The Big Beautiful Conservative Bill

There’s a popular myth — pushed by many in the legacy financial press — that today’s Republican Party has abandoned its fiscal conservative roots. The narrative goes like this: once upon a time, conservatives were flinty-eyed budget hawks. Then along came Trump, and Republicans traded Paul Ryan’s spreadsheets for populist spending and electoral sugar highs. The latest reconciliation bill — packed with tax cuts, investment incentives, and pro-family benefits — is just another sign, we’re told, that fiscal restraint is dead.

But this story is upside-down. The One Big Beautiful Bill Act isn’t a break from conservative economic thought. It’s a return to first principles: a belief that growth, not austerity, is the engine of prosperity.

Growth First, Always

From Alexander Hamilton to Ronald Reagan, conservatives and classical liberals have long understood that a growing economy is the surest path to national strength and long-run fiscal health. Whether through tax cuts, deregulation, or strategic public investment, the goal has never been merely to balance the books — it has been to unleash the full productive capacity of the American people.

The tax cuts in this bill — reductions on investment income, faster expensing for small businesses, and increased child tax credits — are designed to raise work incentives, reward savings, and rebuild the family as the central unit of economic life. And yes, some of these provisions carry short-term fiscal costs. But to conflate that with irresponsibility is to miss the point: conservatives have never believed the road to national greatness runs through static budget math.

A Revenue Engine in the Tariff Code

Critics who warn that this bill will “explode the deficit” conveniently ignore a major component: Trump’s tariff policy is doing double duty — correcting foreign trade imbalances and restoring a time-tested method of government finance.

According to the Congressional Budget Office’s most recent forecast, tariffs enacted under the Trump administration’s trade strategy are expected to generate over $3 trillion in revenue over the next decade. That’s more than the total projected receipts from capital gains taxes, and it gives this bill a reliable stream of revenue to offset the costs of pro-growth tax cuts.

In effect, we are shifting away from taxing productivity and toward taxing consumption of foreign goods — a realignment that fits squarely within the American tradition of tariff-based finance that prevailed from Hamilton to Coolidge.

The Hamilton-to-Kennedy Tradition

The idea that pro-growth fiscal policy might entail a temporary deficit is hardly radical. Alexander Hamilton argued that a moderate national debt, used to secure credit and build national capacity, could be a “blessing.” Henry Clay supported debt-financed infrastructure to unify the country’s economy. Andrew Mellon, Ronald Reagan, and John F. Kennedy — though from different parties — each embraced the logic that cutting tax rates can lead to greater prosperity and, eventually, higher revenue.

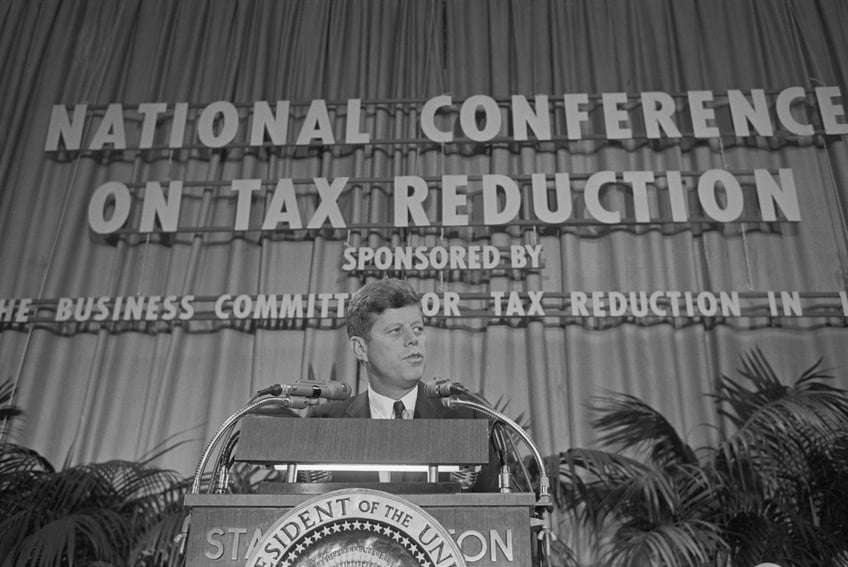

President Kennedy said it best: “Our practical choice is not between a tax-cut deficit and a budgetary surplus. It is between two kinds of deficits: a chronic deficit of inertia, or a temporary deficit of transition.” That insight, dismissed by today’s self-proclaimed deficit hawks, is at the heart of this legislation.

President John F. Kennedy addresses a meeting of the National Conference of the Business Committee for tax Reduction in September 1963. (Bettmann/Getty Images)

Populist? Sure. Also Principled.

Some critics complain that this bill caters to working-class voters and families — as if helping ordinary Americans prosper is somehow incompatible with free-market economics. But it’s not “populist” to let workers keep more of what they earn, or to remove marriage penalties, or to promote domestic production. It’s conservative economics applied to modern realities.

The postwar conservative tradition has always contained room for a pro-family and pro-growth policy that doesn’t worship at the altar of fiscal rectitude for its own sake. Budget balance is a means, not an end; and when growth is lagging or the tax code is misaligned, conservatives have never shied from bold action.

Don’t Fear the Deficit — Fix the Fundamentals

The best way to “pay for” this bill is with a stronger, faster-growing economy. That’s not wishful thinking — it’s what happened after the tax cuts of the 1920s, the 1960s, and the 1980s. Each time, revenue eventually rose because economic activity surged.

And now, tariff receipts provide an added layer of fiscal insurance. As the CBO’s projections show, tariff policy isn’t just good trade strategy — it’s good budget policy too.

What we can’t afford is stagnation. A sluggish economy erodes tax receipts, deepens dependency, and breeds discontent. That’s the real fiscal risk. This bill is an investment in American resilience — a bet that work, savings, family formation, and innovation are still the building blocks of national renewal.

A Conservative Victory

The One Big Beautiful Bill Act is not a departure from conservative economics — it’s a vindication of it. It draws from the same well that fed the tax revolutions of Mellon, Kennedy, and Reagan. It aims not to manage decline, but to ignite renewal. And if that means upsetting the bean counters in the process? Good.

The right question isn’t: “What’s the scorecard from the CBO?” It’s: “Are we building an economy worthy of a free people?” On that front, this bill delivers.