"Many good things may happen, but the actual occurrence remains to be seen..."

That's about as rosy a picture as one could glean from the respondents to today's Dallas Fed Manufacturing survey.

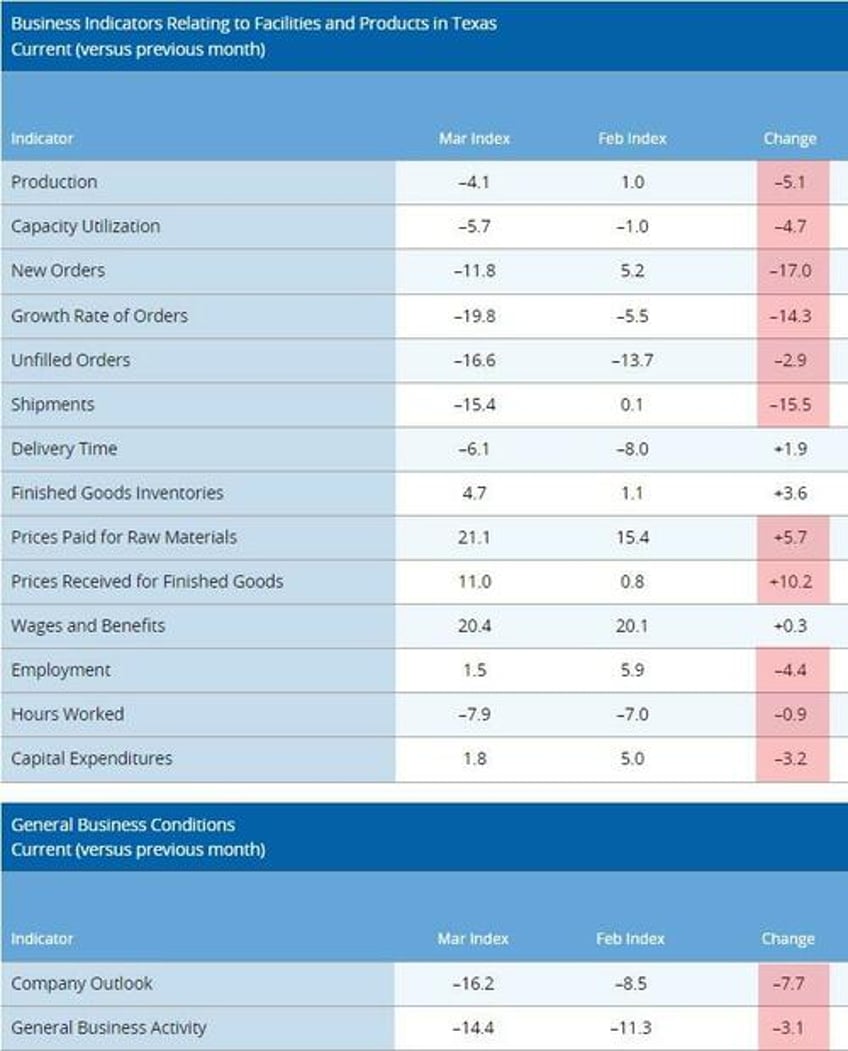

Against expectations of a small improvement from -11.3 to -10.0, the headline sentiment gauge dropped to -14.4 (the lowest end of analysts' forecasts).

Furthermore, the production index, a key measure of state manufacturing conditions, fell five points to -4.1, a reading that suggests a slight decline in output month over month.

Other measures of manufacturing activity also indicated declines this month.

