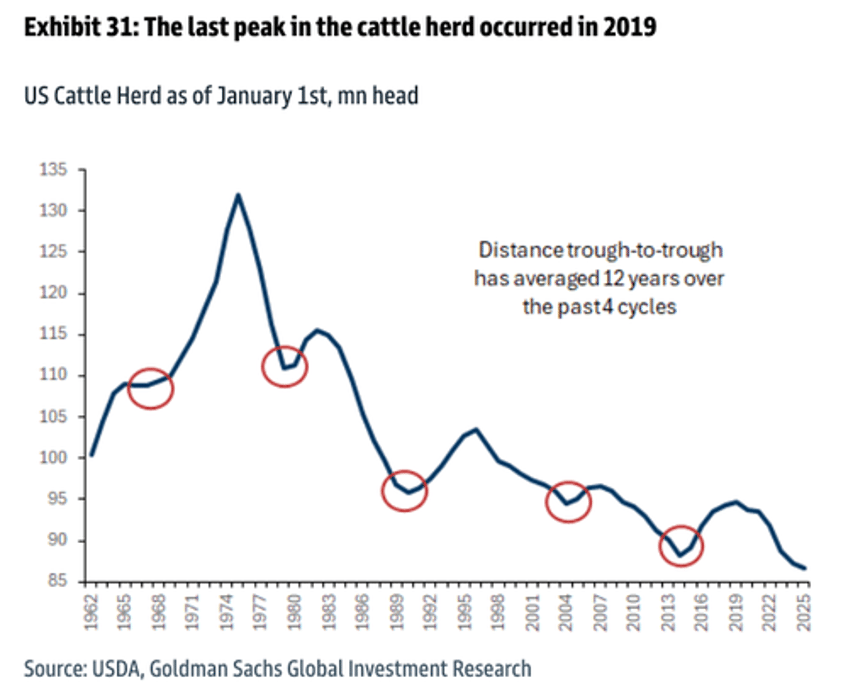

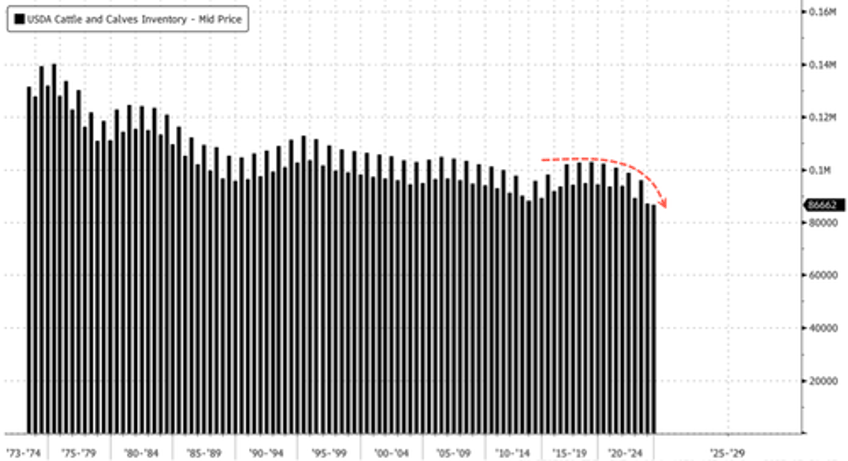

The U.S. beef industry operates on 12-year herd cycles, with the last herd low in 2014 and the beef packer margin trough in 2015. The current herd liquidation began in 2019, and as of the start of 2025, the nation's cattle herd stands at 86.7 million, the lowest level since the 1950s.

