Sorry it has taken so long, but I think we may have found our smoking gun … or mystery buyer. To be honest it came a little out of left-field and was not quite where we expected to find it.

As always it is never an entirely simple answer, but a collection of things, but for sure there is also a stand-out issue too. I'll explain.

Those price supporting factors are well known and can be summarised as being primarily central bank buying, large OTC options bets and Chinese demand ; it was clear Chinese demand was “strong” but it also had some powerful compensating factors, such as weak Indian demand while European and US physical offtake has been dire with one of the sharpest corrections in living memory – in fact there has been significant destocking going on ; German bullion dealers are swamped with buy-backs, Mints are reporting declines in sales of between 80% and 95% and gold coins and bars are flowing wholesale to the major Swiss refineries where they converted into 99.99% purity kilobars, then shipped to China. We knew the flow from West to East was "strong", it was the magnitude we hadn't adequately accounted for.

The perhaps unsurprising answer to the mystery buyer … is China … just a lot more China than we might ever have imagined. On the face of it, yes retail demand is hot, and the central bank bought just 5 tonnes last month (that's roughly half one days gold mine production) – so great some headlines, but not really all that significant.

More impressively 124 tonnes was drawn down from the Shanghai Gold Exchange, which is seen as a proxy for domestic demand, taking Q1 offtake to 522 tonnes – very impressive and roughly double what we would expect to see. Meanwhile ETF gold demand remains small by any comparison. Great – but still no biscuit.

Our view that an options play is a contributory factor still stands, but again not sufficient to account for the price action we have seen. More HERE

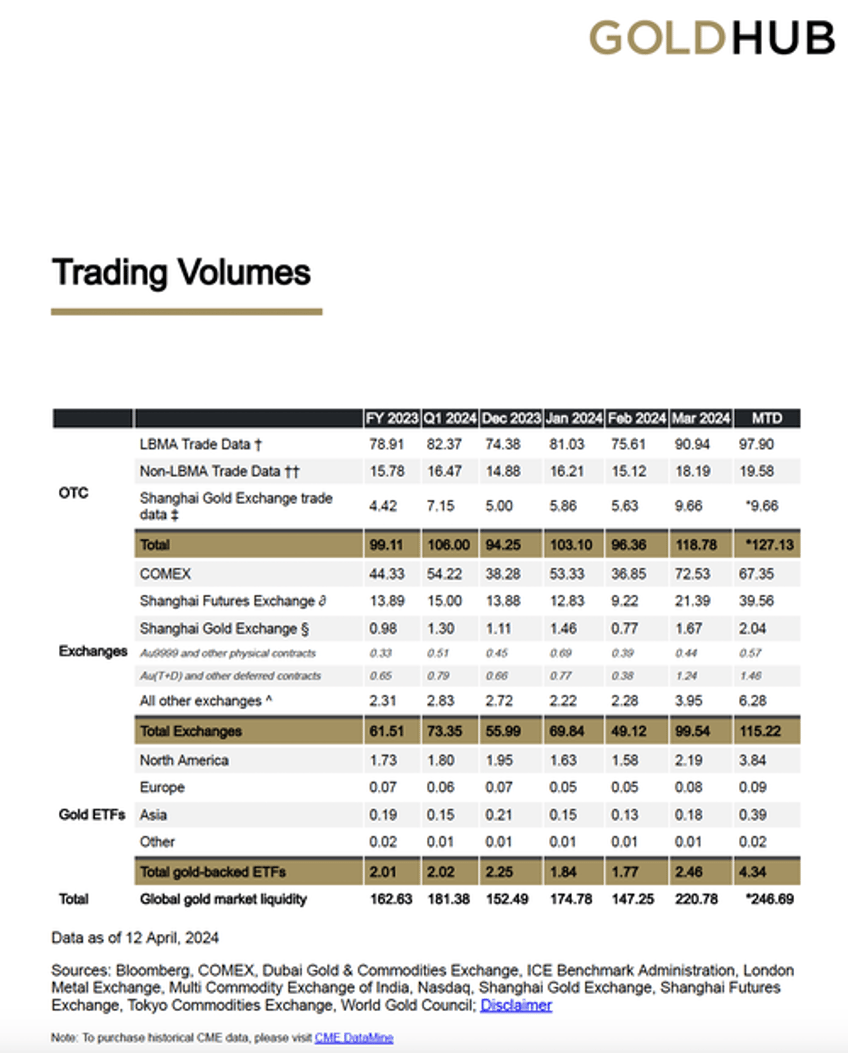

Where the demand seems to be coming from - as the table below shows - is actually from the Shanghai Futures Exchange (SHFE) - often wrongly regarded as the smaller brother of the Shanghai Gold Exchange (SGE).

