The U.S. Department of Education announced it will restart interest accrual for student-loan borrowers in the Saving on Valuable Education (SAVE) plan, starting from Aug. 1, according to a July 9 Education Department (ED) statement.

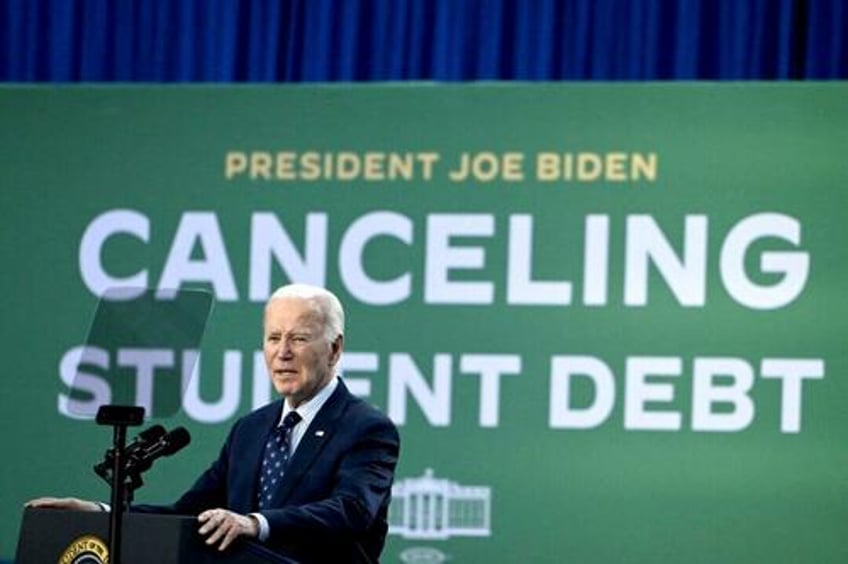

Launched in 2023 by the Biden administration, the SAVE plan calculated student loan payments based on the individual’s income and family size. The plan prevents interest from getting accrued, brings loan payments for those who earn less than $32,800 annually to zero per month, while providing early forgiveness for low-balance borrowers.

In June last year, a federal court blocked parts of the SAVE plan. As a result, student loan borrowers enrolled in the plan had their loans put in forbearance with a zero percent interest rate. The SAVE plan was struck down as illegal by the Eighth Circuit Court of Appeals in February.

In April, a federal court issued an injunction to implement the decision made by the appeals court. The latest action by the ED was taken in order to comply with the court injunction.

The department will start charging interest rates from Aug. 1. The interest will not be assessed retroactively, the department said.

Interest will begin accruing from Aug. 1, when borrowers under the SAVE plan will see their loan balances grow. And when the SAVE forbearance period ends, borrowers will have to start making repayments on the loan, including the accrued interest, according to the ED.

Starting July 10, the department will begin direct outreach to 7.7 million borrowers enrolled in the SAVE plan, providing instruction on how to move to a legal repayment plan.

“For years, the Biden administration used so-called ‘loan forgiveness’ promises to win votes, but federal courts repeatedly ruled that those actions were unlawful,” said Secretary of Education Linda McMahon.

“Congress designed these programs to ensure that borrowers repay their loans, yet the Biden administration tried to illegally force taxpayers to foot the bill instead.”

“Since day one of the Trump Administration, we’ve focused on strengthening the student loan portfolio and simplifying repayment to better serve borrowers.

“As part of this effort, the Department urges all borrowers in the SAVE Plan to quickly transition to a legally compliant repayment plan–such as the Income-Based Repayment Plan. Borrowers in SAVE cannot access important loan benefits and cannot make progress toward loan discharge programs authorized by Congress.”

In its last days in office, the Biden administration forgave more than $600 million for 4,550 borrowers under the income-based payment plans.

“The Administration leaves office having approved a cumulative $188.8 billion in forgiveness for 5.3 million borrowers across 33 executive actions,” an ED statement said at the time. It has since been taken down.

The Biden administration’s zero percent “litigation forbearance” forced American taxpayers to foot the bill, while leaving borrowers without clear direction on how to legally repay their loans, the Education Department said in its latest statement, adding that the Trump administration will support borrowers in selecting a new, legal repayment plan.

The Biden administration announced the SAVE Plan just weeks after the Supreme Court blocked the Education Department from unilaterally waiving federal student loans.

According to the ED, 42.7 million borrowers currently owe $1.6 trillion in student debt.

“Only 38 percent of borrowers are in repayment and current on their student loans,” the ED said in April.

“Most of the remaining borrowers are either delinquent on their payments, in an interest-free forbearance, or in an interest-free deferment. A small percentage of borrowers are in a six-month grace period or in-school.”