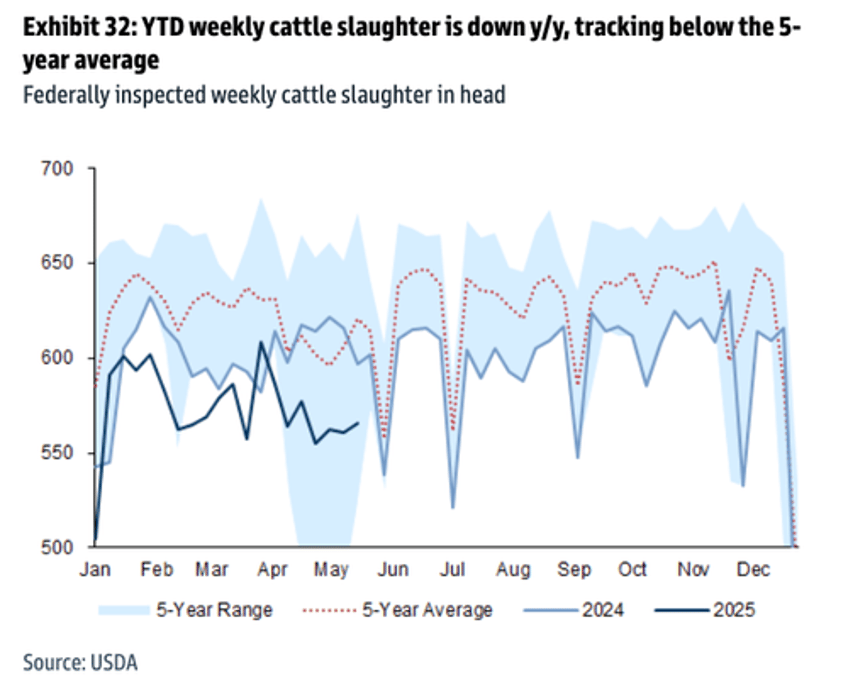

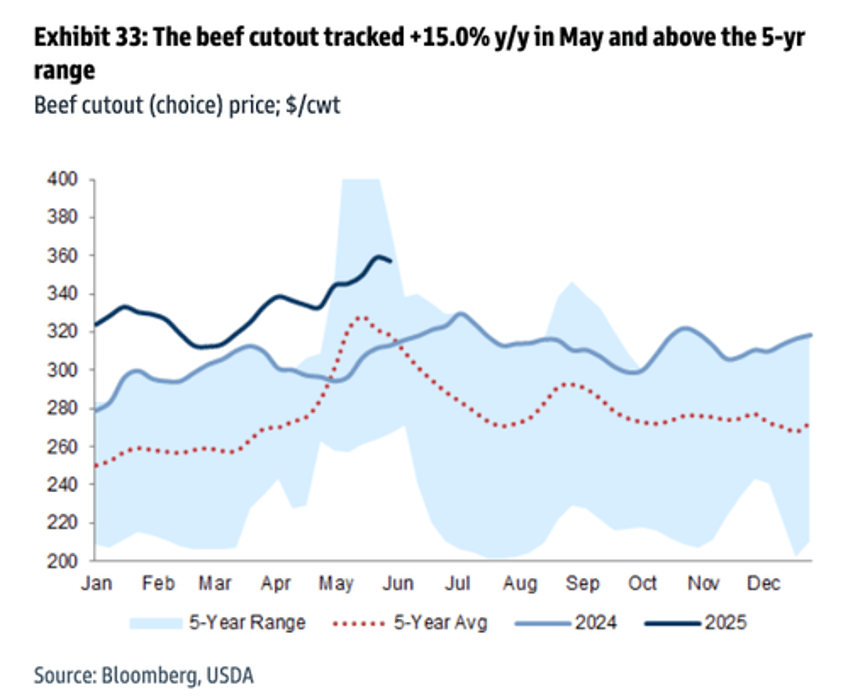

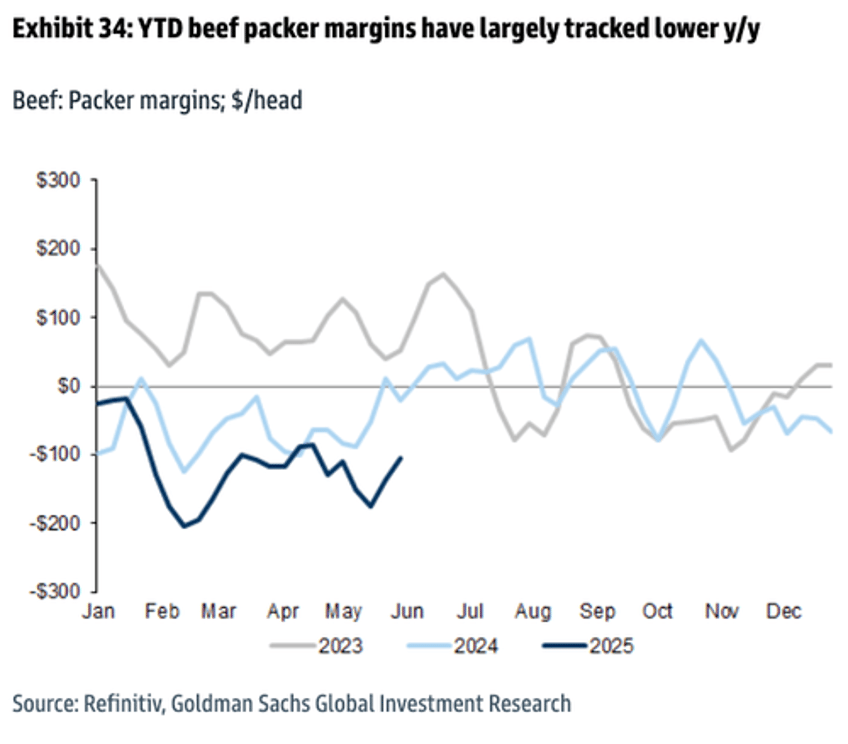

Herd rebuilding trends may begin soon, according to Goldman analysts Leah Jordan and Eli Thompson, who cited support from high calf prices and low feed costs, though herds appear tight for the foreseeable future. They expect this dynamic to keep beef packer margins depressed due to reduced slaughter volumes and elevated live cattle prices.

