Bitcoin Cyclical and Secular Drivers

TL/DR

Bitcoin’s price movements are shaped by a combination of structural and cyclical factors, including halving events, macroeconomic conditions, institutionalization, and regulatory changes. The ongoing 2024 rally underscores this interplay, with the following points highlighted for the immediate cyclical future:

- A sustained loose monetary policy and favorable regulatory developments should further support Bitcoin’s trajectory.

- Key risks include prolonged Federal Reserve rate hikes and the potential failure of the Trump administration to deliver on crypto-friendly promises.

Deutsche Banks believes bitcoin is positioned now "for continued relevance and long-term growth within the financial ecosystem". While the Bank doesn't say it out loud, their implications are clear. As long as Bitcoin behaves in a TradFi environment, it can thrive like the captured wild animal made to be domesticated

Overview:

Deutsche Bank just released a report covering Bitcoin’s cyclicality and handicapping the effect key price drivers. Their analysis categorizes these rallies into "longer" (structural price) uptrends and "shorter" (more cyclical) rallies, examining the macroeconomic, regulatory, and market-specific factors driving these movements, as well as exploring Bitcoin's evolving role in the broader financial ecosystem.

1. Patterns in Bitcoin Cycles

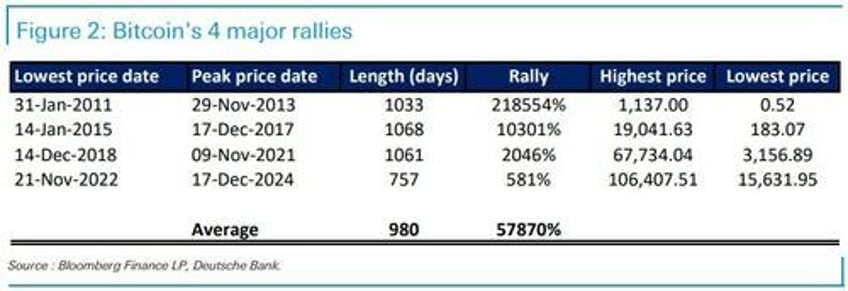

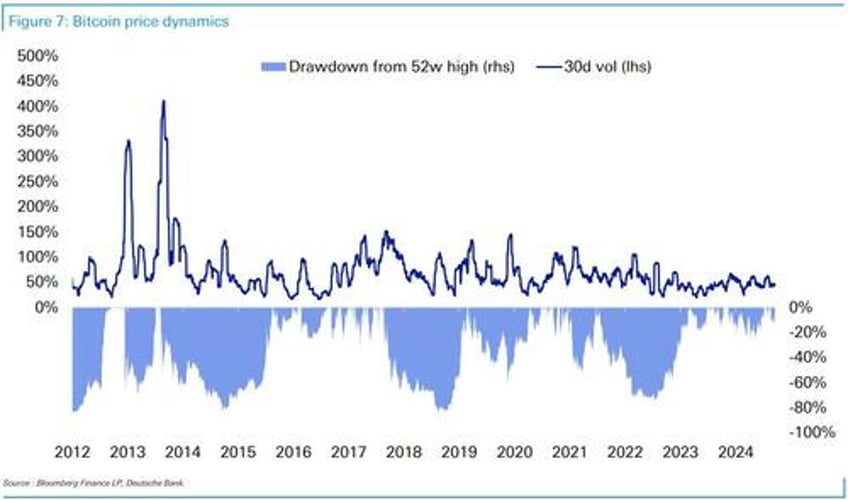

The report identifies four major structural appreciation periods for Bitcoin, each lasting over 750 days. These episodes feature extreme volatility but yield exponential gains, often exceeding tens of thousands of percentage points.

(i) Long Rallies (4 Episodes)

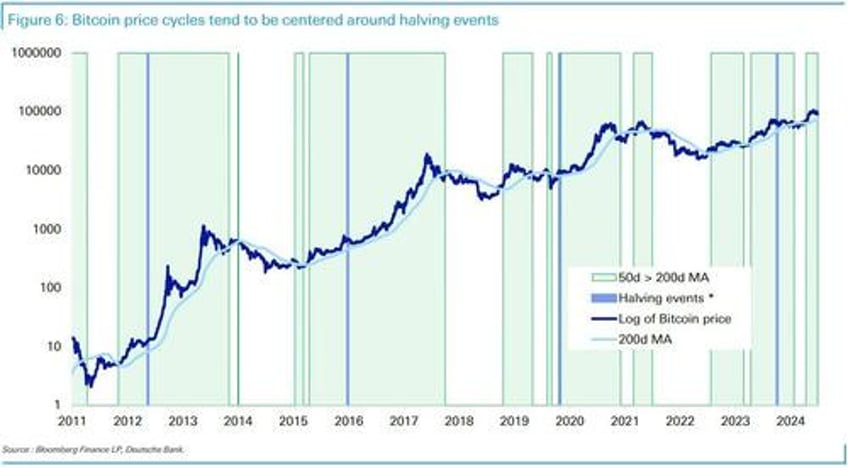

Correlation with Halving Events: Structural rallies align with Bitcoin halving events, which reduce mining rewards and tighten supply. These supply shocks—occurring in 2012, 2016, 2020, and 2024—typically lead to demand spikes and significant price increases.

