How Trump’s 50% Threat Might Be the Kick Europe Needs

Treasury Secretary Scott Bessent said in an interview with Bloomberg TV on Friday that Europe has a “collective action” problem standing in the way of effective trade negotiations with the United States.

It’s a point Bessent has made before. The Treasury Secretary isn’t just taking a swipe at the European Union. He is stating a geopolitical reality. The European Union is a confederation of 27 sovereign nations, each with its own economic interests, domestic politics, and diplomatic priorities. Negotiating trade deals on behalf of all of them is like steering a canoe with 27 paddles—each rowing in a different direction.

But Bessent’s point goes deeper. He’s hinting that Trump’s threat of a 50 percent tariff on EU imports might actually help Europe overcome this dysfunction. By raising the cost of inaction—by making delay and dithering painful—Trump’s strategy creates the very urgency Europe needs to get serious at the negotiating table.

“I think this is in response just to the EU’s pace,” Bessent said. “I would hope that this would light a fire under the EU.”

This flips the media narrative. Pundits say Trump’s tariffs are reckless. But from a game theory perspective, they function like a credible ultimatum. Europe’s problem isn’t a lack of interest in trade—it’s that its decision-making structure makes action nearly impossible. Trump’s move forces a decision. It concentrates minds.

As Bessent noted in his Bloomberg interview, “some countries don’t even know what’s being proposed in their name.” That’s a crisis of governance. And it’s exactly the kind of problem that hard deadlines—and hard consequences—can clarify.

Trump isn’t undermining transatlantic trade. He’s giving it the shock therapy it needs to survive.

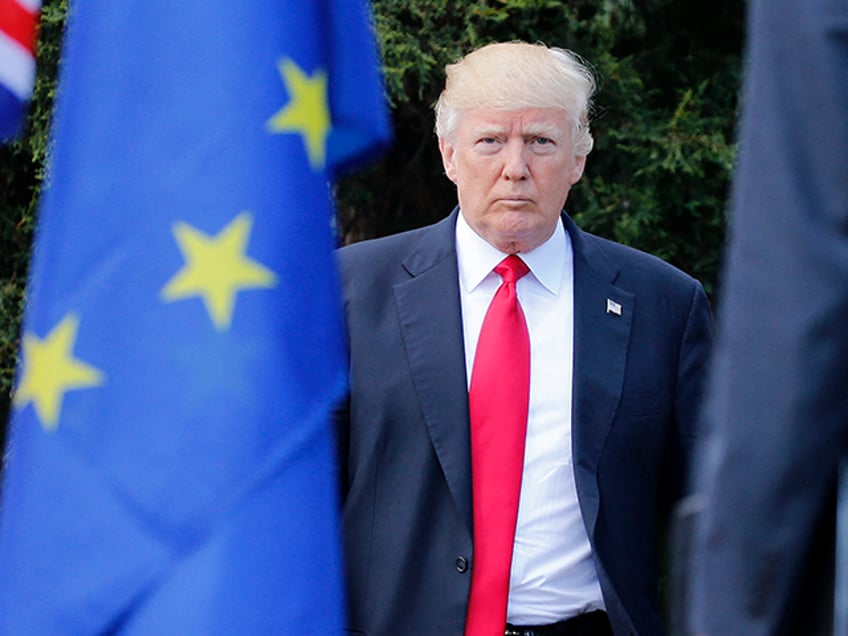

(Dominika Zarzycka/NurPhoto via Getty Images)

Harvard’s Admissions Game: How Foreign Students Help Privatize Public Policy

President Trump’s announcement that Harvard University would no longer be able to grant visas to its international students has helpfully concentrated attention on the surge of the foreign share of seats in elite U.S. universities and the displacement of Americans and immigrants that this has entailed.

Importantly, the surge in international students isn’t harmless globalism—it’s displacement for profit.

That’s why President Trump’s move to cut off visa authority from elite universities like Harvard has sparked overdue scrutiny. This isn’t just symbolic—it targets the revenue stream behind an unsustainable and unfair model.

Harvard likes to boast about its global appeal. What it rarely mentions is the arithmetic behind that appeal: as international enrollment has soared, American students—citizens and immigrants alike—have been pushed aside.

The numbers are clear. At Harvard College, the share of international undergraduates has risen sharply in recent decades, even as the class size has remained essentially flat. Twenty years ago, Harvard’s incoming class had around 1,600 students. Seven percent of them were classified as international. More recently, the share of foreign students is up to 18 percent while the class size has remained unchanged.

That means these new students didn’t join a growing pie—they took slices from someone else’s plate. In other words, for every foreign student admitted, an American was rejected. And it’s not just native-born Americans being displaced. Immigrants and permanent residents—those with long-term stakes in this country—are losing seats too.

Students enter the Admissions Building on Harvard University’s campus on September 12, 2006, in Cambridge, Massachusetts. (Glen Cooper/Getty Images)

Defenders claim international students pay more and therefore subsidize domestic students. But that’s just spin. Harvard’s sticker price is the same for everyone—and the supposed subsidy argument falls apart on closer inspection. There’s no evidence that Harvard uses the additional revenue from foreign students to lower the price charged to American students. If Amazon charged one set of customers more for the same product, would we assume it was doing so to help lower prices for others? Would we celebrate this differential pricing as subsidizing lower prices? Of course not. We’d call it price discrimination—a way to boost profit. That’s exactly what’s happening here.

Harvard is profiting from its ability to grant visas—a public authority—while keeping the earnings private. It’s monetizing a public power—converting admissions into visas, and visas into tuition premiums.

This is not education policy. It’s rent-seeking.

And don’t call this immigration. Foreign students aren’t immigrants. They are temporary residents who will, in most cases, return home after graduation or leave when their visa expires. They are not the huddled masses. They are, quite literally, a source of revenue.

Harvard isn’t opening its doors to the world out of idealism. It’s doing it for the same reason any powerful institution does anything these days: because it pays.