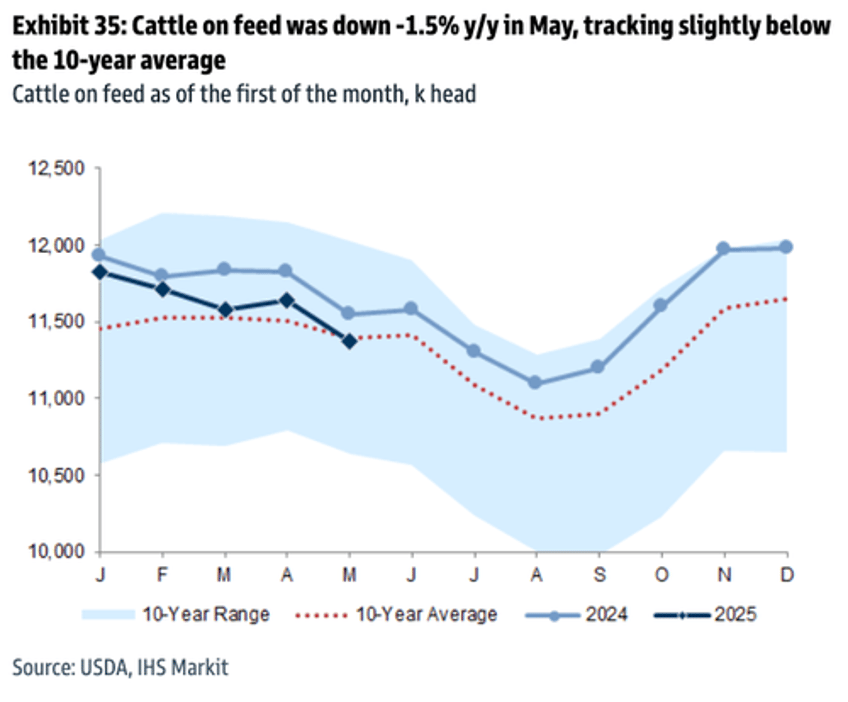

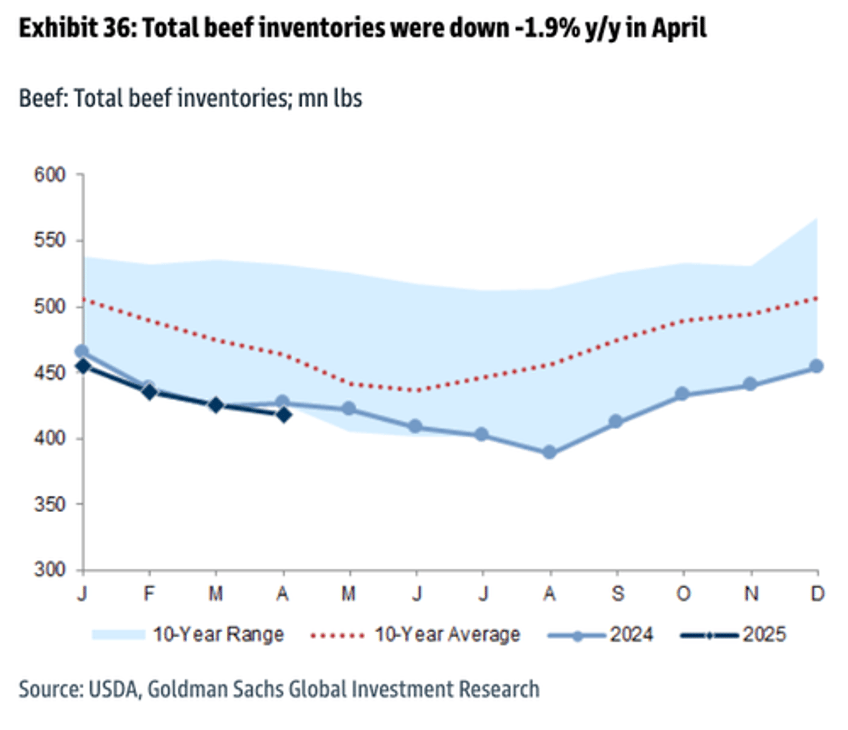

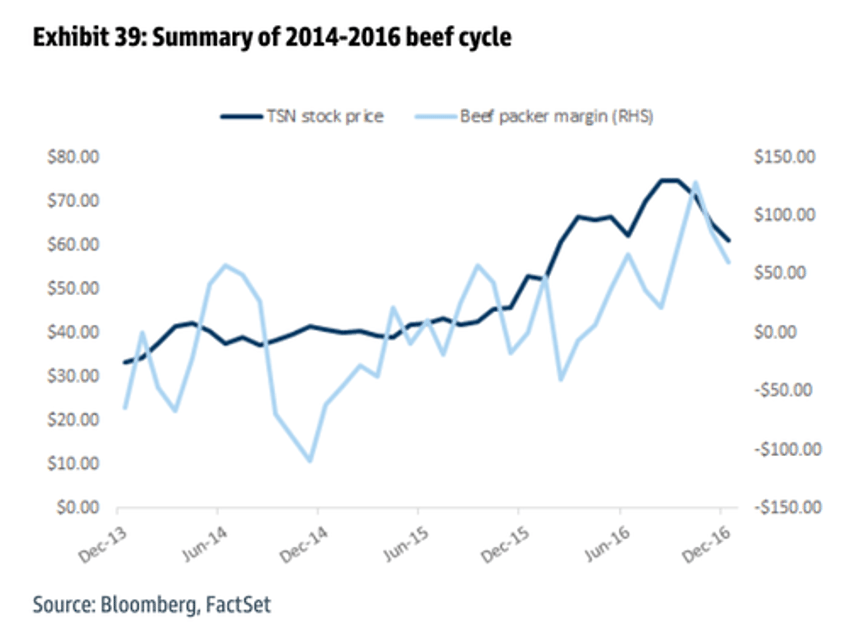

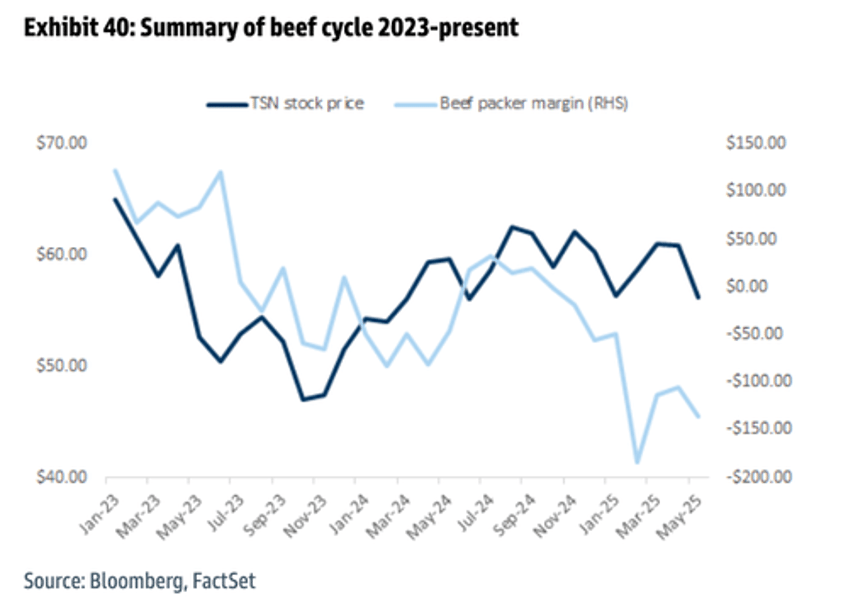

Beef cycles typically last about twelve years on average, looking at trough-to-trough in the cattle herd. The prior trough in the herd occurred in 2014, while the prior trough in beef packer margins occurred in 2015. The current herd liquidation cycle began in 2019, with the herd tracking at ~86.7mm as of January 1, 2025, the lowest level since the 1950s. Herd rebuilding may already be underway, or is likely soon, noting supportive industry conditions (high calf prices and low feed costs), which should further constrain supply in the near-term, partially offset by record weights for cattle on feed.

As a result, we expect beef packer margins to remain depressed in the near-term due to lower slaughter volumes and high live cattle prices. That said, herd retention will set up the industry better for the longer term, and effectively starts the clock for more normalized margins in about two years given the breeding timeline, with better visibility likely in a few quarters.

