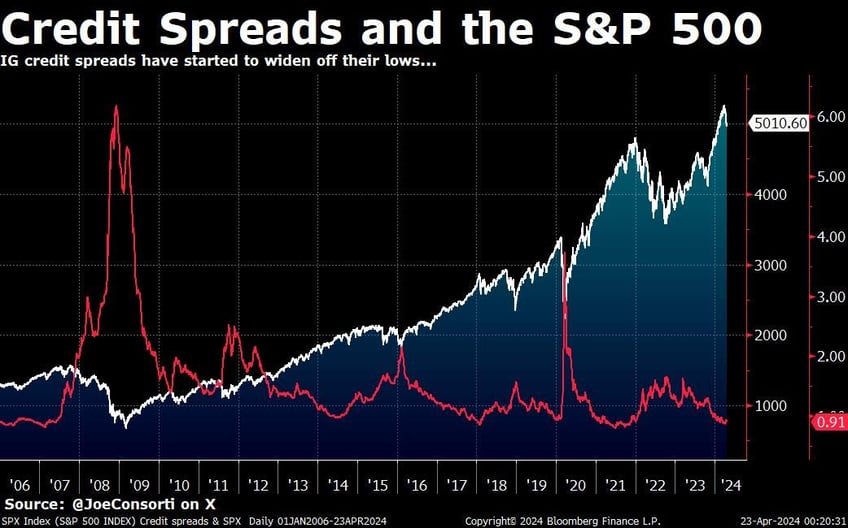

Lastly, we’re observing historically tight corporate credit spreads starting to widen off of their lows—albeit hard to see on a multi-decade chart. Will this mark a cycle shift into fully risk-off territory? We’ll know soon enough. At the very least, widening credit spreads always coincide with local tops:

The defensive positioning in the thick of rising geopolitical strife, rip-roaring yields, and a strong dollar warranted a post from us with our fair warning to remain vigilant and exercise, as Hugh Hendry puts it, extreme cautiousness.

Until next time,

Joe

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

The Bitcoin Layer is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.