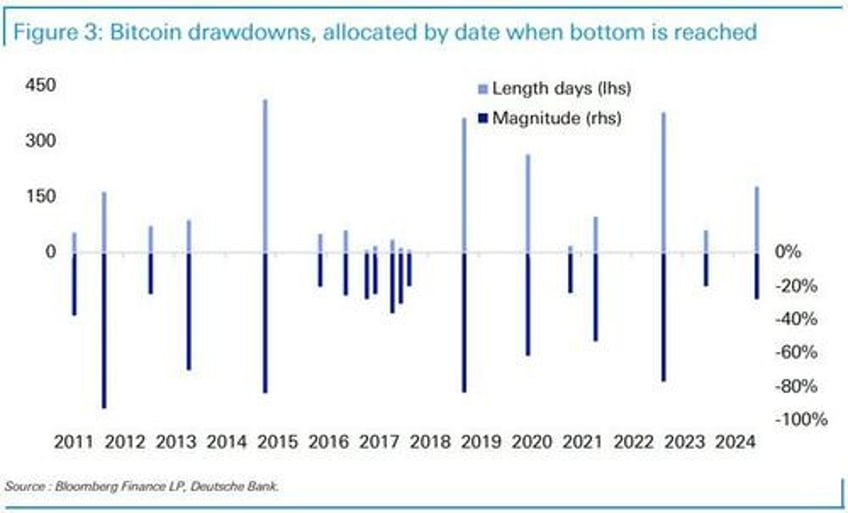

Drawdowns Within Rallies: Despite sustained uptrends, significant drawdowns (19 episodes since 2011) are common, averaging a 44% decline over 123 days. Post-2018, these drawdowns have deepened (-50% vs. -41%) and lengthened (194 vs. 82 days on average).

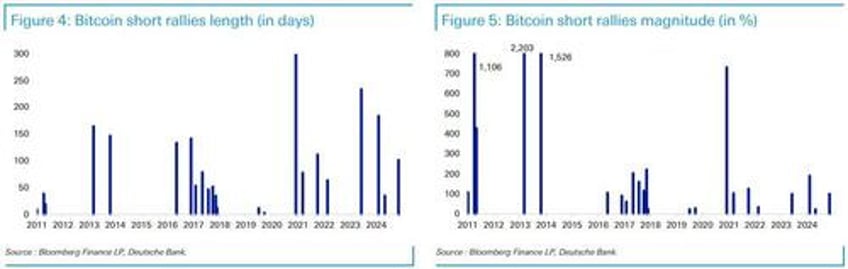

Shorter rallies, defined as lasting less than one year, have been frequent, driven by macroeconomic shifts and market sentiment.

(ii) Short Rallies (23 Episodes)

- Magnitude of Gains: Pre-2018, short rallies averaged a 528% increase; post-2018, the average gain fell to 136%.

- Extended Duration: While shorter than structural uptrends, these rallies have lengthened over time, with average durations increasing from 77 to 103 days.

2. Key Drivers of Bitcoin’s Price Movements

Halving Events

Halving events are identified as primary catalysts for long rally cycles, initiating macro price uptrends. These cycles typically span two years: starting one year before and extending one year after the halving.

Wall Street/TradFi Adoption

The report emphasizes the growing presence of institutional investors since 2017, supported by Bitcoin futures, spot ETFs, and custody services. Institutionalization has improved liquidity and reduced volatility but has not eliminated the risk of drawdowns exceeding 60%.

Jack on a btc reserve.@jack pic.twitter.com/v7fbgZt7LP

— VBL’s Ghost (@Sorenthek) January 24, 2025

The Fed Effect

Bitcoin’s role as an inflation hedge becomes prominent in periods of loose monetary policy. Historical correlations include:

- -27% correlation with the 2020 Fed rate cuts.

- -90% correlation with the 2022 rate hikes.

Corporate (Balance Sheets) and Retail (investor) Status

Despite high-profile corporate investments, broader corporate and retail adoption remains limited:

- Only 16% of Americans and 11% of Europeans report cryptocurrency use or investment, according to the latest survey.

- Adoption rates vary significantly across major economies, with the US, China, and India influencing global market sentiment.

Free Posts To Your Mailbox