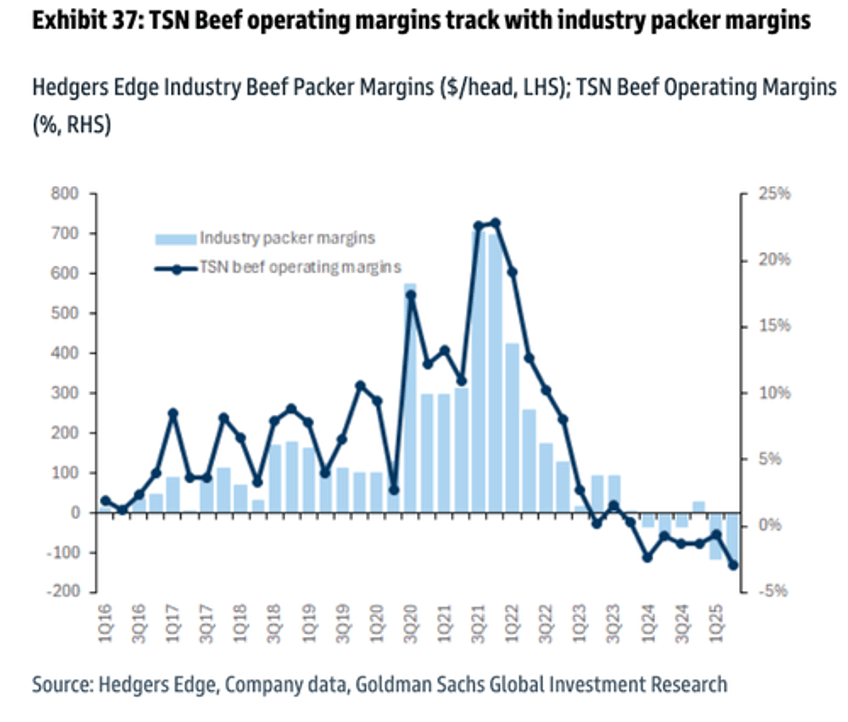

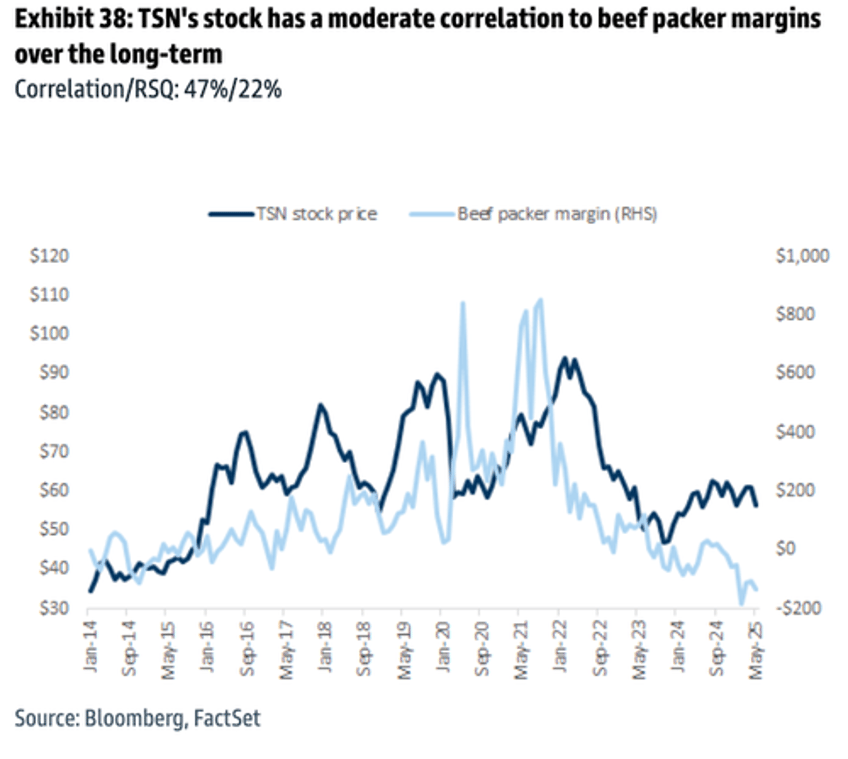

TSN's beef operating margins track with industry packer margins, while its stock has a moderate correlation as well, noting the stock started to work in advance of the beef-driven earnings recovery in 2016. Additionally, the relationship has already started to decouple in the current cycle, owing to the strength of its diversified business mix across proteins (including prepared foods with greater margin stability).

Analysts posed the question: "When will the beef cycle turn?" — one we've been asking at ZeroHedge, too.

Here's a visual breakdown of the beef industry's turning points, as charted by the analysts:

"We also believe the cyclical low in beef profitability is creating an attractive entry point for patient investors in Buy-rated TSN," the analysts noted.

During Tyson Foods' earnings call in early May, Brady Stewart—head of Tyson's beef and pork supply chains—offered insights into what may be the emerging bottom in U.S. cattle supplies, which have fallen to their lowest levels in over 70 years. His comments came in response to a question from one Wall Street analyst.

Stewart explained that while cattle supply remains down year-over-year, record-high animal weights are helping to offset the decline in volume. He added that the U.S. cattle industry is likely at or near the bottom of its inventory cycle, with herd levels now at a 73-year low.

At the start of the year, the U.S. Department of Agriculture's annual Cattle Inventory report revealed that the nation's cattle supply had fallen to a 73-year low, totaling about 86.7 million head.

At the supermarket, USDA data from the end of May showed the average price for a pound of ground beef reached yet another record high of nearly $6 a pound.

While analysts expect a cyclical low in the beef cycle, that doesn't mean the industry is out of the woods just yet—tight supplies and elevated prices are likely to persist for years. Now is the time for consumers to secure local supply chains, even if that means getting to know the rancher down the road.

The rise of the 'MAHA' movement is accelerating this shift, as more Americans turn to clean, locally raised beef and reject products from globalist-owned food conglomerates.