Originally published to The Bitcoin Layer — subscribe for free. Follow Joe on X.

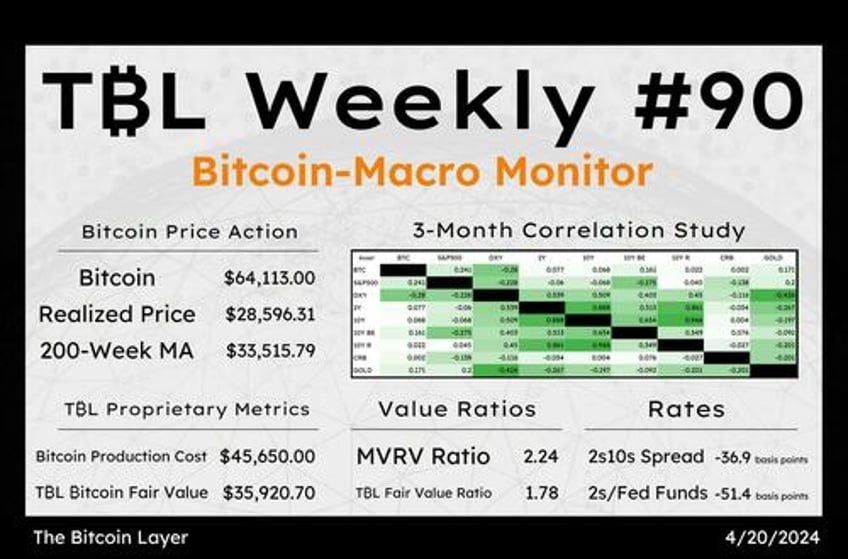

Welcome to TBL Weekly #90—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Bitcoin had its fourth halving yesterday, and the first one to take place on a Friday night! Perfect timing for parties. This was its fourth successful monetary policy adjustment, this time halving issuance from 6.25 BTC per block to 3.125 BTC per block. If only monetary policy were this elegant at the Federal Reserve. Nik and I would be out of a job, there’d be nothing to talk about.

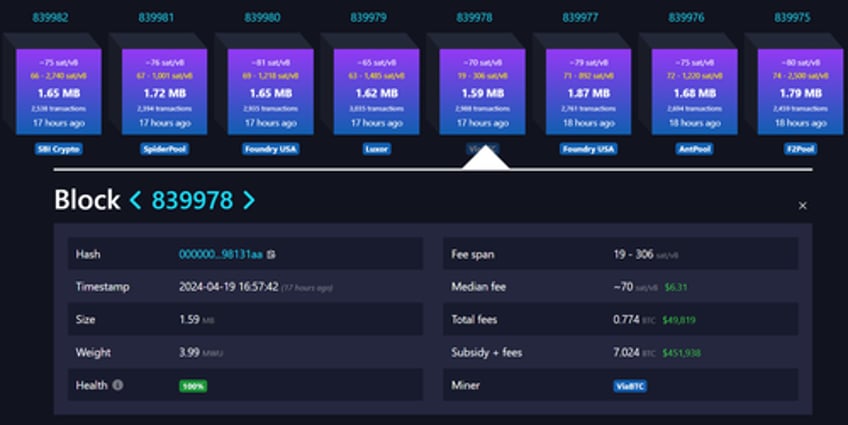

The biggest news of the night has got to be the unbelievably large block reward associated with block 840,000 and beyond. For reference, here’s a typical clock roughly 3.5 hours before the halving took place, with about a 7 BTC block reward, currently worth around $450,000:

Block 840,000, the block that ushered in bitcoin’s fourth supply schedule reduction, had an eyewatering 40.7 BTC block reward, worth some $2.6 million. Total rewards for the halving block quintupled their norm thanks to insane transaction fees:

Why did this happen? And why have blocks since 840,000 had similarly huge transaction fees and a massive total reward? A new token protocol went live on block 840,000 that uses OP_RETURN called Runes, used for inscriptions that have no explicit monetary association with BTC itself—reminiscent of other crypto pump and dumps.

The good news is that plenty of people who tried to mint their tokens in block 840,000 lost thousands of dollars due to their transaction being accepted by one mining pool but not making it into others, or minting a Rune and having it sell out before their transaction was confirmed. Said more simply, non-BTC activity clogged up the blockchain. Hundreds of bitcoin were paid to mint and buy Runes within just the first 10 post-halving blocks. Though it’s a game of greater fools in which essentially everybody loses, it does detract from block space and accentuate the need for hastening the development of and further expansion of liquidity on layer 2 scaling solutions like the Lightning Network.

Transaction fees a percentage of the total block reward jumped to their highest level ever of 75%, a preview of what’s to come in bitcoin mining economics decades from now as bitcoin monetizes into a $10-trillion+ asset, demand for the network is orders of magnitude larger than today, and we’ve had a few more halvings: