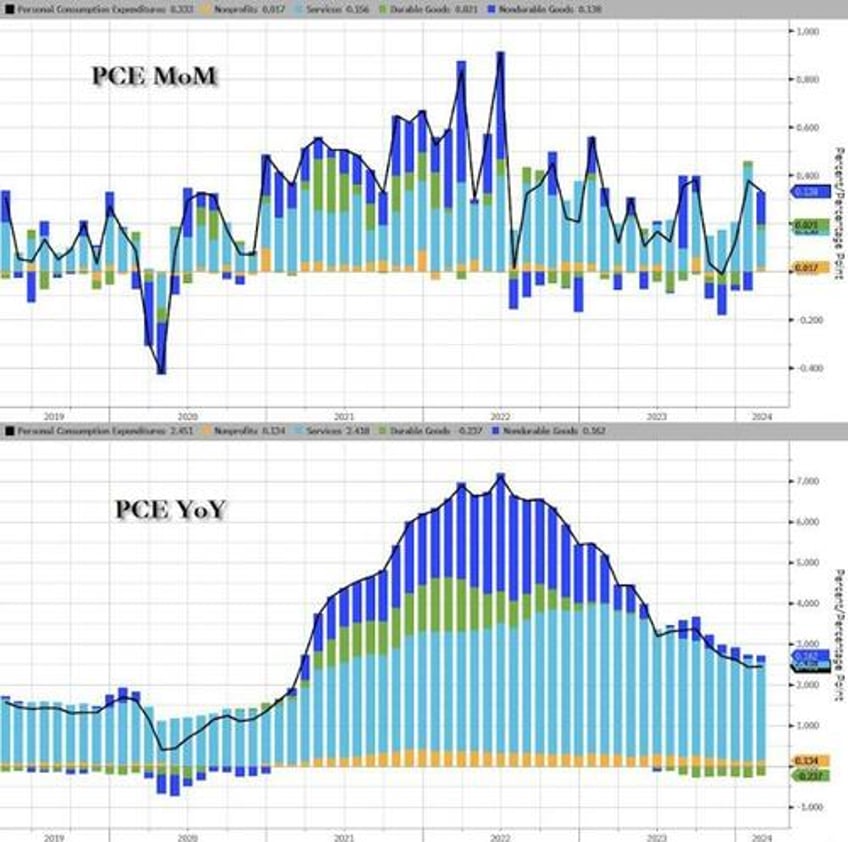

One of The Fed's favorite inflation indicators - Core PCE Deflator - was flat at +2.8% YoY in February (as expected) - the lowest since March 2021.

However, the headline PCE Deflator stalled its disinflationary path, rising to +2.5% YoY (from +2.4%)...

Source: Bloomberg

Durable Goods deflation slowed and non-durable goods inflation picked up in February...

Source: Bloomberg

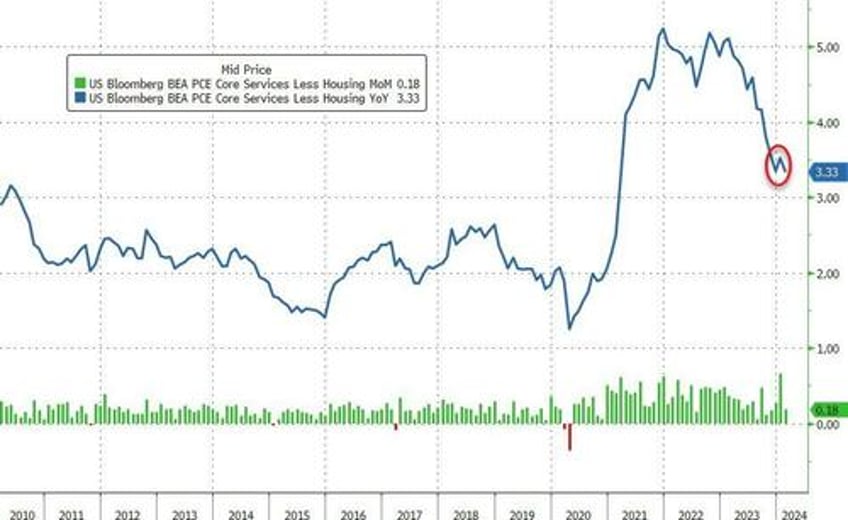

The so-called SuperCore - Services inflation ex-Shelter - remains stalled around +3.33% YoY (up 0.18% MoM)...

Source: Bloomberg

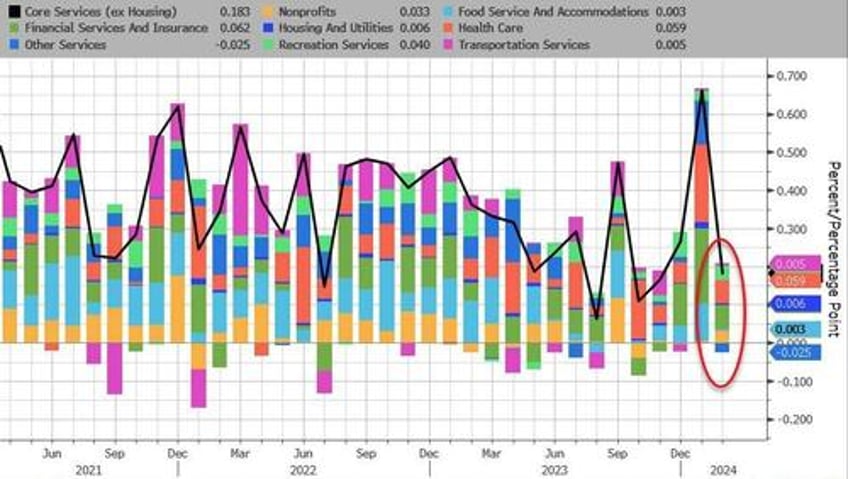

But SuperCore MoM tumbled significantly (as Healthcare cost inflation fell and Other Services prices deflated)...

Source: Bloomberg

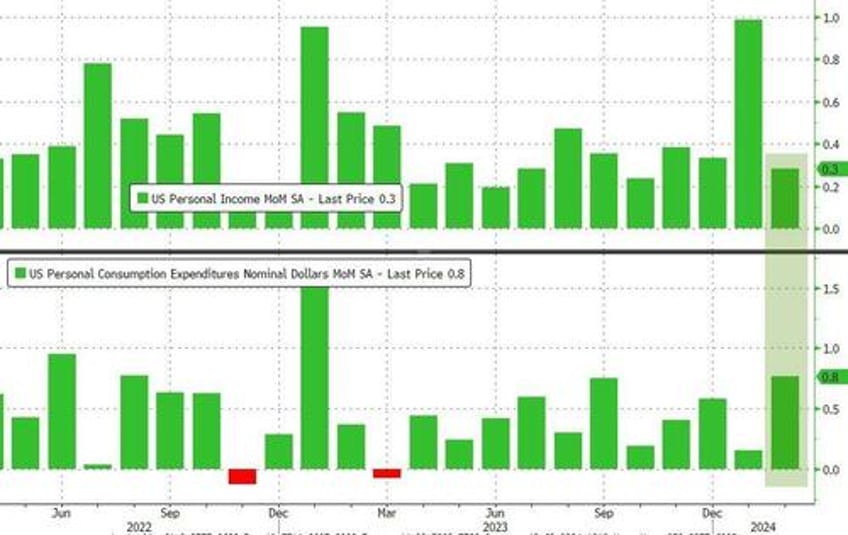

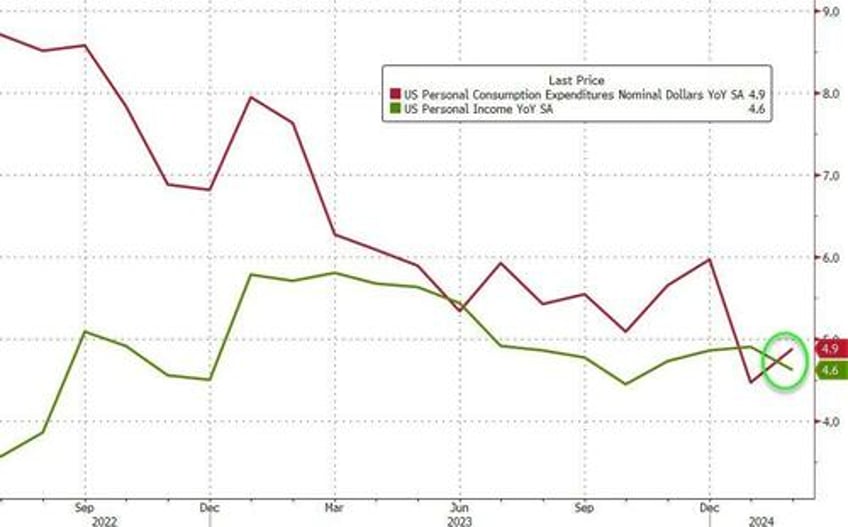

Income and Spending both rose in February with spending far outpacing income (+0.8% MoM vs +0.3% MoM respectively)...

Source: Bloomberg

On a YoY basis, spending is once again outpacing income growth...

