We have been referring to the growth of M2 (money supply) as one of the factors that shows that the Fed has NOT been fighting inflation in our previous articles on Zerohedge (“The Fed Is the Instigator of Speculative Bubbles,” and “The Makings of a Huge Speculative Frenzy, Bigger Than The Dotcom Bubble”).

Let’s face it; the Fed is all talk!

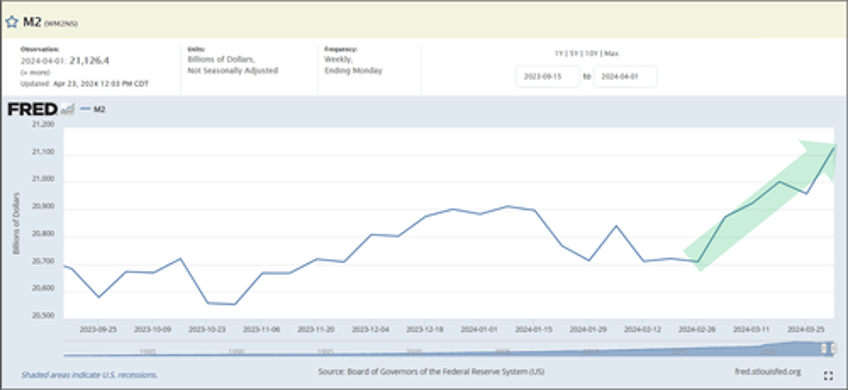

Below we show the updated weekly chart of Money Supply M2, which continues to soar. It is the “not seasonally adjusted” and therefore, does not include the usual fudge factor of “seasonal adjustment” (chart via St. Louis Fed, with our annotations).

During the double-digit inflation period of 1978-1980, our ability to understand the difference between the “seasonally adjusted” and “not seasonally adjusted” data saved and made our members a fortune.

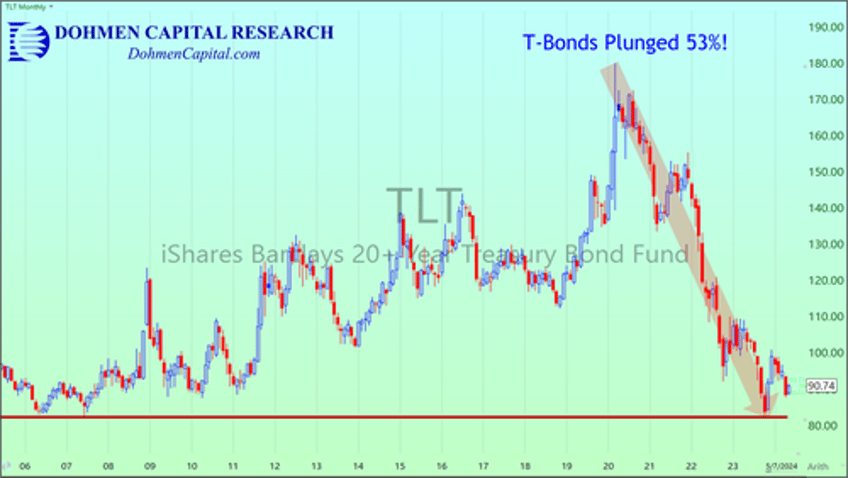

The prime rate at banks hit a high of 20% in March 1980. Then rates dropped significantly. The bond bulls jumped in and bought T-bonds. Big mistake!

In the summer of 1980, the “seasonally adjusted” money supply growth was still down significantly from its peak earlier that year. But we noticed that the “not seasonally adjusted” M2 started rising rapidly although the Fed vowed it was still fighting inflation. That was a complete lie!

That led us to accurately predict a new peak in the prime rate by the end of the year.

Lo and behold, on December 10, 1980, the prime rate made a new high of 21.5%.

This current cycle, the prime rate may not go quite that high because the economic statistics are so intentionally false.

Look at the beautiful upside chart breakout of M2 on the chart above, soaring to a new high above the previous January 2024 high. If that were a stock, it would be a “buy.”

FINANCING THE DEFICITS: The Fed is stuck between a rock and hard place due to persistent inflation and the pressure of financing the record Treasury deficits.

We have written in our Wellington Letter that we believe the massive amount of Treasury debt to be sold each week in the markets, to finance the huge deficits, will eventually cause “indigestion,” i.e. a buyer strike.

Is it possible that perhaps they want to blame the weakness of the bond market, i.e. rising rates, on inflation?

The US Treasury cannot allow the market to start worrying about insufficient market demand for the Treasury debt. Therefore, it is better to blame the weak bond market on inflation pressures.

Look at the longer-term monthly chart of the ETF for T-bonds, TLT. It plunged 53% into late 2023, rallied, and now should go back to the 2023 low (red horizontal line).

CONCLUSION: The Fed is being forced to step on the accelerator to enable the financing of the record deficits at the US Treasury. They know that is inflationary, but they have no alternative.

Therefore, all the talk about how many times the Fed will cut rates this year is BS! They know that they most probably will not be able to cut ruts at all, which will only add more fuel to the markets, especially in the top sectors and stocks that have been propelling this recent rise.

Want to read more about how the Fed is fueling the big AI rally? Check out our latest research report, “The Artificial Intelligence Rally: How You Can Thrive In The Greatest Wealth Opportunity In Decades.”

In our new 21-page report, we reveal how you can profit in this rare market environment. We also explain why the current AI frenzy will exceed the dotcom bubble from the year 2000, which will offer incredible opportunities for those who know how to invest during speculative times.

Readers will also learn about our short-, medium-, and longer-term market forecasts in this pivotal and important election year, allowing investors to position their portfolios now for the great profit potential throughout 2024.

Get your copy FREE for a limited time only. Simply go to DohmenCapital.com or click this link: Get My Free AI Rally Report Now!