Subscribe for free at RuxtonPark Research.

On February 10, 2025, we published a report on Owens & Minor (OMI:NYSE).

The company provided an operational update before meeting with investors. The news was a sneak peek of the full 2024 earnings report expected on February 28th. Management teams often do this so they can speak more freely at face-to-face meetings with investors. Otherwise, they are limited to what they have said or written previously in a public venue.

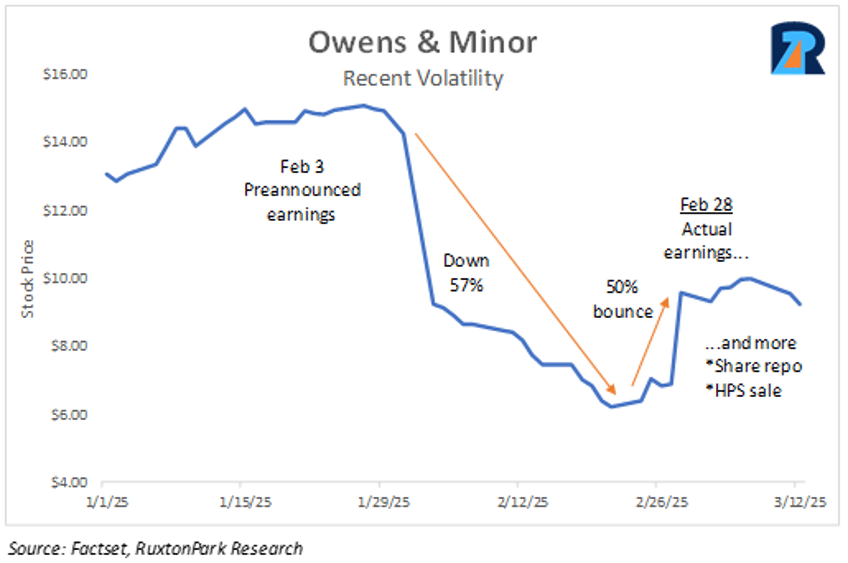

Unfortunately, the news suggested financial results for the fourth quarter and full year would fall slightly short of current analyst expectations. Adding further uncertainty, management gave no hints of 2025.

The stock sold off about 57% in the days following the update. Investors decided to sell now and ask questions later. In my view, the reaction was overdone offering investors an opportunity to buy a defensive healthcare stock on sale.

I love opportunities like this and look for them daily. You can read that full report here.

As anticipated, the poor sentiment was short-lived. On February 28 the company reported its fourth quarter and full year 2024 results. The stock closed 39% higher that day offering subscribers a nice, quick return. It was up 50% from recent lows. I trimmed a small amount but still own the majority of my position. I’m targeting a 50%+ return over my cost basis ($7).

I would make five observations about the earnings report.

1. Actual results aligned with the February 3 update. The results did not get worse. When a company preannounces results like OMI did on February 3, there is always a risk of “another shoe to drop”. That did not happen. In fact, revenue, adjusted-EBITDA, and earnings per share for 4Q24 and the full year all came in slightly higher than the renewed expectations from February 3rd.

2. 2025 financial guidance. Management provided its first view of 2025 financial expectations. Revenue of $11 billion aligned with the expectations while adjusted-EBITDA and EPS were a tiny bit lower. Important to note, management is calling for $200 million of free cash flow generation. If achieved, this represents about 27% of the current market capitalization. Said differently, that is over a quarter of the entire value of the company. Free cash is what is left over after all operating expenses and business investments have been made. It can be used for essentially anything. The proverbial wheels are not falling off the bus.

3. Share repurchase authorized by the board. The company announced a $100 million share repurchase. This was a savvy move in my view. Given the big hit to the stock, this allows the company to buy its own stock and show support aligned with shareholders. At $9.50 a share, the company can reduce shares outstanding by 14% if it chooses. This represents a great return of capital to shareholders.

4. Potential divestiture of Health Products and Services. This move has made our investment much more interesting. It has transitioned from a distressed equity buy to one with some special situation characteristics.

The HPS division accounts for about 80% of revenue but a smaller amount of earnings. This is primarily a distribution business with low single-digit net margins. The Patient Direct business accounts for about $3 billion in revenue but better profit margins. The sale of HPS would lower revenue but simplify the business, and likely not forgo any earnings. Additionally, I believe the sale could happen at 0.5x sales, or $4 billion. This would significantly enhance the balance sheet.

5. The Rotech acquisition remains on track to close in weeks. OMI is in the midst of acquiring Rotech. This is a healthcare business selling directly to consumers and durable equipment suppliers. It will bolt on to the existing Patient Direct business segment and add to revenue and earnings. Better yet, the sale of the HPS business will allow OMI to pay for Rotech with cash and still add over $1 billion of cash to the balance sheet. Important to note, the newly issued financial guidance does not account for the sale of HPS nor the acquisition of Rotech.

Like it Even More

These new strategic decisions make this even more interesting to us.

Excluding the new information, I think the stock is worth $13-$15 a share or about 46% higher than current market price (intraday 3/12). However, the sale of HPS and the acquisition of Rotech could add to that valuation, but the math will be different. Revenues will be less but earnings and growth may increase. Moreover, the stock is incredibly cheap at 3.9x EV/EBITDA. This compares to the S&P 500 at about 18.0x.

I will be doing more work on OMI and reporting back. But for now, I remain comfortable putting new money to work in OMI.

Cheers,

Thomas Carroll

RuxtonPark Research

Want to see more investment ideas I come across? Subscribe for free at https://ruxtonparkresearch.substack.com

Important Disclaimer. Nothing in this report or anything written by RuxtonPark Research, Thomas Carroll, or affiliated research should ever be considered individual investment advice. This is purely for information and educational purposes only. Every investment involves risk, and participants should do ample due diligence, seek the counsel of registered investment advisors, and only risk what they can afford to lose.