Source: Bloomberg

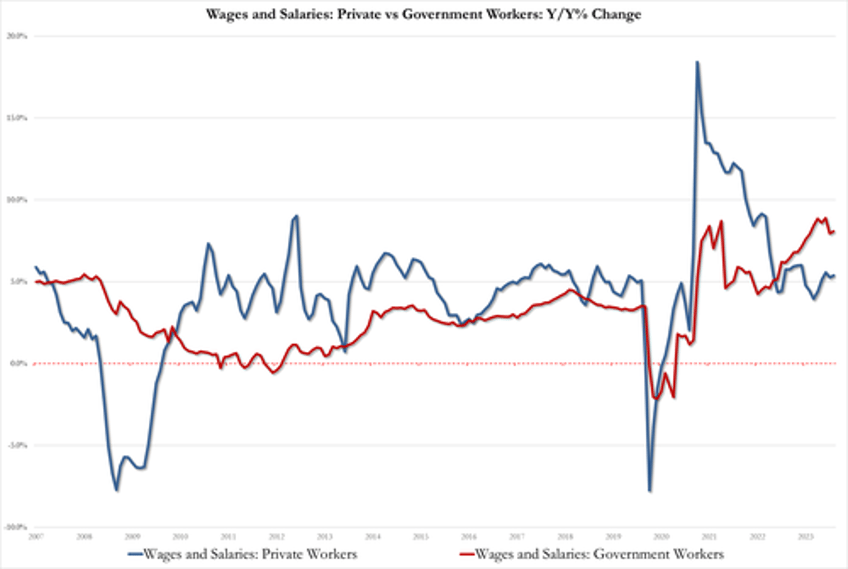

Government workers' record wage growth in January was revised lower (because we caught them)...

Govt wages grew 8.1% in Feb, up from a downward revised 7.9% in Jan and below the record high of 8.9% in December

Private wages grew 5.4% in Feb, up from 5.3% in Jan and back to their pre-covid growth rates

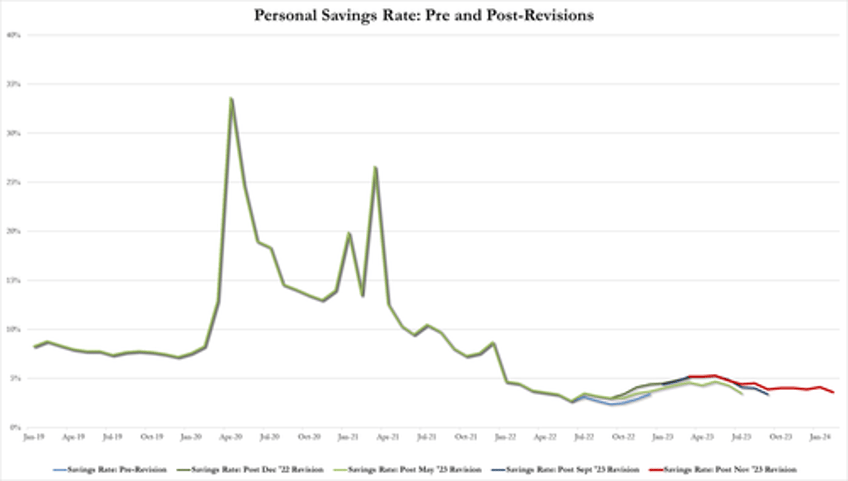

As one would expect with that level of spending, the savings rate collapsed to its lowest since Dec 2022...

Source: Bloomberg

Here's why - government handouts rose significantly once again (+$39BN MoM)...

Source: Bloomberg

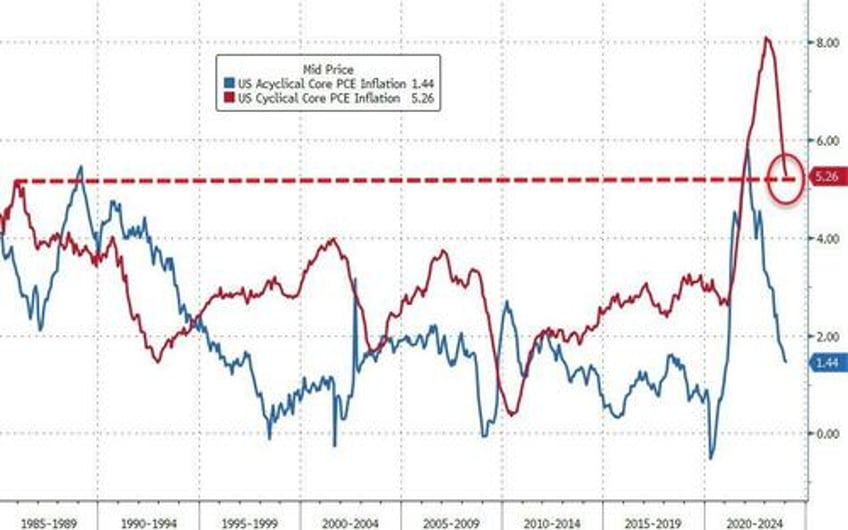

Finally, while the markets are exuberant at the survey-based disinflation, we do note that it's not all sunshine and unicorns. The vast majority of the reduction in inflation has been 'cyclical'...

Source: Bloomberg

Acyclical Core PCE inflation remains extremely high, although it has fallen from its highs.

Is The (apolitical) Fed really going to cut rates 4 times this year with a background of strong growth (GDP) and still high Acyclical inflation?