How well are Americans managing their money, and how does it vary between the states?

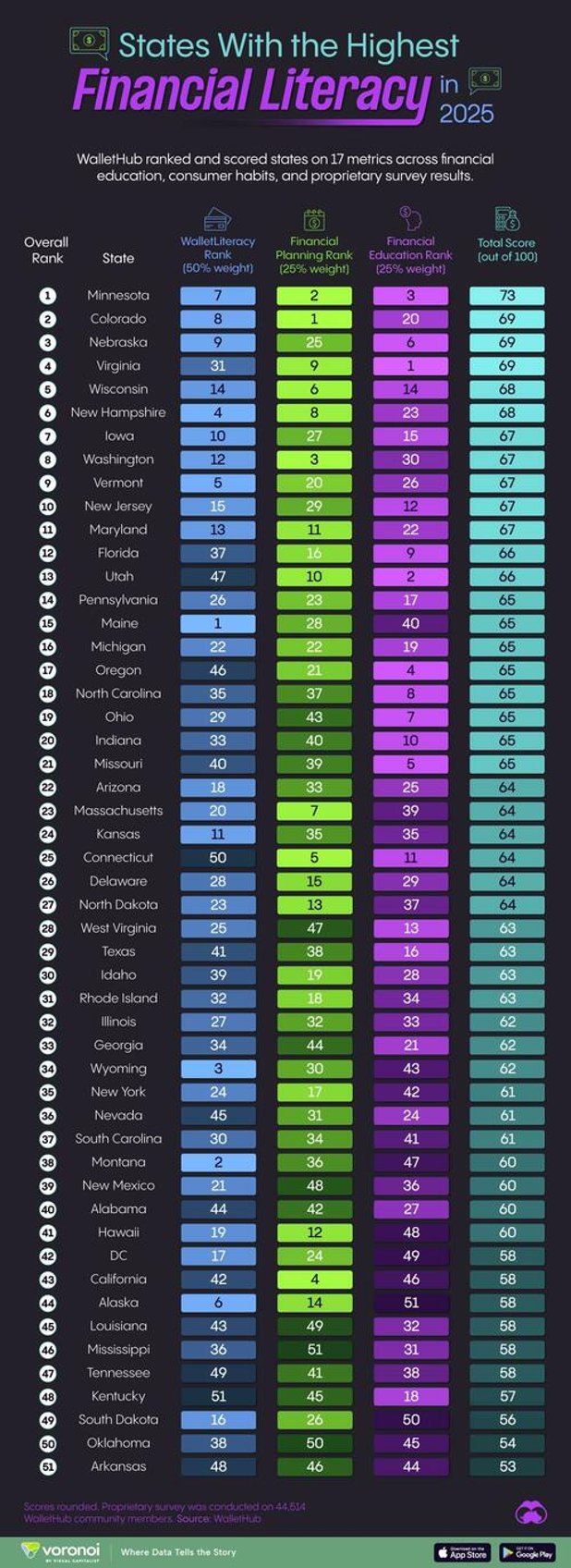

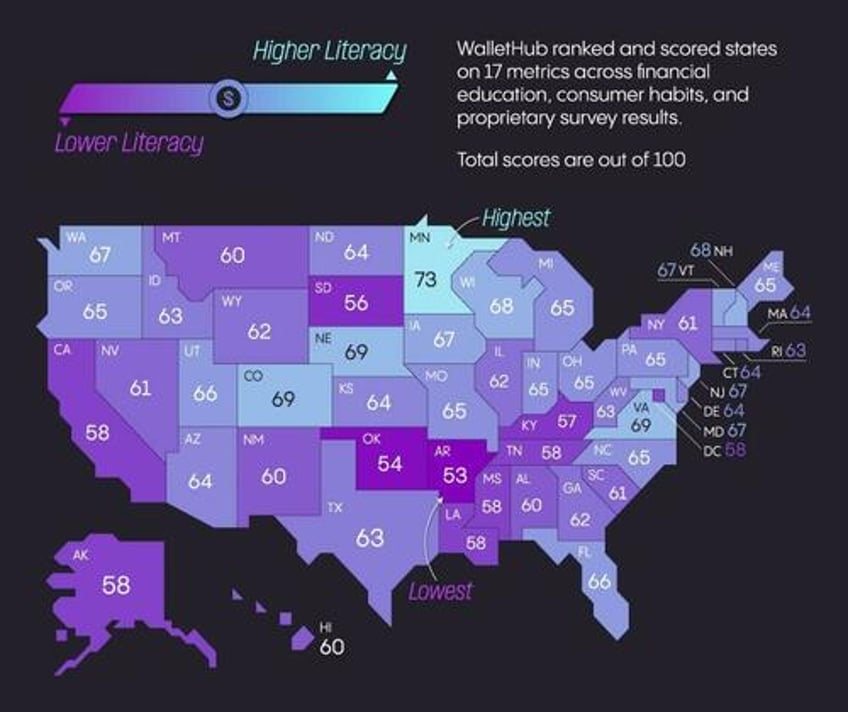

This financial literacy map, via Visual Capitalist's Pallavi Rao, attempts to answer both questions using 2025 data from WalletHub, a personal finance services company.

They ranked and scored states on three main benchmarks: financial education, financial planning (or consumer habits), and how Wallethub’s own users performed on their financial literacy survey.

ℹ️ These benchmarks are further subdivided into 17 metrics (credit score, savings, personal finance courses, etc.) and are weighted differently. Please read the source’s methodology section for a full breakdown.

The Most Financially Savvy U.S. State

Minnesota is the most financially literate U.S. state with 73 points, according to WalletHub’s latest analysis.

Here’s some sub indicators where Minnesota outperformed the rest of the country.

- High-schoolers must take at least one personal finance program.

- Only 15% of the surveyed Minnesotans spent more than they made—the lowest across all states.

- Highest median credit score in the country (751).

And here’s how each state scores out of 100. Figures are rounded.

| Rank | State | State Code | Total Score (Out of 100) |

|---|---|---|---|

| 1 | Minnesota | MN | 73 |

| 2 | Colorado | CO | 69 |

| 3 | Nebraska | NE | 69 |

| 4 | Virginia | VA | 69 |

| 5 | Wisconsin | WI | 68 |

| 6 | New Hampshire | NH | 68 |