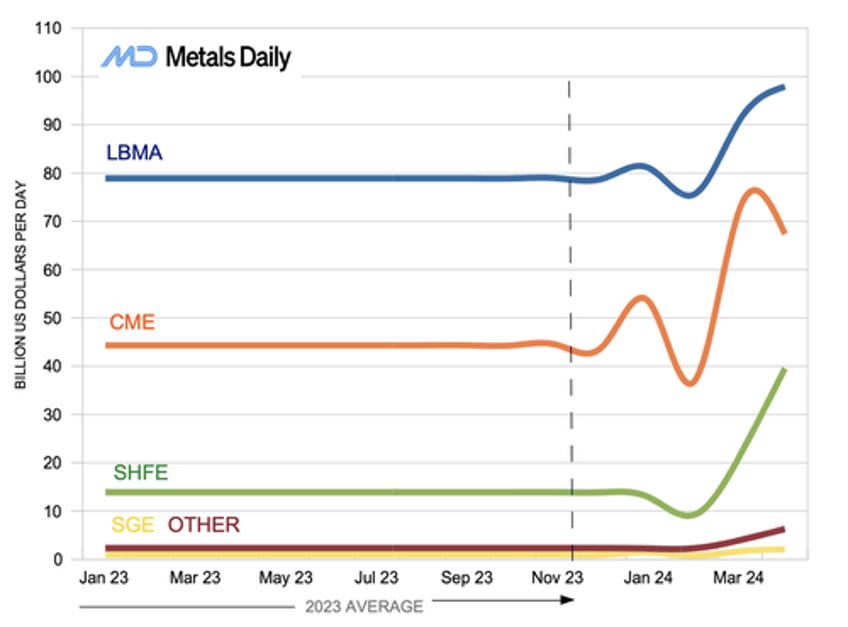

Daily gold turnover on the SHFE last year averaged $13.89 b/day (=billion dollars per day) – well behind London's LBMA average turnover at $78.91 b/day and New York's CME at $44.3 b/day.

And then things changed in March 2024, just when the gold price went through an inflection point. Business on SHFE essentially doubled in a month and then doubled again to nearly $40 b/day. That's headed for roughly half the size of the London market in 2 months.

All other exchanges includes gold contracts traded on: London Metal Exchange, Dubai Gold & Commodities Exchange, ICE Futures, US Metals, Borsa Istanbul, Bursa Malaysia, Moscow Exchange - RTSX, Tokyo Commodity Exchange.

Sources: Bloomberg, COMEX, Dubai Gold & Commodities Exchange, ICE Benchmark Administration, London Metal Exchange, Multi Commodity Exchange of India, Nasdaq, Shanghai Gold Exchange, Shanghai Futures, Exchange, Tokyo Commodities Exchange, World Gold Council. _________________________________________________________________________________________

This might explain why gold had not responded to news for example that the Fed would hold rates higher-for-longer as well as other bearish indicators. The buyers were likely looking at Chinese domestic issues.

So, two questions – what does this mean about the centre of gravity for global trading … and what does the SHFE futures buying mean for the outlook for the gold price ?

Too early to say whether the price discovery process is shifting to the East. Two exceptional trading months are insufficient to make any claim. But liquidity begets more liquidity and the momentum is certainly with China. Exchanges generate their own gravitational pull – its all a bit binary – and London has held the role for centuries as the leading hub, in much the same way that the London Metal Exchange (LME) has done for base metals.

Arguably the Chinese gold price is not adequately representative as a fair global benchmark because it is landlocked – gold cannot be readily exported and hence it could be argued that it only represents the domestic position. But as the world's largest producer and consumer, one would imagine that China has ambitions to be THE price-setter.

On the price direction … well in order to understand the gold market one would need to take a greater account of how things are seen through Chinese eyes – certainly just now.

As regards the price outlook itself … well that depends upon who is placing very large leveraged futures positions on SHFE (speculative or hedging ?) ; SHFE is not cash settled like CME and is for physical delivery which could create an interesting squeeze … generally though I would suggest the buying is of a lesser quality to say Chinese retail demand and central bank demand.

That is to suggest that the gold rally up to $2100 looks assured, but the $300 on top ... less so.

_______________________________

Ross Norman

Metals Daily.com - London

www.MetalsDaily.com