Update (0805ET):

Bloomberg reports, "AMD received similar assurances from the US Commerce Department and plans to restart shipments of its MI308 chips to China once licenses for sales are approved."

This means both AMD and Nvidia will be able to resume shipments of certain AI chips to China, pending license approvals.

In premarket trading, shares of both AMD and Nvidia were trading 4.5% higher.

Earlier, Nvidia announced that its H20 AI chips would be approved for export to China under a U.S. export license... Read below.

* * *

Nvidia shares rose as much as 5% in premarket trading in New York after the company announced in a blog post that exports of its H20 AI chips to China would be approved under a U.S. export license — a major reversal from the Trump administration's earlier stance aimed at curbing Beijing's AI ambitions.

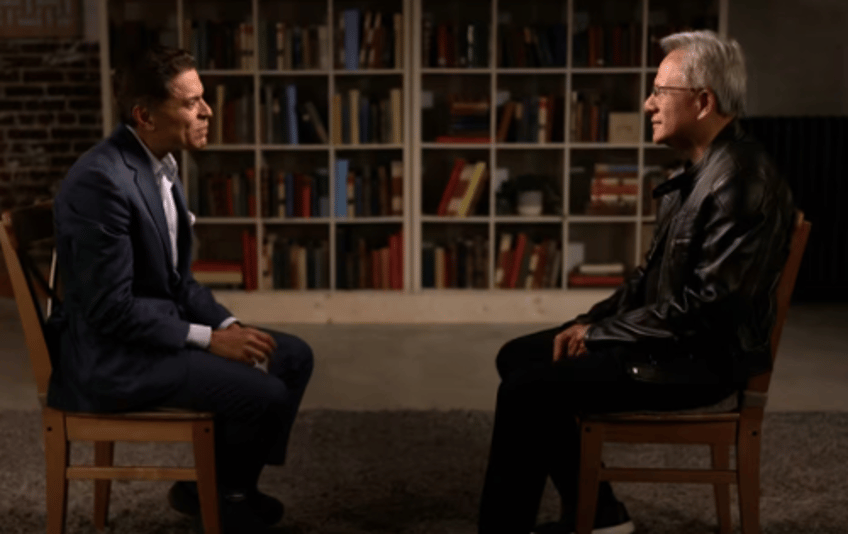

Nvidia CEO Jensen Huang visited the White House last week, appeared in a CNN interview on Sunday, and is now in China, where he met with government and industry officials to discuss AI.

In his CNN interview, Huang emphasized that ensuring U.S. leadership in the AI race requires global AI systems to be built on the American tech stack, not Chinese technology. In other words, export restrictions on Nvidia chips would need to be lifted.

Nvidia's blog post provided further details on the resumption of H20 AI chip shipments to China:

In Beijing, Huang met with government and industry officials to discuss how AI will raise productivity and expand opportunity. The discussions underscored how researchers worldwide can advance safe and secure AI for the benefit of all.

Huang also provided an update to customers, noting that NVIDIA is filing applications to sell the NVIDIA H20 GPU again. The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon.

Well telegraphed...

Nvidia previously projected it would lose billions of dollars in revenue this quarter due to sales restrictions. In the fiscal first quarter, it took a $4.5 billion charge related to the licensing rule, citing "excess inventory and purchase obligations as demand for the H20 diminished." The company estimated that the rule led to $2.5 billion in lost first-quarter revenue and anticipated an additional $8 billion in losses in the second quarter.

In May, Huang told investors, "The $50 billion China market is effectively closed to U.S. industry." Now it appears the Chinese market is back on the table.

The approval of export licenses for the H20 chip will serve as a goodwill gesture by the Trump administration to progress trade talks with Beijing.