| 7 | Iowa | IA | 67 |

| 8 | Washington | WA | 67 |

| 9 | Vermont | VT | 67 |

| 10 | New Jersey | NJ | 67 |

| 11 | Maryland | MD | 67 |

| 12 | Florida | FL | 66 |

| 13 | Utah | UT | 66 |

| 14 | Pennsylvania | PA | 65 |

| 15 | Maine | ME | 65 |

| 16 | Michigan | MI | 65 |

| 17 | Oregon | OR | 65 |

| 18 | North Carolina | NC | 65 |

| 19 | Ohio | OH | 65 |

| 20 | Indiana | IN | 65 |

| 21 | Missouri | MO | 65 |

| 22 | Arizona | AZ | 64 |

| 23 | Massachusetts | MA | 64 |

| 24 | Kansas | KS | 64 |

| 25 | Connecticut | CT | 64 |

| 26 | Delaware | DE | 64 |

| 27 | North Dakota | ND | 64 |

| 28 | West Virginia | WV | 63 |

| 29 | Texas | TX | 63 |

| 30 | Idaho | ID | 63 |

| 31 | Rhode Island | RI | 63 |

| 32 | Illinois | IL | 62 |

| 33 | Georgia | GA | 62 |

| 34 | Wyoming | WY | 62 |

| 35 | New York | NY | 61 |

| 36 | Nevada | NV | 61 |

| 37 | South Carolina | SC | 61 |

| 38 | Montana | MT | 60 |

| 39 | New Mexico | NM | 60 |

| 40 | Alabama | AL | 60 |

| 41 | Hawaii | HI | 60 |

| 42 | District of Columbia | DC | 58 |

| 43 | California | CA | 58 |

| 44 | Alaska | AK | 58 |

| 45 | Louisiana | LA | 58 |

| 46 | Mississippi | MS | 58 |

| 47 | Tennessee | TN | 58 |

| 48 | Kentucky | KY | 57 |

| 49 | South Dakota | SD | 56 |

| 50 | Oklahoma | OK | 54 |

| 51 | Arkansas | AR | 53 |

Meanwhile, Arkansas tested the worst, with 53 points. Its score is impacted by having the second-worst performance on WalletHub’s financial literacy survey.

