By Jonathan Newman, Mises Institute

“Why do we borrow our own currency in the first place?”

Stephanie Kelton posed this question in her new documentary, Finding the Money, and a clip of Jared Berstein’s fumbled response to the question has gone viral on social media. Bernstein is the Chair of the Council of Economic Advisers to Biden, and so we would expect that he would have an articulate answer to Kelton’s question, but he did not.

Instead of trying to parse his response or explain why he fumbled, I want to provide an answer: the State borrows to expropriate real resources from the private, productive part of society.

When I made this claim on Twitter, one MMTer responded (somewhat) approvingly: “We all agree on this part. The question is how they do it and what the effect is. MMT gets that part right [and] Austrians get it wrong.”

So let me go into a bit more detail. The reason the State borrows money (money that it also has the power to tax and print) is so that it can balance the negative political consequences of its various methods of expropriation.

Murray Rothbard would take issue with the original question as soon as the third word, “we,” is uttered:

The useful collective term “we” has enabled an ideological camouflage to be thrown over the reality of political life. If “we are the government,” then anything a government does to an individual is not only just and untyrannical but also “voluntary” on the part of the individual concerned. If the government has incurred a huge public debt which must be paid by taxing one group for the benefit of another, this reality of burden is obscured by saying that “we owe it to ourselves” (Anatomy of the State, p. 10)

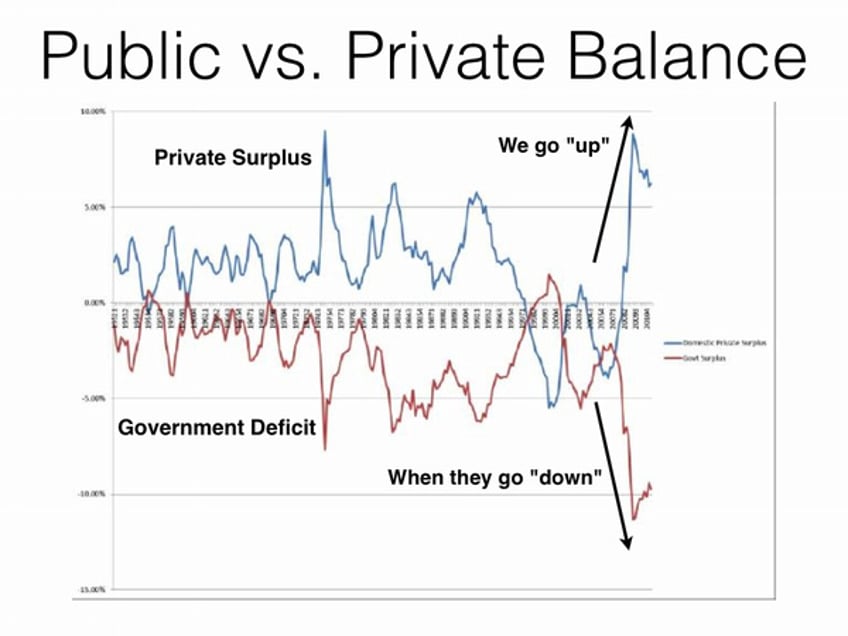

Rothbard was responding to those who downplay the burden of government debt by over-aggregating the groups of winners and losers into one “we.” MMTers, on the other hand, go many strides further by claiming that public debt isn’t a burden at all. For them, public debt is private savings—they literally flip public debts and deficits upside down.

While they describe their framework as providing the “full picture” of government finance, they do not proceed in their analysis (at least not in sufficient detail) by asking what happens when the government pays the people holding the bonds. The money used to pay back the bondholder ultimately comes from taxing and printing, both of which involve expropriation from the private sector.

So MMT’s public-debt-as-private-savings falls apart with just one additional step of analysis. The closest Kelton gets to this insight in her book, The Deficit Myth, is...(READ THIS FULL ARTICLE, FREE, HERE).