Making Sense Of Syria

Our friend Sergei Witte is arguably the best military analyst on X. We've shared his commentary on the Russia-Ukraine war here before, but he follows other wars too. Today he offered a timely summary of the situation in Syria, given the news that Assad's forces are in retreat.

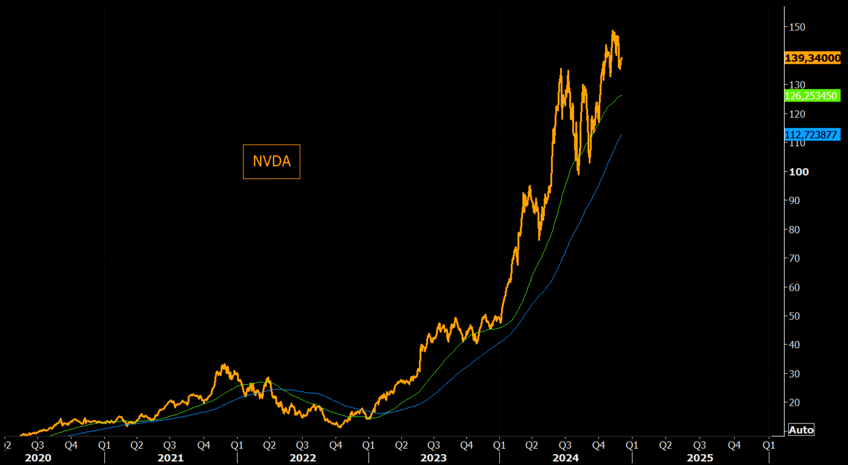

If you've been following Syria from the beginning this will be very basic, but lots of people are keying in for the first time after the rebel shock offensive on Aleppo. It's worth reviewing the basic operational geography of Syria.

The Syrian Arab Army (SAA) [Assad's army] is staring down the barrel of a cataclysm after melting away across the northwestern front.

The structural problem, as such, is that the government's twin strongholds (around the capital in Damascus and on Syria's Mediterranean coastline) can be severed from each other if Hama and Homs can be taken along the vital M5 artery (which runs north-south and connects the country's largest cities from Damascus to Aleppo).

With Hama fallen, Homs is all that remains to connect the capital with Alawite stronghold along the coastal range. The capital would also lose ground lines of communication with critical Russian bases, including the naval base at Tartus and the Khmeimim Air Base at Latakia.

If the SAA loses Homs, it will the climax to a totalizing strategic disaster.

Again, this is all well worn stuff to people that have been following this war for the last decade, but hopefully this simplified map can help people who are new to the subject cut through and see the basic dynamics at play here.

In Case You Missed It

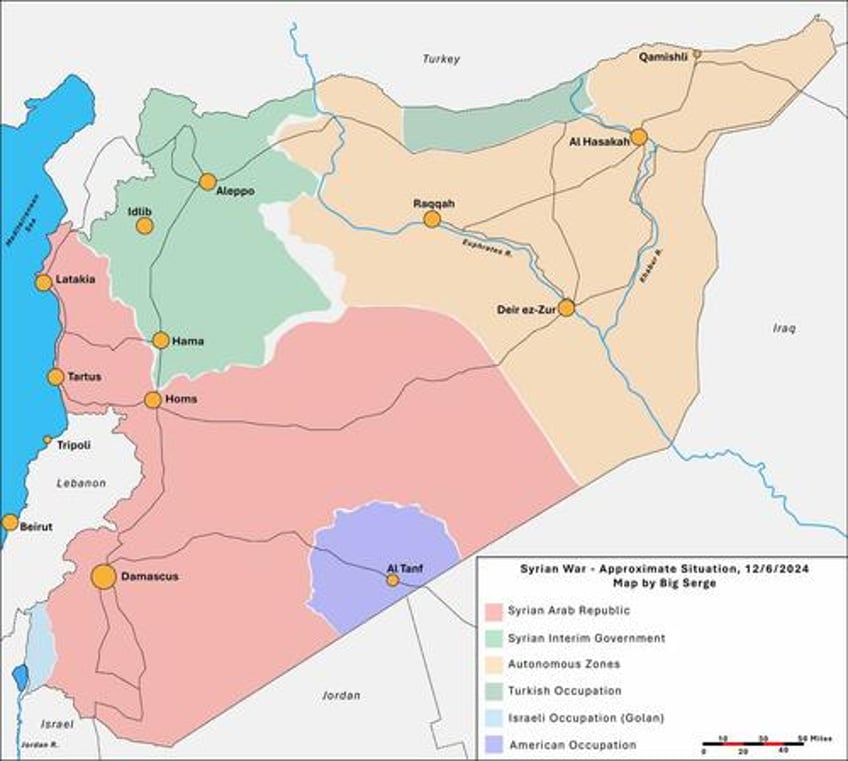

As The Market Ear reported yesterday ("A Legend Expects A Crash In NVDA"), a longtime Nvidia (NVDA) observer expects a crash in the stock:

A PhD in NVDA crashes

"Over the past 25 years, I’ve witnessed five NVDA stock collapses of at least 55% and up to 90% and I’ve participated (via put options) in most of them. I expect a sixth relatively soon. As most know, I’ve been trading in and out of NVDA longer - term puts in recent months. However, prior to their latest report. I put the position back on in bigger size" (Fred Hickey)

