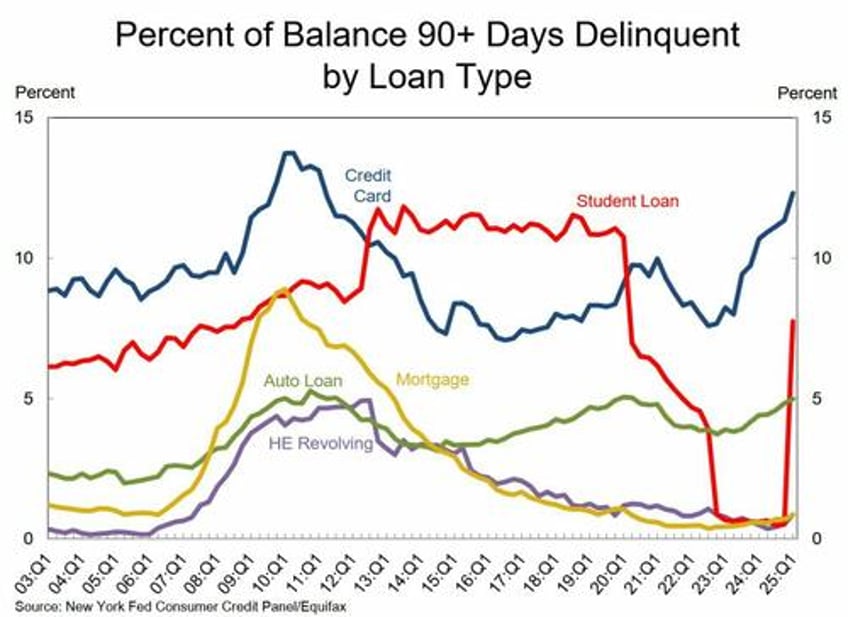

Last week we noted new report from the New York Federal Reserve, which showed that while Americans' credit card debt is falling, credit scores are starting to decline due to an uptick in student loan delinquencies.

The NY Fed's Center for Macroeconomic Data's quarterly report reveals that overall household debt rose by $167 billion - with credit card debt declining by $29 billion. Yet, the delinquency rate for student loans surged from below 1% to nearly 7.7% after a pandemic-era pause on student loan payments was lifted in September 2023.

While the payments were resumed, policymakers extended a one-year ramp-up period that shielded borrowers' missed payments from being reported to credit bureaus. This extension expired in October 2024, with delinquencies starting to hit the first quarter of 2025.

Needless to say, it's total carnage among borrowers, as one can see from Reddit's 'StudentLoans' forum.

"My credit score dropped 240+ points. i dont know what to do!!" said one Redditor, who says she can't pay her bills because she doesn't have a job after graduating in 2024.

"My score was in the high 700s and dropped to about 480," said another Redditor, who said they were notified by reporting agency Experian that their credit "took a massive hit."

"My transunion and equifax scores took a -100 hit due to my loans "just being recognized this January,"" reported another borrower.

"My credit dropped from a 720 to a 550," said yet another - who reported having "6 total loans from school" that have been "deferred for a while."

"Credit Got Torched" reads a Friday post. "i am unfortunately 1 of the 9 million people who received delinquency marks on my credit report from the dept of education for student loans, which decreased my credit score by 118 points."

Interestingly, several redditors said their scores tanked from loans taken out in their names that they were unaware of - including the first example, who said "I have 10 student loans overall, 5 sub, 5 unsub, and have never had anything else on my credit or anything, no cards or loans, etc. I did get my identity stolen, but I disputed the loans that were taken out fraudulently, and my score was barely affected at all from it."

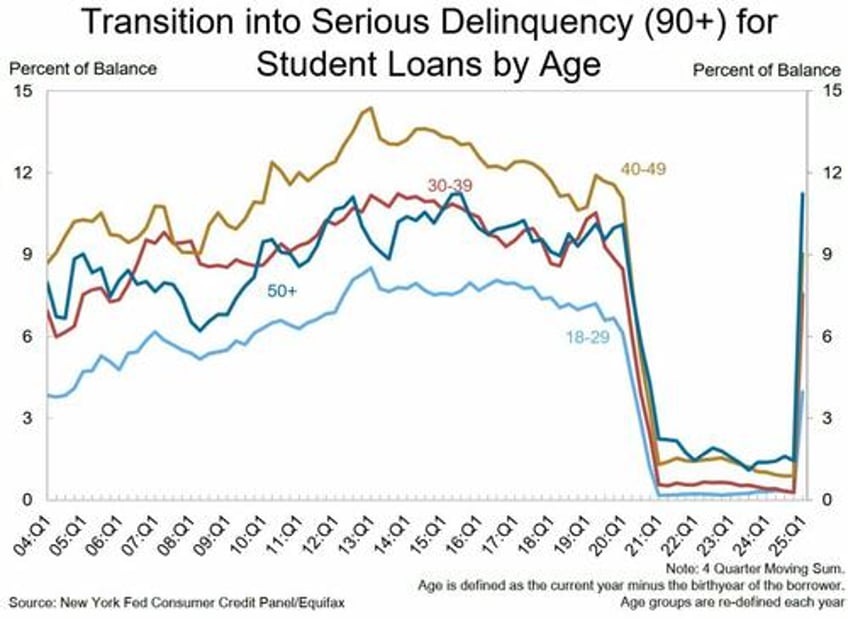

According to the NY Fed report, while over half of the newly delinquent borrowers already have subprime credit scores, around 2.4 million borrowers who entered delinquency this year had scores over 620 - which could have allowed them to qualify for auto loans, mortgages, and credit cards, prior to the delinquency being reported. 3.2 million borrowers whose scores were under 620 (56.6% of the newly delinquent population) saw their scores decline by an average of 74 points.

Another 2 million borrowers with scores between 620 - 719 (35.9% of new delinquencies) saw their credit scores fall by an average of 140 points - while there were 400,000 borrowers whose scores were above 720 (7.2% of new delinquencies) that saw their scores fall by over 100 points.

Over 1 million borrowers saw drops of at least 150 points.

The report found that seven states have a conditional student loan delinquency rate — which excludes borrowers who don't have a payment due — above 30%, including Mississippi (44.6%), Alabama (34.1%), West Virginia (34%), Kentucky (33.6%), Oklahoma (33.6%), Arkansas (33.5%) and Louisiana (31.8%).

At the end of the first quarter, over 20 million federal student loan borrowers weren't in repayment and five million had a zero-dollar monthly payment. -Fox News

"After a five-year hiatus, student loan delinquency has returned to the pre-pandemic 'normal' with more than 10 percent of balances and roughly six million borrowers either past due or in default," according to the NY Fed report, which noted that the collections process that resumed in May includes the "garnishment of wages, tax returns, and Social Security payments."

"Additionally, millions of borrowers face steep declines in their credit standing which will increase borrowing costs or seriously limit their access to credit like mortgages and auto loans."