Cocoa futures in New York reached a new record high this week, exceeding $10,000 per metric ton. Since the start of the year, prices have surged 150%. It smells like hyperinflation.

At the start of February, candy producer Hershey Co's CEO warned: "Historic cocoa prices are expected to limit earnings growth this year."

Now, Wall Street analysts are downgrading the Hershey's Kisses maker because record-high cocoa prices will spark diminishing consumer demand as retail prices of chocolate bars soar.

BNP Paribas Exane's Max Gumport wrote in a note to clients that his recommendation on Hershey was cut from "outperform" to "neutral" on the thesis that cocoa inflation is "Not So Transitory."

"The implementation of the EU Deforestation Regulation is adding structural costs into the system," Gumport said, adding, "A meaningful portion of the cocoa inflation we are currently seeing could well be structural" due to the EU regulation."

He said this is a "step change" in his view that the "vast majority" of the cocoa price surge was due to "temporary supply demand imbalance" from West Africa.

The analysts reduced his 2025 adjusted earnings per share estimate for Hershey by 9% to $9.59 primarily because of the elevated prices that are set to stick around for years. This represents a Wall Street low, according to Bloomberg data, which has a consensus target for next year's EPS of $10.19

Morgan Stanley recently downgraded Hershey to "underweight" from "equal-weight," citing significant risks to Hershey's mid-term outlook, including the "outsized" cocoa inflation.

Bloomberg data shows there are 6 "buys," 19 "holds," and 1 "sell" on Hershey.

Here are the latest analyst recommendations on the chocolate company.

Higher bean prices are an ominous sign for shares of Hershey.

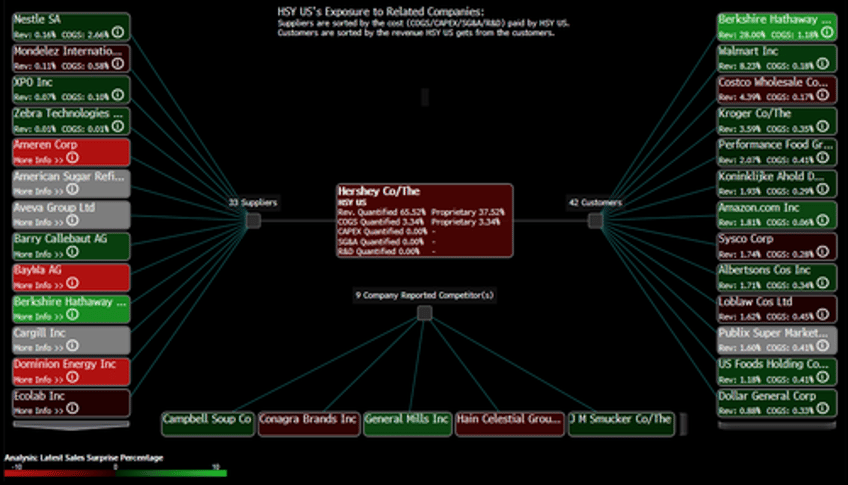

Cocoa inflation is unwelcoming news for consumers ahead of Easter weekend. Bloomberg data provides a supply chain analysis of which companies sell the most Hershey products.

All of a sudden, the rise in cocoa prices looks less transitory. It will only feed into long-lasting food inflation that will pressure consumer pocketbooks.