The AI overbuilding bender

"Proving that human psychology never changes, here we are 24 years later and the tech industry is on another one of its overbuilding benders, even though it’s clear (to me) the result will (inevitably) be a capacity glut and collapse. Instead of the limitless computing capacity needs of the Internet, this time it’s the artificial intelligence (AI) story driving the capacity build out. This is a more dire situation than the great fiber-optic capacity overbuilds"

(Fred Hickey)

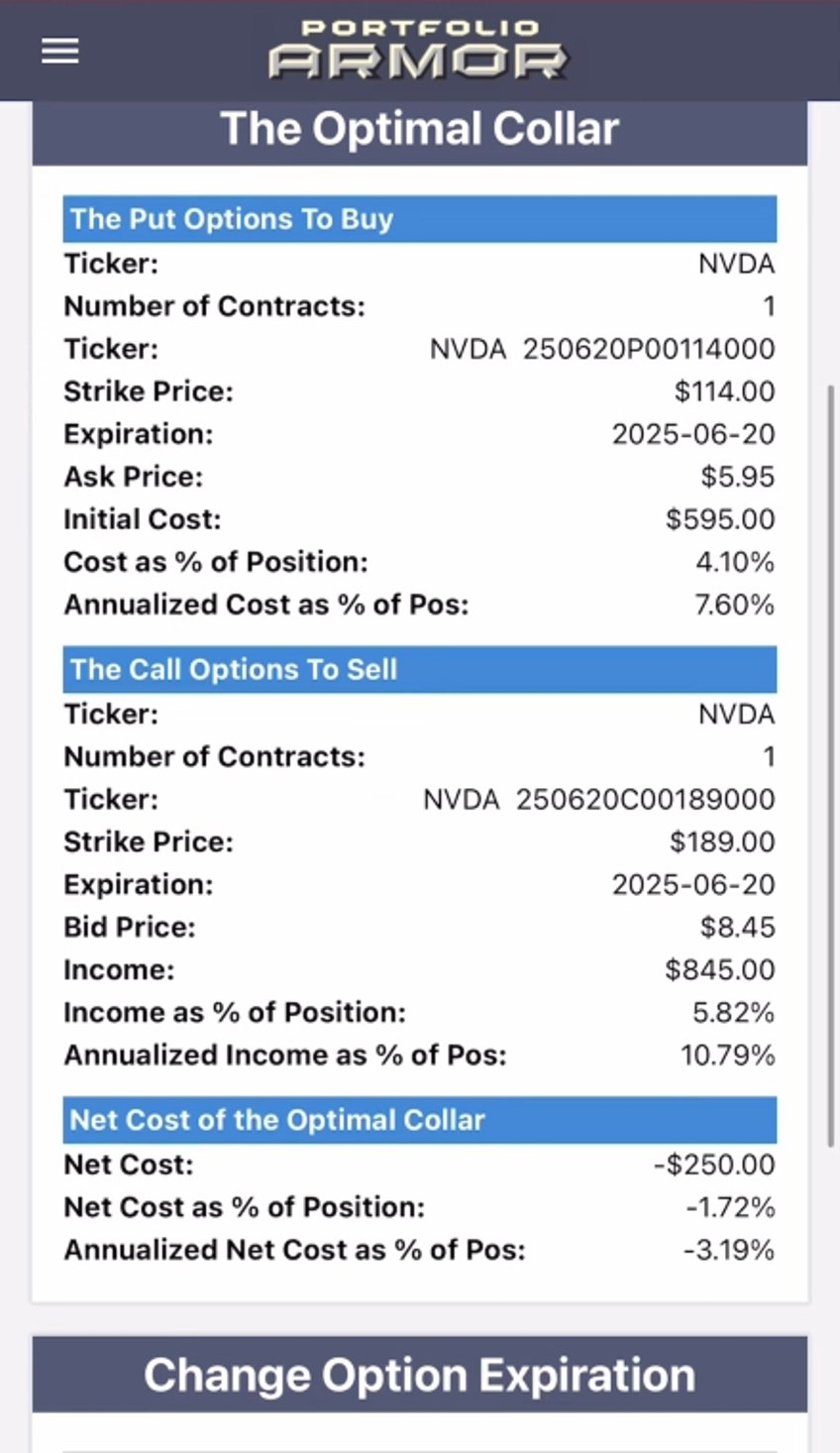

In the event Hickey is right, here are a couple of ways you can hedge your NVDA shares, one with optimal puts, and other with an optimal collar that effectively pays you to hedge:

@dpinsen Hedging Nvidia $NVDA

♬ Twilight Galaxy - Metric

Here's a closer look at that second hedge, an optimal collar on Nvidia.

Note that the net cost of that hedge is negative, meaning you would have collected a net credit of $250 when opening it.

That hedge was calculated as of Thursday's close. For an updated one, you can use the Portfolio Armor iPhone app. You can download it by aiming your iPhone camera at the QR code below, or by tapping here if you are reading this on your phone.

And if you would like a heads up next time we place an aggressive trade, like our recent winner on Robinhood Markets, Inc. (HOOD)

- Calls on Robinhood Markets (HOOD -0.95%↓). Bought for $1.70 on 11/12/2024; sold (half) for $6 on 11/25/2024. Profit: 253%.

You can subscribe to our trading Substack/occasional email list below.

If you'd like to stay in touch

You can follow Sergei Witte on X here, and subscribe to his Substack here.

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).