And here’s each state’s rank within the three main benchmarks.

| Rank | State | WalletLiteracy Rank (50% Weight) | Financial Planning Rank (25% Weight) | Financial Knowledge Rank (25% Weight) |

|---|---|---|---|---|

| 1 | Minnesota | 7 | 2 | 3 |

| 2 | Colorado | 8 | 1 | 20 |

| 3 | Nebraska | 9 | 25 | 6 |

| 4 | Virginia | 31 | 9 | 1 |

| 5 | Wisconsin | 14 | 6 | 14 |

| 6 | New Hampshire | 4 | 8 | 23 |

| 7 | Iowa | 10 | 27 | 15 |

| 8 | Washington | 12 | 3 | 30 |

| 9 | Vermont | 5 | 20 | 26 |

| 10 | New Jersey | 15 | 29 | 12 |

| 11 | Maryland | 13 | 11 | 22 |

| 12 | Florida | 37 | 16 | 9 |

| 13 | Utah | 47 | 10 | 2 |

| 14 | Pennsylvania | 26 | 23 | 17 |

| 15 | Maine | 1 | 28 | 40 |

| 16 | Michigan | 22 | 22 | 19 |

| 17 | Oregon | 46 | 21 | 4 |

| 18 | North Carolina | 35 | 37 | 8 |

| 19 | Ohio | 29 | 43 | 7 |

| 20 | Indiana | 33 | 40 | 10 |

| 21 | Missouri | 40 | 39 | 5 |

| 22 | Arizona | 18 | 33 | 25 |

| 23 | Massachusetts | 20 | 7 | 39 |

| 24 | Kansas | 11 | 35 | 35 |

| 25 | Connecticut | 50 | 5 | 11 |

| 26 | Delaware | 28 | 15 | 29 |

| 27 | North Dakota | 23 | 13 | 37 |

| 28 | West Virginia | 25 | 47 | 13 |

| 29 | Texas | 41 | 38 | 16 |

| 30 | Idaho | 39 | 19 | 28 |

| 31 | Rhode Island | 32 | 18 | 34 |

| 32 | Illinois | 27 | 32 | 33 |

| 33 | Georgia | 34 | 44 | 21 |

| 34 | Wyoming | 3 | 30 | 43 |

| 35 | New York | 24 | 17 | 42 |

| 36 | Nevada | 45 | 31 | 24 |

| 37 | South Carolina | 30 | 34 | 41 |

| 38 | Montana | 2 | 36 | 47 |

| 39 | New Mexico | 21 | 48 | 36 |

| 40 | Alabama | 44 | 42 | 27 |

| 41 | Hawaii | 19 | 12 | 48 |

| 42 | District of Columbia | 17 | 24 | 49 |

| 43 | California | 42 | 4 | 46 |

| 44 | Alaska | 6 | 14 | 51 |

| 45 | Louisiana | 43 | 49 | 32 |

| 46 | Mississippi | 36 | 51 | 31 |

| 47 | Tennessee | 49 | 41 | 38 |

| 48 | Kentucky | 51 | 45 | 18 |

| 49 | South Dakota | 16 | 26 | 50 |

| 50 | Oklahoma | 38 | 50 | 45 |

| 51 | Arkansas | 48 | 46 | 44 |

There’s some further insights to explain some noticeable geographic trends.

- Colorado and Nebraska also require personal finance education in high school.

- Kentucky, Oklahoma, and Arkansas have the lowest share of adults with emergency cash.

- A higher share of Southern state residents borrow from non-bank lenders, affecting their financial planning score.

The Overlooked Part of Financial Literacy: Managing Debt

While investing in the markets is all the rage—particularly with the rise of no-fee platforms—WalletHub’s benchmarks prioritize an often overlooked part of money management: debt.

America’s credit card debt collectively crossed $1 trillion in 2023, and it’s only been growing since.

On average, American households have about $5,000 in outstanding credit card balances, which can take anywhere between one to two years to pay off depending on monthly incomes.

Of course, managing expenditures to avoid or reduce debt has been particularly difficult in the multiple years of post-pandemic inflation.

Need more money management insights about the United States? Check out: America’s Average Bank Account Balance, by State for a quick overview.