President Trump's multibillion-dollar missile defense project, called the "Golden Dome for America," aims to shield the U.S. as the world splinters into a volatile bipolar state. Part of a broader "hemispheric defense" strategy for the 2030s, the multilayered defense system has drawn the attention of Goldman Sachs analysts, who have identified a clear investment opportunity tied to deploying next-generation technologies to shield the Homeland from hypersonic missile threats.

On Wednesday, Goldman analysts Noah Poponak, Anthony Valentini, and Connor Dessert hosted an investor meeting with L3Harris Technologies CFO Ken Bedingfield and VP of Investor Relations & Corporate Development Daniel Gittsovich to discuss the "substantial opportunity" tied to the $175 billion Golden Dome missile defense project.

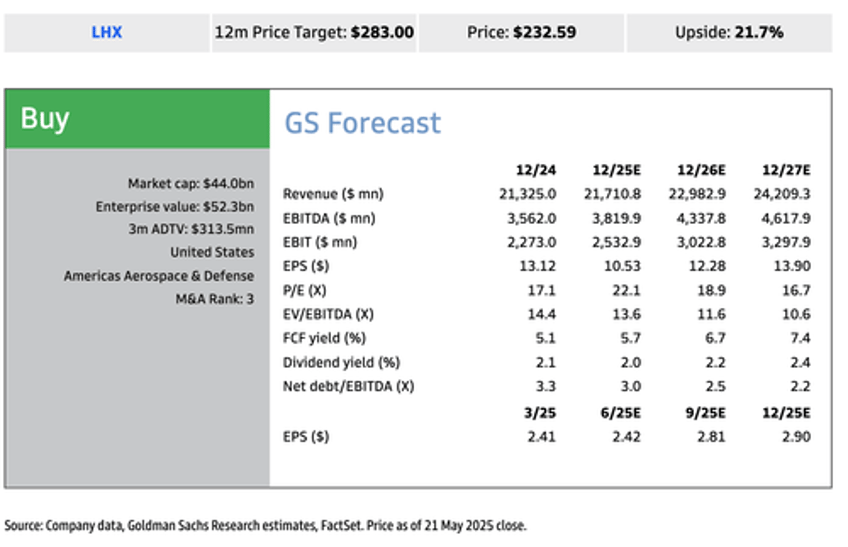

Poponak explained to clients, "We are Buy-rated on L3Harris because management expects its organic revenue growth rate to accelerate in 2026, margins to continue expanding, and strong free cash flow growth going forward."

Here are the key takeaways from the investor meeting between Goldman analysts and L3Harris management

Golden Dome, unveiled May 20 by President Trump and DoD leaders, is a $175 billion multilayered missile defense initiative targeting hypersonic and ballistic threats.

Initial $25 billion funding is part of a continuing resolution in Congress.

L3Harris expects multi-billion-dollar revenue upside, particularly via its Aerojet Rocketdyne segment for missile propulsion and its HBTSS (Hypersonic and Ballistic Tracking Space Sensor) work.

Timeline: 2.5–3 years, though delays are possible due to complexity. LHX is one of the few primes publicly aligned with the program, alongside Lockheed Martin and RTX.

The analysts maintain a "Buy" rating on L3Harris, citing their conversation with management, which reinforced the view that the company is well-positioned to benefit from Trump's Golden Dome project. Management sees 2026 as a pivotal year for growth, driven by strong demand forecasts and a strengthening core portfolio.

Poponak has set the 12-month price target on L3Harris shares at $283, representing 22% upside from current levels.

However, the analysts outlined risks, including:

DoD spending growth and priorities,

margins and program execution,

and capital deployment

L3Harris shares have been trading sideways for much of the last five years. To create a blue-sky breakout, shares would need to clear the $250 level.

Separately, L3Harris commented on being named as one of the participants in the new missile defense shield:

L3Harris is poised to directly support the development of a Golden Dome missile defense shield for America. We recently tripled the size of our space manufacturing facility in Fort Wayne, Indiana, where our dedicated employees design, develop and produce infrared sensor payloads and space-based mission solutions for missile defense programs.

Investors will have more opportunities in the coming months and quarters to capitalize on the hemispheric defense theme as the Trump administration secures funding to build next-generation systems designed to protect North America.