Submitted by QTR's Fringe Finance

To most of my readers, the move in markets today won’t be much of a surprise. In fact, a couple of the names I talked about over the last week or two (and here) are actually green in today’s blood red tape.

For the most part, I’ve already explained why I think markets could be set up for a much bigger move lower. I detailed this in both my March market review and my piece explaining why I think the next crash could very well be different from those of days past and could “break the brain” of market participants, as I detailed here.

I wasn’t going to write a piece midday today until I turned on the television and, despite the best efforts of David Faber to inject some semblance of reality onto CNBC guests, watched portfolio managers justify paying 26x to 40x earnings for tech stocks they said are “on sale”. Thank God I hadn’t eaten lunch yet, or I may have heaved.

So here’s my quick take on where we stand today and what I’ll be watching for to try and denote some type of overall market bottom in the future.

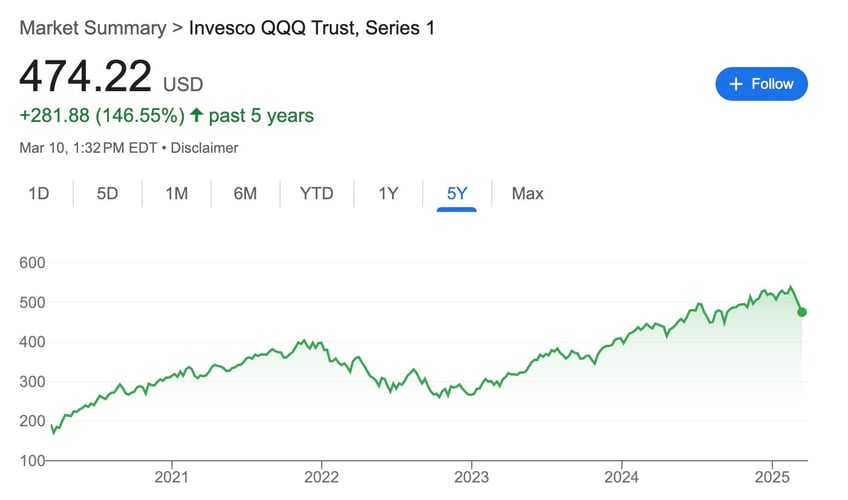

First, let’s keep our bearings about us. While the NASDAQ is down more than 3% today, it is still up more than 140% over the last five years.

Those are astonishing returns that, in my opinion, have been fueled by insanely euphoric expectations, arrogance, hubris, a relentless passive bid as a result of Covid liquidity, and weaponized gamma in the options market.

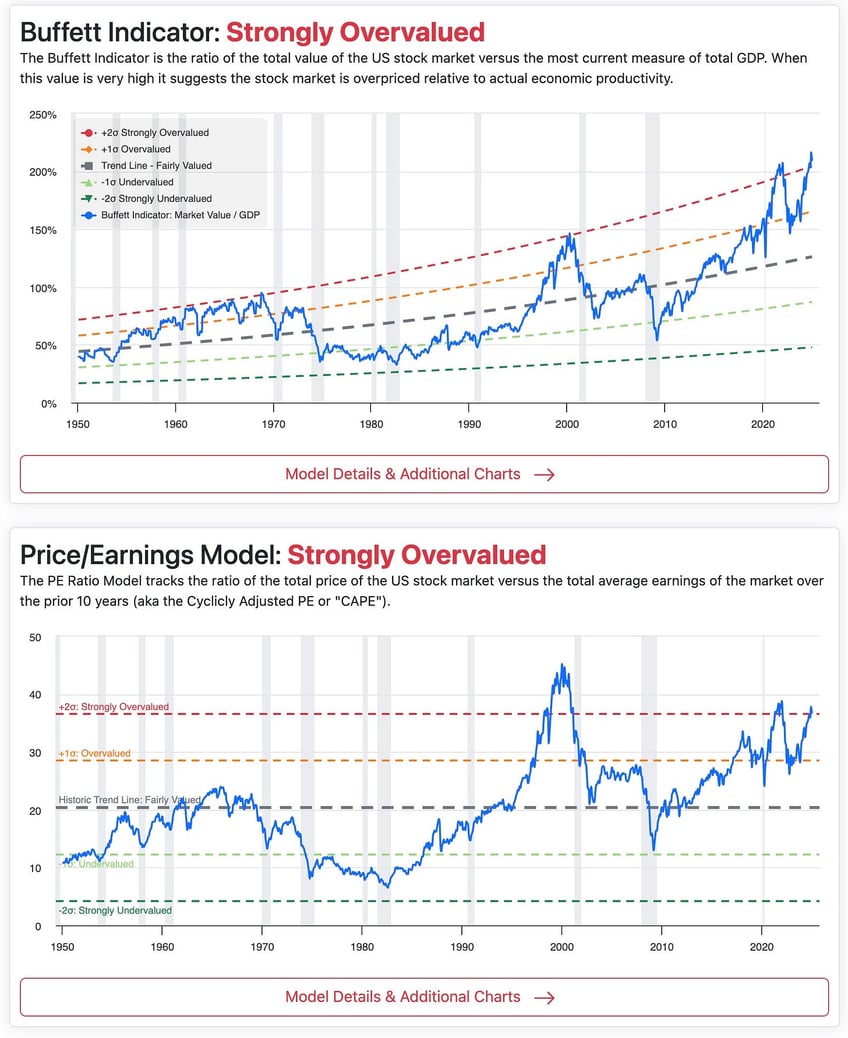

It was a combination of these three things, in my opinion, that led us to far overshoot the euphoria mark on pretty much all valuation metrics. Which is how we got here:

Today when I turned on CNBC, I actually saw David Faber doing a great job of trying to keep some semblance of reality in the air as multiple guests came on and tried to make the ridiculous argument that the tech bullshit they have stuffed their portfolios with at all time highs is somehow “on sale” or “cheap” with names like Apple, Microsoft, and Nvidia still sporting price-to-earnings ratios between 26x and 40x.

“Just take a long-term view,” one of the analysts said today, telling David Faber he was directing his trading team to buy more Microsoft while on the air around lunchtime.

Faber actually did a pretty good job trying to paint a picture of the psychology of the market as it stands today. What he said mostly aligns with what I have been saying over the last couple of weeks: that there is a psychological shift taking place deep in the foundations of the market, not only where people are beginning to entertain the idea that we’re entering a bear market, but also simultaneously entertaining the idea of a rotation out of risk-on speculative US technology stocks and into both US industrials and emerging markets—a sentiment that I have been predicting would take place dating all the way back to the beginning of last year. Here’s what I wrote at the beginning of 2024:

2023 was a year marked by insanely aggressive gains in tech and the NASDAQ. Despite higher rates, investors still haven’t shifted their investing outlook from growth to value, and, as shown in the price of commodities, investors still aren’t positioning themselves defensively. This is a rotation that is long overdue, in my opinion.

I feel like with valuations where they are, technology names could wind up seeing a significant pullback in the coming year, while the steady and consistent dividends of utilities and consumer staples could produce a total return for the year that should be able to beat both the S&P and the NASDAQ if I’m correct.

With the Japanese bond market now on the verge of cracking up, Germany not far behind, and the US eventually going to follow suit, it sure does seem like...(READ THIS FULL COLUMN HERE).

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.