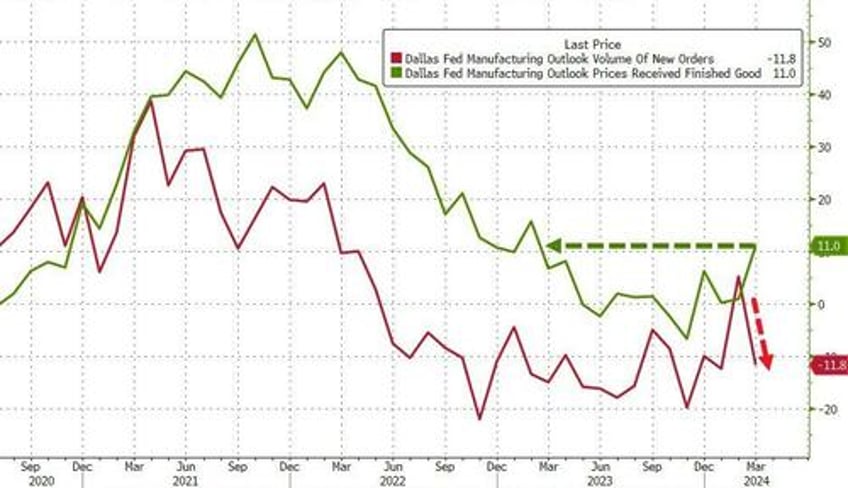

The new orders index - a key measure of demand - dropped 17 points to -11.8 after briefly turning positive last month.

The capacity utilization index edged down five points to -5.7, and the shipments index plunged from 0.1 to -15.4.

The decline in new orders came alongside a surge in prices as raw materials costs rose to 13-month highs...

Source: Bloomberg

That has the stench of stagflation lathered all over it.

It's notr a pretty picture at all under the hood...

And worse still, the prices passed on to end-users is rising and expectations for future price-hikes are also rising...

Source: Bloomberg

But it was the respondents comments that perhaps signal the reality that so many Americans are facing...

There's a lot of uncertainty:

Election, energy and interest rate uncertainty makes business planning difficult.

We kept thinking orders would pick up in the first quarter, but they have not. In fact, they've gotten even fewer and farther apart. Is it election uncertainly, a lack of peace overseas, money still being too expensive, or is it just a wet blanket over the entire economy? We don't know, but we're anxious to get some momentum going into the second half of the year.

Will the consumer continue to spend enough to promote growth? This is the question I cannot answer confidently.

We are seeing general business activity slowing and competition increasing. We generally see this trend as business slows and our competitors become more hungry.

But some are more vocal about the real state of the union...

Only time will tell the true underlying health of the labor market. While there are no disclosures we’re in a recession, ask any manufacturer on the globe and they will tell you we are deep into it. The backbone manufacturing of this country isn’t looking good at all. What is clear is that economic risks abound, and a soft landing is far from the truth out here. I have never seen it this bad in the capital equipment industry in the last 30 years.

A business is only as good as its customers’ business and is completely dependent upon its customers' demand - and demand is weak. It's a far stronger, deeper recession than publicized.

And finally, a direct shot at the Democratic Party agenda:

- Political discussions about taxes are extremely dishonest, and future proposed increases to taxes will further reduce U.S. manufacturing competitiveness globally. I find it very insulting and disingenuous when medium-sized companies are called out as not paying "our fair share" of taxes. Currently, if you look at our total tax paid versus our total profit, we are taxed at over 60 percent as a medium-sized manufacturing company. We can't expand employment, technology and innovation to compete with China with higher taxes.

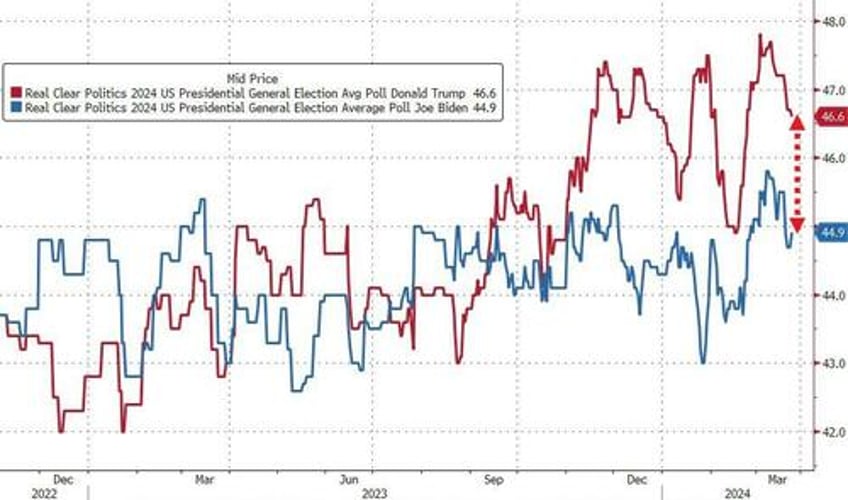

But, hey Joe, keep on telling Americans just how good they've got it!! See how that's working out for you...

Can the Democrats really gaslight their way to getting re-elected... again? With a little help from Powell, maybe.